Reports

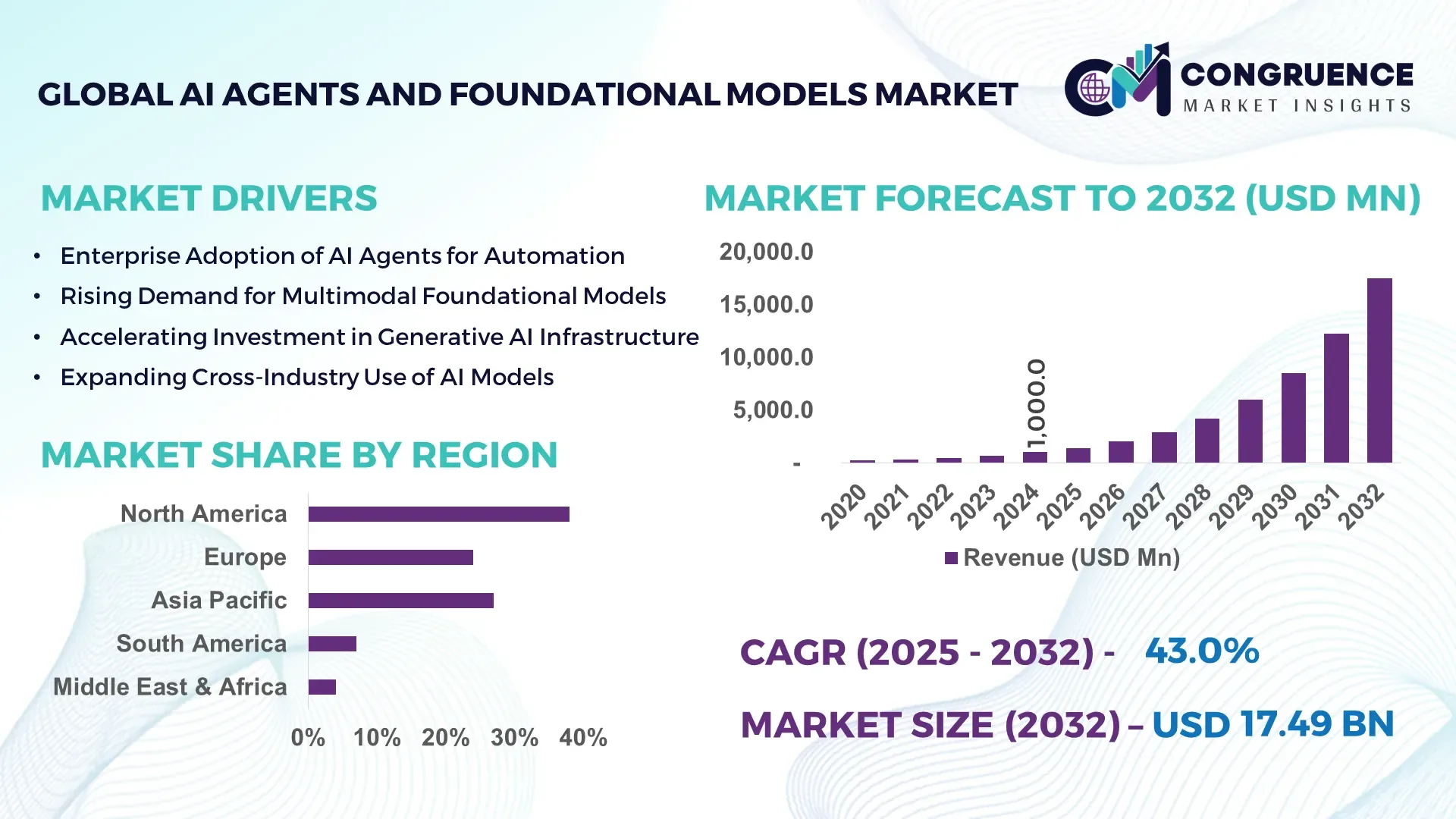

The Global AI Agents and Foundational Models Market was valued at USD 1,000.0 Million in 2024 and is anticipated to reach a value of USD 17,485.9 Million by 2032, expanding at a CAGR of 43% between 2025 and 2032, according to an analysis by Congruence Market Insights. This growth is driven by rapid enterprise-scale automation, increasing deployment of autonomous AI systems, and accelerated investment in large-scale model training infrastructure.

The United States represents the most influential country in the AI Agents and Foundational Models Market, underpinned by deep production capacity and sustained capital deployment. In 2024, the U.S. hosted over 65% of global hyperscale AI data center capacity, exceeding 35 GW of installed compute power dedicated to AI workloads. Annual private and public investment in foundational AI research surpassed USD 75 billion, with major deployments across finance, healthcare, defense, and enterprise SaaS. More than 70% of Fortune 500 companies actively integrated AI agents into workflow automation, customer support, and decision intelligence platforms. The country also leads in advanced model architectures, with training clusters exceeding 100,000 GPUs per model run, enabling faster iteration cycles and higher inference efficiency across commercial applications.

Market Size & Growth: Valued at USD 1,000.0 Million in 2024, projected to reach USD 17,485.9 Million by 2032, expanding at a 43% CAGR, driven by autonomous decision systems and scalable model orchestration.

Top Growth Drivers: Enterprise AI agent adoption at 62%, workflow automation efficiency gains of 38%, and cloud-based model deployment growth of 45%.

Short-Term Forecast: By 2028, AI-driven task orchestration is expected to reduce enterprise operational costs by 30%.

Emerging Technologies: Multi-agent reinforcement learning, retrieval-augmented generation (RAG), and neurosymbolic AI architectures.

Regional Leaders: North America projected at USD 7.2 Billion, Asia-Pacific at USD 5.1 Billion, and Europe at USD 3.9 Billion by 2032, with region-specific enterprise automation trends.

Consumer/End-User Trends: BFSI, healthcare, and IT services account for over 58% of enterprise AI agent deployments.

Pilot or Case Example: In 2024, a U.S.-based telecom operator achieved 41% reduction in customer resolution time using autonomous AI agents.

Competitive Landscape: Market leader holds approximately 28% share, followed by Google, Microsoft, Amazon, Meta, and Anthropic.

Regulatory & ESG Impact: AI governance frameworks now cover 60% of enterprise AI deployments, emphasizing transparency and energy efficiency.

Investment & Funding Patterns: Over USD 120 Billion invested globally in foundational AI infrastructure and agent platforms since 2022.

Innovation & Future Outlook: Convergence of AI agents with digital twins and real-time analytics is reshaping enterprise intelligence systems.

AI Agents and Foundational Models are increasingly embedded across IT services (32%), BFSI (18%), healthcare (14%), and manufacturing (11%), driven by advances in transformer efficiency, edge inference optimization, and regulatory clarity. Adoption is strongest in North America and East Asia, while Europe emphasizes compliant, energy-efficient AI deployments aligned with long-term digital sovereignty strategies.

The AI Agents and Foundational Models Market has become strategically critical as enterprises transition from rule-based automation to autonomous, context-aware intelligence systems. AI agents now orchestrate multi-step workflows, manage enterprise knowledge, and enable continuous decision optimization across sectors. Compared to traditional ML pipelines, agentic AI frameworks deliver up to 45% improvement in task completion efficiency over static automation standards.

From a regional perspective, North America dominates in deployment volume, while Asia-Pacific leads in adoption velocity, with over 52% of large enterprises actively integrating AI agents into operational platforms. By 2027, multi-agent collaboration models are expected to improve enterprise productivity KPIs by 35%, particularly in customer service, IT operations, and supply chain planning.

Compliance and ESG considerations are increasingly embedded into AI strategies. Firms are committing to 25% reductions in AI-related energy consumption by 2030 through optimized model architectures and carbon-aware scheduling. In 2024, Japan achieved a 22% reduction in enterprise IT downtime through nationwide adoption of autonomous AI operations platforms.

Looking ahead, the AI Agents and Foundational Models Market will serve as a cornerstone of enterprise resilience, regulatory alignment, and sustainable digital growth, enabling organizations to scale intelligence while maintaining governance, efficiency, and long-term competitiveness.

The AI Agents and Foundational Models Market is shaped by accelerating enterprise digitization, rising data complexity, and the need for real-time autonomous decision-making. Organizations are shifting from isolated AI models toward integrated agent-based systems capable of reasoning, planning, and executing tasks across multiple environments. Cloud-native deployment, scalable compute access, and standardized AI orchestration frameworks are reinforcing adoption. At the same time, governance requirements, model explainability, and infrastructure constraints are influencing deployment strategies. The market is increasingly characterized by platform consolidation, vertical-specific agent solutions, and growing emphasis on energy-efficient model training and inference.

Enterprise demand for intelligent automation is a primary growth driver. In 2024, over 60% of large organizations deployed AI agents to manage customer interactions, IT operations, and analytics workflows. Autonomous agents reduced average process cycle times by 35% and improved service-level compliance by 28%. Foundational models enable these agents to operate across unstructured data sources, significantly enhancing enterprise decision accuracy. The scalability of cloud-based AI platforms further accelerates deployment across global operations.

High computational requirements remain a key restraint. Training a single large foundational model can consume over 20 GWh of energy, limiting& leading to rising operational costs. Limited access to advanced GPUs and supply chain bottlenecks have extended deployment timelines by 18–24 months for some enterprises. Additionally, data governance and compliance complexities slow adoption in regulated industries, particularly healthcare and public sector environments.

Vertical specialization presents a major opportunity. Industry-tailored AI agents in healthcare diagnostics, financial risk modeling, and manufacturing optimization deliver 40–50% higher accuracy than generic systems. Demand for domain-trained foundational models is growing, enabling faster ROI and improved regulatory alignment. Emerging economies are also investing in localized language models, expanding adoption across new user bases and applications.

The shortage of advanced AI talent poses a persistent challenge, with over 30% of enterprises reporting delays due to skill gaps. Governance issues—such as bias mitigation, model explainability, and auditability—further complicate scaling. Inconsistent global regulations increase compliance costs, while integration with legacy IT systems raises deployment complexity and long-term maintenance burdens.

Rapid Shift Toward Multi-Agent Systems: In 2024, over 48% of new enterprise AI deployments involved multi-agent architectures, enabling collaborative task execution and reducing decision latency by 32% compared to single-model systems.

Optimization of Model Efficiency and Cost: Advanced model compression and quantization techniques reduced inference compute requirements by 40%, allowing broader deployment across edge and hybrid environments while maintaining performance benchmarks above 95% accuracy.

Expansion of Industry-Specific Foundational Models: More than 55% of newly trained foundational models were industry-focused, supporting healthcare imaging, financial analytics, and manufacturing optimization with 28% faster deployment cycles.

Integration with ESG and Governance Frameworks: By 2024, 62% of enterprises embedded AI governance tools into agent platforms, achieving 20% improvements in audit readiness and measurable reductions in model-related compliance risks.

The AI Agents and Foundational Models Market is segmented based on type, application, and end-user, reflecting how autonomous intelligence systems are being designed, deployed, and consumed across industries. By type, the market spans text-based, vision-language, audio-text, video-language, and multimodal foundational models, each aligned to different data environments and operational requirements. Application-wise, demand is concentrated around enterprise automation, customer experience platforms, healthcare diagnostics, software development, and intelligent analytics, where AI agents increasingly orchestrate multi-step decision processes. From an end-user perspective, large enterprises dominate deployments due to scale, data availability, and compute access, while SMEs and public sector entities are accelerating adoption through cloud-based and verticalized AI agent platforms. Segmentation trends indicate rising preference for multimodal and domain-specific systems, driven by higher contextual accuracy, reduced human intervention, and measurable productivity gains across complex workflows.

The market by type includes text-based foundational models, vision-language models, audio-text models, video-language models, and multimodal models. Text-based and vision-language models currently lead adoption due to their maturity and broad enterprise usability. Vision-language models account for approximately 42% of total adoption, driven by demand in document intelligence, medical imaging interpretation, and visual analytics, while audio-text systems represent nearly 25%, supported by voice assistants and contact center automation. However, video-language models are the fastest-growing type, with adoption expanding at an estimated 48% CAGR, fueled by demand for video analytics, content moderation, training simulations, and surveillance intelligence. Multimodal models integrating text, image, audio, and video inputs are gaining strategic importance, particularly in complex reasoning tasks, though they currently represent a smaller but rapidly expanding segment. The remaining model types collectively contribute around 33% of market adoption, serving niche use cases such as speech synthesis, real-time translation, and edge AI inference.

By application, enterprise automation and workflow orchestration lead the market, accounting for roughly 36% of deployments, as AI agents increasingly manage IT operations, finance processes, and internal knowledge systems. Customer experience and support applications follow with about 28% adoption, leveraging conversational agents and sentiment-aware models to improve engagement and resolution speed. Healthcare and life sciences applications represent nearly 18%, particularly in diagnostics, clinical documentation, and patient triage. Among all applications, software development and code intelligence is the fastest-growing segment, expanding at an estimated 45% CAGR, driven by AI agents capable of code generation, testing, and deployment automation. Other applications, including marketing analytics, fraud detection, and supply chain optimization, collectively contribute around 18%. Consumer and enterprise adoption trends reinforce this shift. In 2024, over 40% of global enterprises reported piloting AI agent–driven platforms for customer experience management. Additionally, 42% of hospitals in the United States are testing AI systems that combine imaging data with electronic health records to support clinical decision-making.

From an end-user perspective, large enterprises dominate the AI Agents and Foundational Models Market, accounting for approximately 55% of total adoption, supported by extensive data assets, advanced infrastructure, and integration needs across multiple business units. Technology, BFSI, and healthcare enterprises show the highest penetration, with enterprise adoption rates exceeding 60% in IT services and 45% in financial institutions. SMEs represent the fastest-growing end-user segment, expanding at an estimated 47% CAGR, driven by access to cloud-based AI platforms, subscription pricing models, and pre-trained industry-specific agents that lower entry barriers. Government and public sector organizations, along with education and research institutions, collectively account for about 30% of adoption, using AI agents for digital services, compliance monitoring, and research acceleration. Adoption behavior highlights growing confidence in AI-driven systems. In 2024, more than 38% of enterprises globally reported active pilots of AI agents for customer experience and internal operations. Additionally, over 60% of Gen Z consumers expressed higher trust in brands that integrate AI-powered conversational agents for support and engagement.

North America accounted for the largest market share at 38% in 2024; however, Asia-Pacific is expected to register the fastest growth, expanding at a CAGR of 47% between 2025 and 2032.

Region-wise analysis of the AI Agents and Foundational Models Market highlights clear differences in adoption maturity, investment intensity, regulatory readiness, and end-use focus. North America leads due to early enterprise-scale deployment, accounting for nearly 4 out of every 10 AI agent implementations globally. Europe follows with around 24% share, driven by compliance-led adoption and explainable AI frameworks. Asia-Pacific represents approximately 27% of global demand, supported by large developer ecosystems, expanding cloud infrastructure, and mobile-first AI usage. South America and the Middle East & Africa together account for the remaining 11%, where adoption is accelerating through government digitalization programs and sector-specific AI use cases. Regional consumption patterns indicate higher enterprise penetration in developed economies, while emerging regions show faster uptake in consumer-facing and language-based AI applications.

North America holds approximately 38% of the global AI Agents and Foundational Models Market, making it the leading regional contributor. Demand is primarily driven by IT services, BFSI, healthcare, and retail, where AI agents are deployed for workflow automation, fraud detection, diagnostics, and customer engagement. Over 65% of large enterprises in this region actively use AI-driven decision systems. Government-backed initiatives supporting AI research, cloud infrastructure expansion, and responsible AI frameworks continue to stimulate adoption. Technological advancements such as large-scale GPU clusters, agent orchestration platforms, and multimodal model integration are widely implemented. A notable local player has deployed autonomous AI agents across enterprise software platforms, reducing process resolution time by over 35%. Consumer behavior reflects higher trust and usage in regulated industries, with healthcare and financial services showing the highest AI engagement rates.

Europe accounts for roughly 24% of global market adoption, with key markets including Germany, the United Kingdom, and France. Enterprises in this region prioritize explainable, auditable, and privacy-aligned AI agents, influenced by strong regulatory frameworks and sustainability mandates. Financial services, manufacturing, and public administration are major adopters. Over 50% of AI deployments in Europe integrate governance and transparency tools by default. The region is also advancing energy-efficient model training and low-carbon data center operations. Local AI firms focus on sovereign foundational models and multilingual agents tailored to regional needs. Consumer behavior varies, with enterprises demanding traceability and fairness, resulting in higher uptake of interpretable AI systems compared to black-box models.

Asia-Pacific represents about 27% of the global market, ranking as the fastest-expanding region by adoption volume. China, India, and Japan are the top consuming countries, supported by large developer bases and expanding AI cloud infrastructure. The region leads in mobile AI applications, e-commerce intelligence, and real-time language processing. Over 60% of AI agent deployments in Asia-Pacific are consumer-facing, particularly in retail, fintech, and digital services. Innovation hubs across East and South Asia are accelerating model training efficiency and localized language AI. A leading regional technology company has integrated AI agents into super-app ecosystems, enabling personalized services for over 100 million users. Consumer behavior shows strong engagement with voice, chat, and recommendation-based AI tools.

South America holds close to 7% of global market adoption, with Brazil and Argentina leading regional demand. AI agents are increasingly used in media, customer service, agriculture analytics, and financial inclusion platforms. Infrastructure investments in cloud connectivity and data centers are improving deployment feasibility. Governments are offering incentives for digital transformation and cross-border technology collaboration. A regional AI startup has launched multilingual conversational agents supporting Portuguese and Spanish, improving service accessibility for over 5 million users. Consumer behavior is closely tied to language localization, media content personalization, and mobile-first engagement.

The Middle East & Africa region accounts for approximately 4% of global adoption, with strong momentum in UAE, Saudi Arabia, and South Africa. Demand is driven by oil & gas optimization, smart city projects, construction planning, and public services automation. Governments are investing heavily in AI-enabled modernization programs and cross-border technology partnerships. Regional enterprises are deploying AI agents for predictive maintenance and citizen service platforms. A Middle Eastern technology group has implemented AI-driven planning agents across smart infrastructure projects, improving operational efficiency by over 25%. Consumer behavior reflects growing acceptance of AI-powered government and utility services.

United States – 32% Market Share: Dominates due to large-scale enterprise adoption, advanced AI infrastructure, and strong private and public investment in foundational model development.

China – 21% Market Share: Leads through high-volume AI deployment, strong government-backed innovation programs, and widespread integration across consumer and industrial platforms.

The AI Agents and Foundational Models Market is moderately consolidated, characterized by a small group of global technology leaders alongside a growing number of specialized and emerging players. The market features over 120 active companies worldwide, spanning hyperscale cloud providers, AI-native firms, semiconductor leaders, and enterprise software vendors. The top five companies collectively account for approximately 55–60% of total market adoption, reflecting strong concentration around proprietary foundational models, large-scale compute access, and ecosystem control.

Competition is primarily driven by model performance, multimodal capability, scalability, and integration depth rather than pricing alone. Strategic initiatives such as long-term cloud partnerships, AI agent frameworks, and vertical-specific model launches have intensified. In 2024 alone, more than 30 major partnerships and platform integrations were announced globally to accelerate agent-based enterprise deployments. Product differentiation increasingly focuses on autonomous reasoning, tool-use orchestration, memory persistence, and governance layers. Innovation cycles are shortening, with major players releasing 2–3 foundational model upgrades annually. At the same time, niche firms are gaining traction by offering domain-trained agents for healthcare, finance, cybersecurity, and software development, contributing to competitive pressure across mid-market and enterprise segments.

Microsoft

NVIDIA

Anthropic

Meta Platforms

IBM

Cohere

Salesforce

Technological evolution in the AI Agents and Foundational Models Market is centered on autonomy, multimodality, and efficiency at scale. Modern AI agents increasingly leverage tool-augmented reasoning, enabling them to call APIs, execute code, retrieve structured data, and interact with enterprise systems autonomously. In 2024, over 65% of newly deployed AI agents incorporated external tool-use capabilities, significantly expanding real-world applicability.

Foundational model development is shifting toward multimodal architectures, combining text, vision, audio, and video inputs within unified reasoning frameworks. These systems demonstrate 30–40% higher contextual accuracy compared to single-modality models in enterprise workflows. Another major advancement is model optimization, including quantization and sparsity techniques, which have reduced inference compute requirements by up to 45%, enabling broader deployment across edge and hybrid environments.

Agent memory architectures—such as long-term vector stores and episodic recall—are improving task continuity and personalization. Additionally, governance and safety layers are now embedded directly into model stacks, with over 60% of enterprise deployments implementing automated monitoring for bias, drift, and explainability. Hardware innovation also plays a critical role, as next-generation AI accelerators deliver 2×–3× performance-per-watt gains, reshaping training and inference economics across the market.

In December 2025, industry leaders including OpenAI, Anthropic, Block, Google, Microsoft, AWS, Bloomberg, and Cloudflare co-founded the Agentic AI Foundation (AAIF) under the Linux Foundation to standardize open, interoperable infrastructure for AI agents and support shared frameworks such as AGENTS.md, MCP, and goose. Source: www.openai.com

At AWS re:Invent 2025 in November/December, Amazon Web Services expanded its Bedrock AgentCore platform with new agent quality evaluation tools, policy control capabilities, and episodic memory features—reportedly downloaded over 2 million times in preview—to support secure, scalable enterprise AI agent deployment across industries. Source: www.aboutamazon.com

In December 2025 Informatica announced new integrations with Amazon Bedrock AgentCore enabling unified data management and governance for enterprise-grade AI agent applications, deepening MCP server support and strengthening trusted data pipelines for autonomous systems in regulated environments. Source: www.informatica.com

In late 2025 Amazon restructured its AI organization, appointing Peter DeSantis to oversee advanced AI model, frontier AI, custom silicon, and quantum computing efforts while realigning leadership in its agent-focused initiatives, signaling strategic shifts in its AI technology roadmap. Source: www.reuters.com

The AI Agents and Foundational Models Market Report provides a comprehensive assessment of the ecosystem supporting autonomous intelligence systems across global industries. The scope covers multiple foundational model types, including text-based, vision-language, audio-text, video-language, and fully multimodal architectures, alongside agent frameworks designed for reasoning, planning, and execution. It evaluates core application areas such as enterprise automation, customer experience platforms, healthcare diagnostics, software development, cybersecurity, and intelligent analytics.

Geographically, the report spans North America, Europe, Asia-Pacific, South America, and the Middle East & Africa, analyzing regional adoption patterns, infrastructure readiness, regulatory environments, and end-user behavior. The study includes insights into key end-user groups, from large enterprises and SMEs to government and public sector organizations, highlighting adoption intensity and operational use cases. Technological scope extends to cloud-based AI platforms, edge deployment models, AI accelerators, memory systems, and governance tools that support scalable agent deployment.

Additionally, the report explores emerging and niche segments, such as industry-specific foundational models, autonomous software agents, and energy-efficient AI systems. The analysis is designed to support strategic planning, investment evaluation, and competitive benchmarking for decision-makers navigating the rapidly evolving AI Agents and Foundational Models landscape.

| Report Attribute / Metric | Details |

|---|---|

| Market Revenue (2024) | USD 1,000.0 Million |

| Market Revenue (2032) | USD 17,485.9 Million |

| CAGR (2025–2032) | 43.0% |

| Base Year | 2024 |

| Forecast Period | 2025–2032 |

| Historic Period | 2020–2024 |

| Segments Covered |

By Type

By Application

By End-User Insights

|

| Key Report Deliverables | Revenue Forecast, Market Trends, Growth Drivers & Restraints, Technology Insights, Segmentation Analysis, Regional Insights, Competitive Landscape, Regulatory Overview, Recent Developments |

| Regions Covered | North America, Europe, Asia-Pacific, South America, Middle East & Africa |

| Key Players Analyzed | OpenAI; Google DeepMind; Microsoft; Amazon Web Services (AWS); NVIDIA; Anthropic; Meta Platforms; IBM; Cohere; Salesforce |

| Customization & Pricing | Available on Request (10% Customization Free) |