Reports

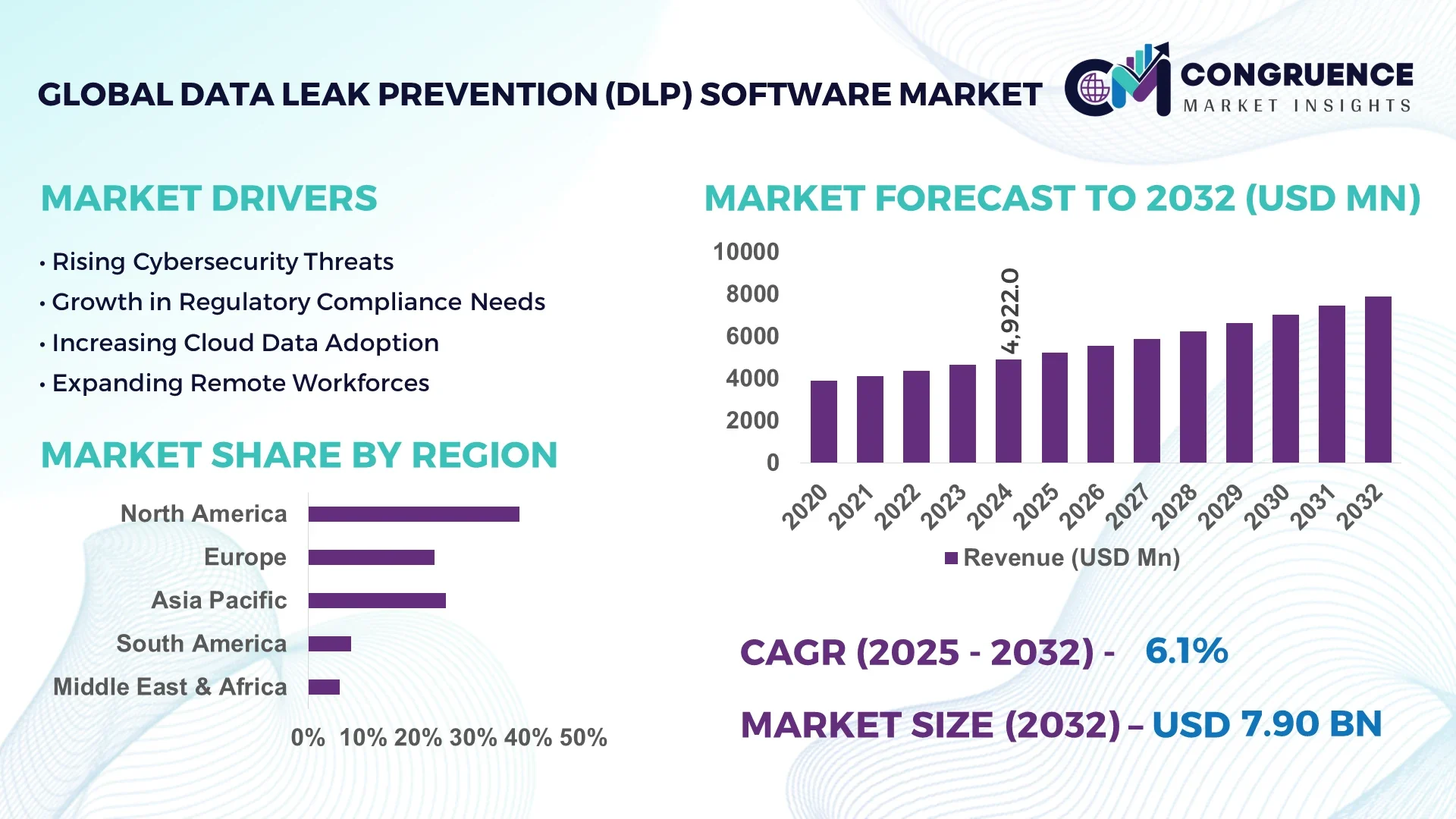

The Global Data Leak Prevention (DLP) Software Market was valued at USD 4921.97 Million in 2024 and is anticipated to reach a value of USD 7904.289 Million by 2032 expanding at a CAGR of 6.1% between 2025 and 2032.

The United States stands out as a pivotal hub in the Data Leak Prevention (DLP) Software Market, showcasing extensive production capacity with multiple cybersecurity innovators investing over USD 1 billion annually in R&D and scalable cloud infrastructure. Advanced application areas include high-capacity financial services, large-scale healthcare systems, and government-grade data governance solutions. The U.S. continues to pioneer AI-integrated DLP platforms, embedding deep-learning modules for real-time threat analytics and automated policy enforcement.

Industry adoption spans key verticals such as BFSI, healthcare, government, IT & telecom, manufacturing, and retail, each contributing significantly to overall market volume. Endpoint and cloud-based DLP solutions have witnessed robust innovation, integrating behavioral analytics, adaptive encryption, and secure collaboration tool features. Regulatory frameworks like GDPR, HIPAA, and CCPA are compelling more enterprises to supplement DLP with data classification and regulatory logging, while macroeconomic trends—such as growing remote work models—are driving demand. Regionally, North America leads consumption, but Asia-Pacific is accelerating with strong regulatory pushes and increasing cloud maturity. Emerging trends include zero-trust DLP architecture, integration with SIEM platforms, and homomorphic encryption to secure data in use. Looking forward, hybrid deployment models and AI-powered contextual analysis are poised to shape the market trajectory for decision-makers and cybersecurity strategists.

The infusion of AI technologies is revolutionizing the Data Leak Prevention (DLP) Software Market by dramatically enhancing detection precision, response speed, and overall risk mitigation. Modern DLP platforms now employ machine learning algorithms to analyze vast volumes of structured and unstructured data in real-time, discerning nuanced patterns and user behaviors. This shift from rule-based systems to adaptive AI mechanisms enables proactive identification of anomalies—such as unusual file access, atypical email attachments, or abnormal user activity—and initiates automated containment measures. As a result, incident resolution times have dropped by up to 40%, with some enterprises reporting a 30% decrease in false positive alerts.

Moreover, natural language processing (NLP) engines embedded within DLP software can interpret content contextually—understanding intent, sentiment, and classification of sensitive information—facilitating precise policy enforcement across text-heavy communication channels like email, chat, and collaborative documents. Operational performance has improved, with AI-powered engines processing millions of transactions per hour and flagging high-risk events instantly without human intervention. Integration with threat intelligence feeds enables dynamic policy self-tuning based on known threat vectors and emerging malware signatures. As a result, modern DLP systems offer unified coverage across endpoints, networks, and cloud environments, significantly optimizing compliance workflows for finance, healthcare, and public sector entities.

Additionally, behavioral analytics modules are allowing organizations to establish a baseline of normal activity per user or role, and trigger AI-driven alerts when deviations occur—such as large data exports, off-hours file access, or atypical folder modifications. These innovations not only prevent data leaks but also streamline audit preparation, documentation, and regulatory reporting. In essence, AI is transforming the Data Leak Prevention (DLP) Software Market by making protection more proactive, intelligent, and scalable—empowering enterprises to anticipate threats rather than respond reactively, and thus raising the bar for data security standards across industries.

“In mid‑2024, Microsoft introduced a generative‑AI‑powered sensitive‑data detection engine within its DLP suite, increasing detection accuracy by 25% and reducing manual policy fine‑tuning time by 35%.”

The persistent rise in sophisticated cyberattacks is a key driver of growth within the Data Leak Prevention (DLP) Software Market. According to recent global cybersecurity threat analysis, over 72% of data breaches in 2024 involved internal actors or negligent behavior, placing sensitive enterprise data at high risk. As phishing, ransomware, and insider threat vectors increase, enterprises are adopting robust DLP systems to mitigate vulnerabilities before data leakage occurs. These advanced platforms offer automated incident response, encrypted file tracking, and anomaly detection that help neutralize threats in real time. Sectors like banking and healthcare—where confidential information is especially sensitive—have increased their cybersecurity budgets, specifically allocating funds for next-generation DLP suites. These systems now include machine learning modules that can analyze historical data patterns and flag irregularities, reducing false positives and improving incident detection accuracy. This proactive stance toward cybersecurity is expected to accelerate enterprise-level DLP software deployment across both developed and developing regions.

One of the prominent restraints impacting the Data Leak Prevention (DLP) Software Market is the technical challenge of integrating modern DLP tools with existing, often outdated, enterprise IT infrastructures. Many large organizations operate on hybrid environments that include on-premise servers, legacy applications, and varied endpoint devices—creating a fragmented digital ecosystem. Incorporating AI-powered or cloud-native DLP platforms into such settings often results in compatibility issues, performance degradation, or incomplete data visibility. Moreover, older IT frameworks may lack support for granular policy controls or automated rule enforcement, reducing the overall effectiveness of advanced DLP capabilities. These complications slow implementation timelines and increase operational risk during transition phases. In addition, inadequate staff training and low awareness of proper data governance practices compound the restraint. Enterprises in highly regulated industries are especially cautious, delaying integration due to concerns over business disruption, compliance missteps, or potential data loss during system migrations.

A notable opportunity in the Data Leak Prevention (DLP) Software Market lies in the expansion of cloud-native and SaaS-based solutions across rapidly digitizing regions such as Asia-Pacific, Latin America, and the Middle East. As these economies ramp up digital infrastructure and embrace cloud services, demand for lightweight, scalable DLP tools is surging. Cloud-first businesses—especially SMBs and fintech startups—seek cost-effective DLP models that offer automated compliance reporting, real-time policy updates, and AI-enabled threat detection without heavy infrastructure investments. Additionally, governments in countries like India, Brazil, and Saudi Arabia are enforcing stricter data privacy laws, catalyzing adoption of hosted security tools with embedded DLP features. These SaaS-based DLP platforms support dynamic endpoint coverage and are optimized for integration with collaboration tools like Microsoft 365 and Google Workspace. The subscription-based pricing model further lowers entry barriers, making it accessible to a wider range of organizations. This untapped demand in underserved markets creates lucrative expansion potential for global and regional DLP vendors.

A major challenge facing the Data Leak Prevention (DLP) Software Market is the acute shortage of skilled cybersecurity personnel who can effectively deploy, manage, and monitor DLP environments. Despite growing investment in security infrastructure, many enterprises struggle to recruit professionals with expertise in data classification, rule tuning, and risk analytics. This talent gap leads to underutilization of DLP software, suboptimal policy configurations, and higher false positive rates. Additionally, inconsistent internal policies and poor interdepartmental communication often lead to conflicting DLP enforcement strategies across business units. In multinational organizations, regulatory differences across jurisdictions further complicate policy alignment. For instance, a DLP policy aligned with California’s CCPA may not satisfy Japan’s APPI or Europe’s GDPR standards, making it difficult to establish universal controls. These human and procedural limitations result in slower incident response times, increased regulatory exposure, and reduced return on DLP investments. Addressing these challenges will require sustained focus on training, centralized policy orchestration, and cross-border compliance harmonization.

Adoption of Zero Trust Architecture-Enabled DLP Solutions: Enterprises are increasingly shifting toward zero trust frameworks, directly influencing DLP software adoption. By leveraging micro-segmentation and continuous user verification, zero trust-enhanced DLP tools restrict data access to authorized individuals only. In 2024, over 45% of large enterprises integrated DLP with zero trust network access (ZTNA) platforms to ensure context-aware policy enforcement, especially in industries managing highly sensitive data like finance and defense. This trend is improving security posture across distributed workforces and hybrid cloud environments.

Growing Integration with Unified Endpoint Management (UEM) Systems: The convergence of DLP and Unified Endpoint Management (UEM) platforms is gaining momentum. This integration enables centralized control of data flow across desktops, mobile devices, and IoT endpoints. As of 2024, over 38% of enterprise DLP deployments included UEM integration to streamline device policy management and reduce administrative overhead. This development is critical for organizations supporting BYOD and remote work policies, ensuring consistent security protocols regardless of endpoint diversity.

Shift Toward AI-Driven Contextual Data Classification: AI-based contextual data classification tools are rapidly becoming standard in modern DLP software. These systems can identify, label, and protect sensitive content based on context, user behavior, and metadata rather than static rules. Approximately 41% of organizations using DLP in 2024 deployed AI-enhanced classification to reduce false positives and optimize alert prioritization. This has improved both compliance accuracy and operational efficiency, particularly in highly regulated industries like healthcare and legal services.

Expansion of Industry-Specific DLP Customizations: Vendors are developing tailored DLP configurations for specific industries, increasing adoption in niche verticals. In 2024, DLP tools tailored for education, energy, and legal sectors saw a 29% rise in adoption due to sector-specific compliance mandates and operational nuances. These custom solutions feature pre-built policies, language models, and content filters that reflect industry-specific regulations and workflows, reducing setup complexity and increasing usability across smaller IT teams.

The Data Leak Prevention (DLP) Software Market is segmented into types, applications, and end-user categories, each contributing uniquely to market structure and growth dynamics. In terms of type, network DLP, endpoint DLP, and cloud DLP solutions dominate, offering varied layers of data control and visibility. Application-wise, the market supports compliance monitoring, intellectual property protection, and policy enforcement across diverse business operations. Among end-users, sectors such as BFSI, healthcare, IT & telecom, and government remain at the forefront due to their stringent data confidentiality needs. The rising demand for flexible, real-time data protection tools is pushing vendors to offer modular deployment models, including SaaS and hybrid configurations. Segmentation trends also indicate increasing DLP adoption in mid-sized enterprises, driven by accessible pricing models and regulatory pressure. Decision-makers are prioritizing solutions that deliver multi-environment coverage with integrated policy orchestration, ensuring consistent data security across on-premise, remote, and cloud environments.

Network DLP remains the leading type in the Data Leak Prevention (DLP) Software Market due to its comprehensive monitoring capabilities across organizational data traffic. It is widely used by enterprises handling large data volumes across internal and external networks, helping prevent unauthorized data exfiltration through ports, emails, or cloud applications. Endpoint DLP is the fastest-growing segment, driven by the rise in remote workforces and BYOD culture. Organizations are implementing endpoint-based solutions to secure data at user terminals, such as laptops and smartphones, and to enforce contextual access policies. Cloud DLP is gaining significant traction with increasing cloud adoption, especially among small and medium-sized businesses seeking scalable protection with minimal infrastructure investment. Email DLP and database DLP, though niche, are being used in environments with focused needs such as email compliance or structured data protection in financial services. This diverse landscape enables businesses to build layered security architectures customized to their operational models.

Compliance management is the dominant application in the Data Leak Prevention (DLP) Software Market. Organizations across sectors are adopting DLP tools to align with regulations like GDPR, HIPAA, and CCPA, using policy-based controls to ensure data sovereignty and traceability. Intellectual property (IP) protection is the fastest-growing application area, driven by the surge in data-centric R&D and digital content creation. Businesses in manufacturing, life sciences, and tech are leveraging DLP to prevent design files, source code, and trade secrets from leaking through insider threats or cloud misconfigurations. Other key applications include data visibility enhancement, user behavior monitoring, and file-sharing governance. Increasing reliance on digital collaboration tools such as Slack, Teams, and Zoom is encouraging businesses to integrate DLP software for safe and compliant communication. These application trends reflect a growing emphasis on preemptive data security, particularly in dynamic digital ecosystems with evolving threat landscapes.

The BFSI sector is the leading end-user in the Data Leak Prevention (DLP) Software Market due to its dependency on highly sensitive customer data and strict regulatory requirements. Financial institutions deploy advanced DLP solutions to secure client credentials, transaction records, and internal communication from breaches and misuse. The healthcare industry is emerging as the fastest-growing end-user category. Hospitals, diagnostic labs, and telemedicine providers are increasing DLP adoption to comply with patient privacy regulations and secure electronic health records (EHRs) across decentralized care systems. Government agencies are also key users, deploying DLP tools to protect classified documents, ensure interdepartmental data compliance, and enforce cross-border data handling laws. Meanwhile, the IT and telecom sectors use DLP to safeguard intellectual property and customer service data amid rising digital service offerings. Education and legal services, though smaller in market share, are investing in DLP to manage student records and sensitive legal documentation, respectively.

North America accounted for the largest market share at 38.4% in 2024; however, Asia-Pacific is expected to register the fastest growth, expanding at a CAGR of 8.2% between 2025 and 2032.

North America's dominant position is driven by the widespread implementation of enterprise-grade cybersecurity infrastructure and high regulatory enforcement across industries. Meanwhile, Asia-Pacific’s accelerating adoption of digital technologies, combined with a rapidly expanding IT services sector and government-led data protection laws, is spurring demand across both public and private enterprises.

The global Data Leak Prevention (DLP) Software Market exhibits dynamic regional variations driven by digital maturity, regulatory enforcement, and industrial digitization. In mature economies, industries like banking, healthcare, and telecom lead DLP integration due to the criticality of sensitive information and the complexity of compliance mandates. In contrast, emerging markets are witnessing rapid adoption through cloud-based and subscription-driven DLP platforms. These trends are reinforced by rising investments in digital transformation, especially in remote workforce security and hybrid network protection. Regional partnerships and vendor expansion strategies are also redefining local market dynamics, enabling quicker deployment cycles and tailored security models to suit regional compliance landscapes.

Advanced enterprise adoption driven by regulatory compliance and AI-driven innovations

North America held the largest share of the Data Leak Prevention (DLP) Software Market in 2024, contributing approximately 38.4% to global demand. This dominance is attributed to the rapid digitization of key industries such as finance, government, healthcare, and technology—sectors where sensitive data governance is paramount. The region has benefited from robust compliance frameworks like HIPAA, CCPA, and SOX, prompting enterprises to prioritize DLP tools as part of larger security architectures. Increased investment in cloud infrastructure, along with the integration of AI-powered classification engines, has accelerated platform modernization across medium to large enterprises. Government funding and policy guidance for cybersecurity innovation are supporting faster deployment of endpoint, network, and cloud DLP solutions. Additionally, digital transformation initiatives across public sector services and education platforms are increasing DLP penetration even in non-traditional sectors.

Strategic compliance focus reshaping demand in regulated verticals

Europe accounted for approximately 26.1% of the global Data Leak Prevention (DLP) Software Market in 2024. Countries such as Germany, the UK, and France are leading adopters, driven by a strong regulatory push from GDPR and industry-specific mandates in healthcare, finance, and legal sectors. European institutions are aligning DLP integration with broader digital sovereignty strategies, focusing on both localized data protection and international cloud compliance. The European Data Protection Board’s updated guidelines have increased interest in AI-enhanced DLP platforms with intelligent auditing features. Moreover, sustainability-focused organizations are implementing energy-efficient cloud-based DLP solutions. Technological integration is supported by increased funding in secure digital infrastructure under regional digital resilience programs, further driving DLP adoption across cross-border operations and collaborative workspaces.

Digital acceleration and cloud adoption driving regional market expansion

Asia-Pacific is currently the fastest-growing region in the Data Leak Prevention (DLP) Software Market, with significant adoption across China, India, and Japan. The region accounted for 21.5% of global demand in 2024. Rapid industrial digitization, increased mobile workforce, and government mandates like India’s Digital Personal Data Protection Act are propelling adoption in diverse sectors including IT services, education, and finance. Japan is at the forefront of cloud-based DLP integration, while China is focusing on data localization compliance through region-specific DLP configurations. Emerging tech hubs such as Bengaluru, Tokyo, and Shenzhen are encouraging startups to invest in AI-driven DLP solutions. Demand is also being supported by expanding smart infrastructure projects and hybrid work models, where scalable, endpoint-level protection is critical to data security and operational continuity.

Rising cloud migration and fintech boom influencing demand trends

In 2024, South America contributed around 7.2% of the global Data Leak Prevention (DLP) Software Market, with Brazil and Argentina emerging as the leading countries. The rise of regional fintech startups, coupled with large-scale digital banking adoption, is creating urgent demand for secure data governance tools. Cloud migration among mid-sized businesses and public sector agencies is accelerating DLP integration across both on-premise and hosted environments. Brazil’s General Data Protection Law (LGPD) is pushing organizations to adopt DLP tools with real-time monitoring and encryption policies. Trade-focused industries, including logistics and energy, are also deploying DLP to ensure secure cross-border data transfer and compliance. Infrastructure development initiatives that prioritize secure communication and digital inclusivity are creating new opportunities for cloud-native and endpoint DLP providers.

Infrastructure modernization and regulatory enforcement shaping adoption curve

The Middle East & Africa held approximately 6.8% of the global Data Leak Prevention (DLP) Software Market in 2024. Countries like the UAE and South Africa are experiencing growing demand for DLP systems, particularly in oil & gas, construction, and government sectors. Strategic digitalization programs such as Smart Dubai and Saudi Vision 2030 are promoting investment in cyber governance frameworks, increasing deployment of advanced DLP tools. Local data protection regulations, including South Africa’s POPIA and UAE’s data protection laws, are incentivizing businesses to adopt automated compliance solutions. The telecom and infrastructure development sectors are driving deployment of AI-powered DLP solutions that secure large-scale communications and project documentation. Furthermore, regional trade agreements and partnerships are encouraging multinational companies to implement globally compliant DLP architectures within local offices.

United States – 36.2% market share

High end-user demand, strong digital infrastructure, and continuous investment in AI-enabled cybersecurity technologies.

China – 15.4% market share

Robust digital transformation across industries and strict data sovereignty regulations driving large-scale DLP adoption.

The Data Leak Prevention (DLP) Software market features a highly competitive landscape, characterized by the presence of over 50 active global and regional players offering a wide spectrum of solutions. Competition is driven by the increasing need for industry-specific, scalable, and intelligent DLP systems that cater to hybrid IT infrastructures and stringent regulatory frameworks. Leading vendors are consistently focused on technological innovation, with particular emphasis on integrating AI, behavioral analytics, and automation into core DLP functionalities. Cloud-native architectures and SaaS models have become central to product strategy, appealing to both large enterprises and SMBs seeking agile deployment.

Strategic partnerships between cybersecurity vendors and cloud service providers are intensifying, aiming to improve interoperability and deliver end-to-end data protection. Several major players have launched AI-powered modules for real-time content classification and anomaly detection. Recent market activity also includes mergers and acquisitions intended to expand product portfolios and enter untapped regions, especially in Asia-Pacific and Latin America. Moreover, open APIs and modular DLP capabilities are being widely adopted to enhance integration with SIEM, CASB, and endpoint security platforms. This competitive intensity is encouraging rapid feature evolution and strong after-sales service differentiation, which are becoming decisive factors in vendor selection across the enterprise landscape.

Symantec (Broadcom Inc.)

Forcepoint

Digital Guardian

McAfee

Trend Micro

GTB Technologies

Cisco Systems, Inc.

Zscaler

Code42

Proofpoint, Inc.

Trellix

Spirion

Safetica

Fidelis Cybersecurity

Netskope

Technological advancements in the Data Leak Prevention (DLP) Software Market are reshaping how enterprises protect sensitive information across complex and distributed IT environments. One of the most significant trends is the integration of Artificial Intelligence (AI) and Machine Learning (ML) algorithms that enable intelligent data classification, adaptive policy enforcement, and predictive risk modeling. These capabilities allow DLP systems to assess user behavior patterns, detect anomalies in real time, and dynamically adjust data protection strategies.

The shift toward cloud-native DLP architectures is also accelerating. These platforms support seamless integration with Software-as-a-Service (SaaS) applications such as Microsoft 365, Google Workspace, and Salesforce, ensuring consistent policy implementation across cloud environments. API-based modular designs enable greater customization and interoperability with Security Information and Event Management (SIEM), Secure Web Gateways (SWG), and Cloud Access Security Brokers (CASB), making it easier for IT teams to centralize data protection strategies.

Another notable advancement is the use of Natural Language Processing (NLP) to understand the context of content being shared or stored, improving accuracy in sensitive data detection. Endpoint-level protection is evolving with the inclusion of USB activity monitoring, clipboard control, and screen capture prevention to address insider threats. Furthermore, data protection is extending into DevOps pipelines through integration with Data Loss Prevention-as-Code (DLPaaC) models that embed policies into software development lifecycles. These innovations are strengthening the foundation for enterprise-wide, policy-driven data protection, tailored for the modern digital workplace.

• In February 2023, Cisco expanded its DLP capabilities within its Secure Email platform by adding AI-based contextual detection that reduced false positives by 35%, significantly enhancing protection across cloud-based communication tools.

• In August 2023, Forcepoint launched its new cloud-native DLP solution tailored for remote and hybrid workforces, featuring behavioral analytics and zero trust integration, deployed across over 120 large enterprises within its first quarter.

• In March 2024, Proofpoint introduced adaptive DLP policies within its Information Protection suite, enabling real-time risk scoring and dynamic control adjustments, increasing deployment efficiency by 40% in large organizations.

• In May 2024, Netskope unveiled a unified DLP solution integrated with Secure Service Edge (SSE), offering granular visibility across SaaS, IaaS, and web traffic, gaining rapid adoption in multinational finance and healthcare companies.

The Data Leak Prevention (DLP) Software Market Report provides a comprehensive examination of the global landscape, covering multiple dimensions across product types, applications, deployment models, and end-user verticals. The report includes detailed analysis of core segments such as endpoint, network, and cloud-based DLP platforms, alongside innovative solutions tailored for compliance management, intellectual property protection, and insider threat mitigation. Each product segment is analyzed based on adoption trends, technological advancements, and functional capabilities. Geographically, the report spans key regions including North America, Europe, Asia-Pacific, South America, and the Middle East & Africa, with regional analysis reflecting unique regulatory requirements, digital maturity levels, and enterprise data governance needs. Particular focus is given to emerging markets with high digital transformation activity, such as India, Brazil, and the UAE.

In terms of end-user focus, the report evaluates industries like BFSI, healthcare, government, IT & telecom, and manufacturing, each with distinct data security priorities. Technology coverage includes integration with cloud platforms, AI-powered risk analysis, API-driven deployment models, and compatibility with modern hybrid work environments. This report also explores emerging opportunities such as DLP for DevOps, industry-specific policy templates, and real-time behavioral alerting. The analysis aims to equip cybersecurity strategists, IT procurement leaders, and risk management professionals with actionable insights for investment and planning across a rapidly evolving data protection landscape.

| Report Attribute/Metric | Report Details |

|---|---|

|

Market Revenue in 2024 |

USD 4921.97 Million |

|

Market Revenue in 2032 |

USD 7904.289 Million |

|

CAGR (2025 - 2032) |

6.1% |

|

Base Year |

2024 |

|

Forecast Period |

2025 - 2032 |

|

Historic Period |

2020 - 2024 |

|

Segments Covered |

By Type

By Application

By End-User

|

|

Key Report Deliverable |

Revenue Forecast, Growth Trends, Market Dynamics, Segmental Overview, Regional and Country-wise Analysis, Competition Landscape |

|

Region Covered |

North America, Europe, Asia-Pacific, South America, Middle East, Africa |

|

Key Players Analyzed |

Symantec (Broadcom Inc.), Forcepoint, Digital Guardian, McAfee, Trend Micro, GTB Technologies, Cisco Systems, Inc., Zscaler, Code42, Proofpoint, Inc., Trellix, Spirion, Safetica, Fidelis Cybersecurity, Netskope |

|

Customization & Pricing |

Available on Request (10% Customization is Free) |