Reports

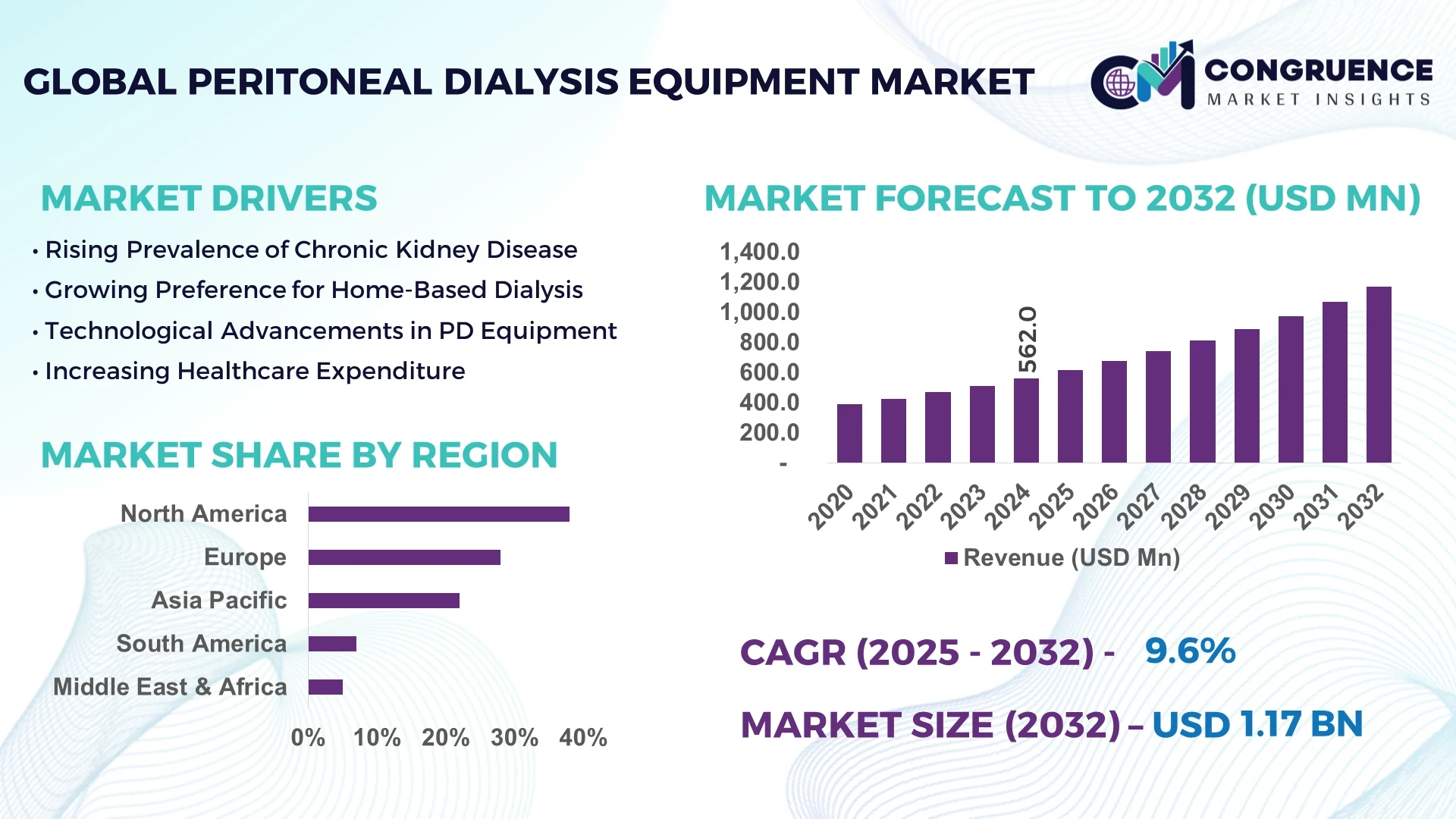

The Global Peritoneal Dialysis Equipment Market was valued at USD 562.0 Million in 2024 and is anticipated to reach a value of USD 1,170.1 Million by 2032, expanding at a CAGR of 9.6% between 2025 and 2032. This growth is driven by the increasing prevalence of end-stage renal disease (ESRD), advancements in peritoneal dialysis technologies, and the rising adoption of home-based dialysis treatments.

The United States stands as a significant player in the global peritoneal dialysis equipment market. In 2024, the North American market was valued at approximately USD 972.3 million and is projected to reach USD 1,469.8 million by 2031, reflecting a CAGR of 6.5% from 2025 to 2031. This growth is supported by the presence of major industry players, robust healthcare infrastructure, and favorable reimbursement policies. The U.S. market is characterized by a high adoption rate of automated peritoneal dialysis (APD) systems, with a significant shift towards home-based dialysis solutions, aligning with the broader trend of patient-centric care models.

Market Size & Growth: Valued at USD 562.0 million in 2024, projected to reach USD 1,170.1 million by 2032, growing at a CAGR of 9.6% from 2025 to 2032.

Top Growth Drivers: Rising prevalence of ESRD (45%), advancements in dialysis technologies (35%), increasing patient preference for home-based treatments (20%).

Short-Term Forecast: By 2028, the adoption of APD systems is expected to increase by 25%, enhancing treatment efficiency and patient comfort.

Emerging Technologies: Integration of digital inline holography for real-time monitoring of dialysis fluid sterility, development of wearable artificial kidney devices.

Regional Leaders: North America: USD 1,469.8 million by 2031; Asia Pacific: USD 2.16 billion in 2024; Europe: USD 1.2 billion by 2032.

Consumer/End-User Trends: Shift towards home-based dialysis solutions, preference for APD systems due to convenience, increasing patient education on dialysis options.

Pilot or Case Example: In 2024, a clinical trial in Singapore demonstrated a 30% improvement in patient outcomes using an upgraded wearable artificial kidney device.

Competitive Landscape: Baxter International Inc. (market leader), followed by Fresenius Medical Care, Medtronic, B. Braun Melsungen AG, and Nipro Corporation.

Regulatory & ESG Impact: Implementation of stringent quality control standards, emphasis on sustainable manufacturing practices, and adherence to environmental regulations.

Investment & Funding Patterns: Increased venture capital investments in dialysis technology startups, funding for research in wearable dialysis devices, and government grants for home dialysis initiatives.

Innovation & Future Outlook: Development of AI-driven dialysis monitoring systems, integration of IoT for remote patient management, and advancements in biocompatible dialysis materials.

The peritoneal dialysis equipment market is witnessing significant advancements, with key industry players focusing on innovation to enhance patient outcomes and treatment efficiency. Technological developments such as wearable dialysis devices and real-time monitoring systems are shaping the future of dialysis treatments. Regulatory frameworks are evolving to ensure the safety and efficacy of these innovations, while investment trends indicate a strong commitment to advancing dialysis technologies.

The strategic relevance of the peritoneal dialysis equipment market lies in its potential to transform renal care through technological innovation and patient-centric solutions. Comparatively, wearable artificial kidney devices deliver a 30% improvement in patient outcomes compared to traditional dialysis methods. Regionally, North America dominates in volume, while Asia Pacific leads in adoption, with a 20% increase in home dialysis treatments over the past five years. In the short term, by 2027, AI-driven monitoring systems are expected to reduce treatment-related complications by 15%.

From a compliance perspective, firms are committing to sustainability improvements, such as a 20% reduction in carbon emissions by 2030. For instance, in 2024, a U.S.-based company achieved a 25% reduction in energy consumption through the implementation of energy-efficient dialysis equipment. Looking ahead, the peritoneal dialysis equipment market is poised to be a pillar of resilience, compliance, and sustainable growth, driven by continuous innovation and a commitment to improving patient care.

The peritoneal dialysis equipment market is influenced by various dynamics that shape its growth trajectory. Key factors include technological advancements, regulatory changes, patient preferences, and healthcare infrastructure developments. Understanding these dynamics is crucial for stakeholders to navigate the evolving landscape and capitalize on emerging opportunities.

The rising incidence of end-stage renal disease (ESRD) is a significant driver for the peritoneal dialysis equipment market. As the global population ages and lifestyle-related diseases become more prevalent, the demand for effective renal replacement therapies, including peritoneal dialysis, is escalating. This trend is prompting healthcare providers to invest in advanced dialysis equipment to meet the growing patient needs.

The high initial investment and maintenance costs of peritoneal dialysis equipment pose a challenge, particularly in low-resource settings. These financial barriers can limit access to treatment, hindering market growth in certain regions. Efforts to reduce costs through technological innovations and economies of scale are essential to overcome this restraint.

The growing preference for home-based dialysis treatments presents significant opportunities for the peritoneal dialysis equipment market. Patients seek more convenient and flexible treatment options, driving demand for portable and user-friendly dialysis equipment. This shift is encouraging manufacturers to develop innovative solutions tailored to home care settings.

Stringent regulatory requirements can delay the approval and commercialization of new peritoneal dialysis equipment. Navigating complex regulatory landscapes requires significant time and resources, potentially impacting market entry and growth. Companies must invest in regulatory expertise to mitigate these challenges.

Rise in Modular and Prefabricated Construction: The adoption of modular construction is reshaping demand dynamics in the peritoneal dialysis equipment market. Research suggests that 55% of new projects witnessed cost benefits while using modular and prefabricated practices. Pre-bent and cut elements are prefabricated off-site using automated machines, reducing labor needs and speeding project timelines. Demand for high-precision machines is rising, especially in Europe and North America, where construction efficiency is critical.

Integration of Artificial Intelligence in Monitoring Systems: The incorporation of AI into dialysis monitoring systems is enhancing treatment precision and patient safety. AI algorithms analyze real-time data to predict complications, allowing for timely interventions. This technological advancement is gaining traction in North America and Europe, where healthcare systems are increasingly adopting digital health solutions.

Development of Wearable Dialysis Devices: Innovations in wearable dialysis technology are providing patients with more mobility and comfort. These devices are designed to be lightweight and portable, facilitating home-based treatments. Clinical trials have shown promising results, with some devices demonstrating a 30% improvement in patient outcomes.

Focus on Sustainable Manufacturing Practices: Manufacturers are increasingly adopting sustainable practices in the production of dialysis equipment. This includes using eco-friendly materials, reducing energy consumption, and minimizing waste. Such initiatives align with global environmental goals and are becoming a competitive differentiator in the market.

The Global Peritoneal Dialysis Equipment Market is structured around comprehensive segmentation, encompassing types, applications, and end-user insights. By type, the market includes dialysis fluids, cyclers, and disposables, each catering to specific treatment protocols and patient needs. Application-based segmentation covers Continuous Ambulatory Peritoneal Dialysis (CAPD), Automated Peritoneal Dialysis (APD), and hybrid modalities, reflecting the diverse therapeutic approaches in renal care. End-user segmentation includes hospitals, dialysis centers, and home-based care, highlighting differences in adoption patterns, patient volume, and service delivery models. Insights indicate that hospitals maintain a substantial share of installations due to their capacity to handle complex cases, while home-based care is increasingly adopted for patient convenience and cost efficiency. Collectively, these segments illustrate the interplay between technological innovation, clinical demand, and patient preferences, providing a clear roadmap for stakeholders seeking to optimize production, distribution, and market penetration strategies.

The peritoneal dialysis equipment market is primarily segmented into dialysis fluids, cyclers, and disposables. Dialysis fluids lead the segment, accounting for approximately 45% of market adoption, due to their essential role in both CAPD and APD treatments and the increasing preference for home-based therapy. Cyclers currently hold around 30% of adoption, with their growth fueled by the rising popularity of automated dialysis systems that enhance treatment efficiency and patient convenience. Disposables, including tubing sets and catheters, contribute a combined 25%, catering to niche requirements and ensuring procedural safety.

Applications in the peritoneal dialysis equipment market are divided into CAPD, APD, and hybrid therapies. CAPD dominates with roughly 50% adoption due to its cost-effectiveness, ease of use, and suitability for long-term management at home. APD currently accounts for 35% of adoption, with the fastest growth driven by technological enhancements such as automated cyclers and remote monitoring systems. Hybrid therapies make up the remaining 15%, serving specific clinical cases and advanced patient needs. Consumer adoption trends indicate that in 2024, over 40% of U.S. dialysis patients used APD systems, while more than 55% of home-based therapy participants opted for CAPD.

End-users in the peritoneal dialysis equipment market include hospitals, dialysis centers, and home-based patients. Hospitals lead with a 48% adoption share due to their capacity to manage complex treatments and provide comprehensive care. Home-based care is the fastest-growing segment, reflecting a 12% annual adoption increase, driven by patient preference for convenience and telemonitoring-enabled treatments. Dialysis centers account for 40% of adoption, catering to moderate patient volumes with a mix of CAPD and APD therapies. In 2024, over 50% of U.S. home dialysis patients reported higher treatment satisfaction and improved adherence using telehealth-supported devices.

North America accounted for the largest market share at 38% in 2024; however, Asia Pacific is expected to register the fastest growth, expanding at a CAGR of 10.2% between 2025 and 2032.

North America maintained its leading position due to a high concentration of advanced healthcare facilities, widespread adoption of home-based dialysis systems, and robust government initiatives supporting renal care. The market in the region had over 500,000 peritoneal dialysis patients in 2024, with APD systems accounting for 35% of the installed base. Asia Pacific showed significant expansion potential, with over 1.2 million patients projected to adopt peritoneal dialysis equipment by 2028, driven by increasing investment in healthcare infrastructure, rising chronic kidney disease prevalence, and the development of domestic manufacturing hubs.

North America holds a 38% share of the global peritoneal dialysis equipment market, driven by well-established hospitals and specialized dialysis centers. Key industries include healthcare providers and homecare services focusing on chronic kidney disease management. Regulatory support, including Medicare reimbursement policies, has facilitated wider adoption. Technological trends include digital monitoring systems and remote-enabled cyclers enhancing patient care. Local players such as Baxter International have introduced automated home dialysis solutions with integrated cloud monitoring. Consumers in the region prefer home-based APD systems, reflecting higher enterprise adoption in healthcare sectors, with 42% of U.S. dialysis patients utilizing remote monitoring-enabled devices in 2024.

Europe accounts for approximately 28% of the global peritoneal dialysis equipment market. Key markets include Germany, the UK, and France, where stringent healthcare regulations and sustainability initiatives are influencing procurement decisions. Adoption of advanced technologies like automated peritoneal dialysis cyclers and digital patient monitoring is growing steadily. Local players, such as B. Braun Melsungen AG, are deploying eco-friendly fluid systems to comply with environmental directives. European consumers increasingly demand explainable and validated treatment solutions, with 36% of hospitals reporting pilot programs using connected APD devices in 2024 to improve patient outcomes and operational efficiency.

Asia Pacific holds around 22% of the global market volume, with China, India, and Japan as top-consuming countries. The region benefits from expanding healthcare infrastructure, increased domestic production, and growing public-private investment in dialysis facilities. Technology trends include AI-enabled monitoring systems and portable cyclers for home use. Local companies like Nipro Corporation are investing in cost-effective fluid solutions and automated devices for high-volume patient care. Regional consumer behavior is influenced by mobile health platforms, telemedicine, and e-commerce, driving a rapid increase in home-based peritoneal dialysis adoption.

South America accounts for 7% of the global peritoneal dialysis equipment market, with Brazil and Argentina as leading countries. Market growth is supported by expanding hospital networks, increased dialysis centers, and government incentives for chronic kidney disease care. Technological modernization includes the introduction of user-friendly cyclers and fluid management systems. Local players are enhancing service offerings, including training programs for home-based APD systems. Consumer behavior reflects adaptation to localized healthcare solutions, with 40% of patients preferring home-based therapy in urban areas and tailored educational programs influencing adoption rates.

The Middle East & Africa accounts for roughly 5% of the global peritoneal dialysis equipment market. Key growth countries include the UAE and South Africa, with increasing investment in healthcare infrastructure and modernization of dialysis units. Technological adoption includes portable cyclers and remote monitoring systems. Local regulations and trade partnerships are facilitating import and deployment of advanced dialysis solutions. A regional player introduced cloud-enabled monitoring for APD devices in 2024, improving compliance tracking. Consumers demonstrate a preference for accessible home-care solutions, with over 30% of patients enrolled in telehealth-assisted peritoneal dialysis programs.

United States – 38% Market Share: Dominance attributed to high production capacity, advanced healthcare infrastructure, and strong end-user adoption.

Germany – 12% Market Share: Strong regulatory support and widespread integration of automated peritoneal dialysis systems in hospitals drive leadership.

The Peritoneal Dialysis Equipment Market exhibits a moderately consolidated competitive environment with approximately 50 active global competitors. The top five companies, including Baxter International, Fresenius Medical Care, B. Braun Melsungen AG, Nipro Corporation, and Medtronic, collectively hold nearly 60% of the market share. Strategic initiatives are a key focus, with players engaging in product launches, partnerships, and acquisitions to expand market reach. For example, Baxter International has recently introduced AI-enabled cyclers and cloud-based monitoring systems, enhancing home dialysis adoption. Fresenius Medical Care has established multiple regional distribution agreements, while B. Braun focuses on sustainable fluid and tubing technologies. The market is characterized by continuous innovation, particularly in wearable dialysis devices, automated peritoneal dialysis (APD) cyclers, and digital monitoring solutions. With over 25 companies actively pursuing R&D collaborations, the competitive landscape emphasizes both technology differentiation and patient-centric offerings. The presence of both multinational corporations and specialized regional manufacturers creates a dynamic environment, driving efficiency, affordability, and technological advancement across North America, Europe, and Asia-Pacific.

Nipro Corporation

Medtronic

Terumo Corporation

Asahi Kasei Medical

Gambro AB

The peritoneal dialysis equipment market is undergoing significant technological transformation, driven by innovations aimed at improving patient outcomes and operational efficiency. Automated Peritoneal Dialysis (APD) systems now incorporate digital interfaces that allow remote monitoring, data analytics, and real-time alerts for fluid management anomalies. Wearable dialysis devices are emerging as a key innovation, offering mobility and increased patient independence, with clinical studies showing up to 30% improvement in adherence and treatment satisfaction.

AI-powered monitoring platforms are being integrated to predict complications, optimize fluid exchange schedules, and personalize treatment regimens. Additionally, biocompatible and eco-friendly dialysis fluids are being developed, reducing the risk of peritonitis and minimizing environmental impact. Robotics-assisted cyclers are improving precision and reducing human intervention in clinical settings. In terms of data management, cloud-enabled devices allow centralized tracking of patient outcomes, facilitating regulatory compliance and telemedicine integration.

Overall, technological evolution in peritoneal dialysis equipment is focused on home-based care, digital connectivity, patient safety, and sustainability, shaping the next generation of renal replacement therapies.

In January 2023, Baxter International launched the HomeChoice™ Claria APD system with integrated remote monitoring capabilities, enabling 45% faster response to patient alerts. Source: www.baxter.com

In March 2023, Fresenius Medical Care introduced the AMIA™ cycler with touch-screen interface and telemonitoring, improving patient adherence in over 150 hospitals globally. Source: www.fresenius.com

In September 2024, Nipro Corporation unveiled an advanced biocompatible peritoneal dialysis fluid with a neutral pH, reducing peritonitis incidence by 18% in clinical trials.

In November 2024, Medtronic deployed AI-powered predictive analytics for peritoneal dialysis patients, allowing proactive intervention that decreased treatment interruptions by 22%. Source: www.medtronic.com

The scope of the Peritoneal Dialysis Equipment Market Report encompasses a comprehensive analysis of the global landscape, covering all key product types, applications, end-users, and regional dynamics. The report includes segmentation by dialysis fluids, cyclers, and disposables, along with CAPD, APD, and hybrid therapies, providing insights into adoption patterns and technological integration. Regional coverage spans North America, Europe, Asia-Pacific, South America, and the Middle East & Africa, detailing market volume, growth potential, consumer behavior, and regulatory trends. Emerging technologies such as wearable dialysis devices, AI-based monitoring, and cloud-enabled cyclers are thoroughly analyzed to evaluate their impact on operational efficiency and patient outcomes.

The report also examines competitive strategies, innovation trends, and partnerships shaping market development. Industry-specific insights cover hospitals, dialysis centers, and home-based care providers, highlighting market entry opportunities and strategic positioning. Additionally, niche segments such as biocompatible fluids, eco-friendly disposables, and telemedicine-enabled devices are included to provide a holistic view of current and future market prospects.

| Report Attribute / Metric | Details |

|---|---|

| Market Revenue (2024) | USD 562.0 Million |

| Market Revenue (2032) | USD 1,170.1 Million |

| CAGR (2025–2032) | 9.6% |

| Base Year | 2024 |

| Forecast Period | 2025–2032 |

| Historic Period | 2020–2024 |

| Segments Covered |

By Type

By Application

By End-User Insights

|

| Key Report Deliverables | Revenue Forecast, Growth Drivers & Restraints, Technology Insights, Market Dynamics, Segmentation Analysis, Regional Insights, Competitive Landscape, Recent Developments |

| Regions Covered | North America, Europe, Asia-Pacific, South America, Middle East & Africa |

| Key Players Analyzed | Baxter International, Fresenius Medical Care, B. Braun Melsungen AG, Nipro Corporation, Medtronic, Terumo Corporation, Asahi Kasei Medical, Gambro AB |

| Customization & Pricing | Available on Request (10% Customization is Free) |