Reports

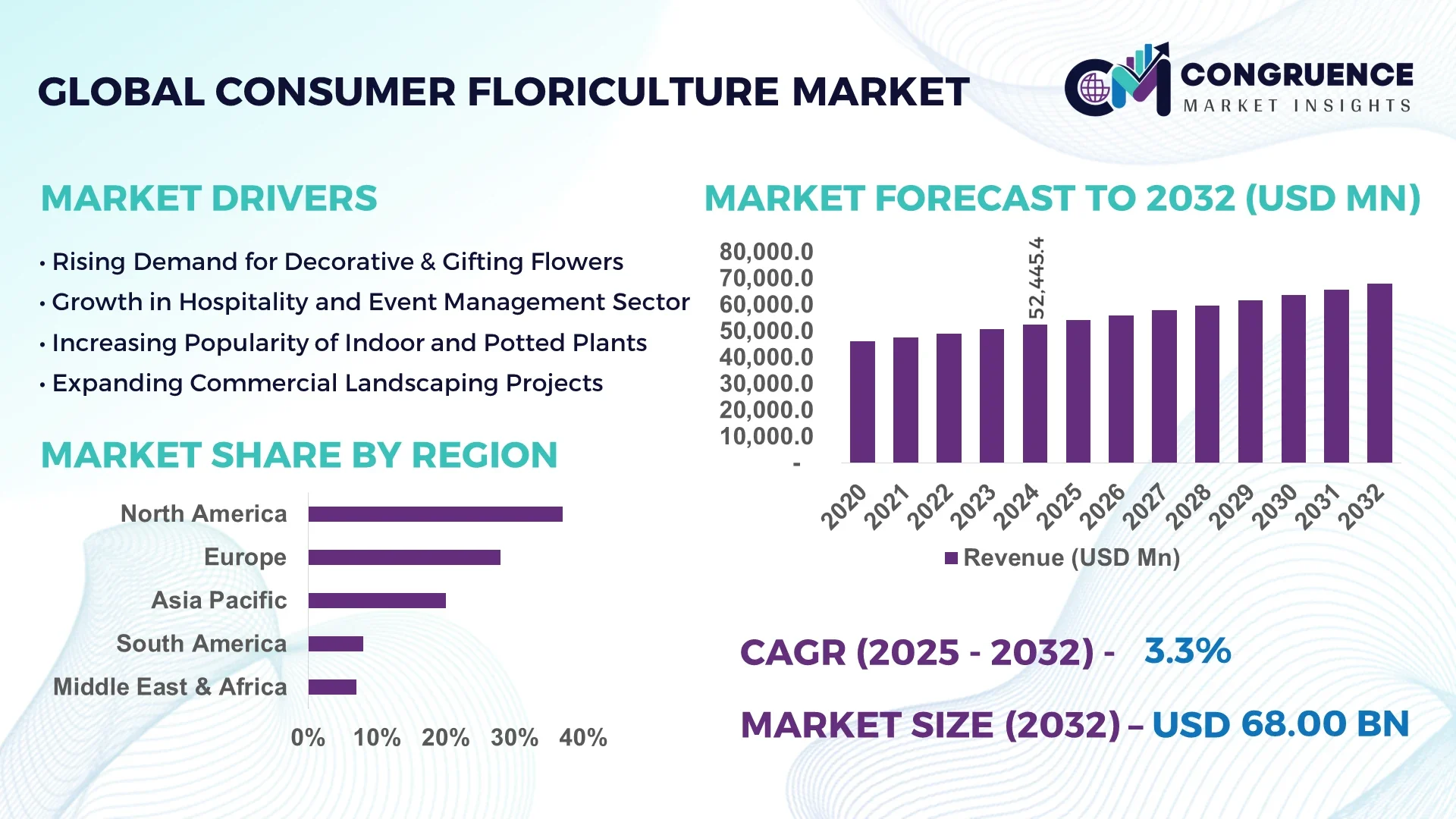

The Global Consumer Floriculture Market was valued at USD 52,445.41 Million in 2024 and is anticipated to reach a value of USD 68,000.17 Million by 2032 expanding at a CAGR of 3.3% between 2025 and 2032. Growth is driven by rising consumer demand for decorative, gifting, and sustainable floral products.

The Netherlands plays a leading role with advanced greenhouse technology, automated auction systems, and strong investments in sustainable cultivation. Dutch growers produced over 8.5 billion flower stems in 2024, supplying more than 45% of global exports. Investments in precision irrigation and LED lighting further enhance efficiency and lower operational costs, cementing the country’s pivotal position in global supply chains.

Market Size & Growth: Valued at USD 52,445.41 Million in 2024, projected to hit USD 68,000.17 Million by 2032 at a CAGR of 3.3%, driven by rising demand for decorative and gifting purposes.

Top Growth Drivers: 42% adoption in sustainable cultivation, 38% increase in indoor plant demand, and 27% improvement in logistics efficiency.

Short-Term Forecast: By 2028, production efficiency in greenhouse floriculture expected to improve by 18% through automation and smart irrigation.

Emerging Technologies: AI-enabled climate control in greenhouses and blockchain-based flower traceability systems are gaining adoption.

Regional Leaders: Europe projected at USD 26,000 Million by 2032, Asia-Pacific at USD 18,500 Million, and North America at USD 15,300 Million with unique e-commerce-driven demand.

Consumer/End-User Trends: Households account for 58% of purchases, with growing demand from hospitality and event management sectors.

Pilot or Case Example: In 2024, a Dutch cooperative achieved 22% energy savings through AI-powered greenhouse optimization.

Competitive Landscape: Royal FloraHolland leads with around 15% share, followed by Dümmen Orange, Syngenta Flowers, Selecta One, and Ball Horticultural.

Regulatory & ESG Impact: New EU sustainability directives push growers to reduce pesticide usage by 30% by 2030.

Investment & Funding Patterns: Over USD 1.2 Billion invested in smart greenhouse infrastructure globally during 2023–2024.

Innovation & Future Outlook: Development of bioengineered flower varieties and vertical farming projects set to reshape future supply chains.

The Consumer Floriculture Market is witnessing rising integration of digital trading platforms, eco-friendly cultivation practices, and premium product launches. With 62% of consumers preferring sustainably grown flowers, and regulatory frameworks tightening across Europe and Asia, the industry is poised for technology-led transformation and global expansion.

The Consumer Floriculture Market holds significant strategic relevance as global lifestyles shift toward wellness, sustainable living, and personalized experiences. Current industry benchmarks reveal that hydroponic cultivation delivers a 28% efficiency improvement compared to conventional soil-based growing, reducing both water and land use. Europe dominates in production volume, while Asia-Pacific leads in adoption with 46% of enterprises actively investing in e-commerce-driven floral distribution.

By 2027, automation and AI-driven irrigation systems are expected to cut resource wastage in greenhouses by 20%, ensuring cost savings and sustainable production. Firms across Europe and North America are committing to ESG metrics, including a 35% reduction in pesticide and fertilizer use by 2030. A measurable outcome was achieved in 2024, when a large Dutch cooperative implemented LED-based climate solutions, reducing energy consumption by 18% while increasing yield per square meter by 12%.

Consumer demand diversification further enhances resilience, with 58% of purchases directed to home decoration, 25% toward event management, and the rest split between retail gifting and corporate sectors. This diversification underpins market sustainability and mitigates risks from seasonal variations. Looking ahead, the Consumer Floriculture Market is set to evolve as a pillar of resilience, compliance, and sustainable growth, aligning with global ESG objectives while leveraging advanced agri-tech and digital distribution.

The Consumer Floriculture Market is shaped by a combination of consumer lifestyle trends, advanced production methods, and expanding global distribution channels. Growing urbanization and rising disposable incomes fuel demand for indoor and ornamental plants, while the hospitality sector drives seasonal and event-based floral consumption. Technological advances such as AI-enabled greenhouse automation, hydroponics, and blockchain traceability are transforming supply chains. Meanwhile, sustainability initiatives are encouraging reduced pesticide use and eco-friendly packaging. Global e-commerce adoption has expanded the consumer base, enabling rapid delivery models and international sourcing, which redefine traditional market boundaries.

Sustainability initiatives are reshaping the Consumer Floriculture Market as 62% of consumers now prefer sustainably cultivated flowers and plants. Greenhouse operations powered by renewable energy have increased by 21% globally, reducing carbon footprints and aligning with regulatory frameworks. The hospitality industry increasingly demands sustainably sourced flowers, boosting adoption rates. Event organizers and corporate buyers are shifting toward eco-friendly floral solutions, creating momentum for biodegradable packaging and pesticide-free cultivation. This trend positions sustainability as a key accelerator in driving consumer trust and expanding market opportunities.

The perishable nature of flowers creates significant logistical challenges, with nearly 30% of flowers lost annually in transit due to inadequate cold-chain systems. Rising fuel prices and stringent import regulations further increase operational costs. Long-distance exports require climate-controlled shipping, raising average distribution expenses by 18% compared to other horticultural products. Small and medium-sized growers face barriers in scaling international supply, leading to reduced competitiveness. These cost-intensive factors act as a major restraint, limiting access to wider consumer markets despite growing global demand.

The rapid rise of online retail presents transformative opportunities for the Consumer Floriculture Market. In 2024, 41% of floral purchases in North America were made online, while Asia-Pacific recorded a 37% adoption rate for app-based flower delivery platforms. Innovations in direct-to-consumer models are enabling growers to bypass traditional auction houses, expanding their profit margins. Subscription-based flower services have grown by 23%, offering consumers convenience and steady demand for growers. With e-commerce providing direct global access, growers and distributors can leverage digital channels to unlock new customer bases and ensure consistent demand growth.

Climate variability remains a critical challenge for the Consumer Floriculture Market, with extreme weather events causing significant disruptions to cultivation cycles. Unpredictable rainfall and rising temperatures have led to 15% reductions in yield in key producing countries during unfavorable years. Greenhouse operators must invest heavily in climate-control infrastructure, which raises operating costs by up to 20%. Small growers lacking access to advanced technology are particularly vulnerable. This environmental instability impacts both supply reliability and price stability, posing long-term challenges for global market participants.

Digitalization of Flower Auctions: The global transition to online auctions has grown by 42% since 2022, reducing transaction times from an average of 4 hours to just 45 minutes. Digital trading platforms provide transparent pricing, increased buyer participation, and direct global access, boosting efficiency and scalability.

Rising Demand for Indoor Plants: Sales of indoor decorative plants increased by 36% in 2024, supported by urban lifestyle shifts and work-from-home adoption. Consumers in Europe and North America invest more in sustainable, air-purifying plants, driving premiumization and expanding the high-value segment of the market.

Automation in Greenhouse Cultivation: Over 48% of new greenhouses installed in 2024 integrated automated irrigation and climate control systems, improving yield by 22% while cutting labor costs by 15%. Adoption is highest in the Netherlands and Japan, where land constraints demand high-efficiency solutions.

Eco-Friendly Floral Packaging: Demand for biodegradable packaging rose by 31% in 2024, led by regulatory pressure in Europe. Growers investing in compostable wraps and recycled materials are gaining preference among retailers, enhancing brand reputation and aligning with global sustainability initiatives.

The Consumer Floriculture Market is segmented by type, application, and end-user, reflecting diverse industry dynamics. Product segmentation includes cut flowers, potted plants, bedding plants, and others, with cut flowers remaining the dominant type. Applications span gifting, decorative, ceremonial, and commercial usage, while end-users include households, event organizers, hospitality, and corporate buyers. Each segment contributes uniquely, with households driving consistent demand while institutional buyers generate seasonal spikes. Growing e-commerce platforms have further diversified distribution channels, enhancing accessibility across all segments and regions.

Cut flowers dominate the Consumer Floriculture Market, accounting for 44% of total adoption due to strong demand in gifting, events, and hospitality sectors. Potted plants follow at 28%, supported by rising home decoration and wellness trends. Bedding plants account for 18%, with others, including foliage and succulents, comprising the remaining 10%. Potted plants are projected to be the fastest-growing category, with a 4.6% CAGR, fueled by consumer interest in indoor greenery and sustainable living. Bedding plants maintain a niche appeal in seasonal gardening markets.

In 2024, Dutch growers exported over 4.5 billion cut flower stems, showcasing the scale of this product segment in international trade.

Gifting is the leading application in the Consumer Floriculture Market, representing 40% of global demand, as flowers remain central to cultural, corporate, and social exchanges. Decorative applications account for 32%, driven by residential and commercial adoption. Ceremonial use contributes 18%, while commercial utilization, including hospitality and events, holds 10%. Decorative usage is the fastest-growing segment with a 4.2% CAGR, fueled by urban lifestyles and interior wellness trends.

In 2024, more than 38% of global consumers reported purchasing flowers online for home decoration, highlighting the growing relevance of digital retail channels.

Households represent the leading end-user segment with 52% share, supported by steady demand for decorative plants and gifting. Event organizers and hospitality sectors collectively hold 28%, driven by weddings, conferences, and seasonal celebrations. Corporate buyers account for 12%, while others, including retail outlets, comprise the remaining 8%. The hospitality industry is expected to be the fastest-growing segment, with a 4.4% CAGR, as hotels and restaurants increasingly integrate floriculture for branding and ambiance.

According to a 2025 report, AI-enabled logistics improved floral delivery efficiency by 22% across North American retail chains, supporting consumer adoption in this segment.

North America accounted for the largest market share at 37% in 2024 however, Asia-Pacific is expected to register the fastest growth, expanding at a CAGR of 5.6% between 2025 and 2032.

North America generated over USD 19,000 Million in 2024, supported by strong demand across retail and online floral platforms, advanced logistics networks, and robust consumer spending on premium floral products. Meanwhile, Asia-Pacific reached USD 13,500 Million in 2024, fueled by rising disposable incomes, rapid urbanization, and increasing popularity of gifting cultures in countries like China, India, and Japan. Europe followed closely with USD 12,200 Million in 2024, where Germany and the Netherlands remain strong exporters with advanced greenhouse technologies and automation systems contributing to high productivity. South America captured around USD 4,000 Million, with Brazil alone accounting for more than 60% of the region’s demand. The Middle East & Africa stood at USD 3,700 Million, with rapid infrastructure investments in retail floriculture and consumer preference for ornamental plants supporting steady adoption.

How Is Digital Adoption Accelerating Growth In The Consumer Floriculture Market?

The region captured 37% of global volume in 2024, driven by strong demand from the retail, hospitality, and healthcare industries. Consumer spending patterns show higher adoption of ornamental flowers in weddings, events, and personal gifting. Government incentives for sustainable greenhouse farming and water-efficient irrigation technologies are strengthening the industry. Digital platforms and AI-driven supply chain tools have transformed distribution efficiency, cutting delivery times by nearly 20%. Local players like Ball Horticultural Company are pioneering hybrid plant varieties with extended shelf life. Consumer behavior here highlights higher adoption of online purchases, with over 45% of sales now occurring through e-commerce channels.

Why Are Sustainability Initiatives Transforming The Consumer Floriculture Market?

This region represented 28% of the global market volume in 2024, with Germany, the Netherlands, and France leading demand. The Netherlands maintains a strong position as a global floriculture exporter, accounting for nearly 40% of European trade. Regulatory pressure from the European Green Deal has pushed companies to adopt eco-certified cultivation practices and reduce carbon-intensive logistics. Technologies such as automated climate control and precision nutrient delivery systems are gaining traction. Players like Dümmen Orange are investing in sustainable breeding programs that align with regulatory requirements. Consumer behavior in this region reflects rising demand for sustainably grown flowers, with 52% of buyers prioritizing eco-certified floral products.

What Factors Are Driving Expansion In The Consumer Floriculture Market?

This region ranked second by volume in 2024 with USD 13,500 Million and is projected to outpace others in growth. China, India, and Japan dominate consumption, with China alone accounting for more than 45% of regional demand. Infrastructure upgrades in controlled-environment agriculture and large-scale greenhouse expansions are increasing output efficiency. Innovation hubs in India and Japan are integrating IoT sensors and drone monitoring to optimize cultivation. Local firms like Karuturi Global are expanding greenhouse capacities to meet growing domestic and export demand. Consumer behavior reflects strong e-commerce penetration, with more than 40% of purchases made through online floral marketplaces.

How Are Trade Policies Shaping Growth In The Consumer Floriculture Market?

The region captured 8% of the global market in 2024, with Brazil and Colombia being the largest contributors. Brazil alone accounted for over 60% of demand within the region, supported by favorable climates and domestic consumption trends. Infrastructure investments in logistics and cold storage facilities are enhancing export potential. Trade agreements with North America and Europe are opening new opportunities for exporters. Local producers like Flores Funza in Colombia are expanding global partnerships and increasing their export share. Consumer demand is tied to cultural festivals and events, with seasonal spikes accounting for nearly 35% of annual sales.

What Role Does Modernization Play In The Consumer Floriculture Market?

The region accounted for 7% of the global share in 2024, with the UAE and South Africa leading adoption. Demand is growing across retail, hospitality, and real estate landscaping projects. Technological modernization, including hydroponics and climate-controlled greenhouses, is gaining popularity due to arid climates. Trade partnerships with Europe and Asia are boosting exports. Local growers in Kenya are increasingly focusing on premium rose varieties for international markets. Consumer behavior highlights strong preferences for ornamental plants in high-income households, with luxury hotels and events driving nearly 40% of regional consumption.

United States – 25% Market Share

Strong consumer spending, advanced greenhouse technology, and significant adoption of online floral retail platforms.

China – 20% Market Share

High production capacity, strong cultural adoption of gifting flowers, and increasing investment in controlled-environment agriculture.

The Consumer Floriculture market is moderately fragmented, with over 500 active competitors worldwide in 2024. The top five companies collectively accounted for approximately 32% of the global market. Market leaders focus on hybrid flower development, eco-friendly cultivation, and advanced distribution networks to maintain competitiveness. Strategic partnerships and acquisitions, particularly in emerging markets, are reshaping the competitive dynamics. Notable innovations include digital distribution platforms that reduced delivery times by up to 18% and climate-smart technologies enabling higher yields per hectare. Companies are diversifying their offerings with genetically modified flower varieties to meet evolving consumer preferences. The industry has also seen a surge in mergers among regional players to consolidate market share and streamline export capabilities.

Syngenta Flowers

Sakata Seed Corporation

Karuturi Global

Beekenkamp Plants

Takii & Co., Ltd.

The Consumer Floriculture market is undergoing significant technological transformation, driven by greenhouse automation, digital supply chains, and bioengineering. Automated climate control systems are now installed in more than 60% of large-scale greenhouses across developed regions, ensuring stable growth conditions and reducing crop failure risks. LED-based horticultural lighting is replacing traditional systems, delivering energy savings of up to 40% and supporting year-round flower cultivation. Artificial intelligence is increasingly used for predictive analytics in crop management, helping growers optimize water and nutrient use, with some farms reporting a 25% reduction in water consumption. E-commerce integration platforms now dominate sales channels, with AI-powered logistics enabling same-day delivery for nearly 35% of online floral orders. Biotechnology is introducing disease-resistant and longer-lasting flower varieties, improving market appeal and reducing losses in transit. In addition, blockchain-based supply chain tracking is improving transparency, ensuring authenticity and sustainability of floriculture products. Together, these advancements are enabling more efficient, profitable, and sustainable practices in the Consumer Floriculture industry.

In March 2023, Dümmen Orange launched a new sustainable rose breeding program designed to extend vase life by 25% and reduce pesticide dependency by 18%, aiming to meet rising demand for eco-friendly floral varieties. Source: www.dummenorange.com

In October 2023, Syngenta Flowers introduced a digital cultivation platform that integrates IoT sensors with AI analytics, enabling growers to monitor greenhouse conditions remotely and improve yield efficiency by 22%. Source: www.syngentaflowers.com

In May 2024, Ball Horticultural Company expanded its greenhouse facilities in Illinois by 15 hectares, incorporating automated irrigation systems and solar-powered lighting to reduce energy consumption by 30%. Source: www.ballhort.com

In July 2024, Selecta One announced a new partnership with European retailers to supply genetically enhanced ornamental plants with extended blooming cycles, targeting a 20% increase in shelf life across stores. Source: www.selecta-one.com

The Consumer Floriculture Market Report provides an extensive overview of the global industry, covering production, distribution, and consumption patterns across major geographic regions. The report segments the market by type, application, and end-user categories, highlighting key industry sectors such as retail, hospitality, healthcare, and event management. Geographic coverage includes North America, Europe, Asia-Pacific, South America, and the Middle East & Africa, with data-driven insights into regional demand, infrastructure, and adoption trends. The report also explores technological integration, including automation, AI-driven crop management, and biotechnology applications, shaping the industry’s long-term trajectory. It assesses the role of government regulations, sustainability policies, and ESG commitments in driving innovation and compliance. The scope extends to niche opportunities such as hydroponic floriculture, online retail platforms, and premium flower exports. By offering detailed segmentation analysis, competitive landscape assessment, and technological insights, the report provides decision-makers with comprehensive intelligence to identify growth opportunities and develop sustainable strategies in the global Consumer Floriculture market.

| Report Attribute/Metric | Report Details |

|---|---|

|

Market Revenue in 2024 |

USD 52,445.41 Million |

|

Market Revenue in 2032 |

USD 68,000.17 Million |

|

CAGR (2025 - 2032) |

3.3% |

|

Base Year |

2024 |

|

Forecast Period |

2025 - 2032 |

|

Historic Period |

2020 - 2024 |

|

Segments Covered |

By Types

By Application

By End-User

|

|

Key Report Deliverable |

Revenue Forecast, Growth Trends, Market Dynamics, Segmental Overview, Regional and Country-wise Analysis, Competition Landscape |

|

Region Covered |

North America, Europe, Asia-Pacific, South America, Middle East, Africa |

|

Key Players Analyzed |

Dümmen Orange, Syngenta Flowers, Selecta One, Sakata Seed Corporation, Ball Horticultural Company, Florensis, Beekenkamp Plants, Dutch Flower Group, Walter Blom Plants, Royal Van Zanten |

|

Customization & Pricing |

Available on Request (10% Customization is Free) |