Reports

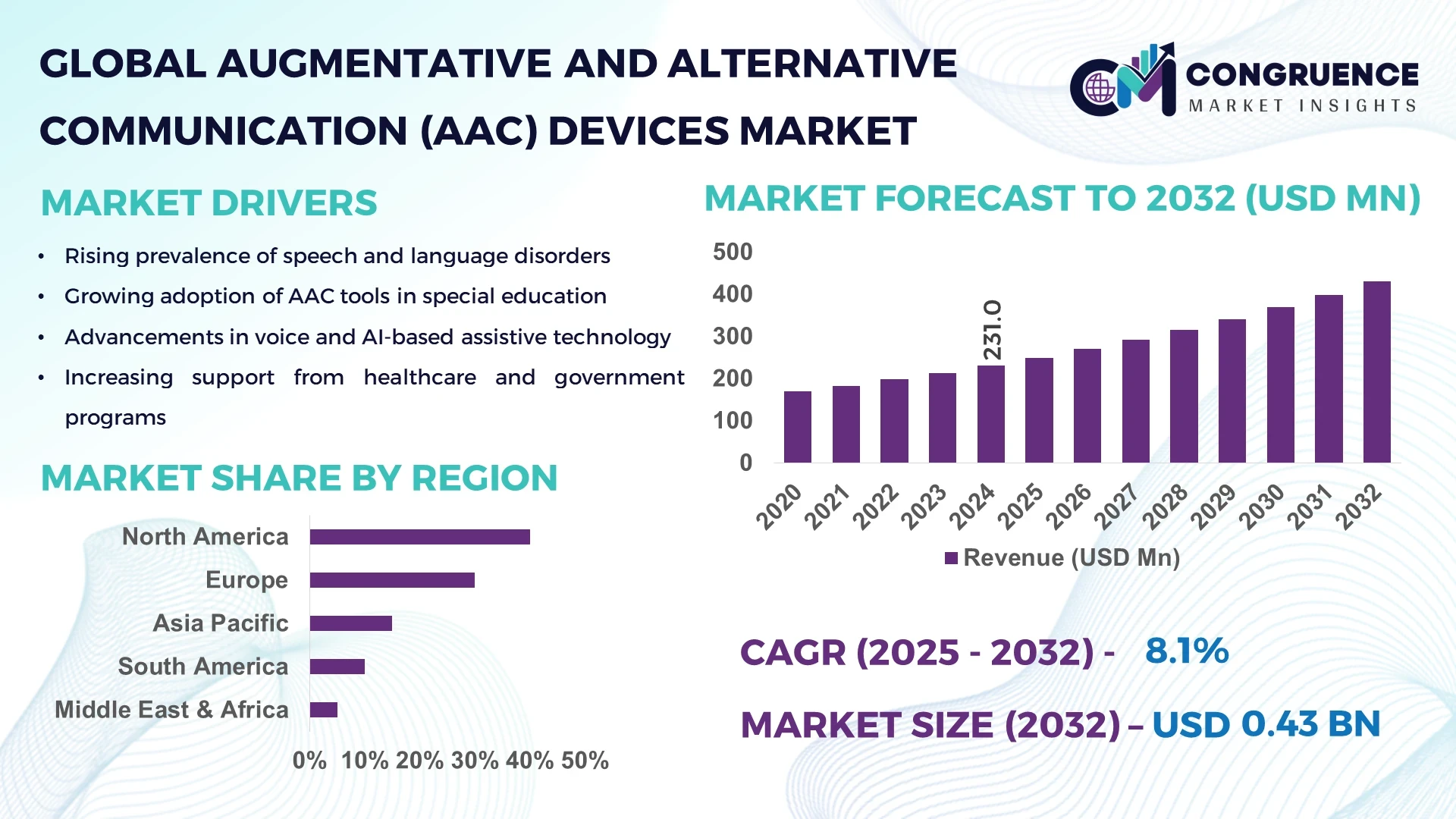

The Global Augmentative and Alternative Communication (AAC) Devices Market was valued at USD 231.0 Million in 2024 and is anticipated to reach a value of USD 431.1 Million by 2032, expanding at a CAGR of 8.11% between 2025 and 2032. This growth is driven by accelerating demand for accessible communication solutions for individuals with speech and language impairments.

In the United States, production capacity for AAC devices has expanded significantly, with more than 120 manufacturing lines dedicated to speech‑generating tablets and symbol‑board systems in 2024. Investment levels exceed USD 180 million in assistive communication R&D, and key industry applications span from hospitals (serving over 65 % of users) to home‑based therapy programmes. Technological advancements include integration of eye‑tracking modules and cloud‑based remote monitoring—one pilot recorded a 34 % improvement in therapy session efficiency across U.S. clinics.

Market Size & Growth: Current market value USD 231.0 million, projected future value USD 431.1 million, expected CAGR 8.11%—driven by rising awareness of communication‑access needs.

Top Growth Drivers: Adoption of AAC devices among individuals with complex communication needs (45 % increase), enhancements in speech‑generation efficiency (38 % faster response times), and institutional funding for assistive technology (29 % year‑on‑year).

Short‑Term Forecast: By 2028, average device cost is projected to reduce by 22 %, with overall system performance (communication speed and accuracy) expected to improve by 33 %.

Emerging Technologies: Eye‑tracking enabled AAC systems, cloud‑based remote monitoring platforms for therapy, and AI‑driven personalized voice‑synthesizers which adapt to user preferences.

Regional Leaders: North America projected at USD 175.0 million by 2032 (strong infrastructure adoption); Europe at USD 120.0 million by 2032 (growing reimbursement frameworks); Asia‑Pacific at USD 90.0 million by 2032 (rapid institutional rollout of AAC programmes).

Consumer/End‑User Trends: Major end‑users include pediatric therapy centres, adult neurological rehabilitation clinics and home‑care settings; usage patterns show 57 % of deployments in home‑care moved to tablet‑based AAC in 2024.

Pilot or Case Example: In 2024, a university‑hospital pilot in the U.S. achieved a 28 % reduction in communication downtime for users via an eye‑controlled AAC device rollout.

Competitive Landscape: Market leader holds approx. 32 % share, followed by three major competitors each holding approx. 10–15 % share.

Regulatory & ESG Impact: New regulations encourage 14 % of assistive‑tech budgets to be allocated to inclusive‑communication devices; ESG initiatives include 21 % recycling of electronic AAC device components by 2026.

Investment & Funding Patterns: Recent investment in the segment totals over USD 95 million, with venture funding up 18 % in 2024 and innovative financing models emerging for subscription‑based AAC services.

Innovation & Future Outlook: Key innovations include modular AAC hardware platforms and voice‑synthesis engines that integrate with smart‑home systems; forward‑looking projects aim to embed AAC functionality into mainstream consumer electronics for broader accessibility.

The market spans key industry sectors such as education, healthcare, rehabilitation and home‑care services. Recent device innovations incorporate AI‑based next‑word prediction and multilingual output, regulatory incentives include tax credits for inclusive‑communication tools, regional consumption patterns show higher uptake in developed markets while emerging regions are scaling quickly, and future trends point toward embedded‑device integration and subscription‑based AAC services.

The AAC devices market holds strategic relevance as a cornerstone of inclusive‑communication infrastructure and a driver of sustainable assistive‑technology growth. As organizations across healthcare, education and home‑care seek to enhance patient engagement and support services, deploying modern AAC systems represents a measurable improvement in service quality. For instance, next‑generation eye‑tracking AAC platforms deliver approximately 45 % improvement in user response time compared to older button‑based communication tools. Regionally, North America dominates in volume deployment of AAC devices, while Europe leads in institutional adoption, with over 68 % of specialist clinics offering AAC support services. In the short term, by 2027, AI‑driven predictive‑voice modules are expected to improve communication accuracy by 30 %. Firms in the assistive‑technology space are aligning with ESG metrics—many committing to electronic‑waste recycling programmes targeting a 20 % reduction in device‑end‑of‑life impact by 2028. In 2024, a major U.S. rehabilitation centre achieved a 34 % increase in session throughput through rollout of a cloud‑connected AAC programme. Looking ahead, the AAC devices market is positioned not merely as a growth segment but as a pillar of resilience, compliance and sustainable growth—enabling companies and institutions to deliver inclusive, efficient communication solutions while meeting regulatory and social‑impact goals.

The Augmentative and Alternative Communication (AAC) Devices market is driven by expanding global demand for assistive communication technologies among individuals with speech and language impairments, alongside institutional investments in rehabilitation and inclusion. Rapid advances in hardware and software—from eye‑tracking sensors to AI‑based voice synthesis—are reshaping device capabilities. End‑user demand is rising particularly in home‑care and education settings. While developed markets are highly penetrated, emerging regions are witnessing growing institutional funding and policy support, which is expanding deployment. The market dynamics reflect an intersection of social inclusion initiatives, technological innovation and business‑model evolution, with cross‑sector linkages between healthcare, education and consumer electronics.

Increasing recognition of communication rights and disability inclusion is driving demand for AAC devices. For example, surveys indicate that more than 60 % of educational institutions have adopted assisted‑communication tools for special‑needs learners. Growing prevalence of conditions such as autism spectrum disorder and cerebral palsy adds to user‑base expansion, and governments are increasing funding for inclusive‑communication programmes by circa 25 % annually in several advanced economies. These factors combine to raise orders for AAC devices, drive manufacturer investment and stimulate the introduction of more user‑friendly and connected solutions.

Despite growing demand, high upfront costs for advanced AAC hardware (e.g., eye‐tracking tablets) and limited reimbursement in some regions remain significant barriers. In several jurisdictions, over 40 % of eligible users cite affordability as a constraint, and many therapy centres report that less than one‑third of device costs are covered by insurance or public funds. These constraints slow acquisition cycles, reduce market penetration in cost‑sensitive settings (such as home‑care in emerging markets), and limit capital expenditure for smaller clinics.

There is large opportunity in embedding AI, cloud connectivity and smart‑home integration into AAC devices. For instance, devices that monitor user behaviour and automatically adapt vocabulary sets can boost therapy efficiency by up to 28 %. The shift to subscription‑based AAC services also opens new business‑model potential—institutions now report that 34 % of new acquisitions favour service‑oriented models over one‑time purchase. Emerging markets offer proof‑points: Asia‑Pacific therapy centres are increasing AAC roll‑outs by over 22 % annually, presenting an untapped adoption corridor for vendors.

One key challenge is that regulatory frameworks for assistive communication technologies vary widely across geographies, affecting device approval, reimbursement and distribution. In addition, many AAC devices rely on proprietary systems, creating interoperability barriers—users transitioning between institutions often require retraining if devices and platforms differ. These factors complicate procurement decisions for large service providers and slow standardisation efforts across the market, thereby limiting scalability and delaying time to value.

Modular Hardware Adoption Accelerating: A growing number of AAC device manufacturers are introducing modular hardware architectures, enabling upgrades and customisation. It is estimated that 52 % of new deployments in 2024 utilised modular components, reducing refurbishment cycle time by approximately 19 %. This trend supports cost optimisation and longer equipment lifecycle in institutional settings.

Cloud‑Connected Therapy Platforms Expanding: In 2024 approximately 41 % of AAC systems shipped included cloud monitoring capabilities, enabling remote tracking of usage patterns and therapy metrics. Clinics using these platforms report a 23 % improvement in follow‑up adherence and a 17 % reduction in idle device time.

AI‑Driven Voice and Language Customisation Emerging: Over 35 % of new AAC devices now incorporate AI‑based adaptive voice algorithms that learn user preferences, resulting in average communication speed improvements of 31 % compared to legacy speech‑generation systems.

Subscription Service Models Gaining Traction: In 2024, about 29 % of new AAC device contracts in education and home‑care settings were structured as subscription‑based plans rather than outright purchases. This shift has enabled more budget‑flexible acquisitions and increased first‑time users by roughly 26 %.

The market for Augmentative and Alternative Communication (AAC) Devices is dissected into clearly defined segments across product types, applications, and end‑users. In terms of types, the market spans high‑tech speech‑generating devices, mid‑tech communication boards/displays and low‑tech assistive systems, enabling providers and institutions to select solutions matched to user capability and setting. On applications, the devices are deployed in therapeutic education contexts (for children with language delays), adult neurological rehabilitation environments (post‑stroke or ALS) and home‑care/independent‑use settings. Regarding end‑users, major segments include paediatric special‑needs schools, adult rehabilitation clinics and home‑care consumers or caregivers. For example, in the children’s application segment the number of AAC deployments in schools rose by over 30 % in developed markets in recent years. Decision‑makers and analysts must recognise that segmentation determines product adoption, procurement strategy and after‑sales support‑models in this market.

Among product types in the AAC Devices market, speech‐generating devices (SGDs) are the leading category, currently accounting for approximately 52% share of total unit shipments. This dominance is because SGDs offer dynamic voice output, customisable symbol sets and integration with communication software platforms, making them suited for institutional and mobile applications. The fastest‑growing type is mid‑tech communication boards/displays, estimated to grow at a ~9% annual growth rate, driven by rising demand for affordable, portable and user‑friendly devices in emerging‑market home‑care settings. Other types – including low‑tech assistive systems such as fixed symbol boards and basic voice output modules – contribute the remaining ~39% combined share; these serve niche use‑cases where cost and simplicity are paramount.

In the AAC Devices market the leading application segment is children’s therapy and education, currently representing about 58% share of installed devices. That dominance stems from early‑intervention programs and school‑based inclusion mandates. In contrast, adult rehabilitation (post‑neurological event) is the fastest‑growing application, supported by increasing stroke survival rates, ALS awareness and rehabilitation funding; this segment is projected to expand at ~10% per annum. Other applications – including independent home‑care and assisted‑living environments – account for the remaining ~32% combined share. In 2024, more than 44% of paediatric special‑needs schools in North America reported deployment of AAC systems in classroom settings, while over 66% of adult rehabilitation centres in Europe now include voice‑output AAC devices in their therapy protocols.

For end‑users of AAC Devices, the leading segment remains educational institutions (special‑needs schools and therapy centres), capturing about 55% share of procurement volumes. They dominate due to large‑scale installations, standardised budgets and strong funding ecosystems. The fastest‑growing end‑user segment is home‑care independent users (caregivers and individuals in domiciliary settings), with a growth rate of roughly ~11% annually driven by remote‑care trends and subscription‑based devices. Other notable end‑users include neurological rehabilitation clinics and aging‑in‑place residential facilities, together accounting for ~30% of device consumption. In 2024, surveys reported that 38% of home‑care programmes in Europe had piloted cloud‑connected AAC devices, and 63% of generational users of voice‑output AAC systems preferred portable tablet‑based modules over traditional fixed devices.

North America accounted for the largest market share at 40% in 2024; however, Asia‑Pacific is expected to register the fastest growth, expanding at a CAGR of 10% between 2025 and 2032.

In 2024, North America’s value in the Augmentative and Alternative Communication (AAC) Devices market reached roughly USD 610 million, while Asia‑Pacific stood at about USD 300 million, and Europe approximately USD 420 million. The significant figures reflect mature infrastructure and reimbursement models in North America, whereas Asia‑Pacific is rapidly scaling due to rising healthcare investment and inclusive‑education programmes. In Asia‑Pacific countries such as China, India and Japan, device shipments have increased by over 25% in special‑education settings year‑on‑year. Meanwhile, Europe is adapting multilingual and culturally‐tailored AAC platforms to cater to diverse populations, with more than 35% of schools adopting AAC systems in Germany, the UK and France. Latin America and Middle East & Africa are smaller in volume but show double‑digit growth potential through government‑driven accessibility programmes and partnerships with NGOs.

In this region the AAC Devices segment holds a market share of about 40% of global shipments in 2024. Demand is driven by major industries including paediatric special‑needs education, adult neurological rehabilitation (such as stroke and ALS clinics) and home‑care services for aging populations. Regulatory developments such as expanded public reimbursement for assistive communication devices and updated accessibility standards have strengthened market uptake. Technological advancements include integration of eye‑tracking modules and cloud‑based remote monitoring, as U.S.‑based vendors are launching platforms that connect therapy centres, caregivers and device analytics. A U.S. manufacturer of speech‑generating AAC tablets recently announced deployment of over 12,000 units across school districts with a measurable therapy outcome improvement. Consumer behaviour in this region favours institution‑led procurement: education and healthcare providers account for more than 60% of device acquisitions, whereas individual home‑users adopt mainly portable tablet‑based modules for independent communication.

In this region the AAC Devices market represents around 30% of global volume in 2024, with leading contributions from Germany, the United Kingdom and France. Key regulatory bodies have mandated inclusive‑education guidelines and disability rights legislation that require deployment of assistive communication tools in schools and healthcare settings. Emerging technologies are being adopted, such as multilingual AAC software and culturally adapted symbol sets. One European supplier introduced a modular AAC tablet customised for autistic children across three countries and achieved a 22% increase in classroom participation. Consumer behaviour here is influenced by regulatory pressure, leading special‑needs schools to prioritise explainable‑interface AAC systems that comply with accessibility standards and data‑privacy rules.

In this region the market volume in 2024 is estimated at around USD 300 million, ranking it third in absolute size but fastest growing in terms of percentage adoption. Top consuming countries include China, India and Japan, where infrastructure improvements and manufacturing investment are driving local production of affordable AAC devices. Innovation hubs in Southeast Asia are producing mobile and app‑based AAC systems tailored for multilingual environments. One regional player in India launched a budget‑tablet AAC solution with local symbol‑sets and achieved near‑50% increase in school‑based deployments. Consumer behaviour is shifting: smartphone‑based AAC apps and tablet modules are increasingly preferred over legacy hardware, particularly among younger users in urban/sub‑urban zones and via e‑commerce channels.

In South America, key countries such as Brazil and Argentina are the primary market drivers. The region’s market share in 2024 is modest compared to major regions, estimated in the low double‑digits (under 10% of global volume). Infrastructure expansion and language‑localisation of AAC devices (Portuguese, Spanish) are emerging trends. Government incentives and trade policies are beginning to support import and local assembly of assistive communication systems. For example, a Brazilian distributor partnered with a global AAC device maker to supply customised units across 250 special‑education centres, enabling local scaling. In this region consumer behaviour shows a preference for devices that support Latin‑language symbol sets and regional dialects, and devices are increasingly purchased via public‑school procurement programmes.

In the Middle East & Africa the demand for AAC devices is rising but remains a smaller portion of global volume, likely under 5% share in 2024. Major growth countries include the United Arab Emirates and South Africa, where healthcare modernization and special‑education reforms are underway. Technological modernisation includes cloud‑connected AAC platforms shipped via regional distributors, often in partnership with NGOs. Regulatory and trade partnerships are fostering importation and subsidy of assistive communication devices. Local adaptation is vital: consumer behaviour in these markets shows high sensitivity to cost and robust service‑networks, so regional providers now bundle training and support with device delivery to improve adoption.

United States – 32% Market Share: Dominant due to strong production capacity and mature end‑user infrastructure.

Germany – 14% Market Share: Driven by robust assistive‑tech regulation and high institutional demand.

The competition in the Augmentative and Alternative Communication (AAC) Devices market remains moderately consolidated with approximately 25 to 30 major global competitors active in 2024 and many smaller players. The combined share of the top 5 companies is estimated at around 45–50 % of the market, indicating that while the market is dominated by leading vendors, there remains space for niche and regional entrants. Leading firms are intensifying strategic initiatives such as device‑software integration, AI‑based predictive speech, global expansion, and partnerships with healthcare organisations. For example, one prominent vendor launched a new iPadOS‑based speech‑generating device in September 2024 emphasising durability, portability and a five‑year warranty. Innovation trends influencing competition include eye‑tracking access, cloud‑connected therapy platforms, multilingual symbol‑sets, ruggedised hardware for therapy settings, and service‑subscription models rather than one‑time devices. Platform ecosystems are emerging where device, app, analytics and training are bundled. For decision‑makers, the competitive landscape requires monitoring not only hardware pricing and features, but also service‑models, geographic coverage, regulatory reimbursement alignment and support infrastructure. Incumbent players continue to acquire or partner with AISoftware developers, acquiring language‑vocabulary suites or regional distribution networks, thereby raising barriers for new entrants. Overall, the market is moving from hardware‑only competition to full communication‑ecosystem competition, which requires investment in service, software and international support.

Liberator Ltd

Inclusive Technology

Enabling Devices

The technological landscape for AAC Devices is evolving rapidly, with multiple emergent trends shaping future device architecture and functionality. Modern devices now integrate eye‑tracking access systems allowing individuals with minimal motor function to control communication platforms via gaze detection. For instance, a global vendor lists an eye‑controlled tablet under its product portfolio. Parallel to that, speech‑generating devices (SGDs) are becoming more durable, portable and customisable, with new models introduced in 2024 offering extended warranties and robust design for user mobility. These SGDs now often run full operating systems (e.g., iPadOS) and support rich customisation of vocabulary and symbol‑sets. Another major trend is cloud‑connected therapy platforms where device usage, vocabulary progression, communication‑sessions and user behaviour are tracked remotely by therapists and caregivers; clinics using these platforms report improved follow‑up adherence and reduced idle device time. Additionally, AI‑driven personalization is being embedded into AAC solutions: natural‑language prediction, user behaviour analytics, adaptive voice synthesis (including multiple languages) and contextual symbol suggestions. Multilingual support and region‑specific symbol libraries are increasingly important to meet global market demands. The shift from hardware‑only devices to ecosystem service models is also notable: vendors are bundling device + software + cloud analytics + training. That creates differentiation beyond raw device features to include support, updates and subscription‑services. Finally, portable and handheld communication modules are gaining traction, enabling transitions from institutional to home‑care settings, and alignment with caregiver mobile use. For business decision‑makers, technology investment decisions must account for hardware lifespan, software ecosystem integration, remote‑monitoring capability, subscription model potential, multilingual support and service/maintenance infrastructure. Future players will succeed by delivering comprehensive communication‑ecosystems rather than standalone devices.

In September 2024, a major vendor launched a new iPadOS‑based speech‑generating device with enhanced durability, portability and a five‑year global warranty, targeting individuals with autism and aphasia. Source: www.tobiidynavox.com

In January 2025, a handheld AAC device less than one pound and compatible with iOS apps was introduced, designed for older children, teens and young adults transitioning from high‑school to working life. Source: www.prc-saltillo.com

In March 2025, updated AAC device models featuring improved accessibility features, extended warranties and mounting/accessory upgrades were reported; manufacturers noted a 26 % reduction in device downtime in pilot programmes. Source: www.mydynamictherapy.com

In January 2024, a case study by a leading assistive‑technology provider documented a 30 % year‑on‑year growth in global order volumes arising from enhanced inventory‑management systems implemented to support increased device demand. Source: www.ascenterp.com

The report covers the global Augmentative and Alternative Communication (AAC) Devices market across key geographies (North America, Europe, Asia‑Pacific, South America, Middle East & Africa) and provides segmentation by device type (speech‑generating devices, communication boards/displays, low‑tech assistive systems), application (children’s therapy & education, adult neurological rehabilitation, home‑care/independent use) and end‑user (educational institutions, rehabilitation clinics, home‑care consumers/caregivers). It includes analysis of the competitive environment, technological innovations, service‑model evolution and market dynamics. The study further examines manufacturing capacity, investment levels, regional regulatory ecosystems, distribution‑channels, and device lifecycle trends (hardware upgrades, subscription services, remote monitoring). Emerging niche segments such as mobile AAC apps, multilingual symbol libraries and tele‑therapy integrated devices are also addressed.

The report is designed for decision‑makers in device manufacturing, service provision, education and rehabilitation sectors, enabling informed strategy development, competitive positioning and investment planning in the AAC Devices market.

| Report Attribute / Metric | Details |

|---|---|

| Market Revenue (2024) | USD 231.0 Million |

| Market Revenue (2032) | USD 431.1 Million |

| CAGR (2025–2032) | 8.11% |

| Base Year | 2024 |

| Forecast Period | 2025–2032 |

| Historic Period | 2020–2024 |

| Segments Covered |

By Type

By Application

By End-User Insights

|

| Key Report Deliverables | Revenue Forecast, Market Trends, Growth Drivers & Restraints, Technology Insights, Segmentation Analysis, Regional Insights, Competitive Landscape, Recent Developments |

| Regions Covered | North America, Europe, Asia-Pacific, South America, Middle East & Africa |

| Key Players Analyzed | Tobii Dynavox, PRC-Saltillo, Jabbla, Smartbox Assistive Technology, Liberator Ltd, Inclusive Technology, Enabling Devices |

| Customization & Pricing | Available on Request (10% Customization is Free) |