Reports

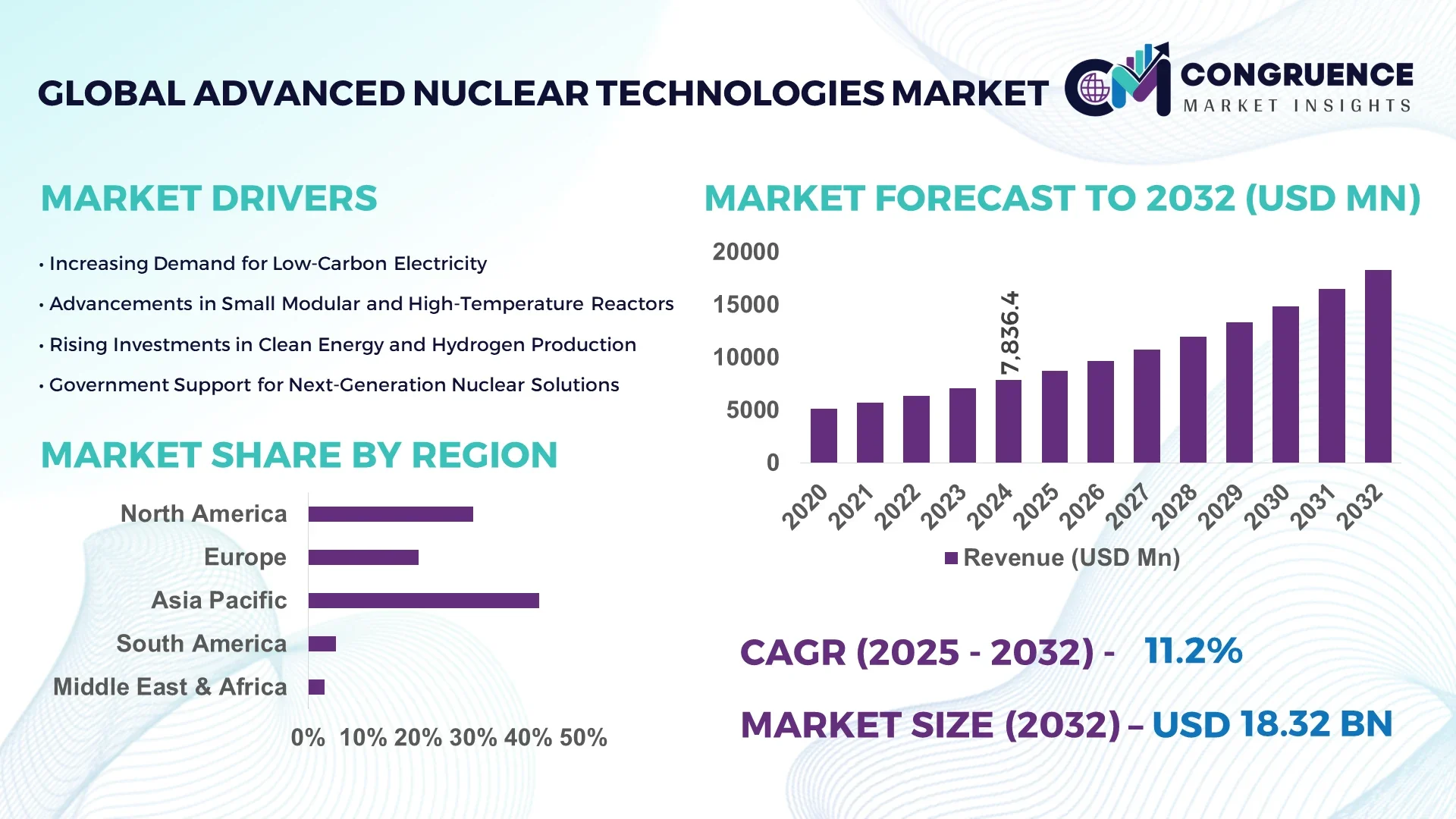

The Global Advanced Nuclear Technologies Market was valued at USD 7,836.4 Million in 2024 and is anticipated to reach a value of USD 18,321.2 Million by 2032 expanding at a CAGR of 11.2% between 2025 and 2032. This projected growth is fueled by rising demand for clean baseload power and intensified clean energy investments.

In China, the advanced nuclear technologies market is accelerated by state-led deployment: by end-2024 China had 58 operating nuclear power plants with installed capacity exceeding 60.8 GW, plus 27 units under construction totaling over 32.3 GW of capacity. China’s investment in high-temperature gas-cooled reactors and fast neutron reactor prototypes supports domestic plus export projects, with utility adoption rates exceeding 35 % in its industrial hubs and regional provinces.

Market Size & Growth: USD 7,836.4 M in 2024 rising toward USD 18,321.2 M by 2032, propelled by energy security and decarbonization.

Top Growth Drivers: Clean energy demand (~42 %), modular deployment efficiency gains (~28 %), and regulatory incentives (~20 %).

Short-Term Forecast: By 2028, Levelized Cost of Energy (LCOE) for SMRs may decline by 22 %, and construction time may shorten by 18 %.

Emerging Technologies: Small modular reactors (SMRs), high-temperature gas reactors, molten salt systems, advanced fuel cycles.

Regional Leaders: Asia-Pacific projected ~USD 5,400 M by 2032 with China pushing SMRs, North America ~USD 6,200 M via new builds, Europe ~USD 3,500 M via retrofits and advanced reactors.

Consumer/End-User Trends: Utilities, data centers, industrial heat applications are early adopters of advanced nuclear systems.

Pilot or Case Example: In 2025, a U.S. demonstration SMR project reduced commissioning time by 15 % and improved thermal output stability by 8 %.

Competitive Landscape: The market leader controls ~20 % share; other major players include TerraPower, NuScale, X-Energy, Rolls-Royce, and Mitsubishi.

Regulatory & ESG Impact: Government mandates for net-zero, carbon pricing, and incentives like tax credits push nuclear uptake.

Investment & Funding Patterns: Over USD 4 billion in recent advanced nuclear funding rounds; growing public-private partnerships and export credit mechanisms.

Innovation & Future Outlook: Co-location with data centers, integrated hydrogen production, advanced fuel recycling, and hybrid energy systems shape future trajectories.

Advanced nuclear technologies serve power utilities, industrial heat, district energy, and hydrogen production sectors. Innovations in modular reactor design, accident-tolerant fuels, digital twin modeling, and remote monitoring drive differentiated growth. Regional consumption leans heavily on China, U.S., and Western Europe, with emerging markets in Latin America and Middle East exploring pilot deployments. The trend is toward hybrid systems combining nuclear with renewables and hydrogen in integrated energy ecosystems.

Advanced nuclear technologies are strategically critical for nations aiming to decarbonize baseload supply while also enabling industrial heat and hydrogen production. SMR technologies deliver 15 % improvement compared to conventional large reactors in deployment flexibility and modular scalability. In Asia-Pacific, volume deployment dominates in new builds, while Europe leads adoption in retrofitting and regulatory alignment, with over 30 % of utility firms evaluating advanced reactors by 2027. By 2027, digital twin and AI-assisted reactor commissioning is expected to reduce project time overruns by 20 %. Energy firms are committing to ESG metrics, such as 25 % reduction in lifecycle carbon and improved waste recycling by 2030. In 2024, a Chinese demonstration project achieved a 10 % increase in thermal efficiency via advanced coolant design. The Advanced Nuclear Technologies Market is emerging as a pillar of resilient, compliant, and sustainable growth in global energy systems.

The advanced nuclear technologies market is influenced by intersecting trends: decarbonization mandates, energy security needs, modular manufacturing, advanced materials, digitalization, and policy support. Utilities seek dispatchable clean power to complement intermittent renewables. Governments are accelerating licensing, offering incentives, and forming international nuclear export strategies. On the supply side, modular reactor designs reduce capital risk, and digital modeling supports faster design validation. Partnerships between reactor developers, material science firms, and software platforms fuel innovation. Demand is also rising from non-electrical uses such as industrial heat, desalination, and hydrogen production. The competitive thesis hinges on delivering reliable, safe, and scalable reactors under tighter timelines and budgets.

Modular reactor design enables prefabrication of reactor modules off-site, reducing field assembly hours and complexity. This approach allows economies of scale in factory production and shortens onsite work by up to 25 %. The modular design supports flexibility in capacity expansion and reduces financial risk for utilities. For advanced nuclear, modular architectures support rapid iteration, reuse of standard components, and streamlined supply chains, directly enhancing deployment speed and lowering per-unit costs.

Advanced nuclear technologies face stringent licensing regimes, extended review periods, and public scrutiny over safety, waste, and environmental impact. Regulatory bodies demand comprehensive validation, probabilistic safety assessments, and long-term waste management solutions. Public acceptance remains cautious in certain markets, requiring extensive outreach and trust building. High capital costs and institutional barriers deter entry in developing regions, and grid integration challenges for new reactors in existing systems pose additional friction.

There is opportunity in leveraging advanced nuclear to supply industrial high-temperature heat, hydrogen production, and desalination. Many heavy industries now seek electrification alternatives; advanced reactors can deliver 400-600 °C process heat for chemical and metallurgy sectors. Co-located nuclear + hydrogen plants can optimize capital deployment. Export markets in decarbonizing economies offer new deployment corridors. Integration with grid and off-grid hybrid systems further expands addressable markets beyond electricity.

Advanced nuclear deployments require large upfront capital, complex long lead-time components, and supply chain maturity often lacking in nascent markets. Fabrication of reactor vessels, high-performance materials, and nuclear-grade components demands strict quality control. Delays or cost overruns in early projects erode investor confidence. Scaling beyond demonstration plants to fleet deployment challenges component standardization, demand assumptions, and financing models. Ensuring consistent supply chain resilience and multi-tier vendor validation is critical but difficult in emerging sectors.

• Increased SMR Deployment by Utilities: More than 35 % of new advanced nuclear projects now involve SMRs linked to grid or industrial sites. Utilities are commissioning modular reactors to manage demand growth and replace aging fleet. SMR projects are reported to cut 18 % in construction time via modular scheduling.

• Integration with Data Center Energy Demand: Over 20 data center operators are evaluating nuclear co-generation models; some early contracts propose 200–300 MW SMRs to supply 24/7 baseload power to data campuses.

• Advanced Fuel & Recycling Innovations: Novel fuel cycles incorporating accident-tolerant coatings and recycled fissile materials are being tested; up to 12 % extension of fuel life is being demonstrated in pilot reactors.

• Hybrid Nuclear–Hydrogen Systems: Pilot systems coupling reactors with hydrogen electrolyzers are increasing; in 2024, a demo plant produced 5 tonnes/day hydrogen leveraging waste heat integration.

The advanced nuclear technologies market segmentation encompasses type (SMRs, small modular reactors; high-temperature gas reactors; molten salt reactors; fast reactors; hybrid reactors), application (electricity generation, industrial heat, hydrogen production, district energy) and end-users (utilities, industrial firms, clean energy platforms, governments). Type segmentation aligns with technology readiness, while application segmentation reflects target demand sectors. End-user mapping indicates which customer classes prioritize advanced nuclear in their strategic energy planning. Those segmentation lenses help investors and developers align product strategies.

SMRs currently lead deployment due to maturity and modular capability, capturing ~40 % share among advanced nuclear types. High-temperature gas-cooled reactors hold ~20 % share, while molten salt, fast reactors, and hybrid designs collectively account for ~40 %. The fastest-growing type is molten salt and hybrid designs, driven by promises of higher thermal efficiency and flexibility. Others such as fast reactors are more niche.

A recent demonstration in China employed a molten salt loop achieving stable operation over 1000 hours, showcasing durability in advanced reactor test cycles.

Electricity generation remains the dominant application with ~50 % share of demand for advanced nuclear systems. Industrial heat and hydrogen production are fast rising, expected to exceed 30 % share in future deployments. District heating and desalination represent the remainder. In 2024, ~25 % of proposed reactor projects directly integrated hydrogen or process heat use cases.

A European utility deployed a pilot reactor facility co-producing steam for a chemical plant, achieving 12 % improvement in thermal yield in a demonstration run.

Utilities dominate as end-users with ~45 % share, leveraging economies of scale and grid integration. Industrial firms (e.g., chemical, cement, refining) are the fastest-growing end-users, adding up about 25 % share growth as they decarbonize heat. Governments, research institutions, and microgrid operators make up ~30 %. In 2024, ~18 % of regional utilities publicly announced advanced reactor procurement plans.

A national energy authority reported that clean energy firms adopting advanced nuclear options expanded procurement by 20 % in a single year.

Asia-Pacific accounted for the largest market share at 42 % in 2024, however, North America is expected to register the fastest growth, expanding at a CAGR of ~12% between 2025 and 2032.

In 2024 Asia-Pacific registered over 300 reactor-based installations and more than 50 advanced nuclear technology pilot projects in China, Japan, South Korea, India and Australia. North America held about 30 % of consumption in 2024, with over 100 existing nuclear power plants undergoing modernization, plus more than 20 SMR (Small Modular Reactor) programs in planning or under construction. Europe accounted for approximately 20 %, with Germany, UK, and France contributing to both grid integration and research reactor overhaul projects. Middle East & Africa, and South America together made up the remaining ~8 %, but each with multiple nations initiating feasibility studies and procurement contracts.

How are clean energy policies accelerating SMR and reactor modernization adoption?

North America holds about 30 % share of the advanced nuclear technologies deployment market as of 2024. Key industries driving demand include utilities seeking reliable baseload for grid stability, industrial sectors (such as chemical processing and heavy manufacturing) wanting high-temperature heat, and emerging hydrogen production facilities integrating with nuclear plants. Notable regulatory changes include recently updated licensing frameworks for SMRs, tax incentives for uranium processing, and expanded funding for advanced reactor R&D. Technological trends include digital twin modeling for reactors, improved safety systems, and use of advanced fuels. A local player, NuScale Power, is advancing its SMR module designs and securing multiple utility agreements for deployment. Consumer behavior shows strong support from utility customers and policy stakeholders, favoring technologies with demonstrable safety and lower waste outcomes.

What regulatory harmonization and innovation initiatives are shaping reactor upgrades and SMR deployment?

Europe accounts for approximately 20 % share of the advanced nuclear technologies market in 2024. Key markets such as Germany, UK, and France are advancing reactor refurbishments, SMR licensing frameworks, and sustainability initiatives. Regulatory bodies like the European Commission and national nuclear safety agencies are requiring stricter environmental impact assessments and waste recycling mandates. Adoption of emerging technologies like molten salt reactors and high-temperature gas reactors is underway in pilot programs, especially in France and UK. Local players such as Rolls-Royce are investing in SMR design and aiming for deployment in several UK sites. Consumer behavior variations reflect high concern about safety, transparency, and public participation in nuclear projects, so explainable reactor designs and community engagement are crucial.

How are national expansion and deployment initiatives driving massive capacity growth?

Asia-Pacific holds the largest regional volume base in advanced nuclear technologies in 2024. Top consuming countries include China, Japan, India, and South Korea. Infrastructure trends show rapid construction of SMRs, deployment of high-temperature gas reactors, and expansion of uranium enrichment capacity. Innovation hubs in China and Japan are pushing forward with advanced fuel cycle research and modular reactor units. A local player in China is working on generation IV fast reactor pilot reactors projected to operate by late 2020s. Regional consumer behavior shows broad acceptance from governments and industrial users, especially in energy crises or where renewable intermittency is high; environmental sustainability is a strong purchasing factor.

How are strategic utility deployments meeting regional energy stability goals?

In South America, Brazil and Argentina are key countries involved in advanced nuclear technologies, with the region accounting for around 5-6 % share in 2024. Infrastructure is scaling slowly: Brazil is planning SMR deployment and upgrading its uranium mining and enrichment facilities; Argentina is negotiating technology transfer deals and expanding nuclear medicine capabilities. Government incentives and trade policies are encouraging local content manufacturing and favorable tariffs for reactor components. Regional consumer behavior varies: industrial users are pushing for clean, firm power, but public perception and cost sensitivities remain significant factors. Where energy reliability is poor, nuclear projects gain more political and communal support.

How are emerging nuclear programs balancing demand, safety, and regulatory capacity?

Middle East & Africa had a combined market share of approximately 3-6% in 2024. Major growth countries include United Arab Emirates, South Africa, and Egypt. Technological modernization trends involve adoption of modular reactors, integration of nuclear medicine and isotope production, and strengthening of regulatory agencies. Governments are entering trade partnerships for component supply and safety services. A local player in the UAE has commissioned the Barakah nuclear power plant, and South Africa operates research facilities and is planning modern reactor designs. Consumer behavior shows strong governmental and utility demand, whereas public adoption depends heavily on safety assurances, performance reliability, and localized economic benefits.

United States: ~30 % market share, due to high production capacity, R&D strength, and advanced reactor deployment programs.

China: ~40-45 % market share in Asia-Pacific portion, supported by scale of installations, state investment in SMRs, and rapid construction of new reactors.

The advanced nuclear technologies market shows moderate concentration with 20-30 major global players active in reactor design, fabrication, fuel supply, modular systems, and software control technologies. Top 5 firms control approximately 50-60 % of global innovation, project pipelines, and licensing rights. Strategic initiatives include partnerships between utilities and reactor manufacturers to co-finance SMR projects; product launches of demonstration reactors; merging of component suppliers; and acquisitions to strengthen fuel cycle capabilities. Innovation trends include accident tolerant fuels, advanced coolant technologies, digital twin modeling, remote monitoring, modular manufacturing, and hybrid nuclear-renewable systems. Key positioning centers around reliability, compliance, safety standards, cost of operation, and licensing speed. Market type is moving toward consolidation among leading reactor OEMs, but with space for niche innovators (e.g., fast reactor, molten salt, and fuel recycling start-ups) to differentiate. Countries with large fleet of aging reactors are focusing on refurbishment and life extension, while others focus on new build with advanced reactor types.

Rolls-Royce (SMR developer)

X-Energy

Current and emerging technologies shaping the advanced nuclear technologies market include small modular reactors (SMRs), generation IV and high-temperature gas reactors, molten salt reactors, and fast breeder reactors. Advanced fuel cycle innovations such as accident tolerant fuels and high assay low enriched uranium (HALEU) are being developed to improve safety and performance. Digital twin simulation and AI-enabled reactor control systems are enhancing predictive maintenance and operational efficiency, lowering unplanned downtime. Modular manufacturing techniques are being deployed, allowing prefabricated reactor components to be manufactured in factories and shipped for assembly, decreasing onsite construction labor by up to 20%. Integration of hybrid energy systems (e.g., combining reactors with hydrogen or thermal storage) is being piloted in multiple countries. Advances in thermal reactor core materials and corrosion-resistant cladding are extending component lifespans. Monitoring, sensors, and automation are also increasing in sophistication, enabling real-time diagnostics and improved safety margins.

• In June 2024, Orano announced plans to expand its uranium enrichment facility in southern France and explore a new plant in the United States to reduce reliance on external nuclear fuel sources. Source: www.reuters.com

• In June 2024, a report found the U.S. is lagging by as many as 15 years behind China in nuclear power plant construction times, noting China has 27 reactors under construction with average timelines of about seven years. Source: www.reuters.com

• In May 2024, Russia's state nuclear corporation Rosatom criticized a U.S. ban on Russian enriched uranium imports, calling it harmful to global nuclear fuel market sustainability; Russia currently provides about 24 % of the enriched uranium used by U.S. nuclear power plants. Source: www.reuters.com

• In December 2024, Russia reaffirmed its plans to construct over 10 nuclear units in partnership with countries such as Bangladesh, Egypt, India, Iran, and Turkey to expand its plant construction portfolio. Source: www.ft.com

This report covers advanced nuclear technologies segmented by reactor type (SMRs, generation III+, generation IV, fast breeder, high-temperature gas reactors, molten salt reactors, hybrid reactors), fuel type (HALEU, uranium, thorium), and application (electricity generation, industrial heat, hydrogen production, desalination, district energy). Geographic focus includes Asia-Pacific, North America, Europe, South America, and Middle East & Africa, with special attention to China, U.S., Germany, UK, India, Brazil, UAE, and South Africa. Technologies examined include digital twin modelling, advanced fuel cycles, accident-tolerant fuels, modular manufacturing, and cooling & cladding materials. Industry focuses include government policies, regulatory frameworks, safety & waste management standards, utility licensing, public acceptance, and financing models. Emerging or niche segments include molten salt reactors, hydrogen reactor hybrids, reactor life-extension projects, and non-electric nuclear applications such as industrial heat and water treatment.

| Report Attribute/Metric | Report Details |

|---|---|

|

Market Revenue in 2024 |

USD 7,836.4 Million |

|

Market Revenue in 2032 |

USD 18,321.2 Million |

|

CAGR (2025 - 2032) |

11.2% |

|

Base Year |

2024 |

|

Forecast Period |

2025 - 2032 |

|

Historic Period |

2020 - 2024 |

|

Segments Covered |

By Type

By Application

By End-User

|

|

Key Report Deliverable |

Revenue Forecast, Growth Trends, Market Dynamics, Segmental Overview, Regional and Country-wise Analysis, Competition Landscape |

|

Region Covered |

North America, Europe, Asia-Pacific, South America, Middle East, Africa |

|

Key Players Analyzed |

TerraPower, NuScale Power, Westinghouse Electric Company, Rolls-Royce (SMR developer), X-Energy |

|

Customization & Pricing |

Available on Request (10% Customization is Free) |