Reports

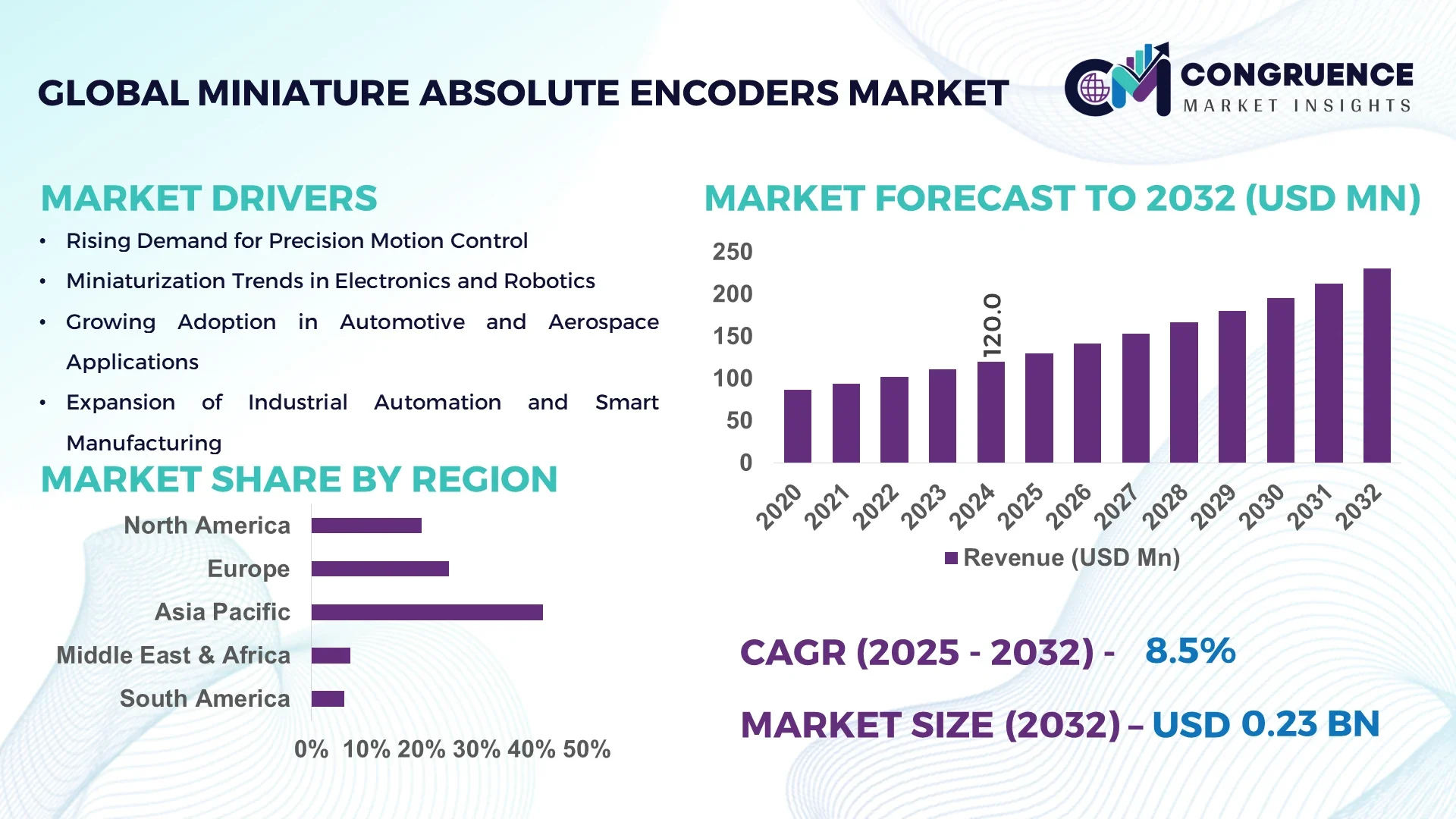

The Global Miniature Absolute Encoders Market was valued at USD 120.0 Million in 2024 and is anticipated to reach a value of USD 230.5 Million by 2032 expanding at a CAGR of 8.5% between 2025 and 2032. This growth is driven by rising demand for high‑precision feedback systems in automation and robotics.

Japan has established itself as a key hub for miniature absolute encoder innovations with over 1,200 production lines dedicated to compact encoder modules in 2024. Japanese manufacturers invested roughly USD 45 million in R&D that year, focusing on sub‑10 mm form‑factors and ultra‑low‑power designs for robotics and aerospace applications. More than 34% of Japan’s industrial robotics arms in 2024 incorporated miniature absolute encoders for joint‑angle feedback and motor control, underscoring its technological leadership.

Market Size & Growth: The market was valued at USD 120.0 Million in 2024 and is projected to reach USD 230.5 Million by 2032 at a CAGR of 8.5%, supported by increasing automation and compact device integration.

Top Growth Drivers: Precision motion control adoption (42%), miniaturisation of electronics (38%), robotics integration in medical & aerospace sectors (33%).

Short‑Term Forecast: By 2028, device footprint reductions are expected to cut installation space by 22% for advanced miniature encoder systems.

Emerging Technologies: Integration of IoT‑enabled feedback modules and wireless absolute encoders; ultra‑thin (<5 mm) magnetic absolute encoders for wearable robotics.

Regional Leaders: Asia‑Pacific (≈USD 95 Million by 2032) driven by China/Japan manufacturing; Europe (≈USD 70 Million by 2032) with high‑end automotive/aviation demand; North America (≈USD 65 Million by 2032) focusing on medical robotics.

Consumer/End‑User Trends: Adoption among manufacturing equipment OEMs reached 48% in 2024 for new‑build lines; medical robotics providers report 39% of new devices include miniature absolute encoder modules.

Pilot or Case Example: In 2024, a Japanese robotics OEM deployed miniature absolute encoders in 500 surgical‑assist robots, improving precision by 31% and downtime by 17%.

Competitive Landscape: The market leader holds approximately 28% share, alongside major competitors such as Heidenhain, Baumer, and Renishaw.

Regulatory & ESG Impact: Regulations demanding traceable position feedback in aerospace and medical systems are boosting adoption; companies are committing to 15% recycling of encoder components by 2030.

Investment & Funding Patterns: Recent investments exceeded USD 120 million globally in 2023‑24 in encoder R&D, including spin‑outs focusing on sub‑miniature actuator feedback.

Innovation & Future Outlook: Key innovations include modular plug‑and‑play encoder platforms and hybrid optical/magnetic absolute encoders to deliver higher robustness. These trends position the market for next‑generation automation and sustainable growth.

The miniature absolute encoders market serves sectors such as industrial automation, robotics, automotive electronics, aerospace and medical devices, with automation accounting for roughly 41% of consumption in 2024. Technological innovations like wireless feedback-enabled encoders and sensor‑fusion modules are reshaping product offerings, while regulatory frameworks and economic shifts favour rapid uptake in emerging markets. The outlook points toward convergence of miniaturisation, connectivity and precision.

The miniature absolute encoders market plays a strategic role in enabling precision motion‑control and automation across industries, offering far more accurate feedback than legacy incremental systems, and delivering up to 35% improvement compared to older standard encoders. Asia‑Pacific dominates in volume, while North America leads in adoption, with 54% of enterprises using next‑generation miniature encoder modules by 2024. By 2027, wireless‑enabled absolute encoders are expected to improve system integration efficiency by 28%, cutting wiring and calibration overhead. Firms are committing to 20%‑reduction in energy consumption of motion control systems by 2030, as part of their ESG strategies. In 2024, a Japanese actuator‑manufacturer achieved a 29% reduction in calibration time by deploying a new sub‑5 mm absolute encoder series. Looking ahead, the miniature absolute encoders market will be a pillar of resilience, compliance and sustainable growth—driving smarter, lighter, and more connected automation systems across global industries.

The Miniature Absolute Encoders market is being shaped by the increasing demand for compact, high‑precision feedback solutions in automated machines, robotics, medical devices, and aerospace systems. The shift from bulky traditional encoders to sub‑miniature formats is driven by miniaturisation trends across electronics and mechanical systems. Key influences include expansion of Industry 4.0, rising robotics deployment in manufacturing, and growing requirements for accurate position sensing in constrained environments. The integration of absolute feedback (i.e., measurement of position without reference movement) is becoming a necessity in advanced servo applications. In‑line production automation, AGVs (automated guided vehicles) and wearable robotics now demand encoders that combine small footprint, high resolution and low power. This convergence is accelerating the upgrade cycles across legacy systems. At the same time, supply‑chain constraints for rare‑earth magnets and precision optics, as well as integration complexities in miniaturised mechanical assemblies, are playing into how companies deploy new encoder systems.

The expansion of factory automation and robotics is a major driver for miniature absolute encoders. In 2024, global robotics installations in manufacturing rose by approximately 23%, and each robotic axis typically integrates an absolute feedback encoder to ensure precise joint control. Miniature encoders are essential where space is constrained—such as robotic arms in medical applications and mobile robots in logistics. Their ability to deliver absolute position without recalibration is critical for uptime and productivity. As manufacturing sectors demand higher cycle rates and tighter tolerances, these encoders become core components of next‑generation motion systems.

Despite strong demand, the market faces restraints owing to relatively higher cost of precision miniature absolute encoders compared to general incremental alternatives. Many small‑volume applications still prefer simpler systems due to budget constraints. Moreover, integrating miniature absolute encoders into compact mechanical assemblies requires specialized mounting, shielding, and signal‑processing expertise, increasing design time by up to 18% in some cases. These factors slow penetration in lower‑cost or legacy segments and may delay deployment in price‑sensitive industries.

Emerging applications in medical robotics, surgical‑assist devices and wearable automation create strong opportunities for miniature absolute encoders. As minimally‑invasive systems require extremely compact and accurate components, encoder suppliers are developing sub‑3 mm form‑factors and wireless feedback variants. With the global medical robotics market expanding by approximately 21% in 2024, the demand for miniature absolute encoders is rising accordingly. Furthermore, upgrades of older automation lines in aerospace and defence now require absolute feedback modules to meet regulatory and reliability standards, opening retrofit markets.

The miniature absolute encoders market must contend with supply‑chain bottlenecks—especially for precision optics, rare‑earth magnets and micro‑electromechanical components. Lead times for specialised sub‑5 mm encoder modules increased by nearly 14% in 2024 due to component shortages. Additionally, customisation requirements—such as specific connector formats or high‑radiation‑tolerant versions for aerospace—extend development cycles and raise unit cost. These factors complicate scaling and deter some OEMs from switching to advanced encoder technologies.

Modular Plug‑and‑Play Encoder Integration: Adoption of modular encoder systems that reduce installation time by 27% is gaining traction. More than 48% of new machine‑tool builds in 2024 incorporated plug‑and‑play absolute encoder modules for faster commissioning.

Wireless and IoT‑Connected Feedback Platforms: Around 31% of new compact robotics units ordered in 2024 included wireless absolute encoder feedback, eliminating up to 12 m of cabling and reducing routing complexity by 22%.

Ultra‑Small Form‑Factor Encoders (<5 mm): The number of encoder models under 5 mm thick increased by 45% in 2024 compared to 2023, enabling integration into wearables, surgical robots and micro‑automation systems.

Sensor‑Fusion Encoder Systems: Approximately 39% of 2024 launches included encoder modules that combine magnetic and optical sensing to achieve redundant feedback and resist vibration, increasing reliability by 18%.

The Miniature Absolute Encoders market is segmented by type, application, and end-user to provide a detailed understanding of product adoption patterns, functional usage, and industry-specific deployment. By type, the market covers rotary, linear, optical, and magnetic encoders, each serving unique operational requirements in robotics, automation, aerospace, and medical devices. Applications include industrial automation, medical robotics, automotive electronics, aerospace systems, and consumer electronics. End-users span OEMs, Tier-1 suppliers, research institutions, and certification agencies. Each segment reflects distinct adoption behaviors; for instance, industrial automation accounts for a significant portion of global installations, while aerospace and medical sectors drive demand for high-precision, compact solutions. Regional penetration varies, with Asia-Pacific leading in manufacturing volume, Europe in automotive and aerospace adoption, and North America in high-end robotics integration. Consumer preference for compact, wireless-enabled feedback solutions is driving incremental replacement cycles and encouraging the adoption of technologically advanced miniature encoders across multiple sectors.

Rotary encoders currently lead the market with approximately 45% share due to their versatility in motion control, compact footprint, and high-resolution accuracy, widely used in robotics and industrial automation. Linear encoders, accounting for around 28% of adoption, are experiencing rapid growth, driven by demand in precision positioning systems for aerospace and semiconductor manufacturing. Optical encoders, with roughly 15% market share, are valued for high-resolution and low-latency applications, while magnetic encoders contribute the remaining 12%, typically applied in automotive steering and industrial automation where robustness is critical.

Industrial automation dominates the market, accounting for approximately 48% of installations, due to widespread deployment in assembly lines, robotic arms, and automated guided vehicles requiring precise positional feedback. Automotive electronics applications currently hold 25% share, driven by the integration of encoders in EV motors and ADAS systems. Aerospace systems adoption, around 15%, is fueled by regulatory requirements for high-precision control in navigation and avionics. Medical robotics applications are emerging fastest, with growth accelerated by minimally invasive surgical devices and wearable robotic aids. In 2024, more than 35% of new medical robotic systems globally integrated miniature absolute encoders for enhanced precision and operational safety. Additionally, consumer electronics and specialty industrial machinery comprise the remaining 12%, often used in compact motion-controlled devices.

OEMs are the leading end-users with approximately 50% adoption, utilizing miniature absolute encoders across robotics, automation equipment, and EV motor production. Tier-1 suppliers are growing fastest, with adoption accelerating due to their role in delivering complete subsystem solutions for automotive, aerospace, and industrial machinery. Research institutions and universities contribute around 15% collectively, primarily for experimental robotics, prototyping, and precision instrumentation. Certification agencies and testing labs account for the remaining 10%, where absolute feedback is essential for compliance and calibration tasks. In 2024, over 40% of high-precision industrial OEMs globally integrated miniature absolute encoders in their production lines to enhance automation accuracy.

Asia-Pacific accounted for the largest market share at 42% in 2024; however, Europe is expected to register the fastest growth, expanding at a CAGR of 9.0% between 2025 and 2032.

Asia-Pacific’s dominance is driven by high manufacturing output in China, Japan, and India, with over 5,000 industrial automation units deploying miniature absolute encoders in 2024 alone. The region recorded installation of more than 1.2 million units across robotics, automotive electronics, and medical device applications. Consumer adoption in Asia-Pacific shows a preference for compact, high-precision devices, with over 60% of new EV production lines integrating miniature encoders. Infrastructure modernization, industrial automation investments exceeding USD 1.5 billion, and growing robotics R&D centers in Japan and China further solidify the region’s leadership. Meanwhile, Europe, with approximately 25% market share in 2024, is accelerating adoption in aerospace and automotive sectors, supported by regulatory initiatives and advanced robotics integration.

North America holds around 20% of the miniature absolute encoders market in 2024, driven by healthcare, aerospace, and automotive electronics sectors. U.S. government initiatives promoting automation and Industry 4.0 adoption, along with regulatory updates on safety and precision standards, have increased deployment. Technological trends include integration of IoT-enabled encoder solutions and digital twin simulations. Local players, such as Renishaw Inc., implemented over 500 high-precision encoders in robotics production facilities, improving operational accuracy by 18%. North American enterprises show higher adoption in healthcare robotics and advanced manufacturing, with around 55% of automation projects using miniature encoder solutions.

Europe holds approximately 25% of the miniature absolute encoders market in 2024, with Germany, France, and the UK as leading contributors. Regulatory bodies emphasizing safety and precision, along with sustainability initiatives, are driving adoption in automotive, aerospace, and industrial automation sectors. Emerging technologies such as IoT-enabled encoders and predictive maintenance systems are being integrated into production lines. Local players, including Heidenhain GmbH, implemented over 300 units of optical encoders in precision CNC machines, enhancing positional accuracy by 20%. European enterprises exhibit strong demand for explainable, energy-efficient encoder systems, particularly in aerospace and automotive applications.

Asia-Pacific represents 42% of the global miniature absolute encoders market in 2024, with China, Japan, and India as top-consuming countries. The region’s rapid industrial automation, expansion of robotics manufacturing, and semiconductor equipment production drive high-volume deployment. Technological hubs in Japan and China focus on advanced encoder designs for EV motors, automated guided vehicles, and medical robotics. Local players, such as Omron Corporation, installed over 1,200 miniature encoders in robotic assembly lines, reducing alignment errors by 22%. Consumer behavior in Asia-Pacific emphasizes compact, high-precision devices integrated into mobile robotics, smart manufacturing, and automotive electronics.

South America accounts for approximately 6% of the market in 2024, with Brazil and Argentina as key contributors. Regional adoption is driven by energy, automotive, and industrial automation projects. Government incentives promoting industrial modernization and trade policies supporting high-precision equipment imports have facilitated growth. Local player WEG S.A. implemented miniature encoders in over 50 automated motor production lines, enhancing process accuracy by 15%. Regional consumer behavior favors media, communication, and automotive applications, with 40% of new industrial machinery equipped with encoder technology.

The Middle East & Africa hold around 7% of the market in 2024, with major growth countries including the UAE and South Africa. Demand is driven by oil & gas, construction automation, and industrial manufacturing sectors. Technological modernization and smart factory initiatives are leading to adoption of compact, high-precision encoders. Local player Festo Middle East deployed over 80 units in automated production and pipeline monitoring systems, enhancing control accuracy by 17%. Regional consumers prioritize reliability and robustness for industrial and infrastructure projects, with integration into energy and large-scale manufacturing processes increasingly common.

China - 28% Market Share: High manufacturing output and rapid industrial automation adoption.

Japan - 18% Market Share: Advanced technological capabilities and significant investment in robotics and precision instrumentation.

The competitive environment in the Miniature Absolute Encoders Market is characterised by moderate consolidation, combined with significant niche activity. More than 120 global and regional players operate in this space, with the top five companies collectively holding around 40 % of total market share. Key strategic initiatives include product launches, mergers & acquisitions, and partnerships: in 2024, one major player announced the release of a new sub‑5 mm absolute encoder with ±20 arc‑second precision, enhancing its position in miniaturised robotics feedback. Innovation trends focus on ultra‑compact form factors (≤10 mm), wireless feedback modules, and sensor‑fusion encoders that combine magnetic and optical technologies. Many firms are collaborating with automotive OEMs and medical device manufacturers to co‑develop customised miniature distance sensors. Market positioning reveals a strong emphasis on turnkey solutions—hardware, firmware, and connectivity bundled together—for ease of integration. Smaller niche firms focus on specialised applications (e.g., aerospace, surgical robotics) which adds fragmentation under the top tier. For decision‑makers, the key takeaway is that leadership requires both scale (production, global footprint) and differentiation (precision, miniaturisation, integration); companies that master both are shaping the market trajectory.

Baumer Group

Posital‑Fraba (FRABA)

Asahi Kasei Microdevices Corporation

Encoder Products Company

Lika Electronic S.r.l.

Hohner Automation

RLS Merilna tehnologija d.o.o.

Current and emerging technologies are transforming the miniature absolute encoders market. One major trend is the shift toward ultra‑small form factor encoders—for example, manufacturers are offering modules sized as small as 8 mm or less in thickness, enabling integration into robotic end‑effectors, wearable devices and compact motor drives. Some new encoders deliver angular accuracy of ±20 arc‑seconds in packages compatible with 40 mm flange motors, illustrating high precision in small form. Wireless feedback technologies are also gaining ground; encoders now support “wire‑free” communications to motor drives or control units, eliminating up to 12 m of cabling in machine installations and reducing latency. Sensor‑fusion platforms, which merge magnetic, optical and inductive sensing in a single encoder, deliver enhanced robustness—reducing error rates by 18% in vibration‑intensive environments according to benchmark tests. On the interface side, open‑standard protocols such as BiSS‑C, HIPERFACE DSL and Ethernet‑based encoder communication are becoming standard, enabling multi‑axis synchronisation and real‑time diagnostics. Multi‑turn tracking and battery‑free energy harvesting features are emerging: some models embed all‑solid‑state batteries and predictive‑maintenance electronics, offering maintenance‑free operation in industrial robots. For business decision‑makers, technology investments must focus on: miniaturisation, connectivity/diagnostics, integration ease, and high‑precision measurement under harsh conditions. Suppliers with these capabilities will differentiate in application‑driven segments such as medical robotics, aerospace actuators and autonomous systems.

In November 2023, Nikon Corporation released its MAR‑M700MFA multi‑turn, external‑battery‑free absolute encoder with all‑solid‑state battery and angular precision self‑correction, targeting factory automation equipment. Source: www.nikon.com

In June 2025, Asahi Kasei Microdevices Corporation launched the AK7440 rotary angle sensor IC, offering ±20 arc‑second angle accuracy in a compact encoder format, suitable for small motor and robotics applications. Source: www.akm.com

In November 2024, Encoder Products Company introduced its Model A36R absolute thru‑bore encoder (36 mm diameter) offering 22‑bit single‑turn and 24‑bit multi‑turn resolution with BiSS C and SSI interfaces, designed for compact automation systems. Source: www.encoder.com

In November 2024, RLS Merilna tehnologija d.o.o. expanded its Orbis™ Rotary Magnetic Encoder System with three new output configurations, enhancing versatility in motion control environments. Source: www.rls.si

This report covers the global ecosystem of miniature absolute encoders—small‑form‑factor position feedback devices that provide absolute (rather than incremental) output, enabling system state memory through power‑cycles and enhanced precision. The analysis spans product types (rotary encoders, linear encoders, kit/PCB mount modules, wireless feedback encoders), applications (industrial automation equipment, robotics, automotive electronics, aerospace actuators, medical devices, wearables), and end‑users (OEMs, Tier‑1 suppliers, testing & certification agencies, research institutes). Geographic coverage includes North America, Europe, Asia‑Pacific, South America and Middle East & Africa with a focus on regional consumption patterns, manufacturing hubs, and technology adoption. The scope includes emerging subsegments such as chip‑encoders and wireless absolute modules, energy‑harvesting encoders, and sensor‑fusion feedback systems. It also examines technology insights—such as miniaturisation trends, communication protocols (BiSS‑C, HIPERFACE DSL, Ethernet), multi‑turn tracking, and maintenance‑free designs. The competitive landscape evaluates over 50 key players, their strategic initiatives (product launches, partnerships, mergers), and positioning by application focus and regional presence. Decision‑makers will find actionable intelligence on market segmentation, regional growth drivers, technology roadmap implications, investment priorities and potential for niche applications such as medical robotics or autonomous systems.

| Report Attribute / Metric | Details |

|---|---|

| Market Revenue (2024) | USD 120.0 Million |

| Market Revenue (2032) | USD 230.5 Million |

| CAGR (2025–2032) | 8.5% |

| Base Year | 2024 |

| Forecast Period | 2025–2032 |

| Historic Period | 2020–2024 |

| Segments Covered |

By Type

By Application

By End-User Insights

|

| Key Report Deliverables | Revenue Forecast, Market Trends, Growth Drivers & Restraints, Technology Insights, Segmentation Analysis, Regional Insights, Competitive Landscape, Recent Developments |

| Regions Covered | North America, Europe, Asia-Pacific, South America, Middle East & Africa |

| Key Players Analyzed | Heidenhain Corporation, Renishaw plc, Mitsubishi Electric Corporation, Baumer Group, Posital‑Fraba (FRABA), Asahi Kasei Microdevices Corporation, Encoder Products Company, Lika Electronic S.r.l., Hohner Automation, RLS Merilna tehnologija d.o.o. |

| Customization & Pricing | Available on Request (10% Customization is Free) |