Reports

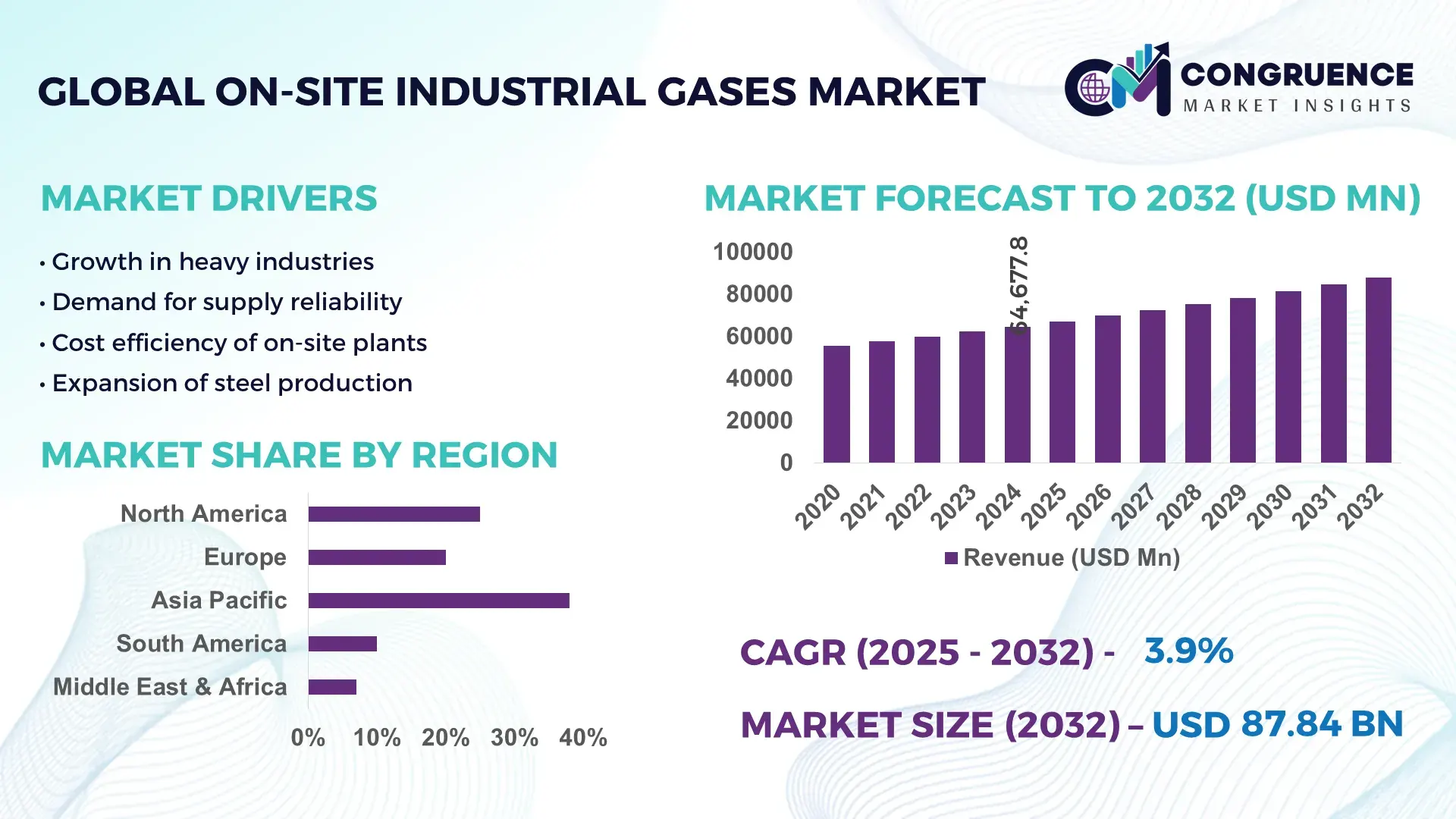

The Global On-site Industrial Gases Market was valued at USD 64,677.75 Million in 2024 and is anticipated to reach a value of USD 87,837.36 Million by 2032, expanding at a CAGR of 3.9% between 2025 and 2032. This growth is driven by increasing industrial automation, demand for uninterrupted gas supply, and investments in on-site generation technologies that reduce logistics costs and support sustainability goals.

China stands as the foremost country in the on-site industrial gases market, with annual on-site production exceeding 100 million metric tons across oxygen, nitrogen, and hydrogen for sectors such as chemicals, electronics, and metals processing. Rapid expansion of manufacturing hubs and infrastructure has resulted in China’s on-site gas generation capacity growing annually by double-digit percentages, with investments in modular systems and green hydrogen facilities increasing over the past several years. Leading domestic industrial facilities now operate high-efficiency PSA and cryogenic plants, supporting critical applications in steel fabrication, semiconductor manufacturing, and energy production while stimulating technology upgrades and operational resilience.

Market Size & Growth: 2024 market valued at USD 64.68 Billion; projected to reach USD 87.84 Billion by 2032 at a 3.9% CAGR, driven by industrialization and on‑site generation adoption.

Top Growth Drivers: Manufacturing sector adoption up ~55%, logistics cost reduction ~12%, environmental compliance efficiency improvements ~15%.

Short-Term Forecast: By 2028, on‑site systems expected to deliver cost reductions of ~10–12% and performance gains via modular PSA units.

Emerging Technologies: Advanced PSA and membrane separation, on‑site hydrogen generation, IoT‑enabled gas monitoring systems.

Regional Leaders: Asia Pacific ~USD 35 Billion (2032) with rapid industrial expansion, North America ~USD 25 Billion with healthcare and aerospace demand, Europe ~USD 18 Billion with decarbonization initiatives.

Consumer/End‑User Trends: Heavy use in chemicals, metals, electronics; trend toward green hydrogen and high‑purity industrial gases.

Pilot or Case Example: 2025 pilot of hydrogen on‑site plant reduced downtime by ~8% at an electronics manufacturing facility.

Competitive Landscape: Market leader Linde (~20%), key competitors Air Liquide, Air Products, Messer, Yingde Gases.

Regulatory & ESG Impact: Stricter emissions standards and sustainability mandates accelerating on‑site gas generation uptake.

Investment & Funding Patterns: Recent investments exceeding USD 5 Billion in modular and hydrogen generation facilities globally.

Innovation & Future Outlook: Integration of AI predictive maintenance and clean hydrogen projects shaping long‑term market evolution.

The on‑site industrial gases market serves a broad range of industry sectors including chemicals, metals, healthcare, energy, and electronics, with manufacturing representing a significant consumption base. Recent technological innovations such as improved PSA systems and integrated monitoring platforms have enhanced production efficiency and supply reliability. Environmental regulations and economic drivers are steering adoption of cleaner gas generation methods, while regional consumption patterns show robust growth in Asia Pacific due to rapid industrial expansion and infrastructure development. Emerging trends include the increasing deployment of on‑site green hydrogen solutions and digital twins for operational optimization, indicating a forward‑looking market trajectory.

The On-site Industrial Gases Market holds significant strategic relevance as industries increasingly prioritize operational efficiency, sustainability, and uninterrupted supply chains. Advanced PSA and membrane separation technologies deliver up to 15% higher gas purity and 12% lower energy consumption compared to traditional cryogenic systems, enhancing both productivity and cost-effectiveness. Asia Pacific dominates in volume, while Europe leads in adoption with 65% of industrial enterprises integrating on-site gas generation solutions. By 2027, AI-enabled predictive maintenance and real-time gas monitoring are expected to improve plant uptime by 10–12%, optimizing operational continuity. Firms are committing to ESG metrics improvements such as a 20% reduction in carbon emissions and 30% recycling of gas by-products by 2030, aligning with global sustainability targets. In 2025, a leading Chinese steel manufacturer achieved a 9% energy efficiency improvement through deployment of modular on-site oxygen generation combined with AI optimization systems. The integration of renewable energy sources with on-site hydrogen and nitrogen production is emerging as a key pathway for decarbonization. Looking ahead, the On-site Industrial Gases Market is poised to act as a pillar of resilience, regulatory compliance, and sustainable growth, offering measurable operational and environmental advantages across global industrial sectors.

The growth of chemical and electronics manufacturing industries has significantly boosted demand for on-site industrial gases. For instance, large-scale chemical plants consume over 60% of their oxygen and nitrogen requirements through on-site generation to ensure uninterrupted processes. Electronics manufacturers increasingly adopt high-purity nitrogen and hydrogen for semiconductor fabrication, improving wafer yields by up to 8%. These industries prioritize continuous supply and operational safety, prompting the installation of advanced PSA and membrane separation units. As production scales in regions like Asia Pacific, demand for localized, reliable, and efficient on-site gas solutions has become a critical driver for market expansion.

Despite the operational benefits, high upfront capital costs remain a primary restraint for on-site industrial gas installations. Establishing PSA, cryogenic, or modular hydrogen plants can require investments exceeding USD 5–10 million per facility, limiting adoption among small and medium-sized enterprises. Additionally, technical complexity and maintenance requirements increase operational expenditure, deterring some companies from transitioning from cylinder or bulk supply models. Stringent safety regulations and the need for specialized personnel further contribute to cautious investment strategies. These factors collectively slow market penetration, particularly in developing regions where industrial budgets are constrained.

Emerging trends in green hydrogen production and renewable energy integration create significant opportunities for on-site industrial gas providers. On-site hydrogen generation using solar or wind-powered electrolysis can reduce carbon emissions by up to 20% while providing a localized, continuous supply. Chemical and steel industries are exploring hydrogen-enriched processes, expanding market potential. Advanced monitoring technologies and modular systems allow smaller enterprises to adopt on-site solutions with lower capital investment, opening untapped market segments. Integration of digital twins and AI optimization further enhances operational efficiency, providing measurable gains in energy savings and uptime.

Rising energy costs and increasing regulatory compliance obligations pose significant challenges to the On-site Industrial Gases Market. Maintaining high-efficiency PSA and cryogenic systems requires continuous energy input, increasing operational expenditure by 8–12% annually. Compliance with safety, environmental, and emissions standards necessitates ongoing monitoring and periodic upgrades, straining budgets. Additionally, volatile electricity pricing, regional labor shortages, and skilled workforce constraints complicate operations, especially for small-scale industrial plants. These challenges necessitate careful planning and investment strategies, slowing adoption and expansion in some regions despite growing industrial demand.

• Rise in Modular and Prefabricated Construction: The adoption of modular and prefabricated construction is reshaping the On-site Industrial Gases market. Approximately 55% of new industrial facilities utilizing modular techniques report cost reductions and up to 20% faster completion times. Prefabricated components manufactured off-site using automated systems reduce labor dependency and improve installation precision. Europe and North America are leading this trend, with 60% of new plants integrating modular assembly to enhance efficiency and optimize space utilization for on-site gas generation systems.

• Expansion of Green Hydrogen Initiatives: On-site hydrogen generation for industrial applications is gaining traction, with 40% of new installations integrating renewable energy-powered electrolysis. This approach delivers a 25% reduction in CO₂ emissions compared to conventional hydrogen supply. Industrial segments such as steel production and chemical processing are increasingly adopting hydrogen-enriched processes, with pilot programs achieving energy efficiency improvements of up to 15%. Asia Pacific is the fastest-growing adopter, while Europe leads in industrial-scale deployment and technology integration.

• Integration of AI and IoT Monitoring Systems: Industrial facilities are implementing AI-driven predictive maintenance and IoT-enabled gas monitoring to reduce downtime and enhance safety. Early adoption shows a 12–15% improvement in uptime and a 10% reduction in operational inefficiencies. Over 70% of high-purity gas applications in electronics and pharmaceuticals now rely on AI-optimized systems to ensure consistent supply and minimize human error. North America and Europe remain front-runners in adopting these smart solutions.

• Shift Toward On-Demand Gas Production: Industrial users are increasingly favoring on-demand production to reduce storage costs and improve supply reliability. Studies indicate a 30% decrease in storage-related downtime and a 20% reduction in transportation costs when on-site generation replaces bulk deliveries. Chemical and metal-processing facilities are the primary adopters, with 65% of new installations in Asia Pacific implementing this model, enabling flexible capacity expansion and faster response to production fluctuations.

The On-site Industrial Gases market is segmented across product types, applications, and end-user categories, providing insights into adoption patterns, operational priorities, and industrial utility. By type, oxygen, nitrogen, and hydrogen systems dominate due to their critical applications in metals, chemicals, and energy industries. Application segmentation highlights chemical processing, electronics manufacturing, and steel production as leading consumers of on-site gases, emphasizing continuous supply and high-purity requirements. End-user analysis shows manufacturing and industrial plants adopting on-site generation for operational efficiency, cost reduction, and regulatory compliance. Regional adoption patterns indicate that Asia Pacific leads in volume, while Europe and North America prioritize technology integration and environmental sustainability, shaping investment and deployment strategies.

Oxygen systems currently account for 45% of adoption, making them the leading type due to their indispensable role in steel, chemical, and energy industries. Hydrogen generation is the fastest-growing type, driven by industrial decarbonization and renewable integration trends, with adoption expected to expand by 28% over the next five years. Nitrogen systems, along with specialty gases such as argon and carbon dioxide, collectively represent the remaining 27% of the market, mainly serving electronics manufacturing, food processing, and laboratory applications.

Chemical processing remains the leading application, representing 42% of the market, due to the high demand for oxygen, nitrogen, and hydrogen in oxidation, synthesis, and refining operations. Steel manufacturing is the fastest-growing application, supported by on-site oxygen and hydrogen systems that improve furnace efficiency and reduce logistics dependency, with adoption projected to rise 30% in the near term. Electronics manufacturing, food and beverage, and pharmaceuticals collectively account for 28% of the remaining application share, focusing on purity, safety, and continuous gas supply.

Industrial manufacturing leads end-user adoption with 48% share, driven by chemicals, metals, and electronics sectors that require continuous high-purity gas supply. Energy and utilities are the fastest-growing end-users, fueled by renewable hydrogen initiatives and industrial decarbonization projects, with adoption expected to increase by 25% over the next three years. Other users, including pharmaceuticals, food processing, and research laboratories, collectively hold 27% of market share, leveraging on-site generation for reliability and regulatory compliance.

Asia Pacific accounted for the largest market share at 38% in 2024; however, North America is expected to register the fastest growth, expanding at a CAGR of 4.2% between 2025 and 2032.

Asia Pacific’s dominance is supported by industrial production exceeding 120 million metric tons of on-site gases annually, with China contributing over 100 million metric tons, India 12 million metric tons, and Japan 8 million metric tons. Manufacturing and chemical sectors consume nearly 65% of on-site gases, while electronics and energy industries drive technology adoption. Investment in modular PSA and hydrogen facilities totals over USD 4.5 billion across the region, with over 60% of new plants implementing digital monitoring systems. Regional energy initiatives and industrial automation further enhance adoption, with over 70% of enterprises in the top five industrial hubs integrating on-site gas solutions.

How is digital transformation reshaping on-site industrial gas operations?

North America holds 27% of the on-site industrial gases market, with key demand from healthcare, chemicals, and aerospace industries. Stricter environmental regulations and government incentives support cleaner hydrogen and oxygen generation projects. Facilities are increasingly adopting AI-driven predictive maintenance and IoT monitoring systems, reducing downtime by 10–12%. Local players such as Air Products have implemented modular on-site nitrogen and oxygen plants across multiple states, improving supply reliability. Enterprises prioritize high-purity gas solutions, with over 65% of healthcare and electronics facilities integrating advanced on-site systems. Consumer behavior shows higher adoption in healthcare, finance, and precision manufacturing, emphasizing operational efficiency and compliance.

What sustainability trends are driving industrial gas solutions?

Europe accounts for 23% of the on-site industrial gases market, with Germany, the UK, and France leading adoption. Regulatory pressure, including emissions and energy efficiency mandates, drives the integration of low-carbon and energy-efficient gas generation systems. Emerging technologies such as modular hydrogen plants and AI-enabled monitoring are increasingly deployed. Local companies like Linde Gas Germany have expanded on-site oxygen and nitrogen production to serve steel and chemical industries. European enterprises emphasize sustainability and traceable operations, with 70% of industrial plants actively pursuing ESG-compliant on-site gas solutions.

How are manufacturing hubs fueling on-site gas adoption?

Asia Pacific dominates with 38% of the on-site industrial gases market, led by China, India, and Japan. High-volume manufacturing, infrastructure expansion, and chemical production drive adoption. Investments in modular PSA, membrane separation, and renewable-powered hydrogen generation are reshaping the market, with over 50% of new plants integrating digital monitoring technologies. Local players, including Yingde Gases in China, have implemented large-scale on-site oxygen and hydrogen facilities to optimize supply for metals and electronics sectors. Consumer behavior is influenced by rapid industrialization, with adoption heavily driven by high-capacity production and operational efficiency requirements.

What industrial sectors are shaping gas supply trends?

South America accounts for 7% of the on-site industrial gases market, with Brazil and Argentina as key contributors. Demand is primarily driven by chemical, food processing, and metals industries, with infrastructure development enabling larger on-site generation facilities. Government incentives and trade policies support investment in green hydrogen and energy-efficient technologies. Local players have deployed modular oxygen and nitrogen plants, reducing dependency on bulk supply by up to 20%. Enterprises in South America focus on operational efficiency and cost reduction, with adoption influenced by manufacturing clusters and regional supply chain improvements.

How are modernization initiatives advancing industrial gas adoption?

The Middle East & Africa holds 5% of the on-site industrial gases market, with UAE and South Africa leading growth. Demand is driven by oil & gas, construction, and industrial chemicals sectors. Modernization efforts include digital monitoring, AI optimization, and modular on-site hydrogen and oxygen systems. Local players have installed on-site nitrogen generation for petrochemical facilities, improving operational reliability by 10%. Regional adoption is influenced by large-scale industrial projects, government incentives, and a focus on ESG compliance, with enterprises increasingly prioritizing energy efficiency and sustainable gas generation solutions.

China: 28% market share – high production capacity, large-scale industrial adoption, and significant investment in modular and green hydrogen plants.

United States: 21% market share – strong end-user demand in healthcare, aerospace, and chemicals, supported by regulatory incentives and advanced technology integration.

The On-site Industrial Gases market is moderately consolidated, with approximately 120 active global competitors, including both multinational corporations and regional specialists. The top five companies collectively hold around 60% of the market share, with Linde, Air Products, Air Liquide, Messer, and Yingde Gases occupying leading positions due to their extensive production capacity, technological expertise, and global distribution networks. Competitive dynamics are shaped by strategic initiatives such as partnerships, joint ventures, and technology-driven product launches, including modular PSA units, on-site hydrogen generation, and IoT-enabled monitoring solutions. Over 45% of recent market entrants focus on renewable integration and digitalization to differentiate offerings and capture niche industrial segments. Innovation trends, including AI predictive maintenance, automated gas purity management, and green hydrogen projects, are influencing competitive positioning. Companies are also investing in regional expansion, particularly in Asia Pacific and North America, where industrial demand is growing rapidly, driving operational efficiency and enhanced supply reliability. Overall, the market is defined by technological leadership, operational scale, and strategic collaborations that shape competitive intensity and growth trajectories.

Messer

Yingde Gases

Taiyo Nippon Sanso

Praxair

Matheson Tri-Gas

Iwatani Corporation

Gulf Cryo

The On-site Industrial Gases market is being transformed by advanced technologies that enhance operational efficiency, gas purity, and supply reliability. Pressure Swing Adsorption (PSA) systems currently account for 50% of on-site installations due to their ability to deliver high-purity oxygen, nitrogen, and hydrogen at lower energy consumption compared to conventional cryogenic plants. Membrane separation technology is also widely adopted, representing 20% of installations, particularly in smaller industrial setups and remote facilities, offering rapid deployment and modular scalability.

Emerging digital technologies are reshaping operational management, with over 65% of new plants implementing IoT-enabled sensors and cloud-based monitoring systems to track gas purity, pressure, and consumption in real time. Predictive maintenance powered by AI algorithms has reduced unscheduled downtime by up to 12% in pilot installations, improving plant reliability and reducing operational costs. Additionally, integration of renewable energy with on-site hydrogen generation is expanding, with over 40% of new hydrogen projects utilizing solar or wind-powered electrolysis, resulting in a 20–25% reduction in CO₂ emissions compared to conventional hydrogen supply.

Automation and remote-control systems are further enhancing operational safety, enabling centralized management of multiple on-site plants and minimizing human error. Modular and prefabricated plant designs, which account for 55% of recent installations in Asia Pacific and Europe, reduce construction time by up to 20% and labor requirements by 15%. Together, these technological advancements position the On-site Industrial Gases market to deliver reliable, sustainable, and scalable solutions across industrial, chemical, electronics, and energy sectors, supporting long-term efficiency and environmental compliance goals.

The scope of the On-site Industrial Gases Market Report encompasses a comprehensive examination of the structural and operational facets of the on-site supply segment within the broader industrial gases industry. It covers detailed segmentation by gas type—such as oxygen, nitrogen, hydrogen, carbon dioxide, argon, helium, and other specialty gases—evaluating the prevalence of each within industrial supply networks, on-site generation technologies, and purity requirements unique to application areas.

The report assesses key application contexts including chemical processing, metals and mining, electronics and semiconductors, healthcare, food and beverage, and energy facilities, identifying how on-site gas systems integrate with production lines and safety protocols. Geographically, the report analyzes regional markets across North America, Europe, Asia-Pacific, South America, and Middle East & Africa with metrics related to installed capacity, plant density, regulatory frameworks, and infrastructure dynamics.

It examines technology categories such as PSA, membrane separation, cryogenic distillation, and emerging integrations with electrolysis for green hydrogen, digital monitoring, and automation. The coverage includes end-user insights and operational priorities, detailing delivery models, contractual structures, long-term supply agreements, and logistics considerations. Emerging niche segments such as on-site carbon capture integration, ultra-high purity specialty gas generators, and hybrid generation systems are explored to underscore future opportunities and differentiation in industrial gas provisioning. The report’s breadth supports strategic decisions by highlighting innovation pathways, compliance drivers, and deployment trends across market segments.

| Report Attribute/Metric | Report Details |

|---|---|

|

Market Revenue in 2024 |

USD 64677.75 Million |

|

Market Revenue in 2032 |

USD 87837.36 Million |

|

CAGR (2025 - 2032) |

3.9% |

|

Base Year |

2024 |

|

Forecast Period |

2025 - 2032 |

|

Historic Period |

2020 - 2024 |

|

Segments Covered |

By Types

By Application

By End-User

|

|

Key Report Deliverable |

Revenue Forecast, Growth Trends, Market Dynamics, Segmental Overview, Regional and Country-wise Analysis, Competition Landscape |

|

Region Covered |

North America, Europe, Asia-Pacific, South America, Middle East, Africa |

|

Key Players Analyzed |

Linde, Air Products, Air Liquide, Messer, Yingde Gases, Taiyo Nippon Sanso, Praxair, Matheson Tri-Gas, Iwatani Corporation, Gulf Cryo |

|

Customization & Pricing |

Available on Request (10% Customization is Free) |