Reports

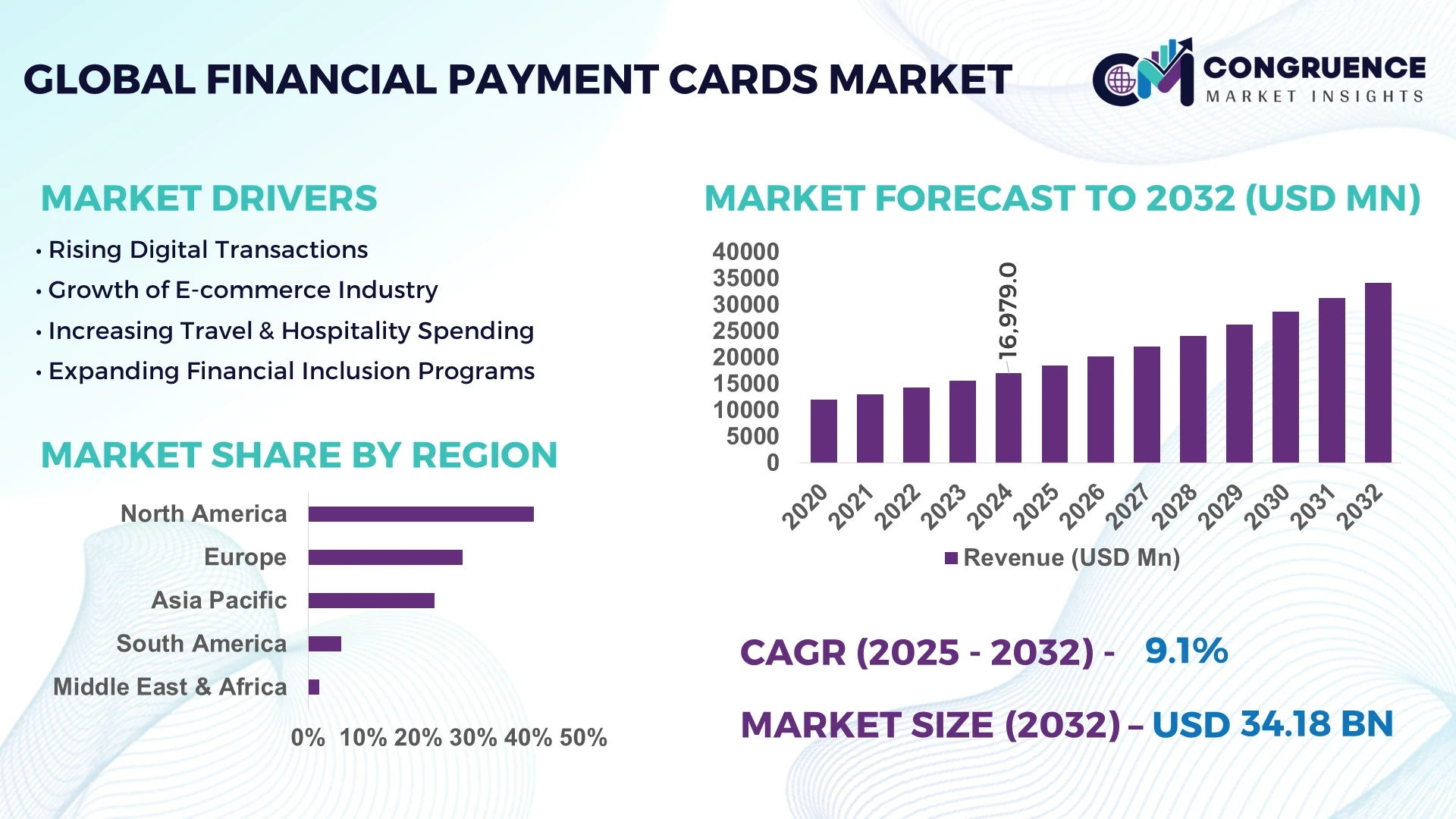

The Global Financial Payment Cards Market was valued at USD 16,979.0 Million in 2024 and is anticipated to reach a value of USD 34,180.9 Million by 2032 expanding at a CAGR of 9.14% between 2025 and 2032.

The United States dominates the Financial Payment Cards Market, with extensive infrastructure supporting card issuance, processing, and digital transaction networks. The country maintains robust investment levels in financial technology and secure transaction systems, supporting both domestic and cross-border payments. Advanced technological initiatives, including contactless payment adoption and integration of AI for fraud detection, enhance operational efficiency. Major applications span retail, e-commerce, and banking sectors, leveraging high production capacity for debit, credit, and prepaid card issuance. The U.S. continues to pioneer innovations in mobile wallets, tokenization, and real-time transaction monitoring.

Globally, the Financial Payment Cards Market is experiencing transformative growth driven by the proliferation of digital payments, expanding e-commerce platforms, and rising consumer preference for secure, convenient transaction solutions. Key industry sectors include banking, retail, hospitality, and travel, which are increasingly adopting contactless and mobile-enabled cards. Technological innovations such as EMV chip cards, AI-based fraud detection, and blockchain-based transaction verification are reshaping the market. Regulatory and economic factors, including strict data security standards and rising digital banking adoption, influence operational frameworks. Regional consumption patterns highlight the U.S., Europe, and Asia-Pacific as critical growth zones, while emerging trends in biometric authentication, virtual cards, and cross-border digital payments define the market’s future outlook.

Artificial intelligence is increasingly reshaping the Financial Payment Cards Market by enhancing efficiency, security, and operational performance. AI-driven fraud detection systems analyze millions of transactions in real time, identifying anomalies and reducing the incidence of unauthorized transactions by measurable percentages. Machine learning algorithms improve credit scoring, optimizing card issuance decisions while minimizing default risk. In the operational domain, AI-powered chatbots and virtual assistants streamline customer service, resolving queries instantly and improving user satisfaction. Payment processing networks leverage AI for transaction routing, reducing latency and operational errors.

In retail and e-commerce sectors, AI enables dynamic risk assessment and personalized reward programs, aligning offers with individual consumer behavior. Predictive analytics using AI tools helps financial institutions anticipate demand for various card types, ensuring optimal inventory management and operational planning. Additionally, AI integration in mobile wallet platforms strengthens authentication protocols through facial recognition and behavioral biometrics, increasing transaction security. Across the Financial Payment Cards Market, AI adoption is accelerating innovation cycles, operational reliability, and customer engagement while enabling stakeholders to maintain compliance with evolving regulations efficiently. By combining real-time analytics, predictive insights, and automated decision-making, AI is solidifying its role as a cornerstone of modern card payment systems.

“In March 2024, Mastercard deployed an AI-based real-time fraud monitoring system across its global transaction network, analyzing over 2 billion transactions monthly and reducing fraudulent activity by 27% within the first quarter of implementation.”

The Financial Payment Cards Market is driven by increasing digital payment adoption, rising e-commerce activity, and growing consumer demand for contactless and mobile-enabled transactions. Global trends indicate rapid technological integration in banking and retail ecosystems, including EMV chip deployment, tokenization, and AI-assisted fraud monitoring. Market participants are focusing on innovation, strategic partnerships, and digital transformation initiatives to enhance efficiency and customer experience. Emerging markets are witnessing a gradual shift from cash-based to card-based transactions, supported by government initiatives promoting financial inclusion. Furthermore, environmental and regulatory pressures are driving the adoption of sustainable card materials, advanced encryption, and compliance with international payment standards, collectively shaping competitive dynamics and growth trajectories.

The adoption of contactless and digital payment solutions is a major growth driver in the Financial Payment Cards Market. Retailers, banks, and e-commerce platforms increasingly rely on NFC-enabled and mobile-integrated cards to enhance transaction speed and convenience. For instance, over 65% of point-of-sale terminals in the United States now support contactless payments, driving card issuance and usage. Financial institutions are investing in advanced payment technologies, including virtual cards and tokenization, to meet consumer expectations. Additionally, increased smartphone penetration and mobile banking adoption encourage the use of digital wallets linked to payment cards, further reinforcing the shift toward cashless transactions. This trend is facilitating operational efficiency, increasing transaction volumes, and supporting the integration of value-added services such as loyalty programs and personalized offers.

Despite technological advancements, security concerns and fraud risks pose challenges for the Financial Payment Cards Market. Cybercrime incidents, including card skimming, phishing attacks, and unauthorized transactions, remain a critical issue. Financial institutions must continuously upgrade encryption protocols, monitor transaction anomalies, and educate consumers on safe usage practices. Regulatory requirements for data protection, such as GDPR in Europe and stringent banking compliance in the U.S., add operational complexity and increase compliance costs. Additionally, emerging markets face challenges in implementing secure card infrastructures due to limited technological adoption and lower consumer awareness. Security concerns may influence customer trust, impacting the adoption of contactless and mobile-enabled payment solutions.

The rapid growth of e-commerce presents significant opportunities for the Financial Payment Cards Market. Online retail platforms are increasingly integrating card payment solutions with digital wallets and buy-now-pay-later services. Cross-border e-commerce also drives demand for multi-currency and virtual card solutions, providing convenient transaction mechanisms for global consumers. Banks and fintech firms are leveraging AI, machine learning, and blockchain to optimize payment processing and reduce operational bottlenecks. Additionally, the development of co-branded and loyalty-linked cards in partnership with merchants and service providers presents new revenue streams. Expanding digital financial services in emerging markets, supported by smartphone adoption and mobile banking penetration, creates additional avenues for growth and innovation.

Financial Payment Cards Market participants face challenges related to regulatory compliance, high operational costs, and technological integration. Compliance with anti-money laundering laws, PCI DSS standards, and data protection regulations necessitates significant investment in secure infrastructure. Card issuers must maintain sophisticated fraud monitoring systems and implement regular audits to avoid penalties. Operational costs associated with card production, distribution, and network maintenance are also substantial, particularly for premium and contactless cards. Furthermore, integrating emerging technologies such as AI, blockchain, and biometric authentication requires skilled workforce and capital investment. These challenges may impact smaller players disproportionately, limiting their ability to scale and compete with established institutions in the global market.

Rise in Contactless Payments: The adoption of NFC-enabled cards and mobile wallet integration has increased transaction speed and reduced checkout times. Over 70% of retail outlets in North America now accept contactless payments, highlighting a measurable shift in consumer behavior.

Virtual and Tokenized Cards: Financial institutions are introducing virtual and tokenized cards to enhance security and support online transactions. In 2024, major banks issued over 150 million virtual cards in North America and Europe, improving operational efficiency and fraud mitigation.

Integration with Loyalty and Rewards Programs: Cards linked with loyalty points, cashback, and personalized offers are driving customer engagement. Approximately 45% of newly issued credit cards in the United States now include integrated reward programs to boost consumer retention.

AI-Powered Fraud Detection: The use of AI in transaction monitoring has significantly reduced fraud incidence. Real-time anomaly detection systems have processed over 2 billion monthly transactions globally, lowering fraudulent activity by 25–30% and reinforcing trust in digital payments.

The Financial Payment Cards Market is structured around key segments including product types, applications, and end-users, reflecting the diverse ways consumers and businesses engage with card-based payment solutions. Types include credit cards, debit cards, prepaid cards, and co-branded or virtual cards, each tailored to specific transaction needs. Applications span retail, e-commerce, banking, travel, and hospitality, where card payments provide convenience, security, and efficiency. End-user segmentation highlights individuals, businesses, and institutional customers, revealing adoption patterns and demand drivers. Understanding these segments allows stakeholders to align offerings, optimize operational strategies, and identify growth opportunities, while also highlighting the technological, regulatory, and economic factors shaping market behavior globally.

The Financial Payment Cards Market comprises several types: credit cards, debit cards, prepaid cards, and virtual or co-branded cards. Credit cards lead the market due to their broad acceptance, flexible credit facilities, and integration with loyalty and reward programs, serving both consumers and businesses. Debit cards are widely used for daily transactions, providing direct access to bank funds and high transactional convenience. Prepaid cards, though smaller in volume, serve niche markets such as travel, gift cards, and employee incentives. Virtual and co-branded cards are the fastest-growing segment, driven by digital transformation, e-commerce adoption, and the need for secure, contactless online transactions. These types are increasingly integrated with mobile wallets, tokenization technology, and AI-based security features, enhancing user convenience and reducing fraud. Collectively, the diversified product portfolio ensures comprehensive coverage across multiple payment scenarios and end-user requirements.

Applications in the Financial Payment Cards Market include retail, e-commerce, banking, travel, and hospitality. Retail is the leading application, driven by widespread card acceptance across point-of-sale terminals and integration with loyalty programs that enhance customer engagement. E-commerce is the fastest-growing application, supported by rising online shopping activity, secure payment gateways, and virtual or tokenized card solutions that enable safe digital transactions. Banking applications involve day-to-day transactions, cash withdrawals, and fund transfers, where card usage remains a core operational tool. Travel and hospitality applications, including ticket booking, hotel check-ins, and transport payments, contribute significantly to card adoption in high-frequency sectors. The growing emphasis on seamless, secure, and rapid transactions across these applications drives technological investments, including mobile wallet integration, AI-based fraud detection, and tokenization systems, shaping the future of the Financial Payment Cards Market.

End-users in the Financial Payment Cards Market are categorized into individual consumers, businesses, and institutional customers. Individual consumers form the leading segment due to daily use for retail, online shopping, and personal banking transactions, supported by convenience, security, and rewards programs. Businesses are the fastest-growing end-user segment, leveraging corporate cards for expense management, payroll distribution, and supplier payments, increasingly adopting virtual and co-branded card solutions. Institutional customers, including educational institutions and government organizations, also contribute to market growth by enabling digital payment systems for services, tuition, and operational expenses. The adoption of mobile banking, AI-driven transaction monitoring, and integration with digital wallets across all end-user groups is expanding card penetration and operational efficiency, ensuring that the market continues to evolve across consumer, corporate, and institutional domains.

North America accounted for the largest market share at 41% in 2024; however, Asia-Pacific is expected to register the fastest growth, expanding at a CAGR of 9.14% between 2025 and 2032.

North America continues to lead the Financial Payment Cards Market due to advanced banking infrastructure, widespread adoption of digital payment methods, and high consumer preference for credit, debit, and prepaid card solutions. The region is characterized by robust technological integration, including AI-based fraud detection and mobile wallet systems. Regulatory frameworks and government support for secure digital payments further strengthen market operations. Meanwhile, other regions such as Europe, Asia-Pacific, South America, and the Middle East & Africa are progressively adopting card-based payment systems, with increasing investment in fintech, digital banking, and contactless payment infrastructure, enhancing global market growth dynamics.

North America accounts for approximately 41% of the global Financial Payment Cards Market, driven by the United States and Canada. Key industries contributing to demand include retail, e-commerce, banking, and travel. Regulatory frameworks such as the Payment Card Industry Data Security Standard (PCI DSS) and government-backed initiatives to promote digital financial inclusion support market stability and growth. Technological advancements include AI-powered fraud detection, contactless and mobile payment solutions, and blockchain-enabled transaction monitoring. Banks and fintech firms are deploying real-time analytics for risk management and customer engagement. North America also sees rising adoption of virtual cards, tokenization, and loyalty-integrated cards, which enhance user experience and operational efficiency. The region continues to lead global innovation in payment card technology and secure digital transactions.

Europe contributes roughly 28% to the Financial Payment Cards Market, with key markets including Germany, the United Kingdom, and France. The region is strongly influenced by regulatory bodies such as the European Central Bank and EU data privacy initiatives like GDPR, enforcing secure transaction standards. Sustainability initiatives encourage the production of eco-friendly cards using recycled materials. Emerging technologies such as AI-based fraud monitoring, blockchain transaction verification, and mobile wallet integration are increasingly adopted. Retail, banking, and tourism sectors are major demand drivers, while e-commerce growth fuels virtual card deployment. European banks are investing in digital infrastructure, including contactless payment systems and smart authentication technologies, ensuring robust market expansion.

Asia-Pacific holds approximately 23% of the Financial Payment Cards Market, with China, India, and Japan as top-consuming countries. The region has rapidly expanded card issuance infrastructure and digital banking networks, supporting widespread adoption. Retail, e-commerce, travel, and financial services are the leading industries driving demand. Technological innovation includes the integration of mobile wallets, contactless cards, AI-based transaction monitoring, and QR-based payments. Innovation hubs in Singapore, Hong Kong, and Tokyo are fostering fintech solutions and cross-border payment systems. Government initiatives promoting cashless transactions and financial inclusion, combined with rising smartphone penetration, are fueling the expansion of the Financial Payment Cards Market across Asia-Pacific.

South America accounts for about 6% of the global Financial Payment Cards Market, with Brazil and Argentina as key countries. The region is witnessing growing adoption of card-based payments in retail, banking, and travel sectors. Investment in POS infrastructure, contactless payment systems, and mobile wallet integration is increasing across major cities. Government incentives and trade policies encourage financial inclusion and the modernization of banking systems. Technological modernization includes AI-driven fraud detection, digital banking platforms, and loyalty program-linked cards. South America’s market growth is supported by rising consumer preference for secure and convenient payment solutions, alongside expanding fintech partnerships.

The Middle East & Africa region contributes approximately 2% to the Financial Payment Cards Market, with UAE and South Africa as leading countries. Demand is driven by banking, oil & gas, retail, and construction sectors. Governments are encouraging digital financial services adoption through policy reforms and infrastructure investments. Technological modernization trends include the use of AI for transaction monitoring, contactless and mobile-enabled cards, and blockchain-based payment solutions. Regulatory frameworks focus on secure payment compliance and digital banking standards. Strategic partnerships among banks, fintech companies, and payment processors are accelerating the adoption of advanced card technologies, positioning the region for future market expansion.

United States – 39% Market Share

High production capacity, advanced digital infrastructure, and widespread adoption of card-based payments across multiple industries.

China – 18% Market Share

Rapid fintech adoption, large consumer base, and strong investment in digital payment systems and mobile wallet integration.

The Financial Payment Cards Market is characterized by a highly competitive environment with over 50 active global players operating across multiple regions. Market leaders focus on strategic initiatives such as partnerships with fintech firms, co-branded card programs, and innovative product launches to strengthen their market positioning. Mergers and acquisitions are also notable, allowing companies to expand service offerings, enhance technological capabilities, and enter new geographic markets. Innovation trends include AI-powered fraud detection, tokenization, blockchain-enabled transaction security, and contactless payment solutions, which are key differentiators among competitors. Companies are increasingly investing in mobile wallet integration, virtual card platforms, and loyalty-linked services to attract and retain customers. Continuous technological advancements and a strong focus on regulatory compliance are influencing competitive dynamics, prompting firms to optimize operational efficiency, enhance user experience, and maintain secure transaction frameworks. The landscape is further shaped by regional players targeting niche markets in emerging economies, making competition multidimensional and global in scale.

Mastercard Inc.

Visa Inc.

American Express Company

Discover Financial Services

JCB Co., Ltd.

UnionPay International

Capital One Financial Corporation

Barclays Bank PLC

Citigroup Inc.

Bank of America Corporation

The Financial Payment Cards Market is undergoing substantial technological evolution, driven by innovations aimed at enhancing security, convenience, and efficiency. EMV chip technology continues to secure physical card transactions, reducing counterfeit fraud significantly. Contactless payment systems, including NFC-enabled cards and mobile wallet integration, allow for rapid, touch-free transactions, increasingly preferred by consumers and retailers. AI and machine learning play a pivotal role in transaction monitoring, fraud detection, and predictive analytics, analyzing millions of transactions in real time to detect anomalies and optimize credit risk assessment. Blockchain technology is also being explored for secure cross-border payments and decentralized transaction verification. Virtual cards, tokenization, and biometric authentication (fingerprint and facial recognition) are becoming standard in enhancing digital payment security. Additionally, fintech collaborations are accelerating the adoption of integrated solutions, including rewards-linked platforms and loyalty programs, offering tailored financial services. The convergence of digital and physical payment technologies is enabling financial institutions to provide seamless user experiences while maintaining compliance with stringent regulatory standards.

In March 2024, Mastercard launched an AI-driven real-time fraud monitoring system analyzing over 2 billion monthly transactions, which reduced fraudulent activity by 27% within the first quarter.

In July 2023, Visa introduced a virtual card platform for e-commerce transactions, enabling secure tokenization and instant issuance for consumers and businesses.

In November 2024, American Express unveiled contactless payment cards with integrated biometric authentication, allowing fingerprint-based approval for high-value transactions.

In May 2023, UnionPay International expanded its co-branded card offerings with major retail chains in Asia, supporting cross-border payments and loyalty reward integration for cardholders.

The Financial Payment Cards Market Report provides a comprehensive analysis of the global card-based payment ecosystem, covering multiple segments including credit, debit, prepaid, virtual, and co-branded cards. It evaluates applications across retail, e-commerce, banking, travel, hospitality, and institutional transactions, offering insights into adoption patterns and technological integration. Geographic coverage spans North America, Europe, Asia-Pacific, South America, and the Middle East & Africa, highlighting regional dynamics, infrastructure, and regulatory landscapes. The report examines key market players, their strategic initiatives, and innovation trends, focusing on AI-driven fraud detection, blockchain, tokenization, contactless solutions, and digital wallet integration. Emerging market segments, such as virtual cards, loyalty-linked cards, and fintech-driven payment platforms, are analyzed to provide actionable insights for stakeholders. This report also addresses end-user behavior, operational challenges, regulatory compliance, and digital transformation trends, equipping decision-makers with a holistic view of market potential, growth drivers, and competitive positioning across global and regional landscapes.

| Report Attribute / Metric | Details |

|---|---|

| Market Revenue (2024) | USD 16,979.0 Million |

| Market Revenue (2032) | USD 34,180.9 Million |

| CAGR (2025–2032) | 9.14% |

| Base Year | 2024 |

| Forecast Period | 2025–2032 |

| Historic Period | 2020–2024 |

| Segments Covered |

By Type

By Application

By End-User Insights

|

| Key Report Deliverables | Revenue Forecast, Growth Drivers & Restraints, Technology Insights, Market Dynamics, Segmentation Analysis, Regional Insights, Competitive Landscape, Recent Developments |

| Regions Covered | North America, Europe, Asia-Pacific, South America, Middle East & Africa |

| Key Players Analyzed | Mastercard Inc., Visa Inc., American Express Company, Discover Financial Services, JCB Co., Ltd., UnionPay International, Capital One Financial Corporation, Barclays Bank PLC, Citigroup Inc., Bank of America Corporation |

| Customization & Pricing | Available on Request (10% Customization is Free) |