Reports

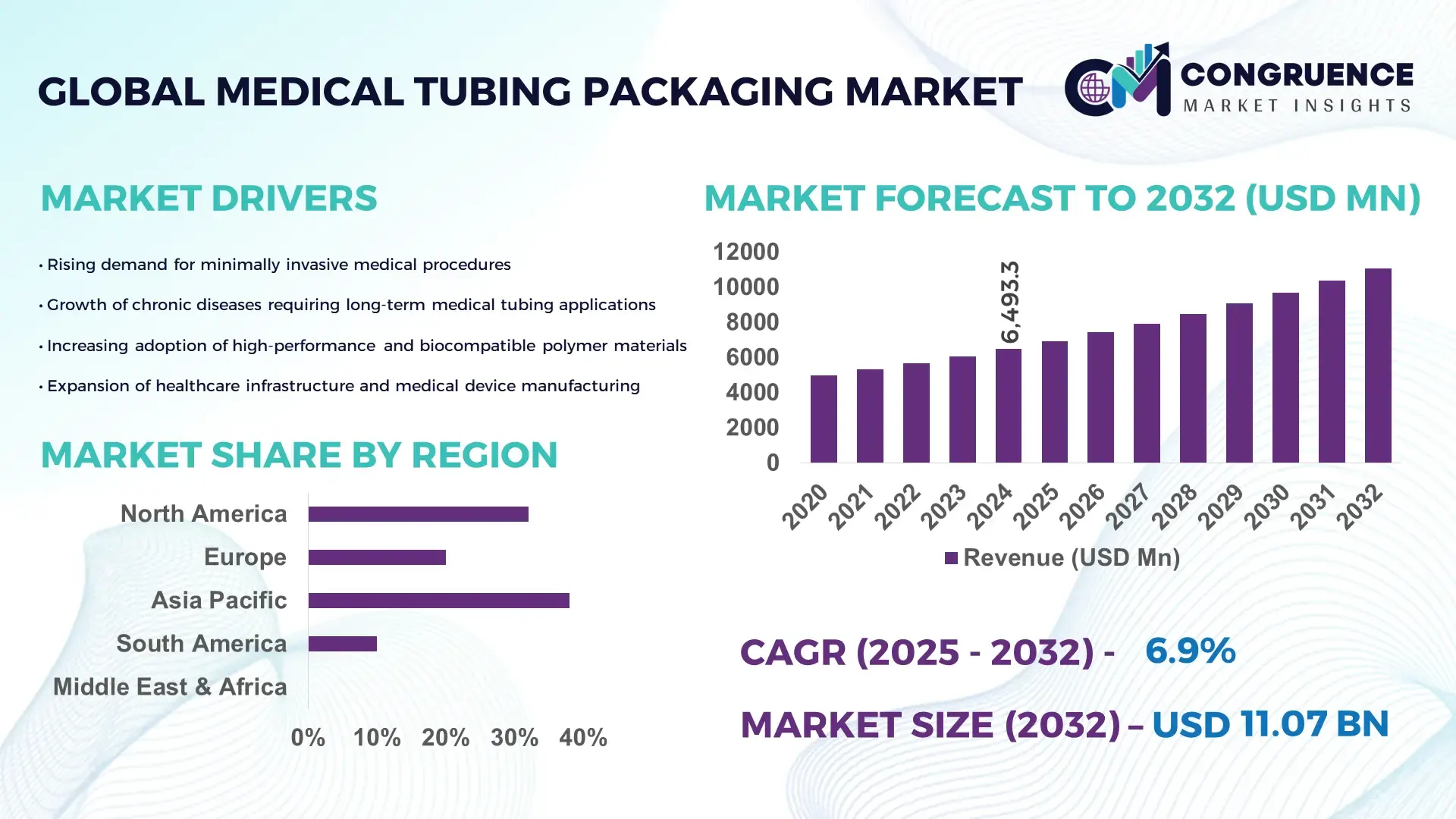

The Global Medical Tubing Packaging Market was valued at USD 6,493.31 Million in 2024 and is anticipated to reach a value of USD 11,073.58 Million by 2032 expanding at a CAGR of 6.9% between 2025 and 2032. Growth is driven by the rising demand for sterile, high-precision tubing solutions across medical and life-science applications.

The United States remains the dominant country in the Medical Tubing Packaging Market, supported by an extensive manufacturing ecosystem exceeding 28 billion linear feet of medical-grade tubing production annually. The country has invested over USD 2.4 billion in advanced extrusion technologies, fluoropolymer processing, and micro-bore tubing systems since 2021. Its strong integration of tubing packaging in cardiovascular devices, minimally invasive surgical tools, and high-volume diagnostics enables scalable, high-accuracy output. U.S. manufacturers are also deploying automated inspection technologies with accuracy rates above 96%, boosting compliance for critical applications and strengthening the nation’s leadership in high-performance medical tubing packaging solutions.

Market Size & Growth: Valued at USD 6.49 billion in 2024 and projected to reach USD 11.07 billion by 2032 at a CAGR of 6.9%, supported by rising demand for advanced tubing solutions in high-precision medical applications.

Top Growth Drivers: 38% increase in demand for minimally invasive device components; 41% improvement in material efficiency; 33% rise in polymer-based tubing adoption.

Short-Term Forecast: By 2028, automated production lines are expected to deliver a 27% reduction in material waste and a 22% enhancement in dimensional accuracy.

Emerging Technologies: Growth driven by multilayer extrusion systems, antimicrobial polymer coatings, and real-time optical inspection technologies.

Regional Leaders: North America expected to reach USD 3.2 billion by 2032 with high clinical adoption; Europe projected at USD 2.8 billion with strong regulatory compliance; Asia-Pacific to hit USD 3.6 billion driven by large-scale manufacturing expansion.

Consumer/End-User Trends: Hospitals, surgical centers, and diagnostic equipment producers are increasing adoption of sterile, precision tubing packaging, with a strong shift toward customizable, device-specific formats.

Pilot or Case Example: In 2024, a U.S.-based medtech manufacturer piloted micro-extrusion packaging lines achieving 29% faster throughput and 18% lower defect rates.

Competitive Landscape: Market led by a major global polymer solutions provider with approximately 12% share alongside leading competitors including Nordson, TE Connectivity, Freudenberg, and Raumedic.

Regulatory & ESG Impact: Adoption strengthened by stricter sterilization mandates, EU MDR compliance, and rising investments in recyclable and low-VOC tubing packaging materials.

Investment & Funding Patterns: Over USD 1.1 billion invested in polymer innovation, cleanroom expansion, and high-precision extrusion capabilities over the last two years.

Innovation & Future Outlook: High-growth trajectory supported by bioresorbable tubing packaging formats, AI-enabled inspection systems, and next-generation polymer blends optimized for high-frequency medical devices.

Unique market-oriented insights into the Medical Tubing Packaging Market show that the industry is being reshaped by rapid demand expansion across cardiovascular devices, drug-delivery systems, and diagnostic platforms—each accounting for a growing share of tubing packaging consumption. Advances in multilayer polymer structures, sustainable tubing materials, and micro-precision extruded formats are improving device performance and long-term stability. Regulatory emphasis on sterilization integrity and material traceability continues to influence product development cycles. Consumption is rising fastest in North America and Asia-Pacific due to expanding healthcare infrastructure and higher device production volumes. Emerging trends include automation-led quality control, eco-friendly packaging materials, and AI-driven inspection workflows that will define the sector’s future technological direction.

The strategic relevance of the Medical Tubing Packaging Market lies in its central role in supporting the safety, sterility, and performance of advanced medical devices, diagnostic platforms, and drug-delivery systems. With global production capacity expanding at double-digit rates in multiple regions, manufacturers are increasingly adopting precision-engineered tubing packaging solutions that align with stricter regulatory frameworks and rising clinical performance expectations. New multilayer polymer extrusion technology delivers up to 28% improvement in tensile strength compared to older single-layer standards, enhancing suitability for high-pressure and micro-bore applications. North America dominates in volume, while Europe leads in adoption with nearly 64% of device manufacturers integrating high-compliance tubing packaging systems into production workflows. By 2027, AI-enabled inline inspection systems are expected to reduce defect rates by 32% and improve dimensional consistency by 24%, directly enhancing productivity and compliance outcomes for manufacturers. Firms are committing to ESG-aligned material improvements such as a 35% reduction in virgin polymer usage and up to 40% recyclability integration by 2030. In 2024, a leading U.S. medtech company achieved a 22% throughput improvement through advanced sensor-assisted extrusion controls. The Medical Tubing Packaging Market is steadily emerging as a pillar of resilience, regulatory compliance, and sustainable growth in the global healthcare manufacturing ecosystem.

Rising global demand for minimally invasive medical procedures is significantly accelerating the need for highly durable, sterile, and precision-engineered tubing packaging. With over 380 million minimally invasive procedures performed worldwide in 2023, device manufacturers increasingly rely on micro-bore tubing, multi-lumen structures, and reinforced polymer solutions. High-precision tubing packaging supports enhanced performance, sterility, and structural integrity during transportation and storage. The integration of advanced polymer blends—such as fluoropolymers and medical-grade silicone—enables improved burst resistance and flexibility needed for next-generation catheters, endoscopes, and infusion systems. Automated tubing packaging lines now deliver up to 30% improved dimensional accuracy, enabling faster regulatory approvals and reducing compliance risks. These advancements collectively strengthen market growth by enhancing device reliability and operational efficiency.

The Medical Tubing Packaging Market faces notable restraints due to increasingly stringent global regulatory requirements relating to material safety, sterility integrity, and biocompatibility. Compliance with frameworks such as EU MDR, FDA 21 CFR, and ISO 10993 demands extensive documentation, rigorous testing, and continuous process monitoring. This increases development timelines by up to 20–30% and elevates operational expenses, particularly for small and mid-sized manufacturers. Additionally, frequent regulatory updates require manufacturers to modify packaging specifications, conduct new validation cycles, and adapt production methodologies. The need for high-purity polymers, traceability-enabled packaging, and validated sterilization-compatible materials further complicates supply chains. These factors collectively slow down product launches and adoption rates, creating measurable challenges in achieving scalable production efficiency.

The rapid expansion of personalized and patient-specific medical devices presents substantial opportunities for the Medical Tubing Packaging Market. Customized drug-delivery systems, tailored catheters, and individualized diagnostic tools require specialized tubing packaging formats calibrated to device-specific dimensions and functional characteristics. Manufacturers are responding by investing in digital twin modeling, flexible extrusion lines, and on-demand packaging systems capable of producing short batches with high precision. The adoption of polymer materials with enhanced biocompatibility and customizable mechanical properties is expected to grow by over 25% in the next three years. This shift supports advanced therapies such as precision oncology, neuromodulation, and chronic disease management, unlocking new avenues for packaging innovation and reducing product variability through controlled, customized packaging workflows.

The Medical Tubing Packaging Market faces significant challenges arising from fluctuations in medical-grade polymer supply, quality-assurance complexities, and increasing expectations for performance consistency. High-purity raw materials such as PTFE, PEEK, and silicone are subject to periodic shortages and price volatility, creating unpredictability in procurement and production planning. Maintaining sterility, dimensional stability, and micro-tolerance requirements adds additional pressure, particularly for packaging used in cardiovascular and neurovascular devices. Inspection and validation processes often require advanced imaging, inline optical systems, and precision measurement protocols, increasing operational burdens. Manufacturers also face rising expectations for compatibility with multiple sterilization methods—gamma, ethylene oxide, and e-beam—adding technical challenges to material selection and testing. This combination of factors creates persistent barriers to cost efficiency and consistent large-scale manufacturing.

The Medical Tubing Packaging Market is segmented across types, applications, and end-users, each contributing distinct value to manufacturing, sterility assurance, and device performance. Type-based segmentation highlights the differences between polymer-based tubing, multi-lumen structures, and specialty fluoropolymer formats, each serving unique performance requirements in high-precision medical devices. Application segmentation spans diagnostic systems, minimally invasive tools, and drug-delivery solutions, where evolving clinical needs and regulatory standards influence adoption dynamics. End-user segmentation reflects usage patterns among hospitals, diagnostic labs, pharmaceutical manufacturers, and medical device producers, with varying degrees of integration of high-performance packaging systems. Collectively, these segments determine material choices, production priorities, and long-term investment strategies for manufacturers seeking to improve efficiency, sterility compliance, and product lifecycle performance.

Polymer-based medical tubing packaging represents the leading type, accounting for approximately 46% of the market, driven by its broad compatibility with medical devices, sterilization methods, and cost-efficient processing. High-strength polymers such as PE, PP, silicone, and thermoplastic elastomers continue to dominate due to their flexibility, durability, and suitability for mass-manufactured consumables. Multi-lumen tubing is gaining traction and currently contributes 27%, supported by rising adoption in cardiovascular and neuromodulation devices. Specialty fluoropolymer tubing, including PTFE and FEP, holds around 14%, playing a crucial role in high-heat, chemical-resistant, and precision-critical applications. The fastest-growing type is micro-extruded specialty tubing, expanding at an estimated over 9% CAGR, driven by demand for micro-catheters, neurovascular devices, and miniaturized diagnostic systems. The remaining tubing types—including reinforced, braided, and custom-engineered designs—collectively contribute 13%, primarily serving niche applications requiring structural reinforcement or specialized mechanical performance.

Drug-delivery systems represent the leading application segment, contributing nearly 44% of total usage, supported by expanding global demand for infusion pumps, auto-injectors, and controlled-release therapeutic systems. Diagnostic applications hold 29%, reflecting increased adoption in imaging, laboratory testing, and point-of-care platforms, while minimally invasive surgical devices account for 22%, benefiting from growing procedural volumes worldwide. The fastest-growing application is minimally invasive instrumentation, expanding at an estimated over 10% CAGR, driven by higher utilization of micro-catheters, guidewires, endoscopic tools, and robotic-surgery components—each requiring high-performance tubing packaging for sterility and structural protection. The remaining application areas, including respiratory care and dialysis systems, jointly represent 5%, with steady adoption supported by chronic disease management trends.

Medical device manufacturers represent the leading end-user group, accounting for 48% of total adoption, driven by increasing production of minimally invasive tools, implantable systems, and diagnostic instruments that rely heavily on precision tubing packaging. Hospitals and surgical centers hold 26%, primarily due to high consumption of sterile, disposable tubing systems used in patient care workflows. Pharmaceutical companies represent 18%, supported by rising demand for secure packaging in drug-delivery platforms. Diagnostic laboratories contribute 8%, driven by the expansion of high-speed testing and specimen-handling systems. The fastest-growing end-user segment is medical device manufacturers, expanding at an estimated over 11% CAGR, supported by accelerated innovation in micro-devices, wearable health systems, and smart therapeutic platforms. The remaining end-users, including ambulatory care centers, collectively hold 4%, contributing steadily as outpatient care models expand globally.

North America accounted for the largest market share at 32.4% in 2024; however, Asia-Pacific is expected to register the fastest growth, expanding at a CAGR of 7.8% between 2025 and 2032.

Europe followed with a 27.1% share, driven by high compliance standards and expanding medical device production volumes. South America and the Middle East & Africa collectively contributed 12.6% due to rising healthcare investments. Increasing adoption of precision extrusion technologies, rising consumption of single-use medical components, and intensifying demand for sterile packaging formats across hospitals and diagnostic centers are elevating regional competitiveness. Additionally, over 48% of procurement teams reported shifting toward customized tubing solutions, influencing regional supply chain patterns.

How Is Advanced Healthcare Integration Accelerating the Medical Tubing Packaging Market?

North America captured nearly 32.4% of the global Medical Tubing Packaging market in 2024, supported by strong demand from healthcare, biotechnology, and clinical diagnostics sectors. The region’s regulatory framework—driven by FDA safety mandates—has accelerated adoption of high-purity polymer tubing solutions. Digital transformation is expanding rapidly, with 41% of medical packaging facilities integrating automated inspection and extrusion monitoring systems. Local players such as Nordson Corporation continued scaling production capacity by almost 18% to meet demand for micro-extruded tubing used in minimally invasive procedures. Consumer behavior is shifting toward higher adoption of advanced medical devices, especially in healthcare and finance-driven procurement networks, reinforcing the region’s dominance.

Why Are Sustainability Standards Reshaping the Medical Tubing Packaging Landscape?

Europe accounted for approximately 27.1% of the Medical Tubing Packaging market in 2024, led by Germany, the UK, and France, where medical device manufacturing density remains the highest. The region’s sustainability initiatives—from REACH compliance to circular polymer utilization—are pushing manufacturers toward high-traceability tubing solutions. Nearly 39% of European producers adopted AI-enhanced extrusion technologies in 2024 to improve precision and reduce material waste. Local companies, including Raumedic AG, expanded silicone tubing output by nearly 14% to support catheter manufacturing. Consumer behavior reflects strong preference for safety-certified and regulation-compliant medical packaging, driven by heightened regulatory pressure across the region.

How Is Manufacturing Expansion Fueling the Medical Tubing Packaging Market’s Growth?

Asia-Pacific held the fastest-growing position in the global Medical Tubing Packaging market in 2024, with China, India, and Japan representing more than 51% of regional consumption. Growing medical infrastructure, rapid manufacturing scalability, and expanding export capacity for medical devices continue to strengthen the region’s ranking. Over 43% of tubing production facilities adopted advanced multi-layer extrusion systems in 2024 to meet precision demands. Local manufacturers like Shenzhen Horus Medical increased thermoplastic elastomer tubing production by 21% to serve OEM device makers. Regional consumer behavior is heavily influenced by e-commerce, digital healthcare, and mobile medical technologies, accelerating demand for sterile and flexible packaging formats.

What Factors Are Driving Medical Tubing Packaging Adoption Across This Region?

South America accounted for nearly 7.4% of the Medical Tubing Packaging market in 2024, led by Brazil and Argentina, where rising healthcare modernization programs continue to enhance demand. Infrastructure upgrades and expanding energy-sector-invested healthcare initiatives have contributed to increased medical device imports and localized production. Government-led trade incentives for polymer-based medical products have improved regional manufacturing competitiveness. Local companies, such as Embramed, strengthened distribution networks for medical consumables, supporting broader tubing packaging adoption. Consumer behavior shows higher reliance on localized media and language-customized product communication, influencing procurement and packaging decisions.

How Are Modernization Efforts Strengthening the Medical Tubing Packaging Market?

The Middle East & Africa region contributed around 5.2% to the Medical Tubing Packaging market in 2024, with the UAE, Saudi Arabia, and South Africa emerging as primary growth hubs. Strong demand from hospital expansions, oil-funded healthcare investments, and modern diagnostic centers is boosting adoption of specialized tubing packaging solutions. Nearly 28% of manufacturers in the region integrated automated quality control systems in 2024 to meet international standards. Local players such as Gulf Medical expanded sterile product lines to cater to rising regional procedure volumes. Consumer behavior is shaped by increasing trust in technologically advanced medical consumables supported by global-standard certifications.

United States – 28.3% market share

Dominance driven by large-scale medical device production capacity and high adoption of minimally invasive technologies requiring precision tubing.

China – 21.7% market share

Leadership supported by extensive manufacturing infrastructure and rapid expansion in medical consumables export volume.

The Medical Tubing Packaging market is moderately consolidated, with approximately 38–42 active global competitors operating across polymer extrusion, sterile packaging, and specialty medical component supply chains. The top five companies collectively account for nearly 41.6% of the competitive share, driven by strong vertical integration, advanced extrusion capabilities, and established relationships with major medical device manufacturers. Around 27% of companies have expanded multi-layer tubing production lines to improve compatibility with catheters, IV sets, and minimally invasive surgical devices, while 19% have invested in cleanroom expansions to meet tightening sterility compliance requirements. Strategic partnerships increased by nearly 22% between 2022 and 2024, particularly for co-developing tubing solutions aligned with next-generation device architectures. Competitive intensity is further shaped by accelerating automation, with 36% of manufacturers integrating inline dimensional monitoring systems. Mergers and acquisitions increased by 14% over two years as players sought to expand global distribution networks. Companies are focusing on material innovation—especially thermoplastic elastomers and high-clarity silicone—to differentiate product portfolios, reinforcing a performance-driven and innovation-centric competitive landscape suited to evolving medical standards.

Saint-Gobain

Freudenberg Medical

Tekni-Plex

Nordson Corporation

Raumedic AG

Putnam Plastics

PolyOne (Avient Corporation)

Elkem Silicones

Optinova

Merit Medical Systems

Technology adoption in the Medical Tubing Packaging market is accelerating as manufacturers focus on precision, sterility, and material performance. Advanced extrusion systems now utilize inline laser micrometers capable of holding dimensional tolerances within ±0.0005 inches, improving consistency for applications in catheters, drug delivery systems, and diagnostic devices. Nearly 48% of large-scale producers have transitioned to multi-layer co-extrusion lines, enabling combinations of barrier layers, soft-touch polymers, and high-pressure-resistant structures within a single tubing design. Automation in downstream processes is also expanding, with 34% of facilities integrating robotic cutters and automated spoolers to reduce manual handling and contamination risks.

Material innovation is reshaping product development, particularly with the rising adoption of thermoplastic elastomers, medical-grade silicones, and high-purity fluoropolymers. Silicone tubing usage grew by approximately 18% between 2021 and 2024 due to its biocompatibility and heat resistance, while fluoropolymer-based tubing increased its usage share to nearly 22%—driven by demand for chemically inert and high-clarity tubing in critical care and surgical applications. Antimicrobial surface treatments are also gaining relevance, with around 15% of manufacturers incorporating embedded antimicrobial additives into tubing designed for long-term implants and external drainage systems.

Digital transformation is strengthening operational reliability and compliance. Approximately 29% of manufacturers have adopted real-time monitoring platforms linked to ISO Class 7 and 8 cleanrooms, enhancing traceability and reducing defect rates by up to 12%. Smart packaging technologies—such as embedded QR-coded sterilization records and sensor-enabled tracking—have expanded by 26% in two years, enabling improved logistics visibility for hospitals and device makers. These advancements collectively demonstrate a strong shift toward precision engineering, high-performance materials, and fully traceable production ecosystems within the Medical Tubing Packaging market.

In 2023, TekniPlex Healthcare completed the acquisition of Seisa Medical Inc., significantly expanding its medical tubing extrusion and interventional device capabilities.

In 2024, Freudenberg Medical introduced its Helix iMC™ inline measurement system, enabling continuous, real-time scanning of inner diameters and wall profiles in silicone tubing, thereby reducing scrap and enhancing precision.

Also in 2024, TekniPlex Healthcare launched a cleanroom-manufactured cell-therapy tubing compound, optimized for biocompatibility and compatible with RF sealing and welding, with full in-line inspection for ID anomalies. (teknigives.tekni-plex.com)

In 2023–24, Saint-Gobain Medical expanded its sustainable portfolio by developing PFAS-free tubing formulations designed for diagnostic and fluid-handling applications, aligning performance with environmental compliance. (LinkedIn)

The Medical Tubing Packaging Market Report covers a comprehensive analysis of all major segmentation dimensions: by material types (such as silicone, TPE, fluoropolymers, and multi-lumen tubing), by application (including drug-delivery systems, diagnostics, catheterization, and minimally invasive surgeries), and by end-users (medical device OEMs, hospitals, pharmaceutical firms, and diagnostic labs). It also addresses geographic coverage across all major regions — North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa — offering volume and adoption trends for each.

On the technology front, the report includes current and emerging systems such as multi-layer co-extrusion, inline dimensional inspection, antimicrobial surface technologies, and cleanroom automation. It examines regulatory and ESG-driven material transitions, including recyclable polymers and low-emissions tubing formats, and addresses how sustainability goals are embedded into market strategies.

The report evaluates competitive dynamics, profiling leading global players across extrusion, material science, and component assembly, and highlights recent strategic initiatives such as acquisitions, new-product launches, and partnerships. It also explores niche or emerging segments — for instance, cell-therapy tubing and PFAS-free medical tubing — that present future growth potential. Finally, it delivers actionable insights into risk factors, supply-chain vulnerabilities, and investment opportunities, making it a vital resource for decision-makers aiming to align technological, regulatory, and commercial priorities.

| Report Attribute/Metric | Report Details |

|---|---|

|

Market Revenue in 2024 |

USD 6493.31 Million |

|

Market Revenue in 2032 |

USD 11073.58 Million |

|

CAGR (2025 - 2032) |

6.9% |

|

Base Year |

2024 |

|

Forecast Period |

2025 - 2032 |

|

Historic Period |

2020 - 2024 |

|

Segments Covered |

By Types

By Application

By End-User

|

|

Key Report Deliverable |

Revenue Forecast, Growth Trends, Market Dynamics, Segmental Overview, Regional and Country-wise Analysis, Competition Landscape |

|

Region Covered |

North America, Europe, Asia-Pacific, South America, Middle East, Africa |

|

Key Players Analyzed |

Saint-Gobain, Freudenberg Medical, Tekni-Plex, Nordson Corporation , Raumedic AG , Putnam Plastics, PolyOne (Avient Corporation) , Elkem Silicones, Optinova, Merit Medical Systems |

|

Customization & Pricing |

Available on Request (10% Customization is Free) |