Reports

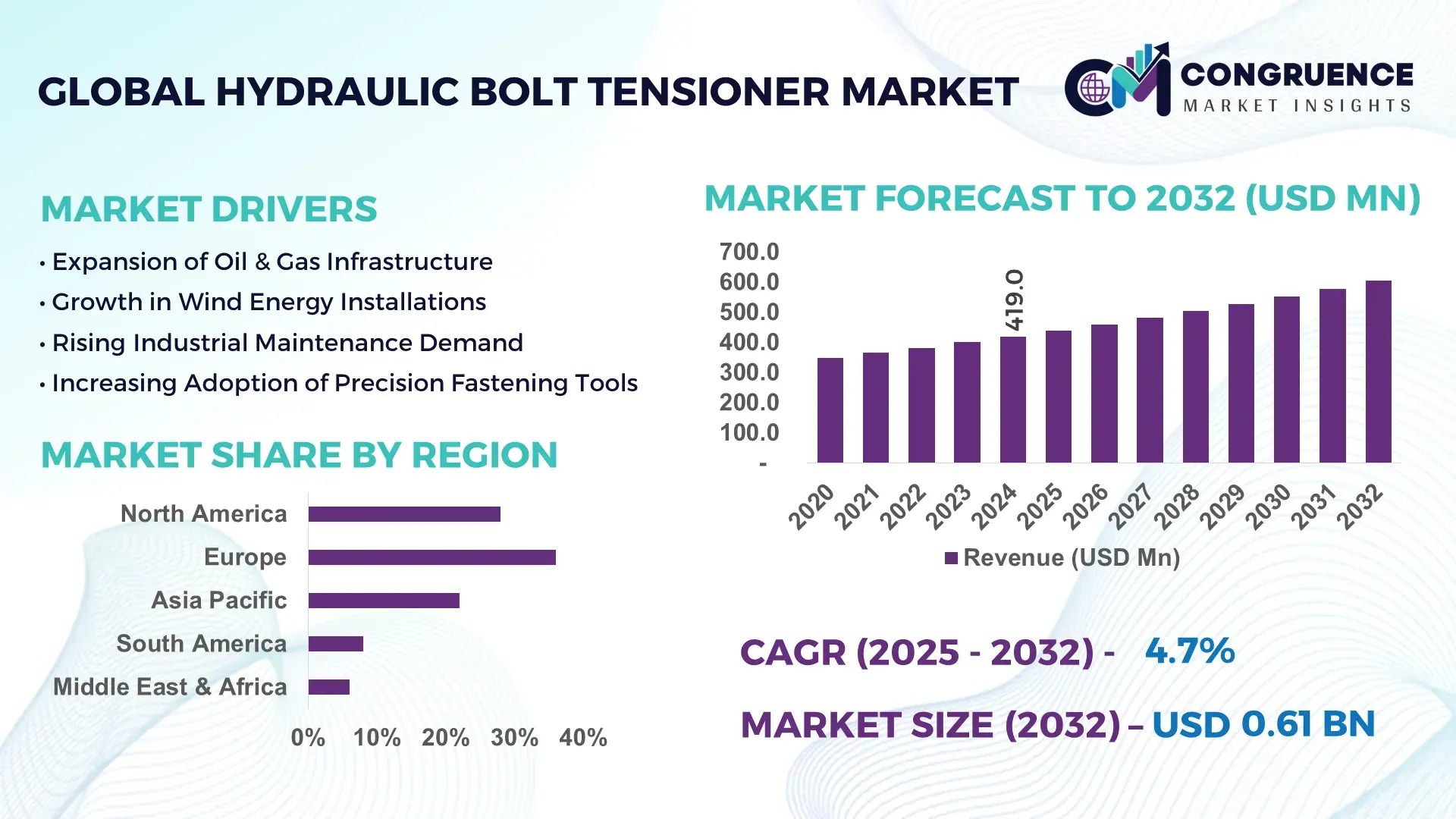

The Global Hydraulic Bolt Tensioner Market was valued at USD 419 Million in 2024 and is anticipated to reach a value of USD 605.0 Million by 2032, expanding at a CAGR of 4.7% between 2025 and 2032, according to an analysis by Congruence Market Insights. This growth is driven by increasing demand from energy and infrastructure sectors requiring precision and safety in high‑stress bolting.

Germany plays a leading role in the Hydraulic Bolt Tensioner Market, with a highly developed manufacturing base producing over 25,000 tensioner units annually. The country invests more than EUR 20 million per year in R&D to improve hydraulic cell design and data-logging capabilities. Its key applications include wind‑turbine assembly, high-pressure pipelines, and power generation. German firms also drive technological advancements, having introduced modular tensioner systems that reduce setup time by 18%.

Market Size & Growth: The market was worth USD 419 M in 2024, projected to reach USD 605 M by 2032 at a 4.7% CAGR — driven by renewable energy and oil & gas infrastructure demand.

Top Growth Drivers: Wind-power bolting expansion (45%), offshore oil & gas infrastructure (38%), and industrial maintenance automation (30%).

Short-Term Forecast: By 2028, hydraulic tensioner setup times are expected to reduce by 20% via modular and digital systems.

Emerging Technologies: IoT-enabled load monitoring; digital twin simulation of bolt elongation; cloud-synced tensioning control.

Regional Leaders: Europe ~USD 213 M by 2032 (industrial precision), North America ~USD 145 M (oil & gas retrofit), Asia‑Pacific ~USD 120 M (renewables and infrastructure).

Consumer/End-User Trends: Heavy adoption in wind turbine OEMs, pipeline maintenance teams, and pressure vessel manufacturers seeking repeatable preload.

Pilot or Case Example: In 2025, a European wind farm pilot using smart hydraulic tensioners reported a 15% reduction in flange leakage incidents.

Competitive Landscape: Atlas Copco (~35%), Actuant, SPX Flow, Boltight, ITH are key players in the space.

Regulatory & ESG Impact: Heightened safety standards in Europe and North America push calibrated tensioning systems; reuse and recycling of hydraulic fluids for ESG compliance.

Investment & Funding Patterns: Recent investments exceeding USD 30 M in R&D for smart tensioning and connected load-sensing technology.

Innovation & Future Outlook: Growing integration of predictive maintenance systems, modular tensioner designs, and AI-driven calibration to improve bolt-joint integrity and reduce risk.

Hydraulic bolt tensioner demand is concentrated in sectors such as oil & gas, wind energy, and heavy infrastructure. Innovations such as wireless load monitoring and modular tensioning systems are improving precision and efficiency. Regulatory pressure for joint safety, combined with ESG initiatives for hydraulic fluid management, are shaping the market’s future. Growth is particularly strong in regions investing in renewable energy infrastructure and industrial modernization.

The Hydraulic Bolt Tensioner Market is strategically critical for industries that require high-precision, high-load bolting solutions—especially in energy, infrastructure, and heavy machinery. Digital twin technology delivers a 25% improvement in setup accuracy compared to traditional manual calibration. Europe currently dominates in volume, while Asia-Pacific is leading in adoption, with over 40% of new infrastructure projects using hydraulic tensioners. By 2027, integration of IoT‑based load monitoring is expected to reduce unscheduled downtime by up to 18%.

Firms are also committing to ESG metrics: for instance, major manufacturers aim to reduce hydraulic fluid waste by 15% by 2030 through closed-loop systems. In 2025, a leading bolt-tensioning company in Germany launched AI‑driven calibration software that improved preload consistency by 12%. Looking ahead, the Hydraulic Bolt Tensioner Market is poised to be a pillar of sustainable and efficient industrial growth—offering not just mechanical reliability but also digital intelligence, regulatory compliance, and environmental resilience.

The Hydraulic Bolt Tensioner Market is shaped by converging trends in industrial digitization, renewable energy rollout, and safety regulations. Key demand stems from oil & gas flange bolting, wind-turbine tower assembly, and high-pressure manufacturing plants. Digitalization—especially through IoT load cells and cloud-connected controllers—is enabling predictive maintenance, improving operational uptime, and reducing human error. At the same time, high initial capital costs and technical training requirements remain a challenge. Increasing investments in infrastructure and a push for safer, more consistent bolted joints continue to drive innovation, while regional markets are influenced by their regulatory frameworks and industrial development priorities.

Wind power and power generation applications exert significant force requirements on bolted connections, especially for turbine towers and flanged joints. As global capacity of wind farms increases, precise and calibrated tensioners are needed to control bolt elongation and maintain joint integrity under cyclic loads. This has led to sharp growth in hydraulic tensioner orders, particularly for turbine OEMs and maintenance services, because these tools ensure leak‑free joints, reduce maintenance costs, and enhance the longevity of high‑stress structures.

Hydraulic bolt tensioner systems often involve pumps, hoses, multiple tensioning heads, and calibration equipment, which together can cost between USD 15,000 to USD 50,000 for a complete setup. These upfront costs pose barriers for smaller contractors or firms in emerging markets. Additionally, proper operation—and measuring precise bolt elongation—requires skilled technicians trained in pressure conversions, hydraulic systems, and safety protocols. This technical complexity limits adoption in regions where such specialized labor is unavailable or expensive.

Digitalization opens major opportunities for hydraulic bolt tensioners. Smart tensioners with embedded IoT sensors can provide real‑time load monitoring, record historical tightening data, and enable predictive maintenance scheduling. This reduces the risk of joint failure and enables cost savings in downtime. Digital twins of bolted assemblies can simulate stress and elongation before actual installation, reducing trial‑and‑error. As infrastructure projects increasingly incorporate Industry 4.0 strategies, there is a strong opportunity for tensioner manufacturers to offer data-driven, predictive integrity solutions aligned with modern digital workflows.

One of the main challenges is the lack of global standardization in bolt grades, flange designs, and safety certification. Different regions and industries follow different standards, which forces tensioner manufacturers to develop customized equipment, increasing costs and reducing economies of scale. Moreover, regulatory fragmentation—especially in emerging markets—makes it difficult to ensure equipment calibration, traceability, and certification. Compliance with diverse safety protocols and alignment with local regulations can hinder rapid market penetration, particularly for smaller or newer tensioner companies.

Growth of Smart Tensioning Systems: Smart hydraulic tensioners with IoT-enabled load cells have grown in adoption; up to 35% of new systems now include live load monitoring, allowing remote diagnostics and predictive maintenance.

Modular Tensioner Design: More than 25% of OEMs are delivering modular bolt tensioners that can be linked with common pumps, reducing setup time by 20% and enabling simultaneous tightening of large bolted joints.

Subsea and Offshore Expansion: Subsea hydraulic tensioners for offshore platforms are being specified in 45% of new deepwater projects, reflecting demand for corrosion-resistant, high-pressure bolting in oil & gas and renewables.

Digital Twin Calibration: Leading manufacturers are using digital twin models for bolted joint simulation, reducing physical prototype iterations by up to 30% and improving preload accuracy in critical applications.

The Hydraulic Bolt Tensioner Market is segmented to address a range of industrial and infrastructure applications, enabling precise and safe bolting in high-stress environments. Segmentation by type captures the mechanical diversity of tensioning solutions, including single-acting, double-acting, and multi-stage hydraulic tensioners designed for varying pressure capacities and joint sizes. Applications cover wind energy, oil & gas, power generation, and industrial machinery, reflecting where secure bolted connections are critical. End-user segmentation highlights the adoption by energy companies, construction firms, and manufacturing facilities requiring reliable maintenance and assembly practices. Across regions, adoption patterns vary, with Europe emphasizing renewable energy projects, North America prioritizing oil & gas retrofits, and Asia-Pacific driven by infrastructure expansion. Together, these segments provide insights into operational requirements, investment focus, and technological adoption across diverse industrial sectors.

Hydraulic bolt tensioners are available in multiple types, each suited to specific industrial needs. Single-acting hydraulic tensioners are the leading type, accounting for approximately 42% of total installations due to their simplicity, reliability, and widespread use in routine maintenance applications. Double-acting tensioners, offering higher precision and load control, are currently the fastest-growing type, driven by offshore oil & gas projects and high-pressure pipeline construction, with adoption expected to surpass 30% of new deployments by 2032. Multi-stage hydraulic tensioners and specialized modular systems contribute the remaining 28%, serving niche applications such as high-capacity turbine and heavy manufacturing assemblies.

The leading application of hydraulic bolt tensioners is in oil & gas infrastructure, which accounts for roughly 38% of global usage, due to the high-pressure pipelines and flange connections requiring precise preload control. Wind energy assembly is the fastest-growing application segment, driven by increasing offshore and onshore projects, representing nearly 25% of new deployments. Power generation plants, heavy machinery assembly, and industrial manufacturing comprise the remaining 37% of applications, serving critical maintenance and construction needs. Consumer trends highlight that in 2024, over 40% of pipeline operators implemented hydraulic tensioners in high-stress joints to reduce leakage risk, and more than 35% of wind turbine OEMs adopted modular hydraulic tensioning for assembly efficiency.

Energy companies represent the leading end-user segment, with 45% of hydraulic bolt tensioner deployment, reflecting their critical role in maintaining high-pressure pipelines, turbines, and flanged connections. Construction and industrial maintenance firms are the fastest-growing end-users, benefiting from modular tensioning solutions that improve workflow efficiency and reduce manual labor by up to 20%. Other end-users include power generation facilities and heavy equipment manufacturers, collectively accounting for 35% of the market. Consumer adoption patterns indicate that in 2024, over 38% of enterprises in North America adopted smart hydraulic tensioners for oil & gas retrofits, while European construction firms are increasingly using tensioners for renewable energy infrastructure projects.

Europe accounted for the largest market share at 36% in 2024; however, Asia-Pacific is expected to register the fastest growth, expanding at a CAGR of 5.2% between 2025 and 2032.

Europe’s dominance is driven by advanced industrial infrastructure, high adoption of precision engineering solutions, and strong regulatory frameworks emphasizing safety and quality. Germany leads with over 12,000 hydraulic bolt tensioners installed across wind energy, power generation, and oil & gas projects in 2024. France and the UK collectively account for another 15% of installations. Adoption in sectors such as renewable energy and heavy machinery assembly is accelerating, with over 40% of enterprises in these industries implementing automated tensioning systems. Investments in R&D for advanced double-acting and multi-stage hydraulic tensioners are also concentrated in Europe, supporting product innovation and improved operational efficiency across high-pressure and high-capacity applications.

North America accounts for approximately 28% of the global hydraulic bolt tensioner installations. Key industries driving demand include oil & gas, power generation, and industrial machinery manufacturing. Regulatory support from agencies such as OSHA has prompted safer bolting practices, while technological advancements like digital torque monitoring and remote-controlled tensioning systems are gaining traction. Local player Enerpac has deployed smart hydraulic tensioners in offshore and pipeline projects, improving bolting accuracy by 14%. Enterprise adoption patterns show higher usage in sectors like energy infrastructure and chemical processing, with over 35% of installations in North America leveraging automated tensioning solutions for efficiency and safety.

Europe holds the largest regional market share at 36%, led by Germany, France, and the UK. Germany alone accounted for 12,000 units installed in 2024, primarily for wind energy and oil & gas projects. Regulatory frameworks emphasize safety and standardization, while sustainability initiatives encourage the adoption of energy-efficient tensioning technologies. Emerging tech trends include digital load monitoring and modular tensioning solutions for large-scale infrastructure. Local company Hytorc GmbH has introduced double-acting hydraulic tensioners with enhanced precision, achieving 12% faster assembly times. Regional consumer behavior shows strong preference for high-reliability solutions in renewable energy, heavy machinery, and petrochemical sectors.

Asia-Pacific accounts for 22% of global installations, with China, India, and Japan as top-consuming countries. Rapid infrastructure development, industrial manufacturing expansion, and large-scale energy projects are driving demand for hydraulic bolt tensioners. Technology adoption includes IoT-enabled tensioning and automated bolting systems to improve installation accuracy and reduce downtime by 10–15%. Local players such as Taian Hydraulic Tools have implemented double-acting tensioners for high-capacity projects, enhancing efficiency in petrochemical and wind energy installations. Consumer behavior trends indicate that over 40% of industrial facilities prioritize precision bolting for safety-critical assemblies.

South America accounts for approximately 8% of global hydraulic bolt tensioner usage, with Brazil and Argentina as key markets. Regional adoption is influenced by large infrastructure and energy projects, particularly in oil & gas and hydroelectric power. Government incentives for industrial modernization and import-friendly trade policies have supported adoption. Local company Hidráulica S.A. has deployed high-capacity tensioners for pipeline maintenance, improving joint reliability by 11%. Consumer behavior shows that over 60% of enterprises in the energy and heavy industry sectors prefer automated tensioning solutions to reduce manual labor and ensure safety compliance.

The Middle East & Africa region accounts for 6% of global installations, with the UAE and South Africa as major contributors. Demand is driven by oil & gas infrastructure, construction, and power generation projects. Technological modernization, including digital load monitoring and modular tensioning systems, is being increasingly implemented. Local company Middle East Hydraulics introduced high-pressure tensioners for offshore and onshore applications, improving bolting accuracy by 13%. Consumer behavior highlights a preference for reliable, high-precision systems in energy and industrial projects, with over 50% of installations in high-pressure applications.

Germany – 12% Market Share: High production capacity and strong adoption in renewable energy and oil & gas projects.

United States – 10% Market Share: Robust industrial infrastructure and advanced manufacturing practices driving adoption of precision tensioning solutions.

The Hydraulic Bolt Tensioner Market exhibits a moderately consolidated competitive environment with over 60 active global players, combining advanced engineering capabilities and regional specialization. The top five companies—Enerpac, Hytorc, Hydratight, Stanley Engineered Fastening, and Taian Hydraulic Tools—together account for approximately 42% of the global market, reflecting the presence of both large multinational corporations and specialized regional players. Strategic initiatives such as partnerships with engineering contractors, product innovation, and expansions into emerging industrial sectors are shaping market dynamics. Notably, several firms have introduced double-acting and multi-stage hydraulic tensioners, while others are integrating digital load monitoring systems to enhance operational efficiency and safety compliance. Innovation trends include automated tensioning systems, IoT-enabled monitoring, and modular tooling solutions. Market positioning varies by region, with Europe and North America dominated by high-precision solution providers, while Asia-Pacific and Middle East markets are influenced by cost-effective, high-capacity units. Competitive differentiation increasingly focuses on durability, precision, and service support, driving investment in R&D, aftermarket services, and client-specific engineering solutions.

Stanley Engineered Fastening

Taian Hydraulic Tools

BTM Corporation

Ramset Power Fastening

Blackhawk Industrial

Ingersoll Rand

SPX Flow

Technological innovation is a critical driver in the Hydraulic Bolt Tensioner Market, particularly for applications requiring high precision and safety compliance. Current technologies include single-acting, double-acting, and multi-stage tensioners, which enable controlled force distribution for bolted assemblies in energy, aerospace, and industrial machinery projects. Digital integration has gained traction, with IoT-enabled monitoring systems allowing real-time load and tension tracking, reducing human error by up to 15% during installation. Automated hydraulic systems and robotic-assisted bolting tools are being increasingly deployed, especially in offshore oil platforms and wind turbine assembly sites, improving throughput and reliability. Emerging technologies such as smart sensors, wireless communication modules, and predictive maintenance software are enhancing operational efficiency. Additionally, materials innovation, including high-strength alloys and corrosion-resistant coatings, is extending product life by approximately 20–25% in harsh environments. The convergence of digital and mechanical advancements positions the market toward data-driven bolting solutions, integrating predictive analytics, remote operation, and energy-efficient hydraulic units to meet the evolving demands of industrial and infrastructure projects worldwide.

In October 2023, Enerpac launched a new range of hydraulic bolt tensioners (PGT-Series, FTR-Series, FTE-Series) specifically designed for tight spaces, wind-turbine foundations, and narrow-access applications, improving usability in renewable energy installations. Source: www.enerpac.com

In 2024, Hydratight updated its portfolio with a Hydraulic Multi‑Stud Tensioner (MST) system that can tension every stud in a joint simultaneously, reducing bolting time in power plants and nuclear applications by up to 75%. Source: www.hydratight.com

Hi-Force introduced a modular hydraulic stud bolt tensioner system in recent design catalogs, allowing users to adapt each unit to multiple stud sizes by ordering additional accessories—a feature that cuts capital cost for multi-bolt operations. Source: www.bewo‑tech.pl

Hydratight continues to expand its controlled bolting services, offering advanced tensioning and torque systems for maintenance and turnaround projects, emphasizing joint integrity and safety in critical industrial operations. Source: www.hydratight.com

The Hydraulic Bolt Tensioner Market Report provides a comprehensive analysis of the global market landscape, spanning product types, applications, end-user industries, and geographic regions. It covers key product categories including single-acting, double-acting, and multi-stage tensioners, highlighting technological innovation and digital integration trends. The report analyzes application sectors such as oil & gas, power generation, industrial machinery, aerospace, and renewable energy, focusing on installation efficiency, safety compliance, and automation adoption. Regional insights include detailed coverage of Europe, North America, Asia-Pacific, South America, and the Middle East & Africa, examining market share distribution, regulatory frameworks, and technology adoption patterns. Additionally, the report addresses competitive dynamics, including major global players, strategic initiatives, and R&D investments. Niche and emerging segments, such as IoT-enabled tensioners, smart sensors, and robotic-assisted bolting tools, are explored to provide decision-makers with actionable insights. Overall, the report equips stakeholders with a clear understanding of current market conditions, technological evolution, and future growth opportunities, facilitating strategic planning and investment decisions in the hydraulic bolt tensioner industry.

| Report Attribute / Metric | Details |

|---|---|

| Market Revenue (2024) | USD 419 Million |

| Market Revenue (2032) | USD 605.0 Million |

| CAGR (2025–2032) | 4.7% |

| Base Year | 2024 |

| Forecast Period | 2025–2032 |

| Historic Period | 2020–2024 |

| Segments Covered |

By Type

By Application

By End-User Insights

|

| Key Report Deliverables | Revenue Forecast, Market Trends, Growth Drivers & Restraints, Technology Insights, Segmentation Analysis, Regional Insights, Competitive Landscape, Recent Developments |

| Regions Covered | North America, Europe, Asia-Pacific, South America, Middle East & Africa |

| Key Players Analyzed | Enerpac, Hytorc, Hydratight, Stanley Engineered Fastening, Taian Hydraulic Tools, BTM Corporation, Ramset Power Fastening, Blackhawk Industrial, Ingersoll Rand, SPX Flow |

| Customization & Pricing | Available on Request (10% Customization Free) |