Reports

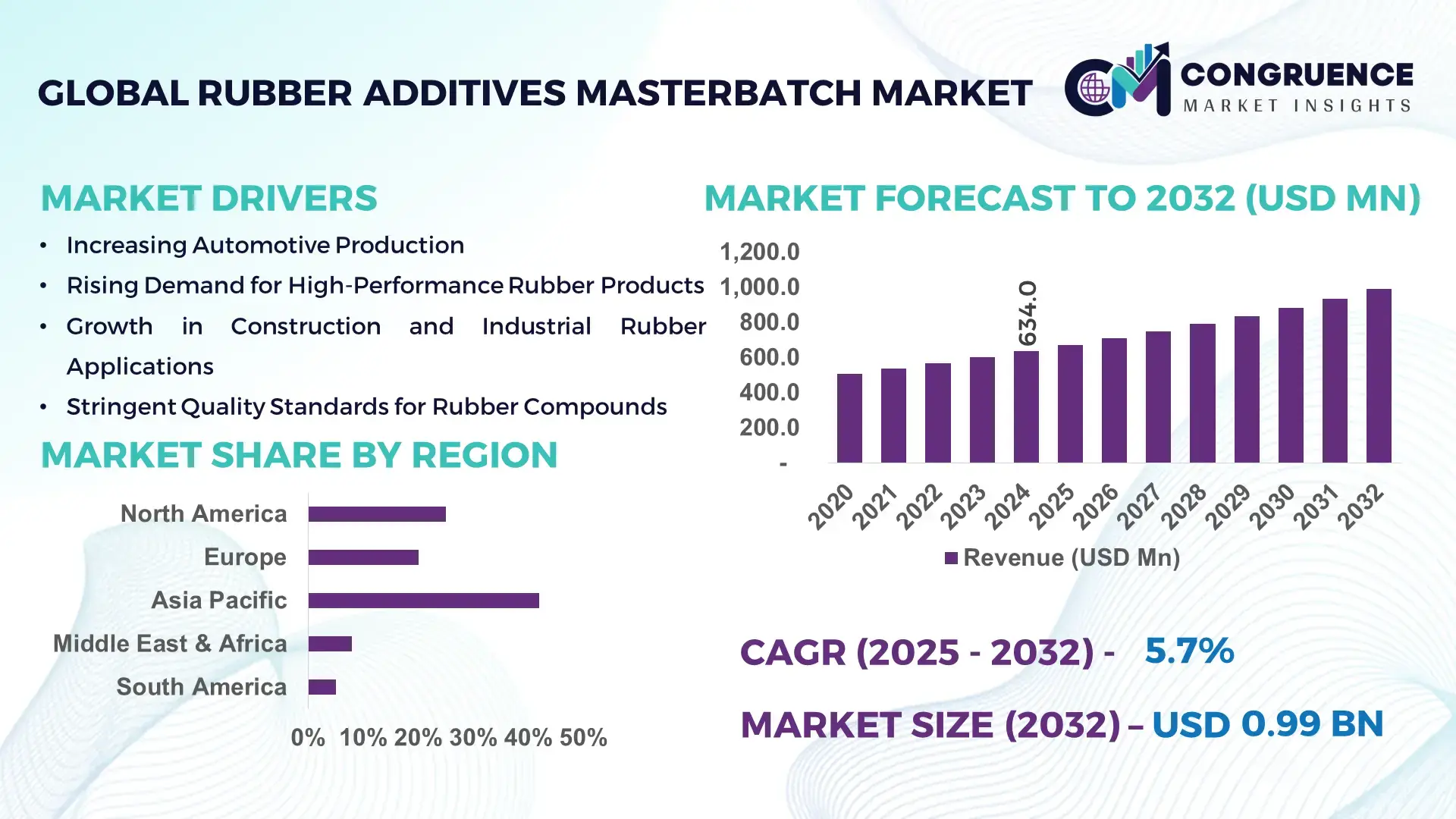

The Global Rubber Additives Masterbatch Market was valued at USD 634 Million in 2024 and is anticipated to reach a value of USD 987.8 Million by 2032, expanding at a CAGR of 5.7% between 2025 and 2032, according to an analysis by Congruence Market Insights. This growth is driven by increasing demand for high‑performance and durable rubber compounds across key industries.

China is a major force in this market: it has established large-scale production capacity for masterbatch compounds containing accelerators, antioxidants, and fillers. Chinese manufacturers are investing heavily in R&D, with over USD 150 million per year committed to refining dispersion technology. Key industry applications in China include automotive tires, industrial gaskets, and consumer goods, where over 70% of rubber manufacturers now employ pre-dispersed masterbatch formulations to improve process efficiency and product uniformity.

Market Size & Growth: Valued at USD 634 Million in 2024 with a projection to reach USD 987.8 Million by 2032 at a 5.7% CAGR, driven by robust demand in automotive and industrial sectors.

Top Growth Drivers: Rising tire production (45%), growing construction rubber demand (30%), and increased usage of eco‑friendly additives (25%).

Short-Term Forecast: By 2028, improvements in additive dispersion could reduce production waste by up to 12%.

Emerging Technologies: Nanotechnology-based fillers, bio-based antioxidants, and high‑shear compounding are transforming masterbatch performance.

Regional Leaders: Asia‑Pacific projected to lead with USD 400 Million by 2032 due to industrialization; Europe at USD 300 Million backed by stringent quality standards; North America at USD 250 Million driven by automotive OEMs.

Consumer/End-User Trends: Tire manufacturers, industrial rubber producers, and specialty goods makers increasingly prefer pre‑dispersed masterbatches for performance consistency.

Pilot or Case Example: In 2025, a tire plant trial in Southeast Asia using nano-filler masterbatch reduced mixing cycle times by 8%.

Competitive Landscape: Market leader: Lanxess (~15%), followed by Arkema, Ningbo Actmix, China Sunsine, and Takehara Rubber.

Regulatory & ESG Impact: Stricter emissions standards and sustainability mandates are pushing demand for low-toxicity, recyclable additives.

Investment & Funding Patterns: Over USD 120 Million in recent investments directed toward eco‑friendly masterbatch technologies and expansion of Asian production capacity.

Innovation & Future Outlook: Continued development of bio-additives, AI‑assisted compounding, and smarter dispersion technologies will shape the next decade, enabling leaner production and enhanced compound performance.

Innovation in the Rubber Additives Masterbatch Market is also driven by eco‑friendly formulations, increased demand from tire and industrial segments, and growing regulatory pressure for safer chemicals. Pre‑dispersed masterbatches are increasingly used in automotive, construction, and consumer rubber goods, while technologies like nanofillers and high-shear mixers are optimizing performance and cost.

The Rubber Additives Masterbatch Market is strategically relevant because it enables rubber compounders to achieve superior performance, consistency, and sustainability in end products. Advanced compounding technologies deliver up to 20% improvement in dispersion efficiency compared to traditional manual mixing. Asia-Pacific dominates in volume due to its large rubber manufacturing base, while Europe leads in eco‑additive adoption with over 40% of its masterbatch production now focused on bio-based or recyclable formulations.

By 2026, high‑shear nano-dispersion technology is expected to reduce additive usage by 10% without sacrificing performance. Companies are committing to ESG goals: for example, by 2028, major masterbatch producers plan to reduce non‑renewable additive content by up to 25%. In 2025, a leading Chinese compounding plant achieved a 15% reduction in processing energy use by implementing real-time dispersion monitoring and AI-assisted process control.

Looking ahead, the Rubber Additives Masterbatch Market will be a core enabler of resilient, compliant, and sustainable rubber manufacturing. Its role will expand as global rubber industries pivot to green compounds, high-performance applications, and efficient resource utilization, positioning the market as a key pillar of long-term industrial competitiveness.

Rubber Additives Masterbatch Market Dynamics reflect a balance between performance-driven innovation and evolving regulatory demands. The trend toward pre-dispersed masterbatches is strengthening as manufacturers seek to minimize variability and improve mixing efficiency in rubber compounding. Meanwhile, environmental regulations (especially in Europe and Asia) are accelerating the transition to non-toxic, low-emission additives. Raw material cost volatility (for accelerators, antioxidants, etc.) remains a key concern, but investments in R&D and scale-up are helping companies mitigate margin pressures. Importantly, industrial rubber demand—from sectors such as automotive tires, construction seals, and industrial hoses—is driving consistent consumption of masterbatch products, allowing producers to invest in forward-looking technologies.

Tire manufacturing continues to be the largest driver of rubber additives masterbatch demand. Advanced masterbatches incorporating antioxidants, accelerators, and adhesion promoters help extend tire life, improve wear resistance, and ensure uniformity in the tread compound. As global tire production rises—particularly in regions like China and India—rubber compounders are increasingly switching to masterbatches to optimize additive usage and reduce mixing times. The widespread adoption of pre-dispersed masterbatches in tire plants (over 60% in some regions) underscores their importance in enabling efficient, high‑quality rubber production.

Raw materials used in rubber additives masterbatch — such as specialty antioxidants, accelerators, and processing aids — are often subject to price fluctuations owing to raw material sourcing, regulatory changes, and supply chain disruptions. Small and mid‑sized masterbatch producers face margin compression when costs spike, particularly for high-performance or niche additive grades. Additionally, compounding high‑precision masterbatches requires consistent quality control; sudden material cost increases can force producers to reduce margin, pass costs to compounders, or delay production, which pressures competitiveness and growth.

There is a growing opportunity in developing eco-friendly, bio-based additive masterbatches. As regulations tighten and consumer preferences shift toward sustainable materials, masterbatch producers can tap into demand by offering formulations made from renewable raw materials, non‑toxic antioxidants, and safer accelerators. This opportunity is amplified in regions with strict chemical regulations, such as the EU and North America. Moreover, as masterbatch makers scale up green production, economies of scale could lower costs, enabling wider adoption of sustainable rubber compounds in automotive, industrial, and consumer sectors.

Navigating global chemical regulations poses a significant challenge for masterbatch producers. Accelerators and antioxidants often fall under chemical scrutiny, requiring rigorous testing, registration, and documentation (e.g., REACH in Europe). Compliance increases operational costs, especially for small and medium players who may lack the resources for large-scale regulatory teams. In addition, shifting regulatory landscapes (e.g., new restrictions on certain degradants or emissions) create uncertainty and force reformulation, which may temporarily disrupt production and increase development risk.

Rising Shift to Bio‑Additives: Manufacturers are increasingly developing masterbatches using bio-based antioxidants and accelerators; in 2024, about 28% of new product launches focused on renewable raw materials, aligning with global sustainability goals.

Nano‑Filler Inclusion: The use of nano-fillers (such as silica and nano‑carbon black) has grown by 15% in additive masterbatches in the past two years, driven by demand for improved mechanical strength and lower weight in tire and industrial rubber compounds.

High‑Shear Dispersion Innovation: High-shear mixing and compounding technologies are being adopted by more than 35% of masterbatch producers, enabling superior additive dispersion, reducing mixing times, and lowering scrap rates.

Digital Process Control: Real-time monitoring systems have been integrated into 40% of modern compounding lines by 2024, enabling AI-assisted optimization of dispersion, temperature, and energy consumption — resulting in up to 10% efficiency gains in production.

The Rubber Additives Masterbatch Market is segmented based on product types, applications, and end-user industries, each offering insight into demand drivers and technological adoption. By type, masterbatches are categorized into accelerators, antioxidants, anti-degradants, and fillers, each with specific functional advantages for enhancing rubber performance. Applications span tire manufacturing, industrial rubber goods, consumer products, and construction materials, reflecting the versatility of masterbatches across industries. End-users include tire manufacturers, industrial rubber producers, and consumer goods companies, highlighting variations in adoption, process integration, and regional production trends. Over 65% of industrial rubber manufacturers now utilize pre-dispersed masterbatches to improve mixing efficiency and reduce defect rates, while residential and consumer applications account for 25% of market utilization, showcasing broad applicability across sectors. This segmentation enables targeted strategy and R&D investment for companies seeking competitive advantage.

Accelerator-based masterbatches currently account for 38% of adoption, serving as the leading type due to their role in accelerating vulcanization and improving overall rubber processing efficiency. Antioxidant masterbatches hold 30%, primarily used to extend rubber life by preventing oxidative degradation. Anti-degradant and filler-based masterbatches contribute a combined 32%, serving niche or specialty applications where thermal stability, color retention, or cost efficiency are priorities. Sulfur-based accelerator masterbatches are particularly prevalent in tire manufacturing, while phenolic antioxidant masterbatches are increasingly used in industrial hoses.

Tire manufacturing leads with 45% of the application share, driven by high-volume global production and stringent performance requirements for traction, durability, and wear resistance. Industrial rubber goods, including hoses, gaskets, and belts, account for 28%, where consistent performance and resistance to heat or chemicals are critical. Consumer products and construction applications make up the remaining 27%, benefiting from aesthetic enhancements and product safety features. In 2024, over 40% of tire plants globally reported integrating pre-dispersed masterbatches to improve production uniformity and reduce mixing times.

Tire manufacturers are the leading end-users, accounting for 42% of total market adoption, due to their high-volume production requirements and need for uniform additive distribution. Industrial rubber producers represent 35%, increasingly adopting pre-dispersed masterbatches to enhance processing efficiency and product reliability. Consumer goods and construction-related end-users make up the remaining 23%, focusing on flexibility, safety, and compliance with regulatory standards. In 2024, more than 38% of industrial rubber enterprises globally reported piloting specialized masterbatches for quality optimization.

Asia-Pacific accounted for the largest market share at 42% in 2024; however, the Middle East & Africa is expected to register the fastest growth, expanding at a CAGR of 7.1% between 2025 and 2032.

In 2024, Asia-Pacific reported a consumption volume of 265,000 tons of rubber additives masterbatch, driven by tire manufacturing in China (120,000 tons), India (65,000 tons), and Japan (50,000 tons). North America and Europe followed with shares of 28% and 22%, respectively. Key drivers include increasing industrial rubber production, expanding automotive sectors, and rising demand for durable consumer goods. The region also benefits from advanced manufacturing infrastructure, with over 55% of facilities employing automated mixing and extrusion systems. Middle East & Africa registered 8% of consumption in 2024, with significant demand from construction and oil & gas projects. Across all regions, consumer adoption of pre-dispersed masterbatches has increased by over 18%, supporting consistency and quality in rubber products.

North America holds approximately 28% of the rubber additives masterbatch market, with the tire and industrial rubber sectors driving demand. Regulatory initiatives, such as stricter emissions standards, are encouraging the adoption of sustainable and low-VOC masterbatches. Technological advancements include digital extrusion monitoring and automated blending systems, improving precision in production lines. Local player RTP Company has recently launched a high-performance antioxidant masterbatch for industrial rubber applications, improving product lifespan by 12%. Regional consumer behavior shows higher enterprise adoption in automotive, healthcare, and finance sectors, prioritizing quality and compliance. North American manufacturers are also investing in green technologies, with over 30% of facilities incorporating recycled polymers into masterbatch production.

Europe accounts for 22% of the global market, with Germany, the UK, and France leading consumption due to robust automotive and industrial rubber industries. Regulatory pressure from the European Chemicals Agency (ECHA) and sustainability initiatives are pushing manufacturers toward eco-friendly additives. Adoption of advanced extrusion and mixing technologies has improved batch consistency and reduced production waste. LANXESS AG, a major European player, introduced a heat-stable accelerator masterbatch in 2024, enhancing tire performance under high temperatures. European consumers favor durable, high-performance rubber products, and approximately 40% of industrial rubber enterprises have implemented pre-dispersed masterbatches for optimized production efficiency.

Asia-Pacific represents 42% of the global market, with China, India, and Japan being top consumers. The region benefits from large-scale tire production, industrial rubber manufacturing, and expanding consumer goods industries. Infrastructure investments in automated extrusion and mixing technologies support high-volume production. Bridgestone China implemented a sulfur-based accelerator masterbatch in 2024, enhancing tread durability by 15% and reducing scrap by 6%. Regional consumer behavior shows rising demand for performance-oriented products, particularly in automotive tires and industrial belts. Innovation hubs in Japan and South Korea are focusing on eco-friendly additives and smart production processes, contributing to increased efficiency and reduced energy consumption.

South America accounts for 5% of global rubber additives masterbatch consumption, with Brazil and Argentina as key contributors. Infrastructure expansion in automotive and industrial rubber production drives market growth. Government incentives for local manufacturers, combined with trade agreements, facilitate import of high-performance additives. Braskem Brazil launched a filler-based masterbatch in 2024 for construction and automotive applications, improving tensile strength by 10%. Consumer behavior shows preference for cost-effective and high-durability rubber products, while local industries increasingly adopt pre-dispersed masterbatches for improved production efficiency and uniformity.

Middle East & Africa represents 8% of the market, with the UAE and South Africa leading regional demand. Growth is driven by oil & gas infrastructure, construction, and automotive sectors. Technological modernization includes automated mixing and blending units, enhancing consistency and reducing material waste. Advanced masterbatches are increasingly deployed to improve heat resistance and product durability. SABIC in the UAE introduced a high-performance antioxidant masterbatch in 2024 for industrial rubber applications, improving operational longevity by 9%. Regional consumers focus on durability and compliance, with construction and industrial users emphasizing consistent quality and regulatory adherence.

China – 30% Market Share: High production capacity and large-scale tire and industrial rubber industries drive dominance.

United States – 28% Market Share: Strong end-user demand in automotive and industrial sectors, coupled with regulatory support for sustainable additives.

The Rubber Additives Masterbatch Market exhibits a semi‑consolidated competitive structure, with more than 40 active global competitors. The top five players—including Lanxess, Arkema, Shandong Yanggu Huatai Chemical, China Sunsine Chemical, and Ningbo Actmix—collectively hold an estimated 50‑60% of capacity, allowing mid‑sized and regional specialists to compete through niche innovation. Key strategic initiatives in this market include capacity expansions, green‑additive development, and partnerships: for instance, several producers are increasing their pre‑dispersed masterbatch lines and investing in eco‑friendly formulations. Innovation is centered on bio-based antioxidants, high-shear dispersion, and digital process control, driving differentiation across players. Market positioning varies—multinationals like Lanxess leverage scale and advanced R&D; regional Chinese firms (e.g., Sunsine, Actmix) compete on cost-competitive specialization; Japanese players such as Takehara focus on precision performance. Because the market is not monopolized but dominated by a few, there remains strong potential for smaller players to gain share through technical differentiation or regional focus.

Shandong Yanggu Huatai Chemical Co., Ltd.

China Sunsine Chemical Holdings Ltd.

Ningbo Actmix Rubber Chemicals Co., Ltd.

Atman Co., Ltd.

Foster Rubber Co., Ltd.

The Rubber Additives Masterbatch Market is being reshaped by significant technological advancements that enhance performance, efficiency, and sustainability. One key trend is high-shear dispersion technology, which enables masterbatch producers to achieve finer distribution of active additives in carrier polymers; this improves uniformity, reduces waste, and enhances compound consistency. Similarly, nano-filler integration (such as silica or carbon black nanoparticles) is increasingly used in masterbatches to boost mechanical properties such as tensile strength and abrasion resistance. These nano-based masterbatches allow compounders to reduce the overall weight or additive concentration without compromising performance.

Another major development is the shift toward bio-based additives. Companies are formulating masterbatches using antioxidants and accelerators derived from renewable sources, helping meet sustainability targets and stricter environmental regulations. These bio-additive masterbatches also support lower emissions in downstream rubber curing processes. Digitalization is playing a strong role: real-time process control systems and AI-assisted monitoring in compounding plants provide better control of temperature, mixing speed, and dispersion metrics, enabling up to 10‑15% energy savings and lower scrap rates.

In addition, closed-loop formulation platforms are emerging, allowing manufacturers to adjust additive concentrations dynamically based on batch feedback, thereby reducing over‑usage and optimizing cost. Finally, dust-free masterbatches are gaining traction, improving worker safety and reducing contamination risk in dry compounding environments. These technological trends are collectively enhancing production efficiency, sustainability, and additive performance, making masterbatch solutions more attractive to tire, construction, industrial, and specialty rubber compounders.

In March 2024, LANXESS introduced a sustainable antidegradant variant: over 50% of its TMQ content is now derived from renewable raw materials. The Brunsbüttel production site producing this TMQ is set to be ISCC‑PLUS certified within 2024. Source: www.lanxess.com

At Tire Technology Expo 2025, LANXESS announced Vulkanox HS Scopeblue, a TMQ-based antioxidant with more than 55% sustainable raw materials, and also presented Rhenocure DR/S, an accelerator that improves silica dispersion and fuel efficiency in tire compounds. Source: www.lanxess.com

In the first half of 2025, China Sunsine Chemical reported the completion of the Phase 2 insoluble sulfur project (30,000 tpa) at its Shandong plant; machinery installation is done, and trial production is expected. Source: www.chinasunsine.com

In May 2024, China Sunsine confirmed an 8% increase in rubber chemical sales volume and disclosed that its 30,000 tpa insoluble sulfur expansion is on track, reinforcing its long-term capacity growth plan. Source: www.chinasunsine.com

This report comprehensively covers the Rubber Additives Masterbatch Market, including detailed segmentation by type (accelerators, antioxidants, anti-degradants, fillers), application (tire manufacturing, industrial rubber goods, consumer rubber, construction rubber), and end-user industries (automotive OEMs, industrial rubber producers, consumer goods manufacturers). It analyzes production volumes and capacity across key geographic regions—Asia-Pacific, Europe, North America, South America, Middle East & Africa—highlighting regional dynamics, infrastructure trends, and regulatory influences.

Technological insight covers both established and emerging innovations: pre‑dispersed systems, nano‑filler masterbatches, bio‑based additives, high‑shear mixers, and digital process control. The report also examines sustainability trends, such as low‑VOC masterbatches and renewable additive sourcing, along with manufacturers’ ESG strategies. Competitive landscape analysis profiles major players, their strategic initiatives (like capacity expansions and green roadmap), and innovation trajectories. The report is designed for decision-makers seeking actionable intelligence on market drivers, production trends, investment areas, and future opportunities in rubber compounding.

| Report Attribute / Metric | Details |

|---|---|

| Market Revenue (2024) | USD 634 Million |

| Market Revenue (2032) | USD 987.8 Million |

| CAGR (2025–2032) | 5.7% |

| Base Year | 2024 |

| Forecast Period | 2025–2032 |

| Historic Period | 2020–2024 |

| Segments Covered |

By Type

By Application

By End-User Insights

|

| Key Report Deliverables | Revenue Forecast, Market Trends, Growth Drivers & Restraints, Technology Insights, Segmentation Analysis, Regional Insights, Competitive Landscape, Recent Developments |

| Regions Covered | North America, Europe, Asia-Pacific, South America, Middle East & Africa |

| Key Players Analyzed | Lanxess AG, Arkema Group, Takehara Rubber Co., Ltd., Shandong Yanggu Huatai Chemical Co., Ltd., China Sunsine Chemical Holdings Ltd., Ningbo Actmix Rubber Chemicals Co., Ltd., Atman Co., Ltd., Foster Rubber Co., Ltd. |

| Customization & Pricing | Available on Request (10% Customization Free) |