Reports

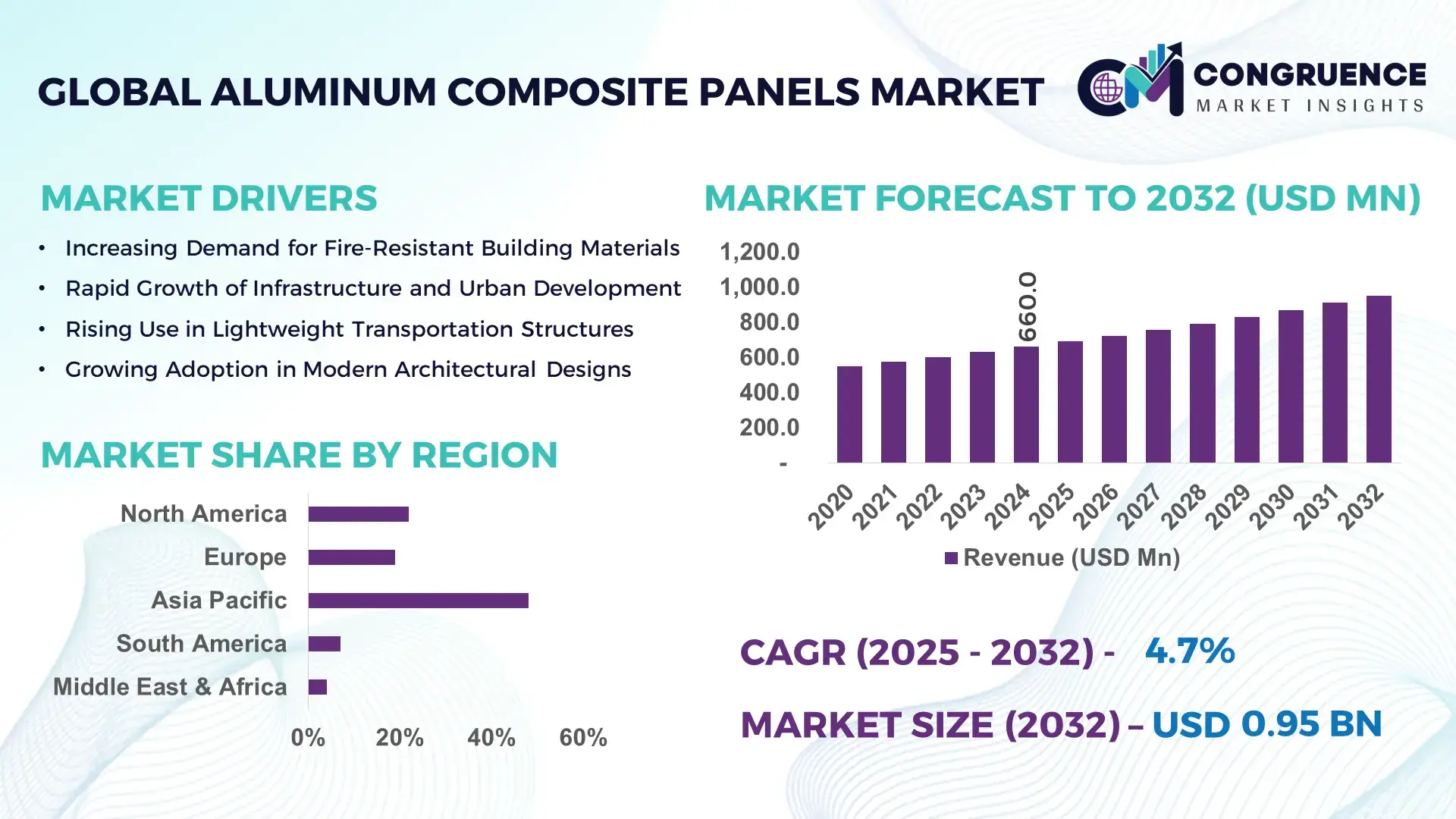

The Global Aluminum Composite Panels Market was valued at USD 660.0 Million in 2024 and is anticipated to reach USD 953.1 Million by 2032, expanding at a CAGR of 4.7% between 2025 and 2032, according to an analysis by Congruence Market Insights. The expansion is primarily driven by rising demand for lightweight, durable, and highly aesthetic cladding solutions across industrial and commercial infrastructure.

China plays a pivotal role in shaping the Aluminum Composite Panels Market due to its expansive industrial ecosystem, exceeding 32 million metric tons of annual aluminum production capacity and large-scale investments in surface-coating and extrusion technologies. The country hosts several advanced ACP manufacturing clusters equipped with automated coil-coating lines, nano-PVDF processing units, and high-speed lamination systems supporting high-volume output exceeding 1.5 billion square meters annually for construction, automotive, and industrial applications.

Market Size & Growth: Valued at USD 660.0 Million in 2024, projected to reach USD 953.1 Million by 2032 at a CAGR of 4.7%; growth driven by rapid expansion in architectural façade modernization.

Top Growth Drivers: 38% rise in adoption across commercial infrastructure; 27% improvement in installation efficiency; 22% increase in demand for fire-retardant grades.

Short-Term Forecast: By 2028, advanced lamination technologies are expected to enhance structural performance by 18%.

Emerging Technologies: AI-driven defect detection and nano-PVDF coatings improving surface durability; laser-based panel fabrication gaining traction.

Regional Leaders: By 2032, Asia Pacific expected at USD 428 Million, Europe at USD 221 Million, and North America at USD 196 Million, each exhibiting rising adoption of energy-efficient ACP systems.

Consumer/End-User Trends: Strong uptake in commercial real estate, transport infrastructure, and interior applications driven by high recyclability and design versatility.

Pilot or Case Example: A 2027 façade renovation pilot in Japan recorded a 29% reduction in installation downtime using robotic ACP mounting systems.

Competitive Landscape: Market leader holds approximately 14% share, followed by key players including 3A Composites, Alstrong, Alucoil, and Multipanel UK.

Regulatory & ESG Impact: Governments increasingly mandating fire-safety compliance and promoting low-VOC coatings to support sustainability frameworks.

Investment & Funding Patterns: Over USD 210 Million invested recently in production-line upgrades, automation, and sustainable coating technologies.

Innovation & Future Outlook: Growth driven by smart panels, self-cleaning surfaces, and rising integration of energy-responsive cladding systems.

The Aluminum Composite Panels Market continues to evolve with technological advances across surface engineering, tighter regulatory norms, increasing adoption in modern façade systems, and rising consumption across fast-growing economies, shaping a robust and competitive global landscape.

The Aluminum Composite Panels Market holds significant strategic relevance as global industries increasingly prioritize lightweight, high-strength, and energy-efficient building materials for next-generation infrastructure. With rapid modernization and stringent architectural standards, ACPs are positioned as a critical component in façade engineering, transport systems, and industrial applications. Strategic initiatives are becoming more data-centric, with measurable outcomes showing that AI-assisted coating systems deliver 21% improvement compared to earlier manual quality-control standards. This operational leap is influencing cost control, uniformity, and durability across production cycles.

Regional variations also reinforce strategic depth: Asia Pacific dominates in volume, supported by large-scale manufacturing and construction growth, while Europe leads in adoption with nearly 46% of enterprises using fire-rated and ESG-compliant ACP solutions. By 2029, automation-led fabrication and robotic installation technologies are expected to improve project delivery speeds by up to 25%, transforming installation economics and improving lifecycle value.

ESG priorities are becoming more critical, with firms committing to 30% reductions in coating-related emissions by 2030 through solvent-free and low-VOC formulations. In 2027, a major ACP manufacturer in South Korea achieved a 17% reduction in surface defects through machine-learning–based predictive lamination control, illustrating measurable progress resulting from digital transformation.

Looking ahead, the Aluminum Composite Panels Market will continue aligning with global sustainability mandates, advanced manufacturing, and intelligent façade systems. These shifts position the market as a pillar of resilience, compliance, and long-term sustainable growth.

The Aluminum Composite Panels Market is characterized by ongoing innovation, regulatory shifts, and rising adoption across construction, automotive, and industrial sectors. Architectural modernization projects are accelerating demand for lightweight and impact-resistant ACP systems with advanced weathering capabilities and extended service life. The market is being shaped by trends such as the expansion of green building certifications, improvements in lamination technologies, and growing implementation of fire-retardant materials. Additionally, digital fabrication, precision cutting systems, and automated coil-coating technologies are enhancing production efficiencies and shaping competitive dynamics. These evolving factors contribute to a market environment defined by technological progress, stringent quality benchmarks, and diversification of end-use applications.

Growing emphasis on high-performance façades is significantly influencing the Aluminum Composite Panels Market. Increasing adoption of ventilated façade systems, which improve thermal regulation by up to 35%, is driving the need for advanced ACP solutions. These panels offer superior rigidity, corrosion resistance, and design flexibility, meeting the architectural requirements of modern commercial structures. The construction industry’s shift toward sustainable and energy-efficient materials is also propelling demand, particularly as building codes tighten globally. Advanced fire-retardant ACP grades and nano-coated surfaces further support widespread deployment in airports, metro stations, and high-rise projects. With urbanization rising rapidly, developers are increasingly prioritizing materials with long lifecycle performance, acoustic insulation benefits, and resistance to extreme climatic variations, collectively boosting ACP utilization.

Stringent fire-safety regulations across multiple regions are creating compliance challenges for ACP manufacturers and slowing market momentum. Regulatory frameworks now demand non-combustible, high-performance cores that must pass advanced testing standards such as EN 13501-1 and NFPA protocols. Developing and certifying these materials significantly increases production time, technical complexity, and operational costs. Manufacturers also face pressure to shift from traditional LDPE cores to mineral-filled variants, which require specialized lamination equipment and complex process controls. This transition affects manufacturing throughput and material costs. Furthermore, large commercial projects increasingly require multi-layer fire-retardant ACP configurations, adding to scalability challenges. As regulatory compliance intensifies, companies are compelled to invest heavily in R&D, testing facilities, and new coating technologies, restraining short-term market expansion.

Smart city development and sustainable infrastructure expansion create significant opportunities in the Aluminum Composite Panels Market. Governments across Asia, the Middle East, and Europe are investing heavily in climate-resilient buildings, which require high-durability and low-maintenance cladding materials. ACPs with self-cleaning, anti-microbial, and UV-resistant coatings are gaining traction as they reduce lifecycle maintenance costs by up to 28%. Growing integration of solar-responsive skins and energy-efficient façade components further enhances market potential. Additionally, the shift toward digitally fabricated components supports customized panel geometries and rapid prototyping for complex architectural designs. Industrial sectors such as transportation hubs, logistics centers, and data centers increasingly adopt ACPs due to their thermal performance advantages and ability to meet strict design specifications, opening new revenue pathways for manufacturers.

Rising production and environmental compliance costs are creating operational challenges for manufacturers in the Aluminum Composite Panels Market. Aluminum price fluctuations, driven by global supply chain uncertainties, have increased raw material expenses by double-digit percentages in recent years. Compliance with VOC emission standards and environmentally safe coating processes requires costly upgrades to coil-coating lines and solvent-recovery systems. Manufacturers must also adapt to stricter waste management and recycling mandates, which involve substantial restructuring of supply chains and investments in circular material flows. Furthermore, the need for advanced testing and certification for fire safety and weatherability adds to operational burdens. Collectively, these financial, regulatory, and technological pressures create complex challenges that require strategic resilience and continuous innovation.

Growth of Modular and Prefabricated Construction: Modular construction techniques are reshaping ACP demand as 55% of new projects adopting prefabrication report measurable cost efficiencies. Automated cutting and lamination systems used in off-site production reduce labor requirements by nearly 30% and accelerate delivery timelines by 22%. The trend is most prominent in North America and Europe, where high-precision building components are crucial for rapid project completion.

Expansion of Fire-Retardant ACP Solutions: Demand for advanced fire-retardant panels is rising sharply, with mineral-core ACP usage increasing by 41% across high-rise and commercial infrastructure. New multilayer lamination structures enhance heat resistance by more than 35%, supporting safety-focused building codes. Innovations in halogen-free coatings are further boosting adoption across public infrastructure projects.

Rise of Digitally Fabricated ACP Components: Digitally controlled machines for laser-cutting, routing, and bending ACPs have seen adoption growth of 33% over the last five years. These technologies offer precision tolerances under 0.2 mm, enabling complex façade geometries and reducing material waste by as much as 18%. Adoption is accelerating across premium architectural projects and transportation hubs.

Increasing Integration of Sustainable Coating Technologies: Eco-friendly coatings, including low-VOC and solvent-free formulations, now account for nearly 47% of premium ACP production. Manufacturers incorporating energy-efficient curing systems report a 24% reduction in energy consumption during coating cycles. These innovations align with global ESG mandates, strengthening ACP positioning in green-certified buildings.

The Aluminum Composite Panels Market is segmented based on type, application, and end-user categories, each contributing unique performance characteristics and adoption dynamics. Type-based segmentation highlights the diversification of ACP products into fire-resistant, PE-based, PVDF-coated, and oxide-finished variants, each serving specific structural and aesthetic requirements. Application segmentation spans building façades, interior design, signage, and transportation, reflecting the broad integration of ACPs across infrastructural and industrial environments. End-user insights reveal strong participation from construction, transportation, corporate, and institutional sectors, driven by increasing demand for durable, lightweight, and design-flexible materials. Measurable growth across multiple segments is supported by rising aesthetic expectations, regulatory compliance needs, and advancements in lamination, coating, and fabrication technologies. Collectively, these segmentation layers create a market ecosystem shaped by performance innovation, sustainability initiatives, and evolving global construction patterns.

The Aluminum Composite Panels Market encompasses a range of types, including fire-resistant ACPs, PE-based panels, PVDF-coated panels, brushed and anodized panels, and oxide-finished variants. Fire-resistant ACPs currently account for approximately 46% of total adoption, driven by heightened safety standards and increasing deployment across mid-rise and high-rise structures. PE-based ACPs follow with around 28% adoption, supported by their lightweight composition and cost efficiency for interior applications. PVDF-coated panels are the fastest-growing type, exhibiting a CAGR of 6.2%, propelled by demand for long-term UV stability, high weather resistance, and architectural-grade surface durability. Brushed, anodized, and oxide-finished panels maintain niche relevance across premium façade and interior décor applications, collectively accounting for approximately 26% of the segment.

Applications within the Aluminum Composite Panels Market span building façades, interior partitioning, signage, transportation exteriors, and industrial cladding. Building façades dominate the application landscape with approximately 49% adoption, driven by rising demand for energy-efficient and aesthetically advanced façade systems. Interior applications hold around 23% adoption, while signage and display solutions account for 18%, particularly in retail and outdoor environments requiring durable and customizable surfaces. Transportation applications represent the fastest-growing segment with a CAGR of 5.8%, supported by the need for lightweight cladding materials that enhance aerodynamics and reduce vehicle mass. Industrial applications, including clean rooms and controlled environments, hold the remaining 10% combined share, reflecting stable but niche deployment. Consumer adoption trends also reinforce market penetration: in 2024, nearly 35% of enterprises globally reported integrating ACP-based modular partitions to support flexible workspace designs, while over 40% of consumers indicated a preference for signage constructed with corrosion-resistant ACPs due to their longevity in outdoor environments.

End-user adoption of Aluminum Composite Panels spans construction firms, transportation manufacturers, corporate infrastructure developers, institutional buyers, and industrial facility operators. The construction sector leads with approximately 52% adoption, driven by the continuous expansion of commercial, hospitality, and residential projects requiring weather-resistant and aesthetically versatile cladding materials. Corporate and institutional end-users follow at 26% adoption, reflecting rising demand for low-maintenance ACP installations across offices, airports, universities, and healthcare buildings. Transportation manufacturers represent the fastest-growing end-user segment with a CAGR of 5.9%, accelerated by rising integration of lightweight ACP exteriors in buses, rail systems, and specialty vehicles. Industrial and warehouse users hold the remaining 22% share collectively, utilizing ACPs for controlled environments, wall protection, and durable partitioning systems. Supporting adoption trends highlight that 37% of enterprises in 2024 reported utilizing ACP-based architectural systems to enhance sustainability goals, while nearly 48% of new commercial buildings in fast-growing economies incorporated ACP façades for improved design flexibility and climate resilience.

Asia-Pacific accounted for the largest market share at 48% in 2024; however, the Middle East & Africa is expected to register the fastest growth, expanding at a CAGR of 6.9% between 2025 and 2032.

The Asia-Pacific region benefits from large-scale construction, aggressive urban infrastructure growth, and strong manufacturing capacities, especially in China, India, and Japan. North America held an estimated 22% share, driven by high-quality architectural cladding demand, while Europe captured 19%, supported by strict façade safety standards. South America accounted for nearly 7% of the market due to moderate construction expansion. The Middle East & Africa represented around 4% but is experiencing rapid adoption fueled by mega projects, free-trade reforms, and foreign investment inflows that accelerate ACP penetration across commercial and industrial structures.

North America held 22% of the global aluminum composite panels market in 2024, driven largely by advanced construction standards and rapid adoption in the commercial real-estate sector. The U.S. remains the primary contributor due to high penetration across retail, transportation facilities, and healthcare institutions. The region's demand is shaped by stringent fire-safety regulations and architectural modernization incentives across states. Technological advancements such as digital surface texturing, nano-coating, and impact-resistant ACP sheets are accelerating adoption. Local players like Alucoil North America continue to expand production capacity with energy-efficient laminating lines. Consumer behavior in the region favors premium, durable, and compliance-certified materials, with higher enterprise adoption in industries such as healthcare, government buildings, and financial institutions where long-life façades and sustainability certifications (LEED, ENERGY STAR) are prioritized.

Europe contributed approximately 19% of the aluminum composite panels market in 2024, supported by major markets such as Germany, the UK, France, and Italy. Regional demand is strongly influenced by the EU’s Green Deal, circular-economy directives, and country-level restrictions on non-fire-rated cladding. Regulatory bodies emphasize low-emission materials, driving adoption of FR- and A2-rated ACP sheets. Innovation in lightweight façade engineering, digital printing, and recyclable aluminum technologies has boosted architectural applications across retail and institutional buildings. Local manufacturers such as Aluverbund Germany have increased their portfolio of sustainable, low-toxicity ACP systems. Consumer behavior in Europe is shaped by high regulatory pressure, leading to strong demand for explainable, verifiable, and fully compliant building materials, fostering region-specific certifications and traceable supply chains.

Asia-Pacific represented the largest volume consumption globally, accounting for 48% of total installations in 2024 due to strong demand from China, India, Japan, and South Korea. Massive infrastructure expansion—including transit corridors, airports, commercial towers, and smart cities—continues to elevate ACP usage. China remains the global production hub with high-volume exports, while India shows strong demand across residential and commercial projects. Innovation hubs in Shenzhen, Tokyo, and Bengaluru are advancing flame-resistant cores, digital-print ACP coatings, and eco-friendly laminate formulations. Companies such as Zhongli Group (China) continue to expand high-speed lamination facilities. The region also demonstrates strong consumer behavior trends: fast installation, cost-efficiency, and e-commerce-driven procurement, with preferences shaped by mobile-based vendor discovery and rapid contractor onboarding.

South America accounted for approximately 7% of the global market in 2024, with Brazil and Argentina representing the highest consumption. Regional market growth is shaped by consistent demand from the commercial real-estate sector, logistics centers, and energy-related infrastructure. Countries such as Brazil have implemented updated façade safety guidelines, pushing demand for FR-rated ACP materials. Government incentives in industrial zones and tax benefits for construction modernization also support market penetration. Local distributors in Brazil and Chile continue to expand product availability through regional import partnerships. Consumer behavior in this region is influenced by media engagement, language localization, and preference for visually appealing building exteriors, especially in retail, transport, and hospitality infrastructure.

The Middle East & Africa held around 4% of the market in 2024 but is the fastest-growing region due to massive construction projects in the UAE, Saudi Arabia, and Qatar, along with industrial modernization in South Africa and Egypt. ACP demand is driven by high-rise buildings, tourism infrastructure, and large-scale commercial hubs. Technological modernization—including heat-reflective coatings, enhanced wind-load resistance, and sand-proof surfaces—is increasingly adopted due to harsh climatic conditions. Regional regulations promoting fire-safe cladding and partnerships with international façade engineering firms further support growth. Local players in the GCC are expanding fabrication units to reduce import dependency. Consumer behavior is shaped by demand for premium, durable, and aesthetically dominant designs, especially across hospitality, luxury retail, and government infrastructure segments.

China – 32% Market Share: Dominates due to the world’s largest ACP production capacity and extensive use in high-volume commercial and residential construction.

India – 14% Market Share: Leads on the back of rapid urban development, strong infrastructure investment, and increasing adoption of façade modernization solutions across Tier 1 and Tier 2 cities.

The Aluminum Composite Panels (ACP) Market features a moderately consolidated yet highly competitive landscape, with an estimated 25–35 active manufacturers globally. Despite the presence of numerous regional suppliers, the top five companies collectively account for approximately 45–50% of total global supply, reflecting a market structure where leadership is concentrated but competition remains intense. Companies continue to strengthen their positioning through strategic initiatives including capacity expansions, new fire-resistant panel launches, mergers, and production modernization.

In 2024, several manufacturers introduced advanced mineral-core and fire-rated ACPs to comply with stricter global building safety regulations. Many facilities adopted automated lamination lines and digital fabrication systems, reducing production lead time and enhancing precision, enabling delivery cycles to drop from nearly two weeks to under seven days for large-scale orders. Sustainability-driven innovations such as recyclable aluminum skins and eco-friendly cores are also gaining attention, shaping competitive differentiation.

Regional players contribute significantly by offering cost-competitive solutions tailored to local compliance requirements. Meanwhile, global firms compete based on certifications, product reliability, sophisticated coatings such as PVDF, and well-established supply networks. Increasing demand for premium façade systems, weather-resistant coatings, and durable architectural finishes further intensifies competition, making innovation, compliance readiness, and digital fabrication capabilities critical for maintaining market advantage.

Alstrong Enterprises India Pvt. Ltd.

Alubond U.S.A.

Yaret Industrial Group Co., Ltd.

Shanghai Huayuan New Composite Materials Co., Ltd.

Jyi Shyang Industrial Co., Ltd.

Technological advancements in the Aluminum Composite Panels Market are rapidly transforming product capabilities, manufacturing efficiency, and compliance standards. One of the most significant transitions is the shift from conventional polyethylene (PE) cores to fire-resistant or mineral-core technologies, driven by heightened global fire-safety regulations. This transition has expanded ACP usage in high-rise buildings, transportation hubs, and commercial complexes.

Surface-coating technology has also evolved, with PVDF-coated ACPs becoming the industry benchmark due to superior UV stability, long-term color retention, and weather resistance—often delivering over 25 years of stable performance. Manufacturers are increasingly adopting eco-friendly coatings, anti-pollution finishes, and antimicrobial layers to meet evolving architectural and environmental requirements.

Digital fabrication technologies are another major development area. More than 150 global ACP production lines now utilize automated CNC routing, laser cutting, 3-axis bending, and advanced lamination systems. These upgrades have reduced production time significantly, improved dimensional accuracy, and enabled complex façade designs previously difficult to execute.

Additionally, next-generation ACPs include functional panels with self-cleaning surfaces, moisture-resistant layers, enhanced thermal insulation, and even embedded sensors for building-performance monitoring. Lightweight composite innovations for transportation exteriors—such as buses, metro coaches, and cargo vehicles—are expanding ACP usage beyond traditional construction.

Overall, technology is pushing ACP evolution toward safer, more durable, and more sustainable solutions while enabling mass customization, better lifecycle performance, and competitive differentiation in an increasingly regulated global market.

March 19, 2024 — 3A Composites (ALUCOBOND®) launched “MONARC” interior composite wall panels, a new product family aimed at interior applications that emphasizes design variety and durable finishes for commercial interiors; the launch announcement was published on the company’s regional press page. Source: www.alucobondusa.com

February 23, 2024 — 3A Composites issued a press release for ALUCOBOND® A2, highlighting its non-combustible A2-s1,d0 classification and positioning the product for renovation and new-build projects requiring higher fire-safety performance in façades. Source: www.alucobond.com

August 26, 2024 — Arconic published its 2023 Sustainability Report, reaffirming company commitments to product safety, responsible sourcing, and lower-carbon aluminum initiatives; the publication and related corporate statements were posted on Arconic’s press pages in 2024. Source: www.arconic.com

2023 — Alubond released an A2 (stone-core / magnesium-hydroxide) product brochure, documenting the fire-retardant stone-core construction (magnesium hydroxide based) and technical performance positioning for higher-safety cladding applications. Source: www.alucobond.com

The Aluminum Composite Panels Market Report delivers a comprehensive analysis of the global ACP industry, covering key segments, geographic distribution, applications, technological advancements, and competitive dynamics. It evaluates all major ACP types, including PE-core panels, fire-rated and mineral-core variants, PVDF-coated panels, textured finishes, and emerging functional composites such as thermal-insulating and sensor-based ACPs. Additional coverage includes printed ACPs, mirror finishes, and recycled-content panels aligned with green-building practices.

The report spans a wide geographic scope, analyzing trends and demand across Asia-Pacific, North America, Europe, Middle East & Africa, and South America. It includes insights into installation volumes, infrastructure investment patterns, regulatory frameworks, and construction-industry growth across each region.

A detailed examination of applications—including building façades, interior cladding, signage, transportation exteriors, and commercial infrastructure—highlights evolving functional requirements such as fire performance, durability, architectural aesthetics, and long-term maintenance efficiency. Technology coverage encompasses innovations in ACP core materials, surface coatings, digital fabrication, automated production systems, environmental performance improvements, and the rise of sustainable composite materials.

The competitive landscape section outlines market structure, major manufacturers, product differentiation strategies, and innovation priorities. Additionally, the report addresses niche segments, such as smart façade systems, energy-efficient ACP designs, and lightweight transportation composites. Overall, the scope provides a holistic and well-structured view for decision-makers, enabling strategic insights across product development, sourcing, capacity planning, compliance, and market-entry strategies.

| Report Attribute / Metric | Details |

|---|---|

| Market Revenue (2024) | USD 660.0 Million |

| Market Revenue (2032) | USD 953.1 Million |

| CAGR (2025–2032) | 4.7% |

| Base Year | 2024 |

| Forecast Period | 2025–2032 |

| Historic Period | 2020–2023 |

| Segments Covered |

By Type

By Application

By End-User Insights

|

| Key Report Deliverables | Revenue Forecast, Market Trends, Growth Drivers & Restraints, Technology Insights, Segmentation Analysis, Regional Insights, Competitive Landscape, Recent Developments, Regulatory & ESG Overview |

| Regions Covered | North America, Europe, Asia-Pacific, South America, Middle East & Africa |

| Key Players Analyzed | 3A Composites GmbH, Arconic Corporation, Mitsubishi Chemical Corporation, Alstrong Enterprises India Pvt. Ltd., Alubond U.S.A., Yaret Industrial Group Co., Ltd., Shanghai Huayuan New Composite Materials Co., Ltd., Jyi Shyang Industrial Co., Ltd. |

| Customization & Pricing | Available on Request (10% Customization Free) |