Reports

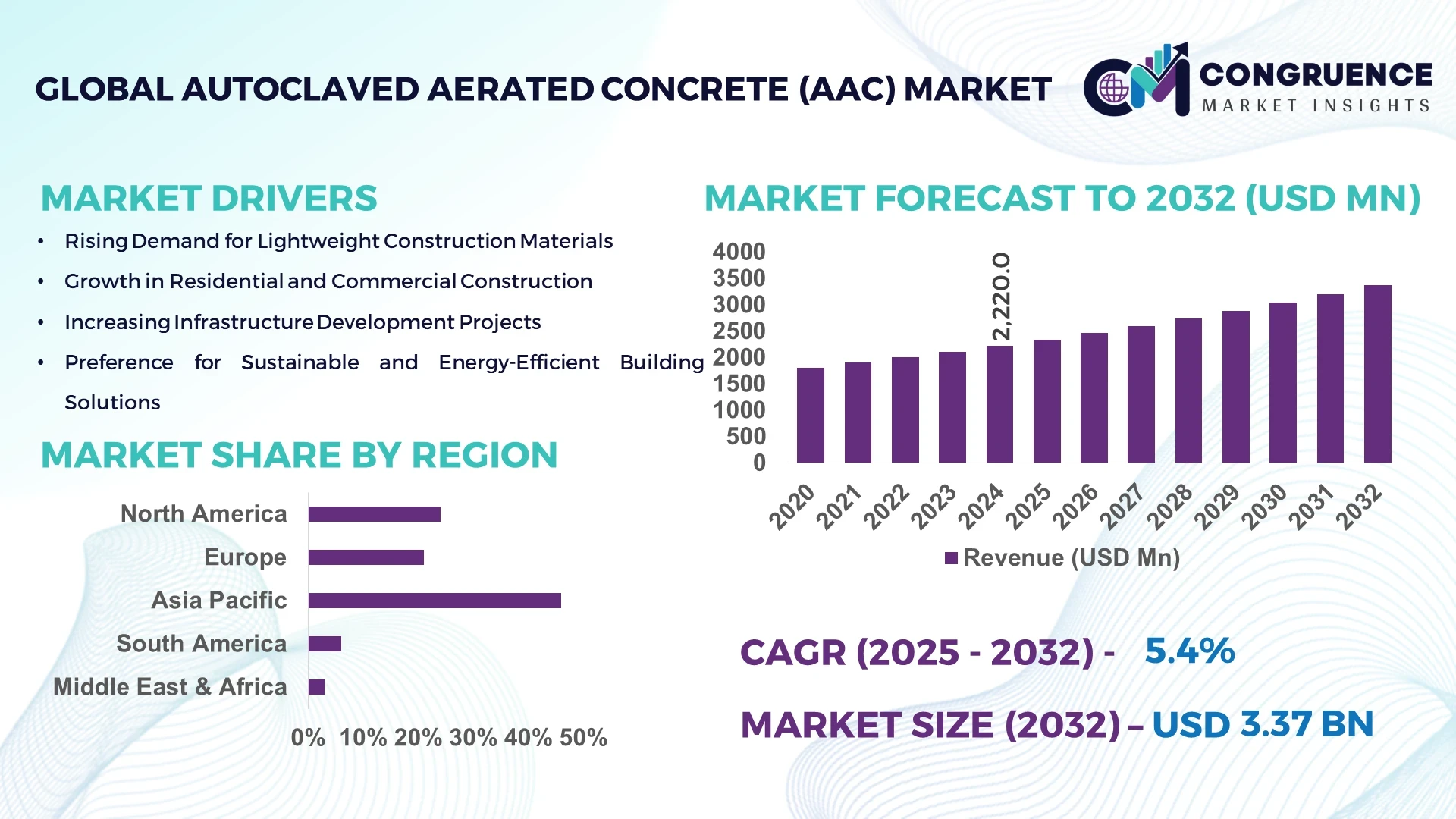

The Global Autoclaved Aerated Concrete (AAC) Market was valued at USD 2,220.0 Million in 2024 and is anticipated to reach a value of USD 3,371.0 Million by 2032 expanding at a CAGR of 5.36% between 2025 and 2032. This growth is driven by increased adoption of lightweight, energy‑efficient construction materials in both residential and commercial sectors.

In China, annual production capacity for autoclaved aerated concrete exceeds 200 million m³ across more than 2,000 manufacturing plants, and a newly commissioned plant targets 500,000 m³ per year of high‑precision panels using automated production systems. The country uses over 100 million tons of industrial solid waste (including fly‑ash) in AAC manufacturing and is advancing in high‑automation equipment and prefabricated panel applications in large‑scale housing and infrastructure programmes.

Market Size & Growth: Valued at USD 2,220 Million in 2024, projected to reach USD 3,371 Million by 2032 at a CAGR of 5.36% as demand grows for eco‑friendly and lightweight construction systems.

Top Growth Drivers: Adoption of sustainable materials (≈45 %), efficiency gains in construction processes (≈30 %), and demand for thermal‑insulated building components (≈25 %).

Short‑Term Forecast: By 2028, modular and precast AAC systems are expected to reduce wall construction cycle times by up to 33 %.

Emerging Technologies: Automated panelised AAC manufacturing lines and advanced autoclave‑curing control systems; high‑precision CNC cutting of AAC blocks.

Regional Leaders: Asia‑Pacific – projected value USD 1,650 Million by 2032 with rapid urbanisation; Europe – projected value USD 880 Million by 2032, propelled by energy‑efficiency mandates; North America – projected value USD 540 Million by 2032, driven by retrofit and green‑building adoption.

Consumer/End‑User Trends: Residential segment remains primary adopter with lightweight AAC blocks for multi‑family housing, while commercial development increasingly uses pre‑cut panels for speed and quality.

Pilot or Case Example: In 2025 a Chinese facility implemented an automated AAC panel line achieving a 22 % reduction in onsite labour and a 15 % improvement in productivity compared to traditional block production.

Competitive Landscape: Market leader holds ~18 % share; major competitors include Xella Group, H+H International A/S, Biltech Building Elements Limited and Buildmate Projects Pvt. Ltd.

Regulatory & ESG Impact: Stricter energy‑codes (e.g., ≤ 45 kWh/m² year for new buildings), incentives for low‑carbon materials, and commitments to 30 % waste‑recycling by 2030 drive AAC uptake.

Investment & Funding Patterns: Recent global investment in AAC production equipment exceeded USD 220 Million in 2024, with rising venture funding for waste‑to‑AAC technology and modular building systems.

Innovation & Future Outlook: Integration of AI‑driven quality‑control in AAC production and increased use of “smart” façade AAC panels are shaping the next phase of the market, positioning AAC as a core enabler of sustainable construction.

AAC market developments reflect increasing momentum in lightweight construction, building‑material innovation and regulatory alignment across regions. Across the construction materials landscape, AAC is now utilised in residential and commercial building wall systems (~64 % of usage), industrial roof/floor panels (~18 %) and infrastructure infill (~18 %). Recent innovations include ultra‑light density AAC (≤ 350 kg/m³) and thin‑joint panel systems, while economic drivers such as rising labour costs and environmental regulations (e.g., carbon reduction targets) are accelerating consumption in Asia and Europe. Emerging trends include modular panel adoption in North America and circular‑economy production using fly‑ash and steel‑mill slag.

The AAC market holds significant strategic relevance within the global construction ecosystem as the industry shifts toward lightweight, high‑performance, and sustainable building materials. Automated panel systems deliver up to 30 % faster installation times compared to traditional block‑and‑mortar methods, improving schedule reliability and reducing onsite labour. In Asia‑Pacific volume dominates due to large residential programmes, while Europe leads in enterprise‑level adoption with ~55 % of major developers using AAC prefabricated elements in new builds. By 2027, AI‑enabled quality monitoring in AAC production is expected to reduce defect rates by 12 % and re‑work by 18 %, enabling cost optimisation across the value chain. Firms are committing to ESG metrics such as 40 % CO₂‑emission reduction by 2030 through increased use of fly‑ash and recycled aggregate in AAC mixes. For example in 2025 the Zhejiang Yuanzhu facility in China achieved a 20 % reduction in energy consumption per m³ of AAC panels by introducing a hybrid autoclave and smart control system. Looking forward, the AAC market is positioned as a pillar of resilience, compliance and sustainable growth—integral to modern infrastructure, green‑building mandates and circular‑economy ambitions.

The AAC market is shaped by rapid urbanisation, the demand for faster‑track construction, and a transition to eco‑efficient materials that offer thermal insulation, fire resistance and reduced structural loads. Lightweight AAC blocks and panels allow designers to deliver thinner wall assemblies, optimise structural framing and meet increasingly stringent building regulations. On the supply side, manufacturers are scaling up automated production lines, enhancing quality‑control and reducing energy consumption per unit. Market dynamics are also influenced by raw‑material availability (fly‑ash, sand), logistics constraints, and regional regulatory regimes. Emerging usage in modular and prefabricated systems is expanding beyond residential into commercial and infrastructure applications. The interplay of cost‑pressures, competitiveness of traditional materials and evolving design practices will influence uptake of AAC systems across global markets.

The drive toward energy‑efficient buildings has elevated demand for AAC, as its thermal conductivity (~0.10 W/m·K) is significantly lower than traditional concrete blocks (~1.00 W/m·K), enabling thinner wall assemblies and lower HVAC loads. In regions such as China and Europe, regulatory mandates on insulation performance encourage first‑time adoption of AAC in new builds. Additionally, developers seeking fast‑track delivery are turning to AAC blocks and panels because installation and finishing time can be reduced by 25–35 %. Collectively, these factors enhance AAC’s appeal as a building material aligned with sustainability, speed and quality goals.

Despite its advantages, AAC production requires specialised autoclaving equipment, higher‑quality raw materials (e.g., fly‑ash, lime, aluminium powder) and precise curing conditions, translating into higher upfront capital cost compared to traditional bricks. In many developing regions, builder awareness remains limited, and established supply chains favour clay‑brick or conventional concrete blocks, which can cost 10–15 % less upfront. Additionally, logistic constraints—such as transporting large prefabricated AAC elements longer distances—can diminish cost savings. These factors act as impediments in price‑sensitive markets, limiting broader AAC adoption.

The rise of modular and prefabricated construction offers a significant opportunity for AAC manufacturers. Prefabricated AAC wall panels, floor slabs and roof elements align with off‑site manufacturing trends that deliver 30 % faster construction cycles and 20 % material savings. Government‑backed affordable‑housing and infrastructure programmes in emerging economies are increasingly specifying AAC for its lightweight, high‑performance credentials. Furthermore, waste‑utilisation pathways (e.g., fly‑ash from thermal‑power plants) present circular‑economy opportunities for AAC producers, enabling both cost optimisation and sustainability claims.

Expanding AAC production and adoption involves navigating diverse building codes, energy‑efficiency standards and certification regimes that vary significantly by region. For example, some jurisdictions require legacy materials certification for wall systems, delaying AAC approval. On the supply chain side, availability and quality of raw‑materials such as fly‑ash and lime can fluctuate, while autoclave equipment and skilled production workforce require investment and specialised training. These complexities introduce implementation risk, elongate pay‑back periods and impose entry barriers—particularly for new market entrants or smaller producers without integrated supply‑chains.

Modular & Prefabricated Construction Surge: The adoption of modular construction is reshaping demand dynamics in the AAC market. Research suggests that 55 % of new projects witnessed cost benefits while using modular and prefabricated practices in their projects. Pre‑bent and cut elements are prefabricated off‑site using automated machines, reducing labour needs and speeding project timelines. Demand for high‑precision machines is rising, especially in Europe and North America, where construction efficiency is critical.

Increased Use of Waste Materials in Production: In China utilization of industrial solid waste in AAC manufacturing has reached approximately 100 million tons, with 48 % of raw‑material feedstock derived from by‑products like fly‑ash and slag, underscoring a move toward circular‑economy production and lowering input costs.

Advanced Automation and Digital Control Systems: New generation AAC plants are delivering productivity gains of 18‑22 % through AI‑driven monitoring of mixing, cutting and autoclave parameters. Automated cutting machines and robotics are increasingly common in high‑capacity lines, particularly in Asia‑Pacific and Europe.

Regulatory and Sustainability Focus: Governments across major markets are tightening building‑envelope energy codes, with some regions targeting 30 % lower embodied carbon by 2030. AAC’s lightweight nature and thermal insulation credentials position it well to meet such requirements, and its adoption in certified green‑building projects is increasing by a reported 24 % year‑on‑year.

The Autoclaved Aerated Concrete (AAC) Market is segmented by type, application, and end-user to provide a comprehensive understanding of demand dynamics. By type, AAC products range from blocks and panels to wall systems designed for lightweight, energy-efficient construction. Applications span residential, commercial, and infrastructure projects, reflecting growing adoption of prefabricated and modular building solutions. End-users include construction companies, real estate developers, and public infrastructure agencies, with residential projects driving initial uptake while commercial and industrial segments are rapidly incorporating AAC for sustainability and efficiency. Regional variations in adoption, regulatory mandates, and technological deployment shape the segmentation landscape, influencing investment strategies and production capacities globally. Advanced production processes, including automated cutting and autoclave curing, further differentiate product types and applications, making segmentation analysis critical for strategic decision-making.

AAC products are primarily available as blocks, panels, and wall systems. Blocks lead the market with approximately 55% share, due to their versatility, ease of installation, and compatibility with various construction projects. Panels are the fastest-growing type, driven by the rise of prefabricated and modular construction, enabling faster project completion and improved on-site efficiency, capturing significant attention from large-scale commercial projects. Wall systems and other niche products account for the remaining 25% combined, catering to specialized structural or architectural requirements.

Residential construction is the leading application segment with a 60% adoption share, primarily due to demand for energy-efficient, lightweight walls and ease of integration with modern building techniques. Infrastructure projects, particularly public housing and commercial complexes, are the fastest-growing application, supported by urbanization trends and modular construction adoption. Other applications, including industrial facilities and renovation projects, account for a combined 25% share. In 2024, more than 38% of developers in Asia reported piloting AAC-based modular systems in residential projects to reduce material waste and improve project timelines.

Construction companies dominate the AAC end-user segment, holding approximately 58% market share, leveraging AAC for residential and commercial projects to achieve structural efficiency and sustainability targets. Real estate developers represent the fastest-growing end-user segment, driven by urban residential expansion and demand for rapid, modular construction, currently accounting for notable adoption gains. Other end-users, including public sector infrastructure agencies and industrial facility developers, contribute a combined 27% share, adopting AAC for efficiency, fire resistance, and thermal insulation. In 2024, over 42% of developers in Europe tested prefabricated AAC wall systems for commercial applications, reporting a 20% reduction in construction cycles.

Asia-Pacific accounted for the largest market share at 46% in 2024; however, North America is expected to register the fastest growth, expanding at a CAGR of 5.8% between 2025 and 2032.

In 2024, Asia-Pacific consumed approximately 1,020 million m³ of AAC products, with China alone producing over 700 million m³. Key countries such as India and Japan collectively contributed 250 million m³, driven by large-scale residential and commercial construction projects. Technological advancements like automated panel lines and prefabricated wall systems are reshaping adoption patterns. North America and Europe are increasingly integrating digital design and quality control systems, while regulatory mandates in thermal insulation and low-carbon building materials influence procurement decisions, ensuring that adoption trends vary regionally.

North America holds approximately 24% of the global AAC market, with adoption primarily in residential and commercial construction. Key industries driving demand include healthcare, education, and commercial infrastructure. Regulatory frameworks supporting energy-efficient buildings have accelerated AAC adoption, alongside digital transformation trends in prefabrication and automated cutting systems. Local players like Buildmate Projects are introducing AI-enabled quality control in panel production, reducing material waste by 15%. Regional consumer behavior favors higher enterprise adoption in healthcare and finance sectors, leveraging lightweight, thermally insulated wall systems to optimize operational efficiency.

Europe accounted for 21% of the global AAC market in 2024, with Germany, the UK, and France as the top-consuming countries. Regulatory pressure through energy-efficiency mandates and sustainability initiatives encourages the adoption of AAC panels and blocks. Emerging technologies, such as automated CNC cutting and digital autoclave monitoring, are enhancing production efficiency. Local player H+H International is investing in prefabricated wall systems to meet low-carbon building standards. European consumer behavior reflects strong compliance with environmental regulations, leading developers to integrate high-performance AAC solutions into new residential and commercial projects.

Asia-Pacific is the largest market for AAC, accounting for 46% of global consumption in 2024. Top consuming countries include China, India, and Japan, with China producing over 700 million m³. Rapid urbanization and large-scale infrastructure projects are driving demand, alongside high-volume manufacturing trends. Technological innovation hubs in China and India are introducing automated panel production lines, AI-enabled quality monitoring, and prefabricated wall systems. Local companies are expanding capacity to supply residential and commercial construction. Regional consumer behavior shows preference for modular and prefabricated solutions, reducing construction time and operational costs.

South America accounted for approximately 6% of the global AAC market in 2024, with Brazil and Argentina as key contributors. Increasing investments in infrastructure and energy-efficient commercial buildings are driving demand. Government incentives promoting low-carbon construction materials are influencing procurement choices. Local players, including Biltech Building Elements, are focusing on supplying prefabricated panels to urban residential projects. Consumer behavior shows growing awareness of thermal insulation benefits and the use of lightweight AAC blocks in multi-story residential construction.

Middle East & Africa accounted for 3% of the global AAC market in 2024, with UAE and South Africa leading adoption. Rapid urban construction, oil & gas infrastructure projects, and industrial developments are driving regional demand. Technological modernization in manufacturing, including automated cutting and advanced curing systems, is improving product quality. Local companies are investing in energy-efficient production and prefabricated panels. Regional consumer behavior reflects preference for durable, fire-resistant, and thermally insulated building materials, particularly in commercial and high-end residential sectors.

China - 32% Market Share: High production capacity with over 700 million m³ produced annually.

India - 14% Market Share: Strong end-user demand in residential and commercial construction projects.

The global Autoclaved Aerated Concrete (AAC) market exhibits a moderately consolidated structure, with an estimated 60‑75 active global competitors spanning manufacturers of AAC blocks, panels, plant‑machinery suppliers and regional construction material firms. The combined share of the top five companies is approximately 38‑42% of the total market, reflecting that while a few large players hold significant scale, multiple regional and local entities continue to influence supply and innovation. Key participants are advancing product launches, plant‑capacity expansions and strategic partnerships; for example, manufacturing license models or joint‑ventures to service emerging markets. Innovation trends influencing competition include fully automated production lines, integration of digital quality‑control systems in AAC plants, and expansion of recycled‑content product versions with lower embodied carbon. Some firms are entering modular building systems, offering reinforced AAC panels for structural wall applications. The competitive environment is further shaped by acquisitions of smaller suppliers, upgrade of existing plants to meet stricter energy‑efficiency standards and geographic expansion into high‑growth regions. Decision‑makers in the AAC value chain must evaluate firms based not only on raw production capacity but on deployment of smart manufacturing, supply‑chain resilience, differentiated product portfolios (blocks + panels + thin‑joint systems) and regulatory compliance strategies (e.g., carbon‑emissions commitments). This competitive set ensures that market entry involves significant capital investment and technical know‑how, favouring those with scale, innovation platform and cost‑efficiencies.

Aircrete Europe

UltraTech Cement Ltd.

Solbet Sp. z o.o.

Manufacturing and product‑technology play a critical role in the AAC market and present significant strategic implications. Modern AAC production lines employ fully automated mixing, cutting and autoclave modules, reducing manual labour by up to 30% and improving dimensional precision to ±2 mm. Reinforced AAC panels with embedded steel or mesh are now being produced in several plants; for example, large‑size panels in Poland incorporate reinforcing frames and automated handling systems to deliver structural wall assemblies rather than simple masonry blocks. Digital factory platforms are increasingly embedded: manufacturing execution systems (MES) monitor steam‑curing pressure, mix ratio and block shrinkage in real time, enabling defect rates to be halved. Another technology trend is circular‑economy materials integration: firms are processing recycled AAC waste into feed‑stock or integrating higher percentages of fly‑ash (up to 45%) to reduce raw‑material costs and lower CO₂ emissions per cubic metre. On the product side, the shift from blocks to panelised systems supports modular construction. Prefabricated AAC floor and roof elements integrate mechanical‑fastening systems and digital logistics tagging, cutting onsite labour by roughly 25–35%. In the area of product performance, innovations aim for densities below 350 kg/m³ while retaining compressive strength of ~3.6 N/mm², enabling wall thickness reduction and structural steel savings. Emerging technologies include automated scanning of finished AAC elements for dimensional verification and augmented‑reality support for installation crews. For strategic decision‑makers, these technology trends mean that firms investing in smart production assets, digitalised operations and recycling loops will be better positioned to capture premium segments (green‑building, modular, infrastructure) and lower lifetime cost of ownership for customers.

In March 2025, Xella Group announced a 6.6% reduction in scope 1 and 2 CO₂e emissions compared to the prior year, alongside a 46% decrease in AAC‑related leftovers sent to landfill. Source: www.ritzau.dk

In June 2024, H+H UK Limited published an updated Environmental Product Declaration (EPD) for its standard‑grade AAC blocks, citing an average gross dry density of 600 kg/m³ and a cradle‑to‑gate GWP‑fossil value of ~188 kg CO₂e per m³. Source: www.hhcelcon.co.uk

In March 2024, Xella’s targets to reduce scope 1‑3 carbon emissions were approved by the Science Based Targets Initiative (SBTi), formalising its roadmap for low‑CO₂ AAC building materials. Source: www.sttinfo.fi

In April 2024, India’s Maharashtra Housing & Area Development Authority (MHADA) approved AAC blocks under its “approved product list” for civil works, formally recognising AAC as a building material for social housing and infrastructure applications.

This report offers a comprehensive examination of the AAC market, covering worldwide geographic regions (North America, Europe, Asia‑Pacific, South America, Middle East & Africa), product types (blocks, panels, floor/roof elements, lintels and cladding), applications (residential, commercial, industrial, infrastructure), and end‑user segments (construction contractors, real‑estate developers, public‑infrastructure agencies). In addition, the report analyses production technologies (autoclave curing, automated cutting, reinforcement integration), raw‑material inputs (fly‑ash, lime, sand, aluminium powder) and sustainability drivers (waste‑utilisation, circular‑economy design, energy efficiency). A focus is placed on modular construction systems, thin‑joint AAC wall systems and panelised prefabrication, which represent emerging niches.

The report also maps regional supply‑chain dynamics—including plant capacity expansion, licensing models, investment in automation and regulatory drivers (green building codes, fire‑resistance requirements) —and presents competitive profiles of the major global producers. Decision‑makers will find actionable intelligence on growth‑hotspots, technology‑upgrade pathways, product innovation strategies and aligned ESG imperatives for selecting partners, evaluating investments, and aligning construction‑material strategies with sustainability imperatives.

| Report Attribute / Metric | Details |

|---|---|

| Market Revenue (2024) | USD 2,220.0 Million |

| Market Revenue (2032) | USD 3,371.0 Million |

| CAGR (2025–2032) | 5.36% |

| Base Year | 2024 |

| Forecast Period | 2025–2032 |

| Historic Period | 2020–2024 |

| Segments Covered |

By Type

By Application

By End-User Insights

|

| Key Report Deliverables | Revenue Forecast, Market Trends, Growth Drivers & Restraints, Technology Insights, Segmentation Analysis, Regional Insights, Competitive Landscape, Recent Developments |

| Regions Covered | North America, Europe, Asia-Pacific, South America, Middle East & Africa |

| Key Players Analyzed | Xella Group, H+H International A/S, Biltech Building Elements Limited, Aircrete Europe, UltraTech Cement Ltd., Solbet Sp. z o.o. |

| Customization & Pricing | Available on Request (10% Customization is Free) |