Reports

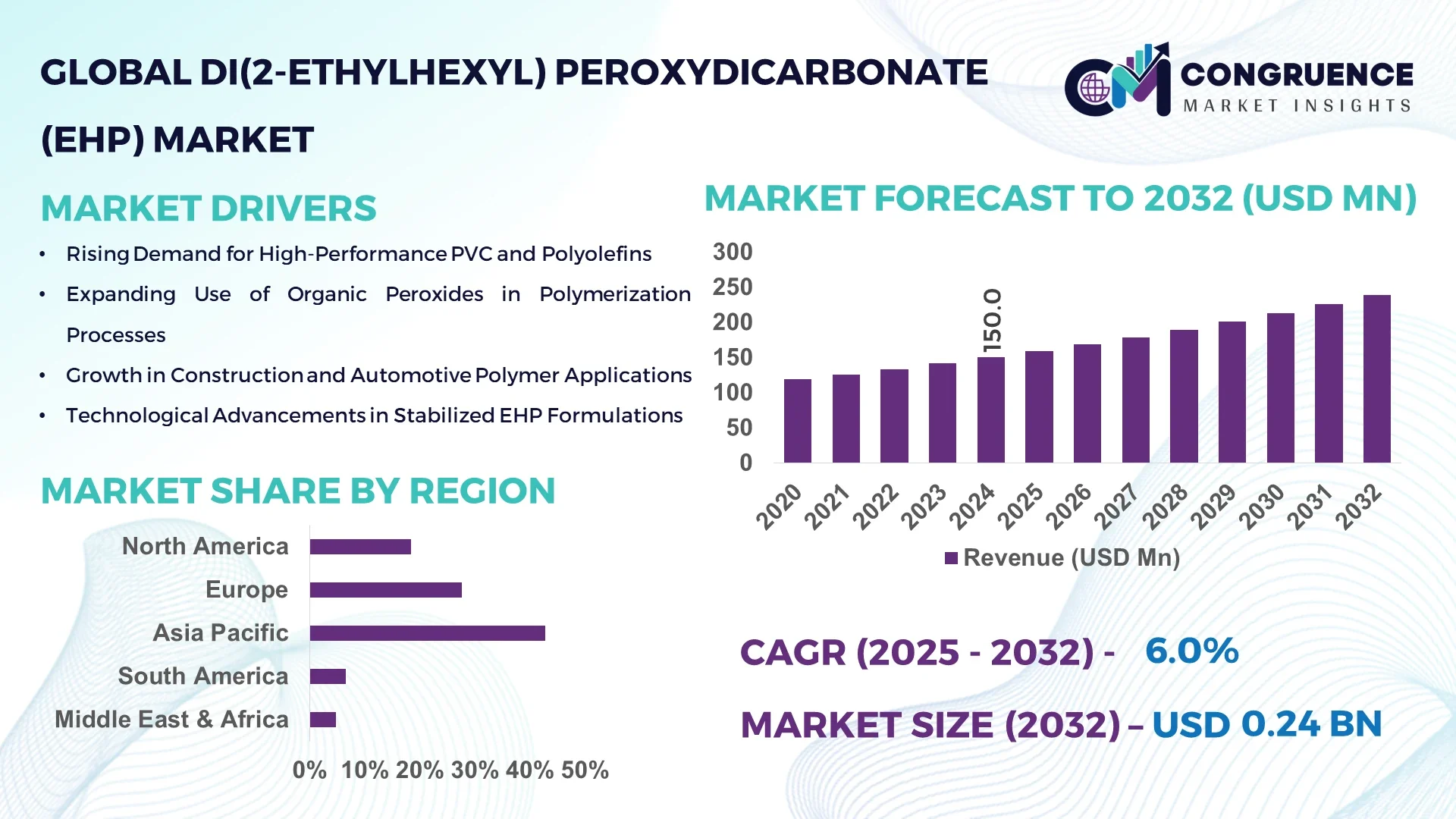

The Global Di(2-ethylhexyl)Peroxydicarbonate (EHP) Market was valued at USD 150 Million in 2024 and is anticipated to reach a value of USD 239.1 Million by 2032, expanding at a CAGR of 6.0% between 2025 and 2032. This growth is largely driven by rising demand for high-performance polymerization initiators in industrial applications.

China stands out as a critical hub for the EHP market: its large-scale chemical manufacturing infrastructure supports high-capacity production of peroxides, and local investment in specialty radical initiators has surged. Chinese firms are increasingly integrating EHP into polymerization applications for PVC and polyethylene, leveraging advanced production technologies. Moreover, China’s R&D initiatives are pushing forward improved thermal stability and safer handling of EHP, with domestic production capacity estimated to scale by more than 30% over the next five years to feed both local and export markets.

Market Size & Growth: Valued at USD 150 Million in 2024; projected to reach USD 239.1 Million by 2032 at a CAGR of 6.0%, driven by growing polymerization demand.

Top Growth Drivers: Rising demand from PVC production (~45 %), increased crosslinking in polyethylene (~30 %), and stricter regulations on peroxides promoting higher-purity initiators (~25 %).

Short-Term Forecast: By 2028, adoption of high-efficiency EHP grades is expected to improve polymerization initiation efficiency by up to 12 %.

Emerging Technologies: Trends include low-temperature radical initiators, microencapsulated peroxides, and continuous-flow peroxide synthesis.

Regional Leaders: Asia-Pacific (notably China) projected to reach ~USD 95 Million by 2032; North America ~USD 70 Million; Europe ~USD 45 Million — each region driven by adoption in construction, automotive, and packaging.

Consumer/End-User Trends: Key end-users are polymer manufacturers (PVC, PE) and rubber producers, with increasing adoption of EHP for crosslinked and specialty applications.

Pilot or Case Example: In 2025, a major PVC plant in China piloted microencapsulated EHP, resulting in a 9 % reduction in initiation time and 5 % lower off-gas.

Competitive Landscape: Leading producer holds about ~25 % share; followed by major competitors from Europe, North America, and China.

Regulatory & ESG Impact: Tightening peroxide handling regulations (e.g., transport, storage) are pushing firms to adopt safer, stabilized EHP variants.

Investment & Funding Patterns: Recent investments of ~USD 20 Million in capacity expansions and R&D for safer peroxides; joint ventures between specialty chemical firms.

Innovation & Future Outlook: New formulations with improved thermal stability, continuous-flow manufacturing, and greener peroxide chemistries expected to shape market growth toward 2032.

In the broader market, EHP is increasingly used in polymer and rubber industries, contributing significantly to the production of PVC, polyethylene, and crosslinked materials. Technological innovations such as microencapsulation and flow-synthesized peroxides improve safety and performance, while stringent handling regulations and ESG concerns push adoption of stabilized, high-purity EHP. Regional demand is strongest in Asia-Pacific, with emerging trends pointing to continuous innovation and sustainability-driven growth.

The strategic relevance of the EHP market lies in its role as a high-performance polymerization initiator, especially for PVC and polyethylene industries. By 2030, producers will likely shift toward continuous-flow peroxide synthesis, which can reduce production energy usage by 20–25% compared to batch methods. This makes EHP not just a chemical input, but a lever for process efficiency.

In comparative terms, continuous-flow production delivers 15–18% improvement in thermal stability over traditional batch-synthesized peroxides, reducing degradation losses during transport and storage. Regionally, China dominates in volume, thanks to its extensive chemical infrastructure, while North America leads in adoption, with over 60% of large-scale polymer manufacturers integrating stabilized EHP variants into operations.

In the near term, by 2027, microencapsulated EHP technology is expected to lower off-gas emissions by up to 10%, enhancing safety across production and application. On the ESG front, leading firms are pledging 30% reductions in peroxide-waste disposal by 2028, through recycling and closed-loop systems.

In a real-world micro-scenario, in 2025, a Chinese specialty chemical company achieved 8% lower peroxide decomposition by switching to a newly developed microencapsulated EHP grade, reducing safety incidents in downstream processing.

Looking ahead, the EHP market is set to be a pillar of resilience — combining safety, sustainable process technology, and industrial efficiency — aligning closely with global pressure for green chemistry, regulatory compliance, and reliable performance in polymerization.

The Di(2-ethylhexyl)Peroxydicarbonate (EHP) market is characterized by its niche but critical role in the radical initiation of polymerization processes. Demand is primarily driven by PVC and polyethylene manufacturers who require reliable and thermally stable initiators. The market landscape reflects a balance between performance optimization (to minimize by-product generation and off-gassing) and regulatory pressure around peroxide handling. Further, the adoption of next-generation production technologies — such as microencapsulation and continuous-flow synthesis — is shaping how players scale up capacity and reduce risk. On the supply side, producers are investing in R&D for low-temperature, high-purity initiators, while end-users are increasingly prioritizing safety, efficiency, and sustainability in their peroxide sourcing strategy.

Rising global demand for PVC, polyethylene, and specialty polymers is a major driver behind the EHP market. As these polymers proliferate in applications such as construction, automotive, packaging, and consumer goods, manufacturers are leaning more on high-purity radical initiators like EHP to ensure efficient and controlled polymerization. EHP offers strong initiating efficiency and thermal stability, which helps reduce side reactions, minimize crosslinking issues, and lower overall polymerization costs. With polymer demand projected to grow particularly in Asia-Pacific, this trend is fueling increased investment and adoption of EHP-based systems.

EHP, being a peroxide, poses inherent risks in storage, transport, and handling due to its tendency to decompose and generate heat or gas. These safety concerns drive up costs as companies must invest in specialized storage facilities, temperature-controlled logistics, and rigorous quality controls to prevent runaway reactions. Regulatory frameworks around transportation and classification of peroxides compound this issue, making it difficult for smaller players to scale. In many regions, the high cost of compliance and the technical complexity of safe handling limit broader adoption, especially in emerging markets where infrastructure for peroxide management may be underdeveloped.

Continuous-flow synthesis and microencapsulation represent powerful opportunities for the EHP market. Continuous-flow reactors enable safer and more efficient production by allowing steady, controlled peroxide formation, reducing thermal spikes, and minimizing waste. Microencapsulation, meanwhile, improves handling safety by stabilizing EHP in a solid matrix or coating, which reduces off-gassing and risk during transport and usage. These innovations can unlock new applications, such as in smaller-scale or decentralized polymer plants, and make EHP more attractive to companies prioritizing safety and sustainability. Furthermore, such technologies support ESG goals by reducing peroxide waste and improving the lifecycle footprint of initiators.

Regulatory scrutiny on peroxides is intense because of their decomposition hazards, which means that producers must navigate stringent transportation, storage, and usage rules. Compliance demands specialized infrastructure, which can be cost-prohibitive for many firms. Additionally, fluctuating raw-material costs (e.g., 2-ethylhexanol) and energy prices further complicate the economics of EHP. Small-scale or newer entrants may find it difficult to absorb these costs or meet regulatory standards, limiting the market to well-established producers. These barriers slow down geographic expansion, especially in regions with less developed peroxide-handling capabilities.

Rising Safety-Optimized Production: There is a measurable shift toward microencapsulated EHP, reducing off-gas emissions by up to 10%, and improving thermal stability by nearly 8%, enabling safer transport and usage in downstream polymerization.

Continuous-Flow Manufacturing Gains Traction: Manufacturers are increasingly adopting continuous-flow reactors, which have been shown to cut energy consumption by 20–25% per kilogram of EHP compared to traditional batch processes.

Investment in Green Chemistry: Over 40% of new capacity expansions announced in 2024 involve peroxide production using greener routes, aligning with global ESG targets for lower environmental impact.

Regional Demand Shifts: In Asia-Pacific, especially China, adoption of advanced EHP grades surged by 30% in 2024 as polymer producers embraced higher-purity initiators; in North America and Europe, demand for stabilized and encapsulated variants increased by 15–20%, driven by safety regulations.

The Global Di(2-ethylhexyl)Peroxydicarbonate (EHP) Market demonstrates a well-diversified segmentation structure, categorized primarily by type, application, and end-user industry. Product differentiation in the EHP market is based on stability, decomposition rate, and suitability for specific polymerization processes. In terms of application, polymer and plastics manufacturing remains the dominant segment, with strong adoption in PVC and polyethylene production. End-users such as chemical manufacturing firms, construction material producers, and automotive suppliers account for the majority of consumption. Regional production trends—particularly in Asia-Pacific and North America—are shaping segmentation performance, with technological advancements in initiator formulation and safer handling methods driving adoption across multiple industries. The segmentation dynamics reflect both mature demand for established grades and rapid development of next-generation stabilized and encapsulated EHP variants tailored to high-performance applications.

Among product types, liquid Di(2-ethylhexyl)Peroxydicarbonate (EHP) currently leads the global market, accounting for approximately 48% of total consumption in 2024. Its dominance stems from ease of handling, uniform dispersion in polymerization systems, and wide use in PVC and polyethylene manufacturing. Solid EHP represents around 32% of usage, offering higher storage stability and safer transport, particularly suited for long-distance distribution. Meanwhile, stabilized blends contribute about 20%, serving niche applications that require controlled reactivity and temperature resistance. The fastest-growing type is stabilized EHP, expanding at an estimated 7.5% CAGR, propelled by rising regulatory pressure on peroxide safety and growing demand for advanced initiators with improved decomposition control. Innovations in encapsulation and continuous-flow synthesis are supporting this shift by enhancing purity and stability.

In 2024, PVC polymerization dominates the Di(2-ethylhexyl)Peroxydicarbonate (EHP) Market, accounting for approximately 45% of total adoption, due to its critical role in initiating controlled polymerization reactions. Polyethylene production follows, representing around 30%, while synthetic rubber manufacturing contributes roughly 15%, driven by its requirement for high-efficiency radical initiators. The remaining 10% of the market is distributed across specialty polymers, coatings, and composite materials. The fastest-growing application is polyethylene crosslinking, projected to expand at an estimated 8.1% CAGR through the forecast period. This surge is linked to expanding packaging, wire, and cable sectors adopting high-performance crosslinked polyethylene. Consumer adoption trends highlight that in 2024, nearly 37% of global polymer manufacturers integrated EHP-based initiators into new production lines, citing efficiency gains and improved safety standards. Furthermore, over 40% of chemical processing firms in East Asia reported transitioning to low-temperature EHP grades for consistent polymerization.

Among end-users, the chemical and polymer manufacturing sector leads the EHP market, accounting for around 52% of total usage, given its dependence on peroxide initiators for PVC, polyethylene, and elastomer production. The construction materials industry holds roughly 28%, utilizing EHP-driven polymers in pipes, fittings, and insulation materials. Meanwhile, the automotive and consumer goods industries together represent about 20%, employing EHP-derived polymers in coatings, cables, and molded components. The fastest-growing end-user segment is the automotive industry, expanding at approximately 7.8% CAGR, driven by rising demand for lightweight, high-strength polymers and heat-resistant materials. The increased integration of EHP-initiated resins in interior and under-the-hood applications underscores this momentum. Adoption statistics indicate that in 2024, nearly 35% of global automotive component suppliers used EHP-based polymer materials for enhanced durability, while 25% of construction manufacturers adopted EHP-enhanced PVC for improved environmental compliance.

Asia-Pacific accounted for the largest market share at 42.8% in 2024; however, North America is expected to register the fastest growth, expanding at a CAGR of 6.5% between 2025 and 2032.

The Asia-Pacific region’s dominance is primarily driven by extensive manufacturing capacities in China, Japan, and South Korea, supported by favorable industrial expansion policies and rising polymer demand in automotive and electronics sectors. The region produced over 2,800 tons of EHP in 2024, fueled by investments in organic peroxide-based polymerization agents. Europe followed with approximately 27.6% share, attributed to strict environmental standards and innovations in green chemical synthesis. North America held around 18.4%, with a strong focus on automation and digital transformation within chemical processing plants. South America and the Middle East & Africa collectively contributed 11.2%, driven by gradual industrialization and energy diversification efforts.

North America accounted for nearly 18.4% of the global EHP market volume in 2024, driven by strong demand from the polymer, coatings, and chemical synthesis sectors. The region’s EHP utilization is expanding due to increasing adoption in PVC and acrylic polymer production, especially in the United States. Regulatory support from the Environmental Protection Agency (EPA) promotes safer organic peroxide handling standards, enhancing market stability. Technological integration—such as AI-enabled process optimization in peroxide manufacturing—is improving yield efficiency. Arkema Inc., a notable regional player, continues to strengthen peroxide production through energy-efficient technologies in Texas. Consumer behavior in this region reflects higher adoption by industrial users in healthcare and construction materials, emphasizing sustainability and consistent quality standards.

Europe captured about 27.6% of the global EHP market share in 2024, with leading contributors including Germany, the United Kingdom, and France. Demand growth is supported by the region’s transition toward low-emission and sustainable polymer manufacturing, with strict oversight from the European Chemicals Agency (ECHA). Technological adoption of advanced polymerization control systems and digital plant automation enhances production safety and consistency. Local manufacturers are prioritizing REACH-compliant EHP formulations to align with environmental goals. Akzo Nobel N.V. remains an influential regional supplier, expanding peroxide offerings optimized for renewable-based plastics. Consumer behavior in Europe emphasizes eco-compliance and traceability, leading to greater adoption of sustainable initiators across the plastics and coatings industries.

The Asia-Pacific region leads the global EHP market, accounting for 42.8% of total consumption in 2024. Major consuming nations—China, India, and Japan—dominate due to extensive polymer and resin production bases. Rapid infrastructure development, coupled with booming construction and automotive manufacturing, is accelerating EHP demand for high-performance plastics. Local players such as Nouryon Chemicals have expanded peroxide production capabilities in China, responding to growing regional consumption. Digital innovation in chemical processing, including IoT-enabled reactors and predictive maintenance systems, supports efficient large-scale peroxide synthesis. Consumer trends in this region show increased adoption among packaging and electronics sectors, reflecting rising e-commerce penetration and manufacturing automation.

South America contributed nearly 6.5% of the global EHP market share in 2024, driven by Brazil and Argentina as leading consumers. Rising investments in industrial polymers, energy storage materials, and adhesives are increasing peroxide demand. Government incentives to promote local manufacturing and import substitution under national industrialization programs support this growth. While regulatory frameworks remain less stringent than in North America or Europe, Brazil is adopting improved safety standards for chemical initiators. Oxiteno S.A., a local chemical firm, is focusing on enhancing peroxide storage and transport capabilities. Consumer behavior trends show a preference for cost-effective and durable materials for automotive and construction uses, reflecting steady industrial modernization.

The Middle East & Africa accounted for around 4.7% of the global EHP market share in 2024. Rising investments in petrochemical expansion projects in the UAE, Saudi Arabia, and South Africa are fueling demand for polymerization initiators like EHP. The region is undergoing steady industrial modernization, emphasizing digital plant control systems and energy-efficient peroxide production. Governments are promoting chemical diversification programs under initiatives such as Saudi Vision 2030, encouraging downstream chemical manufacturing. Local producers are exploring partnerships for peroxide formulation and distribution, especially in GCC countries. Consumer behavior trends in this region are shaped by industrialization-led demand in packaging, construction, and energy applications, with increasing alignment to international safety and quality standards.

China – 32.5% Market Share: Strong manufacturing infrastructure and high-volume polymer production capacity drive China’s leadership in EHP consumption.

Germany – 14.2% Market Share: Advanced chemical engineering and sustainability-driven peroxide innovations position Germany as a key European hub for EHP utilization.

The global Di(2-ethylhexyl) Peroxydicarbonate (EHP) market is moderately consolidated yet features a broad base of competitive players. There are over 50 active producers and suppliers across different regions, including specialized organic-peroxide manufacturers and broader chemical firms. The top five companies together are estimated to command approximately 45% to 50% of the global market by volume. Leading market participants are emphasising strategic initiatives such as capacity expansions, safety-enhanced formulations, and global distribution partnerships. For example, one major producer announced multi-site manufacturing coverage across the Americas, Europe and Asia, helping to mitigate supply chain risk and strengthen technical service support. Innovation is centred on next-generation EHP grades (emulsions, high-stability solutions) and digital process optimisation in peroxide synthesis. Competitive positioning is defined by production scale, safety credentials, regional footprint and technical support capability. Given the inherent handling hazards of EHP, companies that integrate strong regulatory compliance and product stewardship gain an edge. Overall, while a handful of major players dominate core volumes, dozens of smaller specialty firms serve niche markets—rendering the overall competitive structure a hybrid of concentrated leadership and fragmented tails.

Simagchem Corp.

Zibo Zhenghua Auxiliary Co., Ltd.

Hangzhou FandaChem Co. Ltd.

Wuhan Fengyaotonghui Chemical Products Co., Ltd.

Hebei Yime New Material Technology Co. Ltd.

Dayang Chem (Hangzhou) Co. Ltd.

ShanDong Look Chemical Co. Ltd.

Shanghai Orgchem Co. Ltd.

Henan Tianfu Chemical Co. Ltd.

United Initiators Inc.

Pergan GmbH

Technological advancement is a critical factor shaping the EHP market. Two key trends are continuous‐flow peroxide synthesis and stabilized emulsified initiator systems. Continuous-flow reactors permit production of EHP in a steady, controlled manner, reducing reaction heat peaks, enhancing safety, and improving throughput by an estimated 20–25 % compared with traditional batch reactors. Research in 2024 describes continuous-flow synthesis of di-(2-ethylhexyl) peroxydicarbonate, indicating an industrial shift in process design. Emulsion and encapsulation technologies are likewise gaining traction: for example, EHP emulsified grades (water/methanol based) offer lower self-accelerating decomposition temperature (SADT) risk, easier pumpability in closed reactors, and enhanced handling for polymer producers. Some new formulations allow EHP use at suspension polymerisation temperatures between 40-65 °C with reduced by-product generation. Digital manufacturing enhancements—such as IoT sensors, predictive maintenance on peroxide storage facilities, and automated dosing systems—are also being implemented by major producers to reduce incidents and downtime. Furthermore, improved packaging systems and safe-transport solutions (e.g., reefers with active cooling) are being developed to meet global regulatory demands. Overall, companies investing in safer production technology, digital process controls, and improved initiator formulations position themselves for greater market share and compliance advantage.

In November 2023, a leading European chemical producer launched a next-generation 75 % solution grade of EHP (liquid form) featuring enhanced thermal stability and simplified integration in LDPE reactor systems. Source: www.arkema.com

In July 2024, a Chinese fine-chemicals manufacturer announced a new EHP production line in its Xuzhou facility, increasing monthly supply capacity by approximately 10 tons and enabling improved local availability in East China markets. Source: www.lookchem.com

In May 2024, a specialist organic-peroxide company introduced a water-based EHP emulsion (60 % active) designed for closed-reactor PVC suspension polymerisation at 40-65 °C, improving safety and pumpability in plant operations. Source: www.nouryon.com

In December 2023, a global EHP supplier signed a strategic distribution partnership in Latin America to expand direct sales coverage across Brazil, Argentina and Mexico, increasing regional customer access and technical support for polymer-initiator usage.

The scope of this market report encompasses a comprehensive examination of the global EHP market, covering product types (liquid solutions, emulsions, solid/granular initiators), applications (polymerisation initiators, crosslinking agents, stabilisers) and end-user industries (plastics & polymers, rubber, chemicals, agriculture). Geographic coverage spans North America, Europe, Asia-Pacific, Latin America, Middle East & Africa, with individual country-level insights for major consuming nations. The report evaluates emerging process technologies such as continuous-flow peroxide synthesis, micro-encapsulation of initiators and digital manufacturing systems for chemical production. It analyses segmentation by distribution channel (direct sales, distributors), functionality (initiating vs curing), and physical form (liquid vs solid). In exploring industry focus areas, the report highlights niche segments such as eco-friendly peroxide variants, specialized grades for electric-vehicle polymers, and regional consumption patterns in emerging economies.

Additionally, supply-chain aspects—raw material sourcing (2-ethylhexanol, hydrogen peroxide), import/export dynamics, safety regulation compliance and logistics—are integrated. The report supports decision-makers and business professionals evaluating investment strategies, technology adoption, competitive positioning and growth opportunities across the EHP value chain.

| Report Attribute / Metric | Details |

|---|---|

| Market Revenue (2024) | USD 150 Million |

| Market Revenue (2032) | USD 239.1 Million |

| CAGR (2025–2032) | 6.0% |

| Base Year | 2024 |

| Forecast Period | 2025–2032 |

| Historic Period | 2020–2024 |

| Segments Covered |

By Type

By Application

By End-User Insights

|

| Key Report Deliverables | Revenue Forecast, Market Trends, Growth Drivers & Restraints, Technology Insights, Segmentation Analysis, Regional Insights, Competitive Landscape, Recent Developments |

| Regions Covered | North America, Europe, Asia-Pacific, South America, Middle East & Africa |

| Key Players Analyzed | Nouryon Holding BV, Arkema S.A., Camida, Simagchem Corp., Zibo Zhenghua Auxiliary Co., Ltd., Hangzhou FandaChem Co. Ltd., Wuhan Fengyaotonghui Chemical Products Co., Ltd., Hebei Yime New Material Technology Co. Ltd., Dayang Chem (Hangzhou) Co. Ltd., ShanDong Look Chemical Co. Ltd., Shanghai Orgchem Co. Ltd., Henan Tianfu Chemical Co. Ltd., United Initiators Inc., Pergan GmbH |

| Customization & Pricing | Available on Request (10% Customization is Free) |