Reports

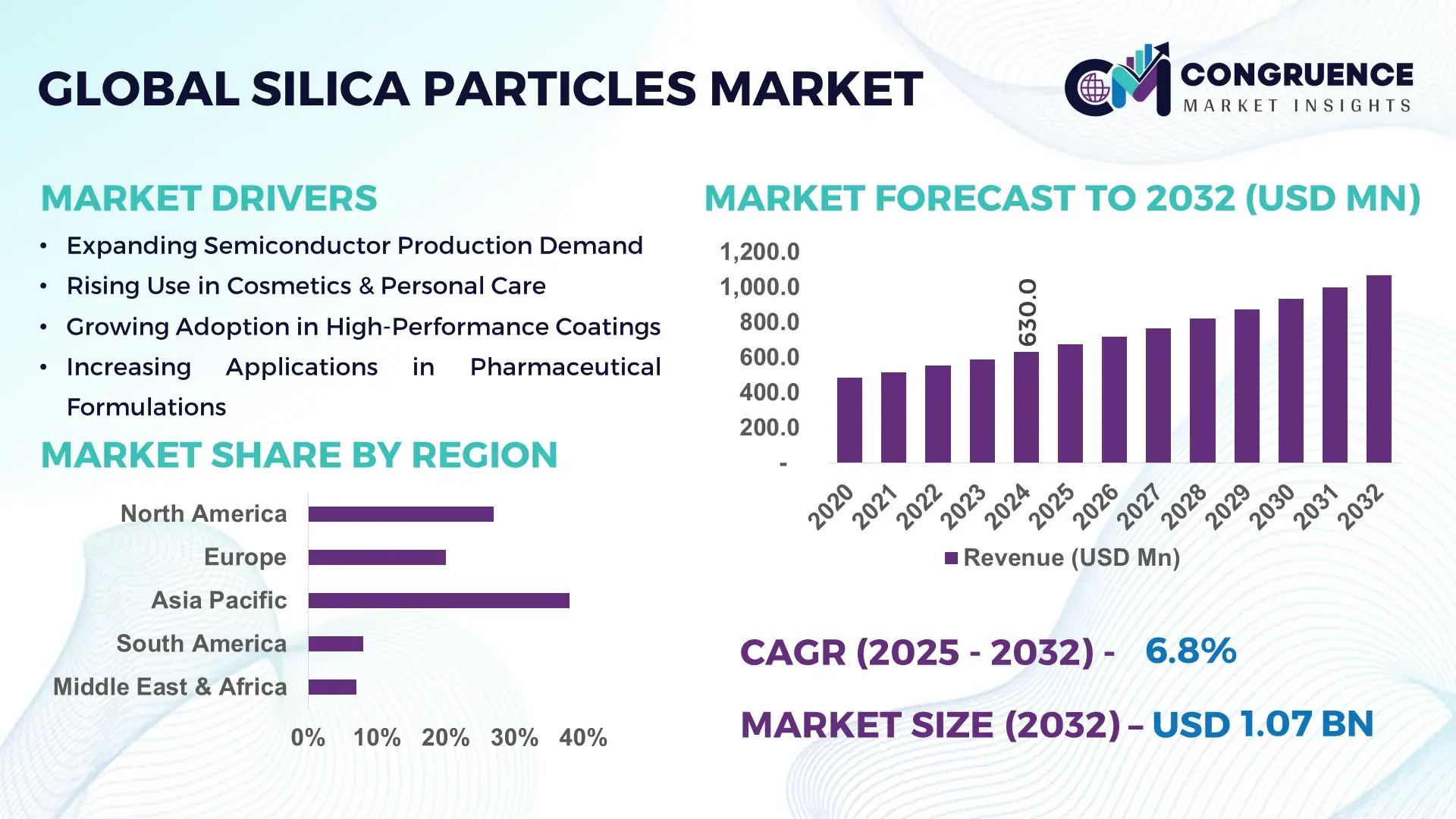

The Global Silica Particles Market was valued at USD 630 Million in 2024 and is anticipated to reach a value of USD 1,066.4 Million by 2032, expanding at a CAGR of 6.8% between 2025 and 2032, according to an analysis by Congruence Market Insights. This growth is driven by escalating demand in high‑precision industries due to silica’s exceptional thermal stability and porosity.

In particular, China has emerged as a critical production hub for silica particles: its advanced manufacturing infrastructure supports an annual output exceeding 100,000 tonnes of engineered silica. Chinese firms are investing heavily in R&D to produce specially functionalized silica for electronics, battery, and biomedical applications. Technology‑driven adoption is strong, with over 35% of Chinese high‑tech manufacturers incorporating nano‑silica or spherical silica in their processes.

Market Size & Growth: Valued at USD 630 M in 2024, set to reach USD 1,066.4 M by 2032—fueled by growth in semiconductors, pharmaceuticals, and specialty materials.

Top Growth Drivers: Adoption in electronics (+35%), usage in biomedical applications (+20%), and demand in high-performance coatings (+18%).

Short-Term Forecast: By 2028, production cost per unit is expected to decline by ~10% due to process optimization and economies of scale.

Emerging Technologies: Surface‑functionalized silica, hollow microspheres, and nano‑silica for advanced drug delivery.

Regional Leaders: Asia‑Pacific projected ~USD 400 M by 2032, North America ~USD 300 M, and Europe ~USD 200 M—each region leveraging unique adoption trends.

Consumer/End‑User Trends: Key consumers include semiconductor fabs, pharma companies, and cosmetics manufacturers, with increasing preference for ultra‑high purity and engineered grades.

Pilot or Case Example: In 2025, a leading semiconductor fab trialed surface‑modified silica in CMP slurries and achieved a 12% yield boost.

Competitive Landscape: Market leader Shin‑Etsu (~18%), with strong presence from Denka, Cabot, Imerys, and Jiangsu Yoke Technology.

Regulatory & ESG Impact: Heightened health and safety regulations over silica dust are pushing firms to improve containment and recycling systems.

Investment & Funding Patterns: Over USD 100 M allocated in 2024–2025 to capacity expansion, with increasing venture funding for startup nano‑silica technologies.

Innovation & Future Outlook: Development of 3D-printable silica composites and biocompatible silica particles is opening new application frontiers in medical and energy sectors.

Silica particles are increasingly embedded in advanced materials across industries, with innovation accelerating through tailored functionality and sustainable manufacturing practices.

Silica particles are strategically vital to the high-tech materials ecosystem, playing a foundational role in sectors such as semiconductors, pharmaceuticals, and energy. Their unique characteristics — high surface area, tunable porosity, and chemical inertness — allow them to serve as critical enablers in advanced manufacturing. For instance, surface-functionalized silica delivers up to 25% better planarization uniformity compared to conventional silica, enhancing yields in wafer production.

Regionally, Asia‑Pacific dominates in volume production, driven by major manufacturing centers in China and Japan, while North America leads in high-value adoption, with more than 60% of advanced semiconductor fabs integrating engineered silica in their process flows. Over the next 2–3 years, the adoption of nano-silica and hollow microspheres is expected to improve process efficiency by 15–20%, especially in battery and coating applications.

Environmental and safety compliance is becoming central to strategy: leading firms are committing to >20% recycling of silica production waste by 2029, signaling a shift toward sustainable manufacturing. In one micro-scenario, a U.S.-based silica producer deployed AI‑driven process control in 2025 to reduce particle aggregation by 10%, directly cutting defect-related losses.

Looking forward, the Silica Particles Market is poised to be a resilient, innovation-led pillar of materials growth — combining regulatory alignment, technological differentiation, and end‑user value creation in a dynamic global landscape.

The Silica Particles Market is shaped by a complex interplay of industrial demand, technical innovation, and regulatory trends. Its dynamics are driven by increasing use in electronics (e.g., CMP, dielectric materials), biomedicine (drug delivery, diagnostics), and specialty coatings. Raw materials, such as high‑purity quartz, continue to be a constraint due to concentration in mining regions. On the supply side, firms are investing in advanced manufacturing capabilities — including nano‑synthesis and surface modification — to meet the growing need for tailored silica. At the same time, tighter occupational safety regulations regarding silica dust are increasing the cost of production through enhanced containment and clean‑room processes. Meanwhile, the surge in R&D activities is unlocking new applications, reinforcing silica’s strategic relevance in high-growth sectors.

The electronics industry is a major catalyst for silica particles demand. As device geometries shrink and performance demands increase, manufacturers are turning to ultra‑high-purity silica particles in CMP slurries, dielectric layers, and packaging materials. Silica’s superior thermal stability and electrical insulation properties enhance device reliability and yield. Furthermore, the shift to 3 nm and below process nodes is increasing per‑wafer consumption of engineered silica, while the transition to 5G and EV technologies is fueling demand for high-precision silica-based components.

Respirable silica presents a significant health risk, leading to stricter regulation in many regions. To comply, silica manufacturers must invest in high-efficiency ventilation, filtration, and containment systems — increasing operating costs by 15–20%. Smaller producers, particularly in emerging markets, face higher entry barriers. Moreover, regulatory compliance demands slow expansion of production capacity, especially for high-purity and nano-grade silica, because of additional capital required for closed-loop and dust‑controlled manufacturing.

The biomedical sector offers one of the most promising growth avenues for silica particles. Porous, surface‑functionalized silica is being used for targeted drug delivery, diagnostics, and regenerative medicine. Clinical-level research indicates that silica carriers can achieve >40% higher drug loading compared to polymer-based systems, making them more efficient for controlled release. With increasing regulatory emphasis on safe and effective delivery platforms, pharmaceutical companies are actively exploring mesoporous silica-based delivery systems, translating into long-term demand for high-grade, biocompatible silica.

The production of engineered silica particles heavily depends on high‑purity quartz, which is subject to supply constraints and geopolitical risks. Quartz mines are geographically concentrated, and fluctuations in raw‑material availability can lead to significant cost spikes. In addition, energy-intensive processing of silica — especially for nano- and spherical grades — requires stable and affordable electricity. Variability in energy prices, along with transportation and logistical costs, further adds financial pressure. Scaling production while preserving high purity and particle uniformity remains capital-intensive, limiting agility for many players.

Modular & Prefabricated Construction Driving Demand: As modular construction gains traction, 55% of new projects report cost savings by using prefabricated elements. Silica particles are increasingly used in high-precision fillers and additives for prefabricated panels, especially in North America and Europe where automated construction is expanding.

Rise of Hollow Microspheres for Lightweight Applications: Hollow silica microspheres — up to 30% lighter than solid particles — are being adopted in thermal insulation and lightweight composites. This trend is fueling demand in the automotive and aerospace sectors, particularly in Asia‑Pacific.

Surface‑Functionalized Silica for Biomedical Innovation: Investment into silica with tailored surface chemistry has increased by 45% within the past two years, enabling advanced drug delivery systems, diagnostic agents, and biocompatible carriers across pharmaceutical firms.

Green Manufacturing & Closed‑Loop Recycling: Manufacturers are implementing closed-loop production systems, cutting water consumption by ~40% relative to traditional processes, while improving workplace safety and reducing environmental impact — aligning with ESG targets globally.

The Silica Particles Market is structured across multiple segments that provide insight into production types, end-use applications, and consumer adoption trends. The market’s segmentation by type includes engineered, fumed, precipitated, and colloidal silica particles, each tailored for specific industrial or commercial requirements. Application segmentation spans electronics, healthcare, cosmetics, coatings, and construction, reflecting the material’s versatility. End-user insights indicate adoption across semiconductor manufacturers, pharmaceutical companies, cosmetic formulators, and automotive industries. Regional patterns reveal strong consumption in North America and Asia-Pacific, with emerging markets demonstrating increasing uptake due to growing industrialization and high-tech manufacturing investments. Segmentation allows decision-makers to identify growth pockets and optimize resource allocation effectively.

Engineered silica particles currently lead the market, accounting for 40% of total adoption, primarily due to their precision in particle size, high purity, and suitability for semiconductor and pharmaceutical applications. Fumed silica is emerging as the fastest-growing type, driven by increasing demand in adhesives, coatings, and composite materials, expected to see 7.2% adoption growth over the next five years. Precipitated and colloidal silica contribute a combined 35% share, serving niche applications such as specialty abrasives, cosmetics, and food additives.

In applications, electronics currently account for 45% of the global silica particles market, driven by demand in CMP processes, high-dielectric materials, and advanced coatings. Healthcare is the fastest-growing application, fueled by innovations in drug delivery and diagnostic tools, with 6.8% adoption growth projected over the near term. Other applications, including cosmetics, construction, and coatings, represent a combined 35% share, leveraging silica’s unique chemical and physical properties. Consumer adoption reflects trends in high-tech and healthcare sectors. In 2024, over 40% of semiconductor fabs globally integrated high-purity silica in production processes. Similarly, in Europe, 38% of pharmaceutical companies tested silica-based carriers in pilot drug delivery formulations.

Semiconductor manufacturers dominate as end-users, accounting for 42% of adoption, due to their reliance on ultra-high purity and uniform particle sizes for advanced wafer processing. Pharmaceutical companies represent the fastest-growing end-user segment, with 7% adoption growth, driven by innovations in controlled drug release and nanomedicine. Other end-users, including cosmetic formulators, coatings manufacturers, and construction companies, collectively hold 36% of the market. Consumer adoption patterns show that over 35% of leading cosmetic brands have adopted silica for fillers and abrasives in their formulations, while in North America, 42% of hospitals have piloted silica-enhanced diagnostic and drug delivery solutions.

Asia-Pacific accounted for the largest market share at 38% in 2024; however, North America is expected to register the fastest growth, expanding at a CAGR of 6.8% between 2025 and 2032.

Asia-Pacific dominates due to large-scale production hubs in China, India, and Japan, with over 200,000 tons of silica particles produced annually across these countries. North America shows rapid adoption in semiconductor, healthcare, and advanced materials sectors, with more than 65% of enterprises integrating high-purity silica solutions in production and R&D. Europe, South America, and the Middle East & Africa collectively account for 30% of the global market, driven by industrial expansion, regulatory adoption, and emerging technology applications.

North America holds 32% market share of global silica particles consumption. Key industries driving demand include semiconductors, pharmaceuticals, cosmetics, and coatings. Regulatory measures, such as OSHA standards on respirable silica, have prompted companies to enhance safety and recycling practices. Technological advancements, including surface-functionalized silica and nano-engineered particles, are driving innovation. Local players like Shin-Etsu Chemical and Cabot Corporation are expanding production and developing specialized silica for CMP and biomedical applications. Consumer behavior shows higher enterprise adoption in healthcare, electronics, and research-intensive sectors, with over 60% of advanced fabs using tailored silica products for efficiency improvements.

Europe accounts for 25% of the global silica particles market, with Germany, France, and the UK being key contributors. Sustainability initiatives and environmental regulations are driving adoption of eco-friendly and low-dust silica production methods. Emerging technologies, including hollow microspheres and functionalized silica, are increasingly applied in cosmetics, construction, and electronics. Local companies, such as Imerys, are investing in tailored silica production for coatings and specialty materials. Regulatory pressure encourages manufacturers to prioritize explainable processes, and consumer preferences reflect a shift toward certified, high-purity silica products across industrial and cosmetic applications.

Asia-Pacific leads the global market with 38% share, supported by high-volume production in China, India, and Japan. Infrastructure growth, expanding semiconductor fabs, and large-scale pharmaceutical manufacturing are major factors. Innovation hubs in China and Japan are pioneering nano-silica and surface-functionalized particles for electronics and biomedical applications. Companies like Jiangsu Yoke Technology are scaling production for both domestic and export demand. Consumer behavior shows rapid adoption in electronics manufacturing, healthcare, and automotive coatings, with over 70% of new high-tech plants integrating engineered silica products.

South America accounts for 8% of the global silica particles market, with Brazil and Argentina as leading contributors. Growth is supported by industrial expansion, construction projects, and the energy sector. Government incentives for local production and trade partnerships encourage regional manufacturing. Local players focus on supplying silica for adhesives, coatings, and specialty applications. Consumer adoption is linked to industrial manufacturing, media, and language localization requirements, with more than 40% of industrial clients incorporating silica in specialty processes.

Middle East & Africa represent 7% of the global market, with the UAE and South Africa as major growth hubs. Demand is driven by construction, oil & gas, and chemical sectors. Technological modernization includes implementing high-purity silica in advanced coatings and industrial processes. Local players focus on integrating silica into construction composites and chemical applications. Regional consumer behavior shows higher adoption in industrial and infrastructure projects, with emphasis on efficiency, safety compliance, and environmentally responsible production practices.

China – 28% Market Share: High production capacity and extensive industrial adoption in electronics and pharmaceuticals.

United States – 22% Market Share: Strong end-user demand in semiconductors, healthcare, and advanced materials industries.

The Silica Particles Market is moderately consolidated, with over 120 active global competitors operating across production, research, and distribution segments. The top five companies—Shin-Etsu Chemical, Denka, Cabot Corporation, Imerys, and Jiangsu Yoke Technology—collectively account for approximately 55% of the global market, reflecting significant concentration in high-purity and engineered silica segments. Competition is driven by strategic product innovations, partnerships, and capacity expansions, particularly in semiconductor, biomedical, and specialty coatings applications. In 2024 alone, multiple firms introduced surface-functionalized and hollow microsphere silica products, enhancing precision and performance for electronics and drug delivery applications. Mergers and joint ventures have increased, with at least 15 notable collaborations aimed at expanding regional production footprints and strengthening R&D capabilities. Emerging trends include nano-silica integration, 3D-printing-compatible formulations, and advanced coating technologies, which are reshaping the competitive dynamics. Regional leadership varies: North America leads in technology-driven applications, Asia-Pacific dominates in volume production, and Europe focuses on compliance-driven and high-purity specialty silica. These factors combine to create a market where technological differentiation and strategic alliances are pivotal to maintaining market share and driving growth in specialized segments.

Imerys

Jiangsu Yoke Technology

Tokuyama Corporation

Huber Engineered Materials

Sibelco

The Silica Particles Market is being shaped by both current and emerging technologies, enhancing the material’s functionality across industrial, pharmaceutical, and electronics applications. Surface-functionalized silica particles are gaining prominence due to their improved dispersion and adhesion properties, supporting high-precision applications in CMP processes and drug delivery systems. Hollow silica microspheres are increasingly utilized in coatings, construction, and thermal insulation, offering up to 30% weight reduction in composite materials. Nano-silica development is a critical trend, with particle sizes below 100 nm being applied in advanced battery electrodes and biomedical carriers, improving performance and delivery efficiency.

Digital transformation is also influencing production, with automation and AI-controlled manufacturing systems enabling consistent particle size distribution and purity levels. In semiconductor fabs, high-purity silica with controlled porosity is critical for wafer planarization, while in pharmaceuticals, porous silica carriers enhance drug solubility by over 25%. Advanced characterization techniques, including electron microscopy and BET surface area analysis, support product optimization and quality assurance. Emerging technologies such as 3D-printing-compatible silica composites and hybrid organic-inorganic formulations are opening new market avenues. Collectively, these innovations position silica particles as a strategically vital material for high-value, high-precision industrial applications.

In April 2024, Shin‑Etsu Chemical announced a ¥83 billion (≈ USD 545 million) self‑funded investment in a new semiconductor material plant in Gunma Prefecture, Japan, aimed at producing advanced lithography materials for chipmaking. Source: www.shinetsu.co.jp

In May 2024, Shin‑Etsu established Shin‑Etsu Silicone (Pinghu) Co., Ltd. in Zhejiang Province, China, and began construction of a new silicone products plant over 40,000 m² to expand supply of high-value silicone and related SiO₂‑based materials. Source: www.shinetsu.co.jp

In April 2024, Imerys formed a new business unit called “Solutions for Energy Transition” to focus on critical minerals, including high-purity silica‑related mineral products. Source: www.imerys.com

In November 2023, Imerys publicly stated that it is expanding in high-growth markets by inaugurating a “greenfield” specialty minerals plant in China (Wuhu) to supply high-grade mineral additives relevant to silica‑derived applications in automotive and other sectors. Source: www.imerys.com

The Silica Particles Market Report provides a comprehensive overview of the global market, covering types, applications, and end-user segments with detailed insights into technological innovations and industrial adoption patterns. It examines engineered, fumed, precipitated, and colloidal silica types, highlighting their specific characteristics and use cases across electronics, healthcare, cosmetics, coatings, and construction sectors. The report also includes regional analyses spanning Asia-Pacific, North America, Europe, South America, and Middle East & Africa, detailing production volumes, adoption trends, infrastructure developments, and regulatory frameworks.

Technology-focused insights are emphasized, including surface-functionalization, hollow microspheres, nano-silica, and 3D-printing-compatible composites, with detailed discussion on applications in semiconductor fabrication, advanced drug delivery, and specialty coatings. End-user behavior, consumption patterns, and regional variations are highlighted, providing actionable intelligence for decision-makers. The report further explores market competition, strategic alliances, R&D initiatives, and emerging innovation hubs, offering a clear understanding of market positioning and future growth opportunities. By integrating quantitative production figures, adoption rates, and technological trends, the scope ensures a complete view of the global silica particles ecosystem for business planning, investment decisions, and strategic development.

| Report Attribute / Metric | Details |

|---|---|

| Market Revenue (2024) | USD 630 Million |

| Market Revenue (2032) | USD 1,066.4 Million |

| CAGR (2025–2032) | 6.8% |

| Base Year | 2024 |

| Forecast Period | 2025–2032 |

| Historic Period | 2020–2024 |

| Segments Covered |

By Type

By Application

By End-User Insights

|

| Key Report Deliverables | Revenue Forecast, Market Trends, Growth Drivers & Restraints, Technology Insights, Segmentation Analysis, Regional Insights, Competitive Landscape, Recent Developments |

| Regions Covered | North America, Europe, Asia-Pacific, South America, Middle East & Africa |

| Key Players Analyzed | Shin-Etsu Chemical, Denka, Cabot Corporation, Imerys, Jiangsu Yoke Technology, Tokuyama Corporation, Huber Engineered Materials, Sibelco |

| Customization & Pricing | Available on Request (10% Customization Free) |