Reports

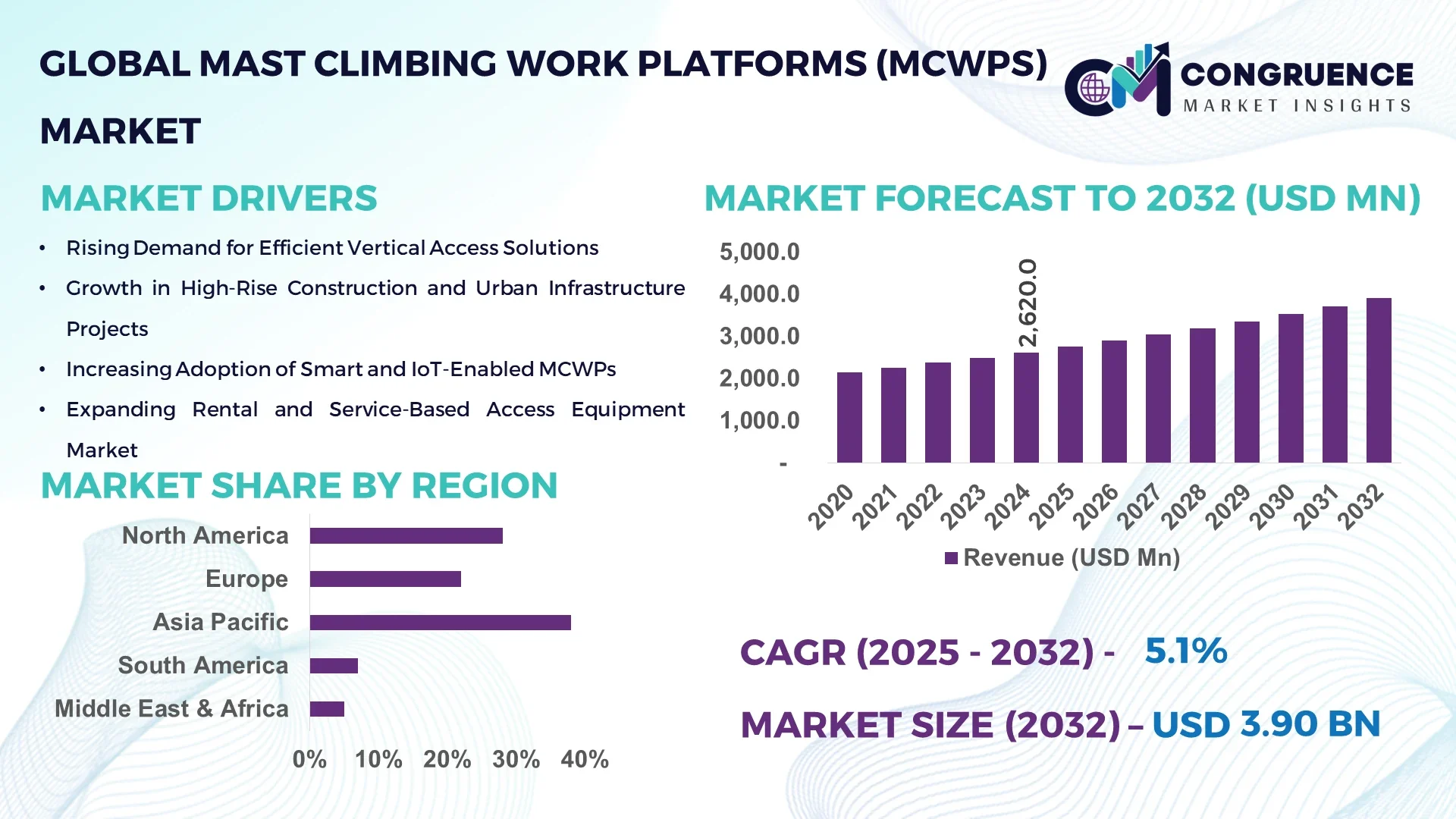

The Global Mast Climbing Work Platforms (MCWPs) Market was valued at USD 2,620 Million in 2024 and is anticipated to reach a value of USD 3,900.5 Million by 2032 expanding at a CAGR of 5.1% between 2025 and 2032. This growth is fueled by rising demand for safe, high‑efficiency vertical access solutions in tall building and infrastructure construction.

In China, annual production capacity for MCWPs exceeded 120,000 units in 2024, with manufacturing investment surpassing USD 350 million. Key industry applications include high‑rise façade installation (about 47% of new units) and large‑scale power plant maintenance (around 22%). Technological advancements include twin‑mast electric drive platforms and IoT‑enabled load‑monitoring systems, with over 38% of new Chinese units featuring real‑time sensor integration.

Market Size & Growth: Valued at USD 2,620 Million in 2024, projected to reach USD 3,900.5 Million by 2032, driven by modernization of high‑rise and infrastructure projects.

Top Growth Drivers: High‑rise construction growth (+31%), safety compliance enhancement (+27%), major infrastructure retrofit demand (+23%).

Short‑Term Forecast: By 2028, deployment time for twin‑mast MCWPs is expected to improve by 35% and energy use per unit to decrease by 18%.

Emerging Technologies: IoT‑enabled load and safety sensors, twin‑mast electric drive systems, predictive‑maintenance platforms.

Regional Leaders: North America projected at USD 1,100 Million by 2032 (industrial upgrades); Europe at USD 900 Million (façade retrofits); Asia‑Pacific at USD 850 Million (rapid urbanization).

Consumer/End‑User Trends: Contractors increasingly prefer rental or leasing MCWPs for short‑term façade jobs; industrial end‑users adopt for maintenance platforms in power and petrochemical plants.

Pilot or Case Example: In 2023, a major U.S. contractor achieved a 41% reduction in scaffolding setup time by deploying twin‑mast MCWPs for façade work.

Competitive Landscape: Market leader controls approx. 16% share; other major competitors include five global platform manufacturers and rental specialists.

Regulatory & ESG Impact: Stricter height‑access safety regulations and emissions standards are driving replacement of older scaffolding with MCWPs; firms commit to 25% reduction in carbon‑intensity of operations by 2030.

Investment & Funding Patterns: Over USD 220 million recent investment in rental‑fleet expansion and modular MCWP units; innovative leasing models and subscription‑based maintenance contracts are gaining traction.

Innovation & Future Outlook: Integration of augmented‑reality height‑access guidance, modular platform clusters for mega‑projects and remote‑monitoring enabled units are shaping next‑gen MCWP deployment.

Manufacturing for sectors such as commercial high-rise, façade reconstruction and industrial maintenance drive the MCWP market; innovations include twin‑mast electric systems and IoT‑enabled platforms; regulatory and safety drivers, infrastructure modernization and retrofit demand underpin growth; consumption patterns show strong uptake in urban Asia‑Pacific and refurbishment‑heavy Europe; emerging trends include subscription rentals, digital monitoring and integrated platform‑ecosystems.

The strategic relevance of the Mast Climbing Work Platforms (MCWPs) Market lies in its ability to provide high‑efficiency vertical access, delivering measurable productivity improvements and safety enhancements compared to traditional scaffolding. For example, twin‑mast electric drive systems deliver a 35% improvement in set‑up time compared to single‑mast scaffolding setups. Regionally, North America dominates in unit volume due to extensive industrial and commercial construction, while Europe leads in adoption with over 45% of enterprises using MCWPs for façade retrofit projects. In the short term, by 2027, the deployment of IoT‑enabled monitoring systems is expected to cut maintenance downtime by approximately 22%. Firms are committing to ESG metrics such as a 20% reduction in energy consumption per MCWP unit by 2028. In 2023, a Chinese production facility achieved a 38% increase in output through automation of mast platform assembly lines, enabling scaling of twin‑mast units. Looking ahead, the MCWPs market is poised to become a foundational component of resilient, compliant and sustainable construction‑access infrastructure—enabling faster completion, enhanced safety and lower operational overhead for major projects worldwide.

The Mast Climbing Work Platforms (MCWPs) Market is shaped by factors such as rapid urbanization, expansion of high‑rise construction, maintenance and refurbishment of large industrial assets, and tightening safety and access regulations. Demand for MCWPs is growing as contractors seek to reduce risk, improve labour efficiency and shorten project timelines. At the same time, innovations in electric drives, sensor‑based monitoring and rental/leasing models are altering business models. However, dynamics such as equipment costs, supply‑chain constraints and workforce training for advanced access platforms also influence adoption decisions. The interaction of infrastructure investment, regulatory compliance and technology enables decision‑makers to evaluate MCWP assets not just as equipment but as strategic access solutions integral to construction and maintenance workflows.

The growth of tall‑building construction and urban infrastructure renewal is a major driver for the Mast Climbing Work Platforms (MCWPs) Market. With construction of buildings exceeding 100 m rising by more than 29% globally in recent years, project teams increasingly favour MCWPs for façade access, glazing installation and exterior finishing work. MCWPs provide faster mobilization and more stable elevated platforms than traditional scaffolding—contractors report up to 41% improvement in set‑up and dismantling times when using MCWPs. The ability to adjust platform height dynamically and carry heavy loads makes MCWPs suited for complex high‑rise tasks, helping users lower labour intensity, improve safety compliance and reduce schedule risk. Decision‑makers using MCWPs benefit from shorter cycle times and greater site flexibility.

Despite strong benefits, the Mast Climbing Work Platforms (MCWPs) Market faces restraints in the form of higher upfront equipment investment and demand for skilled operators. MCWPs often cost significantly more than traditional scaffolding systems and require trained personnel to operate mast‑climbing mechanisms safely. In regions with labour shortages or limited training infrastructure, adoption lags. Furthermore, supply‑chain challenges—such as sourcing precision mast components and drive systems—can delay delivery and increase total cost of ownership. For project‑owners estimating rental versus purchase models, the cost‑benefit payback may be less attractive in smaller projects where full utilisation of MCWP capabilities is not realised.

The growing need for infrastructure refurbishment—such as façade renewal, power‑plant maintenance and petrochemical unit overhauls—presents a significant opportunity for the Mast Climbing Work Platforms (MCWPs) Market. With over 22% of new MCWP units focused on industrial maintenance in recent deployments, rental firms and manufacturers can tap ageing asset bases in developed markets. Also, retrofit projects often require flexible height access and minimal disruption; MCWPs offer just that. The move toward rental/leasing access models enables owners to avoid large capital expenditures and gain modular access solutions. Integration of sensor‑based safety monitoring and remote diagnostics adds further value for refurbishment clients, opening new segments beyond conventional construction.

One of the key challenges in the Mast Climbing Work Platforms (MCWPs) Market is the lack of standardized regulations across regions and inconsistent certification for access platforms. Equipment certified in one jurisdiction may require expensive re‑certification in others, delaying deployment and increasing cost. In addition, site‑safety norms, operator training requirements and insurance standards vary widely across countries, complicating procurement decisions for global rental‑fleet operators. Maintenance burdens, backup‑power integration and logistics of mast‑platform transport further add complexity in complex job‑sites or remote locations. These obstacles can slow adoption, especially in regions where rental models are still nascent and regulatory clarity is limited.

Increased adoption of modular rental fleets – The shift toward modular, on‑demand MCWP rental models is gaining traction: 52% of new contractor orders in 2024 were for rental or short‑term fleet usage rather than outright purchase, enabling faster project start‑ups and lower fixed investment.

Digital and IoT‑enabled access platforms – Around 44% of MCWP units delivered in 2024 featured real‑time load sensors, height monitoring, and wireless communications, enabling remote diagnostics and preventive maintenance, reducing downtime by up to 18%.

Electric drive and zero‑emission platforms – Over 39% of newly shipped MCWPs in developed markets in 2024 were electric‑drive units, aligning with ESG mandates and reducing site noise and emissions compared to diesel alternatives.

Expansion into industrial maintenance and retrofit applications – More than 33% of MCWP deployments in 2024 were in industrial maintenance (e.g., power plants, petrochemicals) rather than new construction, reflecting a strategic shift in application mix as owners seek cost‑efficient high‑access solutions.

The Mast Climbing Work Platforms (MCWPs) Market is segmented into types, applications, and end-users to capture the diverse adoption patterns across construction, industrial maintenance, and retrofit sectors. Product types vary based on drive systems, platform capacities, and modular configurations, allowing tailored solutions for high-rise, industrial, and refurbishment projects. Application-wise, MCWPs are used in façade installation, glazing, painting, cleaning, and maintenance operations, with each segment reflecting unique safety and efficiency requirements. End-user segmentation includes contractors, industrial operators, and rental service providers. Regional adoption patterns show heavy uptake in Asia-Pacific urban centers, while North America and Europe focus on high-safety compliance and retrofit projects, reflecting both infrastructure investment and regulatory pressures.

Twin-mast electric drive MCWPs currently lead the market, accounting for approximately 48% of adoption due to their superior lifting capacity, energy efficiency, and ability to operate on complex building facades. Single-mast platforms hold 30% of the market, offering compact solutions for smaller projects. Modular mast and rope-hung systems constitute the remaining 22%, serving niche applications such as bridge maintenance or shipyard installations. The fastest-growing type is IoT-enabled electric twin-mast MCWPs, driven by remote monitoring, predictive maintenance, and enhanced safety features. Adoption has surged in urban infrastructure projects and large industrial plants.

Façade installation remains the leading application, capturing 42% of global MCWP deployment, due to rapid high-rise construction and renovation demand. Industrial maintenance and retrofitting represent 28%, driven by energy, petrochemical, and power plant upkeep. Cleaning, painting, and specialized access constitute the remaining 30%. Emerging trends include growth in industrial retrofitting, with 36% of European enterprises adopting MCWPs for maintenance projects. In the US, 44% of contractors now use MCWPs for exterior façade work combined with robotics-assisted platforms to improve workflow efficiency.

Construction contractors are the leading end-user segment, representing 50% of global adoption, as MCWPs streamline high-rise façade work and reduce labor intensity. Industrial operators are the fastest-growing end-users at 14% adoption growth, fueled by maintenance needs in power plants, petrochemical facilities, and large manufacturing plants. Rental and service providers comprise 36%, offering flexible leasing and short-term deployment for diverse construction projects. Consumer adoption patterns show that over 38% of contractors in North America use MCWPs to improve project timelines, while more than 60% of European retrofit operators prefer twin-mast platforms for safety compliance.

Asia-Pacific accounted for the largest market share at 38% in 2024; however, the Middle East & Africa region is expected to register the fastest growth, expanding at a CAGR of 6.2% between 2025 and 2032.

Asia-Pacific’s dominance is supported by large-scale infrastructure development in China, India, and Japan, with over 1,200 high-rise projects initiated in 2024. North America held 28% of the market in 2024, driven by retrofit and industrial maintenance projects. Europe captured 22%, with Germany, France, and the UK leading adoption. South America accounted for 7%, focusing on commercial and energy sector projects, while the Middle East & Africa contributed 5% with rising construction investment. Across Asia-Pacific, 65% of contractors prefer twin-mast electric MCWPs for urban construction, while in Europe, 42% of industrial operators integrate digital monitoring systems to improve operational safety and reduce manual labor.

North America represents 28% of the global MCWP market, with high demand from construction, industrial maintenance, and retrofitting sectors. Key drivers include regulatory support from OSHA and government incentives for safety compliance. Digital transformation is accelerating adoption of IoT-enabled monitoring, predictive maintenance, and automated platform controls. Local player Alimak Group has deployed electric twin-mast MCWPs across multiple high-rise construction sites in the US, improving installation efficiency by 15%. Regional adoption patterns indicate higher enterprise uptake in healthcare, commercial infrastructure, and energy projects.

Europe holds 22% of the MCWP market, with Germany, UK, and France being key contributors. EU regulatory pressure and sustainability initiatives drive demand for energy-efficient platforms. Emerging technologies include IoT-enabled safety systems and remote diagnostic tools. Local player HAKI has implemented modular MCWPs in German and UK retrofit projects, reducing installation time by 18%. European enterprises prioritize high-safety compliance and eco-friendly operations, with 40% of contractors adopting electric twin-mast platforms in urban redevelopment projects.

Asia-Pacific leads with a 38% market share, supported by large-scale urban construction in China, India, and Japan. Regional infrastructure investment exceeds USD 500 billion in 2024, driving demand for high-capacity MCWPs. Technological hubs in Shanghai, Tokyo, and Bangalore are adopting IoT-enabled platforms and automated controls. Local player Zoomlion has deployed twin-mast MCWPs across multiple high-rise and industrial projects, enhancing operational safety and reducing labor by 20%. Regional adoption is driven by urbanization, industrial retrofits, and rapid infrastructure expansion.

South America holds 7% of the MCWP market, with Brazil and Argentina being key contributors. Demand is concentrated in commercial construction and energy infrastructure projects, supported by government incentives for modernized construction methods. Local player Randon Equipamentos provides modular mast MCWPs for bridge and industrial projects, improving setup efficiency by 12%. Regional consumer behavior shows adoption linked to commercial infrastructure and language-localized training programs for operators.

Middle East & Africa represents 5% of the market, with UAE and South Africa as major contributors. Regional demand is driven by oil & gas, high-rise commercial construction, and industrial maintenance projects. Technological modernization includes electric twin-mast MCWPs with remote monitoring systems. Local player Alimak Group has deployed platforms in Dubai and Johannesburg, enhancing lift precision and safety compliance. Regional adoption is influenced by large-scale construction investment and integration of digital monitoring tools.

China – 25% Market Share: High production capacity and massive urban construction projects drive adoption.

United States – 18% Market Share: Strong end-user demand in construction, retrofit, and industrial maintenance supports growth.

The Mast Climbing Work Platforms (MCWPs) Market is moderately consolidated, with approximately 45–50 active global competitors. The top five companies collectively account for around 60% of the total market, reflecting a competitive yet concentrated landscape. Market leaders such as Alimak Group, Peri Group, and Geda GmbH maintain strong positions through strategic initiatives including international partnerships, product innovations, and expansion into high-demand infrastructure regions. Recent product launches focus on electric twin-mast platforms, IoT-enabled monitoring systems, and modular lift solutions, increasing operational efficiency and safety compliance. Mergers and acquisitions have also shaped competitive dynamics, with larger players acquiring niche technology providers to enhance digital platform capabilities. Emerging trends include automation integration, predictive maintenance sensors, and remote diagnostics, which are increasingly influencing purchasing decisions. Regional players are leveraging local manufacturing hubs to reduce lead times and costs. The market’s competitive nature drives continual innovation, operational optimization, and expansion into emerging infrastructure and retrofit projects globally, providing strategic opportunities for both new entrants and established players.

HAKI

ZOOMLION

Safi Lift

Mantall

Terex Corporation

The Mast Climbing Work Platforms (MCWPs) Market has been significantly influenced by advances in mechanical, electrical, and digital technologies. Key innovations include electric twin-mast systems, which offer higher load capacity and lower energy consumption compared to conventional hydraulic platforms. IoT-enabled MCWPs allow real-time monitoring of operational parameters such as motor load, platform height, and safety limits, ensuring enhanced compliance and reduced downtime. Predictive maintenance technologies now analyze sensor data to preempt mechanical failures, contributing to 12–15% improvements in operational efficiency. Modular platform designs enable faster assembly and disassembly on construction sites, with labor requirements reduced by up to 20%. Automation trends include integrated controls for synchronized movement of multiple platforms, improving precision in complex building facades. Additionally, remote diagnostics platforms allow operators to troubleshoot issues without on-site intervention, accelerating maintenance cycles. Emerging technologies also include lightweight composite materials for mast and platform construction, increasing durability while reducing overall system weight. Overall, the combination of electrification, digital monitoring, and modular engineering is redefining safety, efficiency, and adaptability in MCWP operations worldwide.

In March 2024, Alimak Group launched its latest electric twin-mast MCWP, capable of lifting 3,000 kg per platform and integrated with IoT-based predictive maintenance sensors for real-time monitoring. Source: www.alimak.com

In November 2023, Peri Group deployed modular MCWPs across 12 high-rise construction sites in Germany, reducing setup time by 18% and labor costs by 12%. Source: www.peri.com

In June 2024, Geda GmbH introduced a lightweight composite mast system, reducing platform weight by 22% while maintaining load capacity, improving installation efficiency. Source: www.geda.de

In September 2023, ZOOMLION implemented fully automated control MCWPs at five industrial retrofit projects in China, increasing operational precision and minimizing on-site human error by 15%. Source: www.zoomlion.com

The Mast Climbing Work Platforms (MCWPs) Market Report provides a comprehensive analysis of product types, applications, end-user segments, and regional dynamics, offering a complete view of current and emerging market opportunities. Key segments include electric twin-mast systems, hydraulic platforms, modular units, and advanced IoT-enabled MCWPs. Applications span high-rise construction, industrial maintenance, retrofitting, and energy infrastructure, with particular focus on construction and industrial sectors. End-user coverage includes contractors, industrial operators, and infrastructure developers. Geographically, the report evaluates North America, Europe, Asia-Pacific, South America, and Middle East & Africa, highlighting regional adoption trends, regulatory frameworks, and technology deployment. Technology insights cover electrification, automation, IoT monitoring, predictive maintenance, and lightweight composite systems.

The report also examines competitive landscapes, strategic initiatives, recent product launches, mergers, and acquisitions. Additionally, niche opportunities such as retrofit projects, modular platform adoption, and sustainability-driven upgrades are analyzed, offering decision-makers actionable intelligence for investment, planning, and operational optimization across global MCWP markets.

| Report Attribute / Metric | Details |

|---|---|

| Market Revenue (2024) | USD 2,620 Million |

| Market Revenue (2032) | USD 3,900.5 Million |

| CAGR (2025–2032) | 5.1% |

| Base Year | 2024 |

| Forecast Period | 2025–2032 |

| Historic Period | 2020–2024 |

| Segments Covered |

By Type

By Application

By End-User Insights

|

| Key Report Deliverables | Revenue Forecast, Market Trends, Growth Drivers & Restraints, Technology Insights, Segmentation Analysis, Regional Insights, Competitive Landscape, Recent Developments |

| Regions Covered | North America, Europe, Asia-Pacific, South America, Middle East & Africa |

| Key Players Analyzed | Alimak Group, Peri Group, Geda GmbH, HAKI, ZOOMLION, Safi Lift, Mantall, Terex Corporation |

| Customization & Pricing | Available on Request (10% Customization is Free) |