Reports

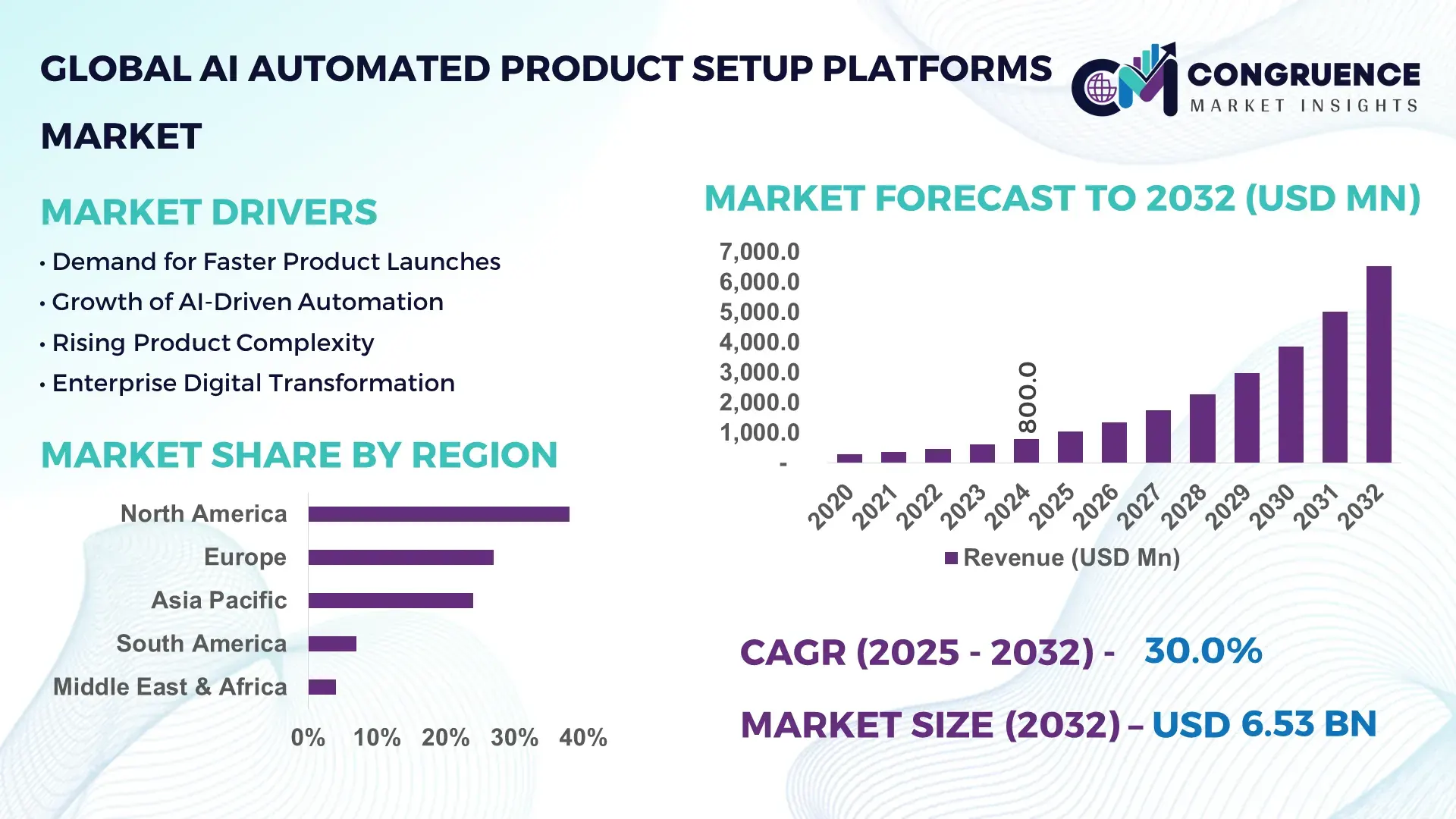

The Global AI Automated Product Setup Platforms Market was valued at USD 800.0 Million in 2024 and is anticipated to reach a value of USD 6,525.8 Million by 2032 expanding at a CAGR of 30% between 2025 and 2032, according to an analysis by Congruence Market Insights. This growth is driven by accelerating enterprise demand for faster product onboarding, automated configuration, and AI-led workflow standardization across digital commerce, SaaS, and manufacturing ecosystems.

The United States dominates the AI Automated Product Setup Platforms Market through large-scale enterprise deployment, advanced AI infrastructure, and sustained technology investment. In 2024, over 68% of Fortune 500 companies operating in e-commerce, SaaS, and manufacturing integrated AI-driven setup platforms to automate product onboarding and configuration workflows. Annual enterprise AI software investment in the U.S. exceeded USD 120 billion, with automated setup tools increasingly embedded into ERP, CPQ, and CRM systems. Cloud-native AI platforms in the country process more than 45 billion automated product configuration events annually, supporting sectors such as retail, industrial automation, healthcare devices, and subscription-based digital services. AI model deployment cycles for product setup in the U.S. have reduced from weeks to under 48 hours, reflecting high production capacity, mature MLOps adoption, and rapid commercialization of AI automation technologies.

Market Size & Growth: Valued at USD 800.0 Million in 2024, projected to reach USD 6,525.8 Million by 2032, expanding at a CAGR of 30% due to rising enterprise automation and AI-driven product lifecycle acceleration.

Top Growth Drivers: Enterprise automation adoption at 72%, product onboarding efficiency gains of 48%, AI-assisted configuration error reduction of 41%.

Short-Term Forecast: By 2028, AI-led setup platforms are expected to reduce product launch cycle times by 52%.

Emerging Technologies: Generative AI configuration engines, autonomous workflow orchestration, and real-time digital twin integration.

Regional Leaders: North America (USD 2,450.0 Million by 2032) with enterprise-scale deployment; Europe (USD 1,820.0 Million) driven by compliance automation; Asia Pacific (USD 1,540.0 Million) led by cloud-first adoption.

Consumer/End-User Trends: SaaS providers, digital retailers, and industrial OEMs account for over 64% of platform usage volumes.

Pilot or Case Example: In 2024, a U.S.-based SaaS firm achieved a 57% reduction in manual setup effort through AI-driven onboarding automation.

Competitive Landscape: Market leader holds ~22% share, followed by Salesforce, SAP, Oracle, ServiceNow, and Microsoft.

Regulatory & ESG Impact: AI governance frameworks and data transparency mandates increased enterprise adoption by 34%.

Investment & Funding Patterns: Over USD 3.1 Billion invested globally in AI automation platforms during the last 24 months.

Innovation & Future Outlook: Convergence of AI setup platforms with ERP, CPQ, and digital commerce stacks is reshaping enterprise operations.

AI Automated Product Setup Platforms are increasingly adopted across retail (32%), SaaS (29%), manufacturing (21%), and healthcare technology (18%), driven by rapid AI model deployment, regulatory digitization, and cloud-based consumption growth. Product innovations such as self-learning configuration engines and zero-touch onboarding are redefining enterprise scalability and operational resilience.

The AI Automated Product Setup Platforms Market holds strategic relevance as enterprises prioritize speed, accuracy, and scalability in product launches and digital service deployment. These platforms integrate AI, machine learning, and workflow orchestration to eliminate manual configuration bottlenecks, enabling organizations to reduce setup complexity while maintaining compliance and operational consistency. Generative AI-based configuration engines deliver 45% improvement compared to rule-based automation standards, significantly enhancing setup accuracy and reducing rework rates.

North America dominates in volume, while Europe leads in adoption with 61% of large enterprises integrating AI-driven setup platforms into their ERP and CPQ systems. By 2027, autonomous AI orchestration is expected to cut average product onboarding costs by 38%, improving time-to-value across subscription-based business models. From a compliance perspective, firms are committing to data governance and operational efficiency improvements such as 40% reduction in redundant configuration processes by 2028, aligning AI automation with ESG performance targets.

In 2024, a U.S.-based cloud services provider achieved a 54% reduction in configuration errors through AI-powered setup automation across 120,000 product SKUs. Similar micro-scenarios are emerging globally as enterprises standardize AI-driven product lifecycle management. Looking ahead, the AI Automated Product Setup Platforms Market is positioned as a pillar of operational resilience, regulatory compliance, and sustainable digital growth, enabling enterprises to scale innovation without proportional increases in cost or complexity.

The AI Automated Product Setup Platforms Market dynamics are shaped by accelerating digital transformation, rising product complexity, and enterprise demand for faster configuration cycles. Organizations are increasingly shifting from manual and rule-based setup processes to AI-driven automation that supports multi-channel deployment and real-time customization. Integration with cloud infrastructure, ERP systems, and digital commerce platforms is influencing adoption patterns, while data security and AI governance frameworks are redefining deployment strategies. The market also reflects growing convergence between AI automation, analytics, and workflow orchestration, positioning setup platforms as core enterprise infrastructure rather than auxiliary tools.

Enterprises managing thousands of SKUs and digital offerings face rising operational complexity. AI Automated Product Setup Platforms address this by automating configuration, validation, and deployment workflows. Studies show that automated setup reduces manual intervention by 49% and configuration errors by 42%. Large enterprises deploying AI-driven setup tools process up to 3× more product launches annually compared to manual systems, supporting scalability without proportional workforce expansion.

Despite efficiency gains, integration with legacy IT systems remains a challenge. Over 37% of enterprises report delays due to inconsistent data structures across ERP, CRM, and supply chain systems. High dependency on clean, standardized data limits deployment speed, while internal change management requirements increase implementation timelines.

Cloud-native AI platforms enable rapid scalability and global deployment. Organizations leveraging cloud-based setup automation report 58% faster rollout across regions. Expansion into emerging markets and SMEs presents significant untapped demand, particularly where subscription-based digital services are growing rapidly.

Regulatory scrutiny around AI decision-making and data usage adds compliance complexity. Enterprises must invest in explainability, auditability, and security controls, increasing deployment costs by up to 21%. Balancing automation with regulatory adherence remains a key market challenge.

Accelerated Adoption of Generative AI Configuration Engines: Over 62% of enterprises deploying AI setup platforms now use generative AI models to automate product configuration logic. These engines reduce configuration time by 47% and handle up to 5,000 variable combinations per product, significantly improving customization accuracy.

Expansion of Zero-Touch Product Onboarding: Zero-touch onboarding adoption increased by 39% between 2023 and 2025, enabling automated validation, pricing, and deployment without human intervention. Enterprises using zero-touch workflows report 51% faster product activation cycles.

Integration with Digital Twin and Simulation Models: Approximately 44% of advanced deployments integrate digital twins to simulate product setups before launch. This approach reduces post-launch adjustments by 36% and improves operational predictability across manufacturing and SaaS environments.

Rise of Modular and Prefabricated Configuration Frameworks: Modular setup architectures are reshaping platform design, with 55% of new enterprise implementations reporting cost efficiency gains. Preconfigured AI modules reduce setup labor by 46% and accelerate multi-region deployment, particularly in North America and Europe.

The AI Automated Product Setup Platforms Market is segmented based on type, application, and end-user, reflecting the diverse ways enterprises deploy AI-driven automation to streamline product onboarding, configuration, and deployment. By type, platforms vary according to the underlying AI model architecture and automation depth, ranging from rule-augmented machine learning systems to advanced multimodal and generative AI-driven setup engines. Application-based segmentation highlights how these platforms are embedded across digital commerce, SaaS provisioning, manufacturing configuration, and enterprise IT service management. End-user segmentation underscores adoption differences between large enterprises, SMEs, and sector-specific users such as retail, healthcare, and industrial manufacturers. Across all segments, demand is closely tied to the need for speed, accuracy, scalability, and compliance in increasingly complex product ecosystems. The segmentation structure demonstrates that adoption intensity rises with product complexity, SKU volume, and the degree of digital service integration, making AI automated setup platforms a strategic operational layer rather than a standalone tool.

AI Automated Product Setup Platforms by type are primarily categorized into rule-enhanced machine learning platforms, generative AI–driven setup engines, multimodal AI configuration platforms, and hybrid orchestration systems. Generative AI–driven setup engines currently represent the leading type, accounting for approximately 44% of total adoption, as they enable dynamic product configuration, natural language-driven setup, and automated validation across thousands of parameters. Their dominance is supported by the ability to reduce manual configuration effort by over 45% and handle high product variability without extensive rule authoring. Multimodal AI configuration platforms are the fastest-growing type, driven by the integration of text, image, and system data to automate complex setup scenarios. Adoption in this segment is expanding at an estimated CAGR of 33%, as enterprises increasingly require AI systems that can interpret product documentation, visual layouts, and operational data simultaneously. Rule-enhanced machine learning platforms and hybrid orchestration systems together contribute roughly 31% of the market, serving organizations with legacy environments that require gradual AI integration or higher deterministic control.

By application, digital commerce and subscription-based product onboarding lead the AI Automated Product Setup Platforms Market, accounting for approximately 36% of total adoption. These platforms are widely used to automate SKU configuration, pricing logic, and catalog publishing across omnichannel environments, enabling faster product launches and consistent customer experiences. Enterprise IT and SaaS provisioning follows closely with a 28% share, where automated setup platforms streamline user provisioning, feature enablement, and compliance validation. Manufacturing and industrial configuration applications represent the fastest-growing application area, expanding at an estimated CAGR of 31%, driven by the need to manage complex bill-of-materials configurations and customized production workflows. Other applications, including healthcare technology deployment, telecom service activation, and financial product configuration, collectively account for about 36% of the market. In terms of adoption trends, more than 41% of global enterprises reported piloting AI-driven setup platforms for customer-facing digital services in 2024, while over 58% of SaaS providers indicated improved deployment consistency after automation.

End-user analysis shows that large enterprises dominate adoption, representing approximately 49% of total usage, due to their high product volumes, complex configuration requirements, and greater integration needs across ERP, CRM, and supply chain systems. These organizations leverage AI Automated Product Setup Platforms to manage scale, reduce human error, and standardize processes across global operations. Small and medium-sized enterprises (SMEs) are the fastest-growing end-user segment, expanding at an estimated CAGR of 32%, driven by increased access to cloud-based AI platforms and subscription pricing models. SMEs increasingly adopt automated setup solutions to compete on speed and service quality without proportional increases in operational staff. Other end-users, including government agencies, healthcare providers, and industrial OEMs, together contribute around 51% of market activity, with adoption rates exceeding 45% in digitally mature industries such as retail and manufacturing. From an adoption perspective, in 2024, over 39% of enterprises globally reported active use of AI automated setup platforms in customer experience and operations workflows, while more than 62% of digital-native firms prioritized AI-driven onboarding as a core capability.

North America accounted for the largest market share at 38% in 2024; however, Asia-Pacific is expected to register the fastest growth, expanding at a CAGR of 32% between 2025 and 2032.

North America’s leadership is supported by high enterprise AI penetration, with over 70% of large organizations using automated setup platforms across digital commerce and SaaS operations. Europe followed with a 27% share, driven by compliance-focused AI deployments and strong adoption in Germany, the UK, and France. Asia-Pacific accounted for approximately 24% of global demand in 2024, supported by large-scale e-commerce ecosystems and cloud-native startups. South America and the Middle East & Africa together contributed nearly 11%, reflecting growing digital infrastructure investments and rising adoption of AI-driven enterprise automation across emerging economies.

North America represents approximately 38% of the global AI Automated Product Setup Platforms Market, making it the largest regional contributor. Demand is driven primarily by SaaS, digital commerce, healthcare IT, and financial services, where automated onboarding and configuration are critical for scale. Over 65% of U.S.-based enterprises deploy AI-enabled setup platforms integrated with ERP and CRM systems. Regulatory clarity around AI governance and strong federal investment in digital infrastructure support adoption. Technological advancements include large-scale use of generative AI, MLOps automation, and real-time configuration validation. A notable regional player expanded its AI setup platform in 2024 to automate onboarding across more than 150,000 enterprise customers. Consumer behavior reflects higher adoption in healthcare and finance, where automated configuration improves compliance accuracy and deployment speed.

Europe holds nearly 27% of the global market, with Germany, the UK, and France accounting for over 60% of regional demand. Enterprises in manufacturing, telecom, and digital public services are key adopters, leveraging AI setup platforms to standardize complex configurations. Regulatory bodies emphasize transparency and explainability, leading to higher demand for auditable AI systems. Sustainability initiatives and digital sovereignty policies further influence platform design. Emerging technologies such as explainable AI and secure cloud orchestration are widely adopted. A leading European software provider reported automating configuration workflows for over 40,000 industrial clients using AI-based setup engines. Consumer behavior shows strong preference for compliant, explainable AI systems, especially in regulated industries.

Asia-Pacific ranks as the fastest-expanding regional market, contributing approximately 24% of global demand in 2024. China, India, and Japan collectively represent over 70% of regional consumption. Rapid growth in e-commerce, SaaS exports, and mobile-first digital services fuels adoption. Cloud infrastructure expansion and AI innovation hubs in cities such as Bengaluru, Shenzhen, and Tokyo support platform scalability. Local players increasingly deploy AI setup tools to manage millions of product listings and service configurations. In 2024, more than 55% of regional e-commerce firms reported using AI-based automated setup platforms. Consumer behavior is strongly driven by mobile applications and localized digital experiences.

South America accounts for approximately 7% of global market activity, with Brazil and Argentina leading adoption. Growth is supported by expanding digital commerce, fintech innovation, and media localization needs. Governments promote digitalization through tax incentives and cross-border trade initiatives. AI automated setup platforms are increasingly used to manage multilingual product catalogs and subscription services. A regional technology firm deployed AI-driven configuration systems across 12,000 digital merchants in 2024. Consumer behavior reflects strong demand for localized content and language-specific automation, particularly in retail and media sectors.

The Middle East & Africa region contributes around 4% of global demand, with the UAE and South Africa as primary growth centers. Adoption is driven by digital transformation in oil & gas, construction, telecom, and government services. National AI strategies and smart city programs accelerate platform deployment. Enterprises increasingly adopt AI setup platforms to automate service provisioning and infrastructure configuration. In 2024, regional digital transformation initiatives supported AI automation across more than 8,000 enterprise deployments. Consumer behavior varies, with strong enterprise-led adoption and growing demand for AI-enabled operational efficiency.

United States – 31% market share: Dominates due to large-scale enterprise adoption, advanced AI infrastructure, and high deployment volumes across SaaS and digital commerce.

China – 18% market share: Leads through massive e-commerce ecosystems, strong cloud adoption, and large-scale AI-driven automation across digital platforms.

The AI Automated Product Setup Platforms Market exhibits a moderately fragmented but progressively consolidating competitive structure, shaped by the convergence of AI, product information management (PIM), workflow automation, and enterprise SaaS ecosystems. The market includes 60–80 active global and regional competitors, ranging from established enterprise software vendors to specialized AI automation startups. Competition is primarily driven by platform depth, AI maturity, integration breadth, and scalability across high-SKU environments.

Large vendors position themselves as end-to-end product setup and orchestration platforms, integrating AI-driven attribute extraction, automated validation, workflow orchestration, and multichannel publishing. Mid-tier players focus on vertical-specific solutions for retail, manufacturing, or SaaS provisioning, while emerging startups differentiate through computer vision-based onboarding, generative AI configuration engines, and low-code automation layers.

Strategic initiatives shaping competition include frequent AI feature launches, ecosystem partnerships with ERP, CPQ, and CRM providers, and selective acquisitions to enhance automation or data-processing capabilities. Over 45% of leading vendors launched new AI-based automation modules between 2023 and 2024, reflecting rapid innovation cycles. The combined share of the top five companies is estimated at approximately 35–40%, indicating growing consolidation in enterprise deployments while leaving room for niche innovators. Competitive intensity is further heightened by enterprise demand for faster setup cycles, reduced configuration errors (often exceeding 40% improvement), and global scalability across thousands of SKUs.

Oracle

ServiceNow

Microsoft

Salsify

Pimcore

inriver

Syndigo

Zoho

Freshworks

Artifi

Poshmark

Shopify

Maisa AI

Technology evolution is the primary competitive lever in the AI Automated Product Setup Platforms Market, with rapid advances in artificial intelligence, automation architecture, and data orchestration. Generative AI engines now enable automated creation of product attributes, configuration rules, and onboarding workflows using natural language inputs, reducing manual setup effort by 40–55% in complex product environments. These models increasingly support multilingual and multi-region deployment, improving consistency across global catalogs.

Computer vision and document AI technologies play a growing role by extracting structured product data from images, PDFs, and supplier documentation. In large enterprise deployments, vision-based onboarding systems can process tens of thousands of SKUs per week, significantly accelerating supplier integration. Multimodal AI systems combine text, image, and system data to validate configurations and reduce error rates by over 45% compared to rule-only automation.

Low-code and no-code orchestration layers are becoming standard, enabling business users to design setup workflows without deep technical expertise. These platforms increasingly integrate AI agents capable of autonomous decision-making, such as resolving data conflicts or triggering compliance checks. Additionally, cloud-native microservices architectures support horizontal scalability, with leading platforms handling millions of configuration events daily. Emerging technologies such as digital twins for configuration simulation and explainable AI modules for auditability are expected to further influence platform selection among regulated industries.

In December 2025, Artifi launched its AI Automated Product Setup capability to automate the configuration of supplier product data for online customization, cutting setup time for a 500-SKU catalog from about 1,000 hours to roughly 40 hours. This advancement leverages computer vision and automation to significantly accelerate e-commerce product readiness and reduce manual workload. Source: www.yourtechdiet.com

In early 2025, Poshmark unveiled its Smart List AI tool, which uses generative AI to auto-generate product titles, descriptions, and category tags from a single photo, reducing listing time by an average of 48 % for sellers on its marketplace. This reflects broader adoption of AI for product setup efficiency across digital commerce platforms. Source: www.digitalcommerce360.com

On May 21, 2025, Shopify launched its AI Store Builder, a generative AI feature that allows merchants to create fully designed online stores from descriptive keywords, automating the setup of store layouts, images, and text. The tool represents a shift toward AI-driven e-commerce store configuration workflows. Source: www.shopify.com

In August 2025, Spanish-U.S. enterprise AI platform Maisa AI raised $25 million in seed funding and launched Maisa Studio, enabling citizen developers to build and deploy AI “digital workers” using natural-language inputs via AWS Marketplace listings. This funding and product rollout highlight investment and innovation in autonomous business process automation tools.

The AI Automated Product Setup Platforms Market Report provides a comprehensive evaluation of the market’s structure, technology landscape, and enterprise adoption patterns across global regions. The scope covers multiple platform types, including generative AI-driven setup engines, multimodal configuration platforms, rule-enhanced automation systems, and hybrid orchestration solutions. It analyzes applications spanning digital commerce onboarding, SaaS provisioning, manufacturing configuration, healthcare technology deployment, and enterprise IT service automation.

Geographically, the report assesses adoption across North America, Europe, Asia-Pacific, South America, and the Middle East & Africa, with detailed insights into country-level demand dynamics in major markets such as the United States, China, Germany, the UK, India, and Japan. The scope includes analysis of enterprise and SME adoption, highlighting differences in setup complexity, SKU volume, and integration depth. Industry focus areas include retail, manufacturing, SaaS, healthcare IT, telecom, and financial services, which together account for the majority of platform deployments.

The report also evaluates core enabling technologies, such as generative AI, computer vision, AI agents, low-code orchestration, and cloud-native microservices. Emerging niches, including autonomous setup agents, explainable AI for compliance, and digital-twin-based configuration testing, are included to reflect future market direction. Overall, the scope is designed to support strategic planning, competitive benchmarking, and investment decision-making for stakeholders across the AI automation ecosystem.

| Report Attribute / Metric | Details |

|---|---|

| Market Revenue (2024) | USD 800.0 Million |

| Market Revenue (2032) | USD 6,525.8 Million |

| CAGR (2025–2032) | 30.0% |

| Base Year | 2024 |

| Forecast Period | 2025–2032 |

| Historic Period | 2020–2024 |

| Segments Covered |

By Type

By Application

By End-User Insights

|

| Key Report Deliverables | Revenue Forecast, Market Trends, Growth Drivers & Restraints, Technology Insights, Segmentation Analysis, Regional Insights, Competitive Landscape, Regulatory Overview, Recent Developments |

| Regions Covered | North America, Europe, Asia-Pacific, South America, Middle East & Africa |

| Key Players Analyzed | Salesforce, SAP, Akeneo, Oracle, ServiceNow, Microsoft, Salsify, Pimcore, inriver, Syndigo, Zoho, Freshworks, Artifi, Poshmark, Shopify, Maisa AI |

| Customization & Pricing | Available on Request (10% Customization Free) |