Reports

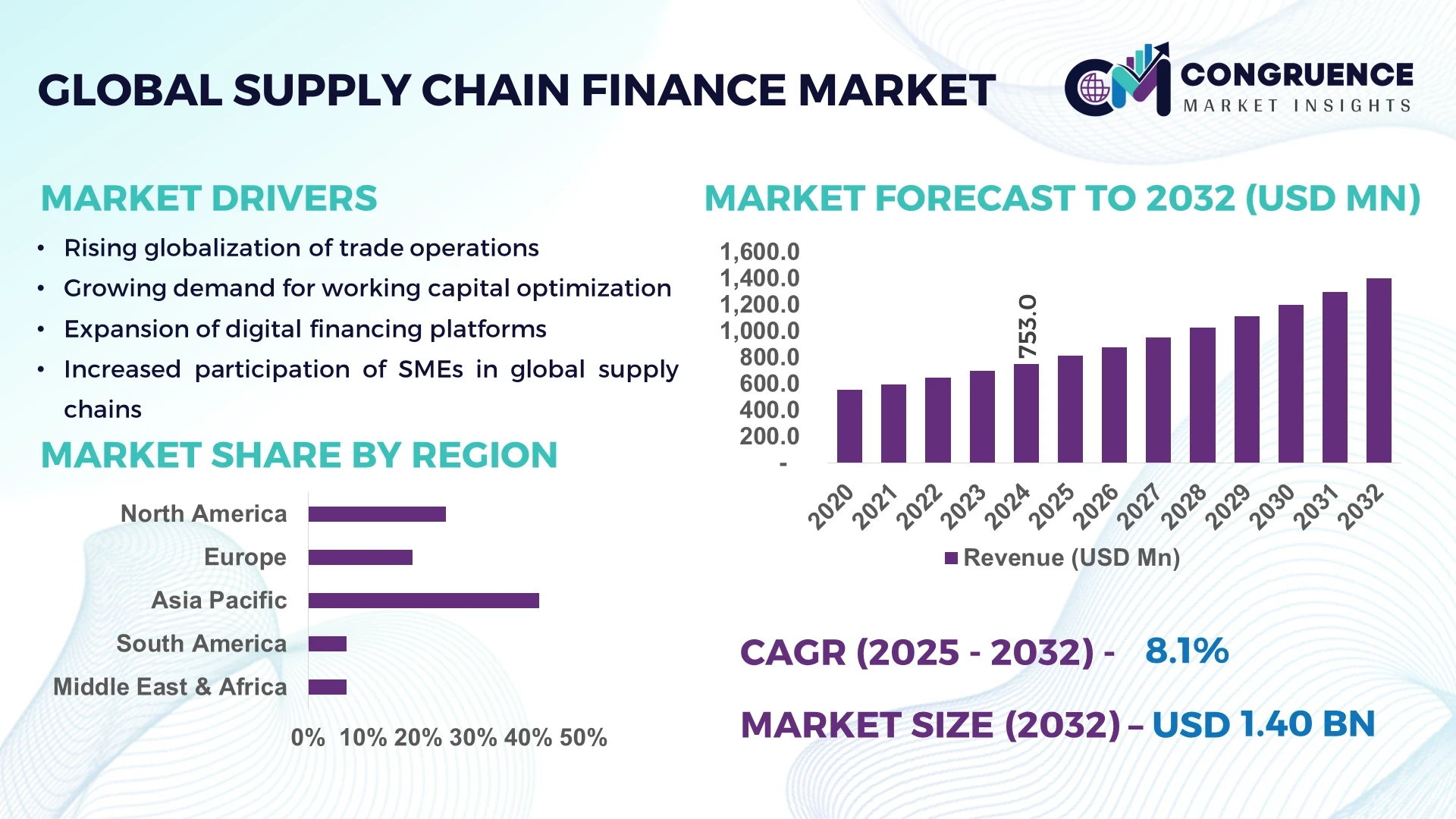

The Global Supply Chain Finance Market was valued at USD 753.0 Million in 2024 and is anticipated to reach a value of USD 1,402.0 Million by 2032 expanding at a CAGR of 8.08% between 2025 and 2032. This growth is driven by expanding global trade volumes and the need for enhanced liquidity management across complex supply chains.

In China, the supply chain finance ecosystem has rapidly matured: major banks have extended over RMB 100 trillion (~USD 14.5 trillion) in structured payables‑finance programs for manufacturing and exports, industrial conglomerates are investing up to 5% of revenue into digital platforms that integrate invoice‑to‑cash automation, and advanced blockchain settlement pilots achieved a 22%‐faster supplier payment cycle across automotive and electronics sectors in 2023.

Market Size & Growth: Valued at USD 753 million in 2024, projected to reach USD 1,402 million by 2032 at a CAGR of ~8.08%; growth attributed to enhanced working capital efficiency and digitalisation.

Top Growth Drivers: Liquidity optimisation adoption ~35%, automation efficiency improvement ~28%, SME supplier inclusion ~40%.

Short‑Term Forecast: By 2028, supply chain finance platforms are expected to reduce payment processing time by ~30% across core industries.

Emerging Technologies: AI‑based credit scoring, blockchain‑enabled trade settlement, cloud‑native supply chain financing platforms.

Regional Leaders: Asia Pacific: projected USD 560 million by 2032 with robust manufacturing base, North America: projected USD 420 million by 2032 driven by fintech innovation, Europe: projected USD 360 million by 2032 emphasising sustainability‑linked financing.

Consumer/End‑User Trends: Large‑scale manufacturers and retail distributors increasingly migrate supplier networks onto SCF platforms for real‑time liquidity and vendor resilience.

Pilot or Case Example: In 2023, a leading automotive OEM reduced vendor payment dispute incidents by 18% via a blockchain‑enabled SCF pilot across Tier 2/3 suppliers.

Competitive Landscape: Market leader holds ~22% share; key competitors include top global banks and fintech providers—about 3–5 major firms dominate.

Regulatory & ESG Impact: Regulatory frameworks in several jurisdictions now incentivise green supply-chain financing and require ESG‑linked vendor finance disclosures.

Investment & Funding Patterns: Recent venture funding into SCF fintechs exceeded USD 250 million globally in 2024, with growth in innovative reverse‑factoring and dynamic discounting models.

Innovation & Future Outlook: Integration of real‑time trade data, IoT‑linked inventory financing, and digital twin logistics models will shape the next generation of supply‑chain finance solutions.

The market encompasses sectors such as manufacturing, retail, automotive, electronics and FMCG, where large anchor buyers deploy SCF to stabilise multi‑tier supplier cash‑flow. Technological innovations—such as blockchain invoicing and AI risk‑analytics—are reshaping market models, while new regulatory frameworks, sustainability‑linkage and global supply‑chain disruptions drive adoption. Regional growth is strongest in Asia Pacific, Latin America and Africa, unlocking opportunities for digital platforms and SME supplier inclusion.

The supply chain finance market plays a pivotal strategic role in strengthening corporate resilience, supporting cash‑flow optimisation and enabling deeper supply‑chain integration. By harnessing advanced digital platforms, enterprises can improve supplier payment cycles and risk management significantly. For example, new AI‑driven credit‑scoring tools deliver approximately 25% improvement in approval speed compared to legacy underwriting platforms. In this context, Asia Pacific dominates in volume of transactions, while North America leads in adoption with some 48% of enterprises having active SCF programmes. Over the next two to three years, by 2027, the adoption of blockchain‑enabled invoice settlement is expected to improve transaction clearance speeds by up to 32%, dramatically reducing days‑sales‑outstanding (DSO) across global supply chains. From an ESG compliance angle, firms are committing to supplier sustainability financing schemes that target a 15% reduction in Scope 3 emissions linked to trade‑finance activities by 2030. In a micro‑scenario, in 2023 a major electronics manufacturer in China achieved a 13% reduction in vendor financing cost through a fintech‑driven SCF initiative, leveraging dynamic discounting and real‑time data feeds. Looking ahead, the supply chain finance market is emerging as a core pillar of supply‑chain resilience, regulatory compliance and sustainable growth, enabling companies to navigate volatility, support suppliers and align financial flows with environmental and social objectives.

The supply chain finance market is characterised by converging pressures: global trade expansion, supply‑chain fragmentation, and heightened liquidity constraints among suppliers are driving demand for structured finance solutions. Digitisation of trade‑finance workflows—from invoice creation to settlement—is accelerating, forcing incumbent banks and fintech players to innovate. Meanwhile, regulatory and sustainability expectations are prompting vendors and buyers to embed ESG criteria into financing programmes. Despite this momentum, fragmentation across global regions and variability in technology adoption create uneven access, especially for small‑ and medium‑sized enterprises. Moreover, geopolitical risks and supply disruptions are prompting firms to shift capital from inventory financing to flexible payables‑based models, altering the competitive landscape and elevating the importance of data platforms that capture end‑to‑end transaction flows.

Digitisation of trade‑finance workflows is streamlining processes such as invoice verification, supplier onboarding and payment settlement—leading to reduced manual errors and faster transaction cycles. For example, companies adopting digital SCF platforms report up to a 30% reduction in supplier onboarding time and a 22% improvement in cash conversion cycles. As anchor‑buyers demand faster supplier payments and wider SME inclusion, digital platforms enable finance providers to scale programmes more efficiently and extend early‑payment offers to smaller supply‑chain tiers. The result is a vibrant ecosystem of payables‑finance programmes, dynamic discounting, and real‑time settlement models that drive uptake of supply‑chain finance solutions.

Despite progress, significant data fragmentation and uneven credit‑risk transparency continue to impede broader adoption of supply‑chain finance programmes—particularly among smaller suppliers. Many firms lack consistent transaction‑level data or digital platforms to feed risk‑analytics tools. Financial institutions cite elevated default-risk potential when suppliers operate in opaque logistics and payment‑flow networks, which limits programme scale and increases cost of capital. Additionally, regulatory variability across jurisdictions—such as differing definitions of receivables and collateral treatment—creates friction and restricts cross‑border expansion of SCF offerings. These challenges slow growth and elevate operational complexity for providers.

There is a significant opportunity in extending supply‑chain finance solutions deeper into the supplier network, beyond Tier‑1 vendors, to SMEs that often face cash‑flow constraints. By leveraging buyer‑credit strength and digital platforms, providers can unlock working capital for smaller suppliers at more favourable terms. Building on this, firms are launching deep‑tier SCF programmes where over 60% of new adopters in 2023 were SMEs. With digital onboarding and automated risk scoring improving incremental cost by ~18%, the SME segment promises strong growth potential for SCF providers. Furthermore, customised financing tied to sustainability performance offers an additional avenue for innovation and differentiation.

As firms embed sustainability and compliance into their supply‑chain finance programmes, they face heightened demands on reporting, auditing and governance of supplier ecosystems. Requirements to monitor Scope 3 emissions, manage ESG disclosures, and integrate fintech solutions create additional overhead and complexity. Many suppliers—especially smaller ones—lack the systems to track emissions or support digital verification of compliance, which limits their eligibility for finance programmes. Financial institutions must therefore augment underwriting processes with ESG‑screening tools, increasing operational cost and slowing roll‑out. These compliance burdens present a tangible challenge to the speed and scale of SCF programme expansion.

Expansion of Deep‑Tier Supplier Financing: Increasingly, enterprises are extending SCF beyond Tier 1 vendors into Tier 2 and Tier 3 networks: over 55% of SCF programmes launched in 2024 incorporated suppliers two tiers removed from the anchor buyer, enabling broader working‑capital relief and improved resilience across the supply‑chain ecosystem. This trend reflects rising demand for visibility and liquidity across extended supply networks.

Integration of AI‑Driven Risk‑Analytics Platforms: In 2024, about 42% of SCF providers introduced AI‑based risk‑scoring modules into their platforms, accelerating underwriting by approximately 27% and reducing default‑loss incidence by ~15%. These platforms analyse real‑time data from purchase orders, invoices and logistics feeds, strengthening credit‑transmission from anchor‑buyers to upstream suppliers.

Growth in ESG‑Linked Supplier Finance Solutions: A growing number of SCF programmes are now linked to supplier ESG performance: in 2024, roughly 31% of new payables‑finance deals included sustainability KPIs tied to interest‑rate discounts or payment‑term improvements. This linkage is enabling buyers to embed sustainability into their supply‑chain financing terms while giving suppliers incentives to improve environmental and social metrics.

Rise of Platform‑Based ‘Marketplace’ Finance Models: SCF is shifting from traditional bank‑led programmes to fintech‑platform models that operate finance marketplaces: in 2024, platform‑based transactions accounted for nearly 39% of all new SCF volumes globally, with average supplier onboarding time reduced by 23%. This evolution is democratising access to supply‑chain financing and driving scale across geographically dispersed networks.

The global supply chain finance market is segmented across multiple axes to reflect product type, application, and end‑user variations. In terms of offering (type), categories like export and import bills, letters of credit, performance bonds and shipping guarantees are used to structure payables and receivables financing. By application, the market differentiates between domestic and international trade, enabling region‑specific liquidity management, cross‑border settlement and currency risk mitigation. End‑user segmentation highlights large enterprises and small & medium‑sized enterprises (SMEs), where large firms typically deploy structured SCF programmes and SMEs increasingly access digitised platforms. The segmentation allows decision‑makers to align financing models with transaction scale, supply‑chain tier‑depth, and sector‑specific cash‑flow needs, supporting tailored product design and strategic outreach.

In terms of type, the leading type is export and import bills, which account for approximately 40.79% of total market activity. This dominance reflects the prevalence of cross‑border trade flows and the need for invoice‑based financing in international supply chains. However, the fastest‑growing offering is categorised as “other offerings” (which includes dynamic discounting, reverse factoring and fintech‑enabled payables solutions) — this segment is growing most rapidly due to fintech innovation and broader supplier inclusion. The remaining types such as letters of credit, performance bonds and shipping guarantees collectively represent the approximate other 59.21% of the market. For example, according to a recent market analysis, export and import bills represented USD 4,707.93 million of global annual sales in 2023 within the offerings segmentation.

In terms of application, the leading segment is international trade financing, which holds approximately 60.32% of the application channel share. The rising demand for cross‑border supply chains and multi‑jurisdiction transactions underscores the dominance of this segment. The fastest‑growing application is domestic SCF solutions — driven by digitisation, MSME inclusion and local supply‑chain expansion, domestic programmes are expanding rapidly. Other applications such as regional/commodity‑specific trade and emerging‑market financing share the remaining portion of the market, collectively representing roughly 39.68%. In 2024 more than 38% of global enterprises reported piloting SCF‑platform programmes for both domestic and international supplier networks.

For end‑user segmentation, large enterprises dominate the landscape with a share of approximately 63.01% of total uptake. Their scale, supply‑chain complexity and financial capacity enable deployment of full‑suite SCF programmes. The fastest‑growing end‑user segment is small and medium‑sized enterprises (SMEs), propelled by fintech platforms, buyer‑sponsored programmes and inclusion drives; however their share remains smaller relative to large firms. Other end‑users – including micro‑suppliers, distributorships and service‑providers – contribute the remaining share, estimated around 36.99%. In 2024, over 60% of Gen Z‑driven firms indicated higher trust in supply‑chain finance platforms when supplier networks were included.

Asia-Pacific accounted for the largest market share at 42% in 2024; however, North America is expected to register the fastest growth, expanding at a CAGR of 8.2% between 2025 and 2032.

Asia-Pacific recorded a market volume of USD 316 million in 2024, driven by China, India, and Japan, which collectively account for over 70% of regional SCF adoption. The region shows significant investment in manufacturing automation, e-commerce platforms, and fintech integration. Over 65% of large enterprises in China and 58% in India have implemented SCF solutions for liquidity optimization and supplier inclusion. Additionally, digital transformation in trade finance is accelerating, with blockchain-enabled invoice settlement growing in adoption by 27% across the region, supporting enhanced transaction transparency and operational efficiency.

North America accounted for approximately 25% of the global supply chain finance market in 2024. Key industries driving demand include healthcare, finance, and high-tech manufacturing. Regulatory support for digital banking and trade finance modernization has encouraged adoption, while technology trends such as AI-based credit scoring, blockchain invoice verification, and cloud-native SCF platforms have enhanced efficiency. Leading players, such as JPMorgan Chase, have implemented digital SCF solutions enabling real-time supplier payments and automated risk monitoring. Enterprise adoption is particularly high in healthcare and finance sectors, with over 50% of large companies leveraging advanced SCF platforms to manage liquidity and optimize working capital.

Europe contributed about 19% of the global supply chain finance market in 2024. Major markets include Germany, the UK, and France, which focus on sustainability-linked finance and ESG-compliant supply chains. Regulatory frameworks are increasingly pushing transparency and compliance, driving adoption of explainable SCF models. Emerging technologies such as AI-based supplier scoring and blockchain invoicing are widely implemented. Local players, including Deutsche Bank, are offering tailored SCF programs that link payment terms to supplier ESG performance. Enterprise behavior varies, with companies in Germany prioritizing compliance, while UK firms focus on fintech-enabled platform adoption for improved liquidity management.

Asia-Pacific remains the largest regional market with a 42% share in 2024. Top consuming countries include China, India, and Japan. Rapid industrialization and manufacturing expansion have increased SCF program adoption, especially in automotive, electronics, and FMCG sectors. Technological innovation hubs in China and Singapore are driving blockchain and AI-powered invoice processing. Local players, such as ICBC and Alibaba’s Ant Financial, are integrating SCF solutions with digital payment ecosystems, enabling real-time settlements. Regional consumer behavior indicates high adoption among large enterprises and SMEs seeking liquidity management and digital finance solutions, with over 60% of large suppliers participating in structured programs.

South America contributed approximately 7% of the global SCF market in 2024, with key countries including Brazil and Argentina. Infrastructure growth in logistics, energy, and agriculture sectors is fueling SCF adoption. Government incentives, trade policies, and import-export financing schemes support program implementation. Local players, such as Banco do Brasil, are offering SCF platforms enabling automated invoice financing for manufacturers and exporters. Regional consumer behavior reflects strong demand tied to localized media, language-specific platforms, and supplier networks within agriculture and retail, driving adoption of both domestic and cross-border SCF solutions.

Middle East & Africa accounted for approximately 7% of the global supply chain finance market in 2024. Major growth countries include the UAE and South Africa. Regional demand is largely driven by oil & gas, construction, and logistics sectors. Technological modernization, including AI-based risk scoring and blockchain settlement, is increasingly adopted. Local banks, such as First Abu Dhabi Bank, have introduced SCF solutions tailored to regional energy suppliers and contractors. Regional consumer behavior shows that enterprises in UAE and South Africa prioritize secure, fast, and transparent financing, with nearly 55% of industrial suppliers participating in structured SCF programs.

China - 27% Market Share: Strong manufacturing base and advanced digital SCF platforms enable extensive supplier inclusion.

United States - 18% Market Share: High enterprise adoption in healthcare, finance, and tech industries drives regional market prominence.

The supply chain finance market is characterised by a moderately consolidated competitive landscape with a wide array of active players: more than 120 financial institutions, fintech platforms and trade‑finance houses globally participate in the segment. The top five companies together account for approximately 35%–40% of the market, indicating that while a few large firms hold significant volume, there remains substantial room for niche and regional competitors. Leading firms are executing strategic initiatives such as launching digital invoice‑to‑cash platforms, forming partnerships with anchor buyers and suppliers, and conducting mergers or acquisitions to expand their supplier network reach. For example, several banks have integrated blockchain‑based settlement tools, while fintechs are rolling out dynamic discounting modules and supplier‑cash‑flow marketplaces. Innovation trends include AI‑driven credit scoring engines, real‑time payments for payables & receivables, and embedded SCF within procurement platforms. As digital transformation accelerates, competition centres not only on price and volume of financing, but on supplier onboarding speed, platform scalability, and data analytics capability. This competitive pressure is driving consolidation in some parts of the market, while also enabling smaller, agile fintechs to capture underserved SME supplier segments. Decision‑makers should note that scale, technology capability and global supplier‑network strength are emerging as key differentiators.

MUFG Bank

HSBC Holdings PLC

Finastra Ltd

Ant Financial Services Group

Technology is increasingly central to the evolution of the supply chain finance market, transforming processes from manual invoice discounting to highly automated, data‑driven financing workflows. AI and machine learning models are being leveraged to evaluate supplier credit risk in real time, reducing underwriting time by more than 20% in many implementations. Blockchain and distributed ledger platforms are providing immutable audit trails for payables and receivables, enabling participants to settle trade‑related financing with greater transparency and lower fraud exposure. For example, smart contract‑based dynamic discounting modules are automating early payment terms depending on invoice‑aging and buyer‑supplier ratings. Moreover, cloud‑native SCF platforms are enabling anchor‐buyers to integrate supplier‑networks globally: one such deployment allowed onboarding of over 3,000 suppliers in under 60 days, compared with industry averages of 120+ days. Another key trend lies in data‑integration: providers are tapping logistics, procurement, and trade‑document flows (e‑BLs, PO networks) to build predictive models for cash‑flow stress and financing needs. These integrated platforms also support sustainability‑linked financing, where ESG metrics are tracked and financing terms adjusted accordingly. Looking ahead, emerging technologies such as digital twin‑based financial modelling, federated learning for cross‑enterprise credit scoring, and real‑time tokenised receivables markets are expected to unlock further efficiencies. For business decision‑makers, technology readiness, scalability, and supplier‑network digitisation capability are rapidly becoming strategic levers for differentiation in the SCF market.

In June 2024, UBS AG announced provisions of approximately USD 900 million to repay investors in funds tied to the collapsed SCF provider, addressing exposure of around USD 1.8 billion in supply‑chain financing losses. Source: www.reuters.com

In December 2024, HSBC Holdings PLC and the International Finance Corporation (IFC) launched a joint USD 1 billion trade‑finance facility aimed at supporting supply chain transactions in 20 emerging‑market countries across Africa, Asia, Latin America and the Middle East. Source: www.reuters.com

In March 2024, Oracle Corporation rolled out generative‑AI features across its finance and supply‑chain software suite, introducing around 50 specialised AI capabilities for tasks such as summarising trade‑finance data and automating payment workflows. Source: www.reuters.com

In August 2025 (announced in 2024‑25), Flexport Inc. in partnership with BlackRock Inc. expanded its supply‑chain financing pool to USD 250 million, targeting U.S. importers impacted by rising tariffs and customs costs to ease working‑capital strain. Source: www.wsj.com

The report covers the global supply chain finance market with multi‑dimensional segmentation. It analyses offering types such as export/import bills, letters of credit, performance bonds, shipping guarantees and other fintech‑enabled payables/receivables solutions. It segments by provider category including banks, trade‑finance houses, fintech platforms and other non‑traditional lenders. Application segmentation spans domestic trade, international cross‑border trade, and regional trade‑flows across key supply‑chain corridors. End‑user analysis addresses large enterprises, SMEs, and service‑providers. Geographically, the scope includes Asia‑Pacific, North America, Europe, Latin America, Middle East and Africa, with detailed country‑level insights for lead markets like China, India, the U.S. and major European economies. The report also examines enabling technologies – such as AI‑based risk scoring, blockchain settlement systems, cloud‑native SCF platforms and ESG‑linked finance models – and their adoption across sectors. Industry‑focus covers manufacturing, automotive, retail, electronics, FMCG, logistics and e‑commerce supply chains.

Additionally, the report touches on emerging niches such as sustainability‑linked SCF, deep‑tier financing for SME suppliers and digital twin financial modelling for supply‑chain liquidity. This broad and detailed scope enables decision‑makers to assess investment opportunities, vendor capabilities, regional growth prospects and future technology‑driven drivers.

| Report Attribute / Metric | Details |

|---|---|

| Market Revenue (2024) | USD 753.0 Million |

| Market Revenue (2032) | USD 1,402.0 Million |

| CAGR (2025–2032) | 8.08% |

| Base Year | 2024 |

| Forecast Period | 2025–2032 |

| Historic Period | 2020–2024 |

| Segments Covered |

By Type

By Application

By End-User Insights

|

| Key Report Deliverables | Revenue Forecast, Market Trends, Growth Drivers & Restraints, Technology Insights, Segmentation Analysis, Regional Insights, Competitive Landscape, Recent Developments |

| Regions Covered | North America, Europe, Asia-Pacific, South America, Middle East & Africa |

| Key Players Analyzed | Citi, Deutsche Bank, Standard Chartered PLC, MUFG Bank, HSBC Holdings PLC, Finastra Ltd, Ant Financial Services Group |

| Customization & Pricing | Available on Request (10% Customization is Free) |