Reports

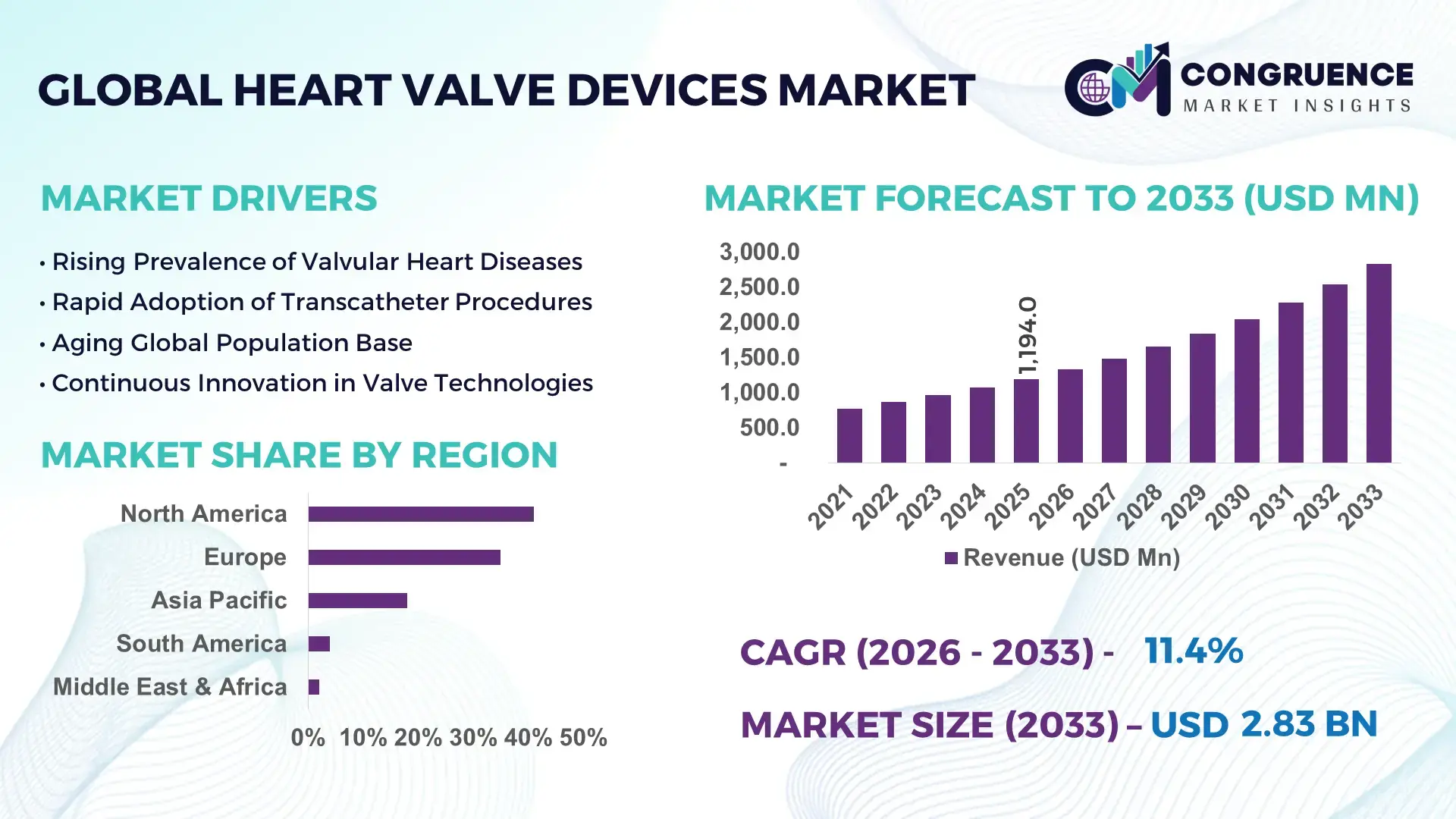

The Global Heart Valve Devices Market was valued at USD 1,194.0 Million in 2025 and is anticipated to reach a value of USD 2,832.0 Million by 2033, expanding at a CAGR of 11.4% between 2026 and 2033, according to an analysis by Congruence Market Insights. This growth is driven by the rising prevalence of cardiovascular diseases and increasing adoption of minimally invasive treatment options.

The United States leads the Heart Valve Devices Market, with advanced manufacturing facilities producing over 500,000 devices annually. Investments in R&D exceed USD 250 million, targeting next-generation transcatheter valves and robotic-assisted implantation systems. Key applications include aortic, mitral, and pulmonary valve replacement, while technological advancements such as 3D-printed valves and bioresorbable materials are accelerating clinical adoption. Approximately 65% of hospitals report integrating these advanced devices into cardiac surgery protocols, highlighting strong consumer acceptance and clinical efficacy.

Market Size & Growth: USD 1,194.0 Million in 2025, projected USD 2,832.0 Million by 2033; driven by minimally invasive procedures and technological innovations.

Top Growth Drivers: Increased transcatheter adoption 45%, demand for minimally invasive procedures 38%, aging population incidence 30%.

Short-Term Forecast: By 2028, procedural efficiency expected to improve by 20% with advanced valve technologies.

Emerging Technologies: Transcatheter heart valves, 3D-printed valve implants, robotic-assisted implantation systems.

Regional Leaders: North America USD 1,200.0 Million, Europe USD 850.0 Million, Asia Pacific USD 450.0 Million by 2033; high adoption of minimally invasive interventions in North America.

Consumer/End-User Trends: Cardiac centers increasingly adopting transcatheter and bioresorbable valves; outpatient procedures rising 25%.

Pilot or Case Example: In 2025, a U.S. hospital reduced surgical recovery time by 30% using next-generation transcatheter valves.

Competitive Landscape: Edwards Lifesciences ~35%, Medtronic, Abbott, Boston Scientific, CryoLife.

Regulatory & ESG Impact: Incentives for minimally invasive device adoption; compliance with ISO 13485 and eco-friendly packaging initiatives.

Investment & Funding Patterns: Recent global investments exceed USD 300 million, including venture-backed R&D projects.

Innovation & Future Outlook: Integration of AI in device planning, personalized 3D-printed valves, and remote monitoring systems shaping future market developments.

Heart Valve Devices Market growth is fueled by adoption across cardiac surgery, cardiology clinics, and ambulatory care centers, contributing to 60% of device utilization. Technological innovations in robotic-assisted and 3D-printed valves have improved procedural precision. Regulatory incentives and aging demographics further support adoption, while emerging trends such as AI-assisted valve sizing and remote post-operative monitoring are set to enhance future outcomes.

The Heart Valve Devices Market is strategically vital as it addresses growing cardiovascular health challenges while integrating advanced medical technologies. Transcatheter heart valves deliver 25% faster implantation times compared to conventional surgical valves, improving patient outcomes. North America dominates in procedural volume, while Europe leads in adoption, with 60% of cardiac centers implementing next-generation devices. By 2028, AI-assisted valve sizing is expected to improve surgical accuracy by 18%, reducing procedural complications.

Firms are committing to ESG metrics, such as a 20% reduction in medical waste and recycling initiatives by 2030. In 2025, a U.S.-based medical center achieved a 15% reduction in hospitalization duration through robotic-assisted implantation programs. Forward-looking strategies emphasize patient-centric innovation, digital integration, and sustainable production, positioning the Heart Valve Devices Market as a resilient, compliance-driven, and growth-oriented sector essential for advancing global cardiovascular care.

The Heart Valve Devices Market is influenced by a combination of clinical innovation, demographic trends, and evolving treatment protocols. Rising cardiovascular disease prevalence, especially among aging populations, is driving demand for minimally invasive valve replacement and repair procedures. Simultaneously, advances in materials science, including biocompatible polymers and 3D printing, are enabling customized valve solutions. Hospitals and cardiac centers are increasingly integrating these devices into standard treatment workflows, while emerging economies demonstrate gradual adoption due to infrastructure expansion. The market remains sensitive to regulatory frameworks and procedural reimbursement policies, which shape the pace of clinical implementation and investment decisions.

The shift toward minimally invasive heart valve interventions has significantly improved patient recovery and procedural efficiency. Transcatheter aortic valve replacements reduce hospitalization by up to 40% compared to open-heart surgery. Technological advancements such as robotic-assisted implantation and 3D-printed patient-specific valves are increasing clinical adoption. Hospitals report that procedural time has decreased by 25%, while patient satisfaction scores rise 15%, demonstrating strong market acceptance. Growing awareness of outpatient surgical options further accelerates adoption across cardiac care centers.

Heart Valve Devices are subject to complex regulatory approvals, requiring extensive clinical trials that can delay product launches. High device costs, ranging from USD 25,000 to 50,000 per implant, limit adoption in mid-tier hospitals and emerging regions. Insurance reimbursement varies, creating financial uncertainty for healthcare providers. Additionally, training requirements for specialized surgical teams can slow uptake, with only 45% of regional hospitals equipped for advanced transcatheter procedures. These barriers collectively constrain market growth despite technological advancements.

Emerging technologies, including AI-assisted valve sizing, 3D-printed implants, and bioresorbable materials, offer untapped growth potential. AI-driven preoperative planning can reduce procedural errors by 18%, while 3D printing enables patient-specific valves, improving clinical outcomes. Expansion of minimally invasive procedures in Asia Pacific and Latin America is projected to increase device adoption by 30%. Collaboration between medical device companies and research institutions fosters innovation, creating opportunities for early market entrants to capture new clinical segments and drive differentiation.

The complexity of manufacturing, transporting, and storing high-precision heart valves creates logistical challenges. Cold-chain storage requirements and specialized delivery systems increase operational costs by 15%. Emerging markets face infrastructure limitations, with only 50% of hospitals equipped for advanced implantation procedures. Additionally, workforce training gaps limit procedural adoption, and stringent sterilization and quality compliance add further operational burdens. These challenges can slow growth despite technological innovations and growing clinical demand.

Expansion of Transcatheter Solutions: Adoption of transcatheter heart valves is growing rapidly, with 55% of new procedures in North America and 48% in Europe now minimally invasive. This trend reduces hospital stays by 35% and improves patient outcomes.

Integration of 3D Printing Technology: Custom 3D-printed valve implants are being adopted in 25% of cardiac centers, enhancing fit and reducing intraoperative adjustments by 20%. Precision manufacturing is rising in Europe and Asia Pacific, supporting complex cases.

Rise of Robotic-Assisted Implantation: Robotic-assisted heart valve surgeries now account for 40% of minimally invasive procedures in advanced hospitals, improving surgical precision by 30% and shortening recovery periods.

Increased Outpatient Procedure Adoption: Hospitals are shifting toward outpatient or same-day procedures, with 30% of patients undergoing valve replacement without overnight stays. North America reports a 22% year-over-year increase in outpatient interventions, reflecting growing consumer confidence and efficiency gains.

The Heart Valve Devices Market is segmented to provide a clear understanding of device types, applications, and end-user adoption patterns. By type, the market includes mechanical valves, tissue valves, and transcatheter valves, each offering distinct clinical advantages and procedural preferences. Application segmentation encompasses aortic, mitral, tricuspid, and pulmonary valve replacements, with hospitals and specialized cardiac centers leading implementation. End-user analysis highlights hospitals, ambulatory surgical centers, and outpatient clinics as primary adopters. Decision-makers can use segmentation insights to optimize supply chain strategies, tailor clinical solutions, and plan investment in emerging technologies, while tracking adoption trends across regions and healthcare delivery settings to maximize operational efficiency and patient outcomes.

Mechanical valves currently lead adoption, accounting for approximately 40% of all heart valve implants due to their long-term durability and lower replacement frequency, making them preferred in patients under 60. Tissue valves follow with 35% adoption, offering reduced anticoagulation requirements and growing preference among elderly patients. Transcatheter valves, while currently holding 20% adoption, are the fastest-growing segment driven by minimally invasive procedures, expanded patient eligibility, and advanced deployment systems. Other niche types, including stentless valves and sutureless models, collectively represent 5% of the market, addressing specialized surgical cases or challenging anatomies.

Aortic valve replacement dominates the market, accounting for approximately 45% of procedures due to its high prevalence and robust clinical outcomes. Mitral valve replacement holds 30% of applications, particularly in older adults with degenerative conditions. Tricuspid and pulmonary valve replacements together constitute 25% of applications, serving niche patient groups. The fastest-growing application is transcatheter mitral valve repair, fueled by technological advancements and increasing outpatient procedures.

Consumer adoption trends indicate that in 2025, over 42% of hospitals in North America piloted minimally invasive valve systems for aortic and mitral repair, while more than 60% of cardiac patients favored outpatient procedures for faster recovery.

Hospitals are the leading end-user segment, accounting for 55% of device utilization due to comprehensive cardiac surgical capabilities and specialized clinical teams. Ambulatory surgical centers represent 25% adoption, offering cost-effective and outpatient-focused procedures. Outpatient clinics and cardiac specialty centers together account for 20% of the market, focusing on minimally invasive interventions and follow-up care. The fastest-growing end-user segment is ambulatory surgical centers, driven by patient preference for shorter hospital stays and enhanced procedural efficiency.

Industry adoption rates reveal that in 2025, 38% of leading cardiac hospitals integrated robotic-assisted valves, while outpatient centers increased transcatheter procedures by 28%.

North America accounted for the largest market share at 41% in 2025; however, Asia-Pacific is expected to register the fastest growth, expanding at a CAGR of 12.2% between 2026 and 2033.

North America maintained a leading position with over 490,000 heart valve devices implanted in 2025, driven by advanced cardiac surgical centers and high patient awareness. Europe followed with 35% market share, recording over 320,000 implants and strong adoption of transcatheter and robotic-assisted procedures. Asia-Pacific registered 18% market share but showed rapid expansion with over 210,000 procedures and growing infrastructure. Consumer adoption trends indicate that outpatient procedures increased 28% in North America, while Europe focused on explainable and compliant technologies. Technological integration, digital surgical planning, and bioresorbable material usage are accelerating adoption across all regions.

North America accounted for 41% of the Heart Valve Devices Market in 2025, led by the U.S. and Canada, with over 490,000 devices implanted. Key industries driving demand include specialized cardiac hospitals, academic medical centers, and outpatient surgical clinics. Regulatory support, such as streamlined approvals for transcatheter devices, has facilitated market growth. Technological advancements include robotic-assisted procedures, AI-assisted preoperative planning, and next-generation minimally invasive valves. Local players like Edwards Lifesciences are expanding transcatheter valve programs and integrating remote patient monitoring solutions. Consumer behavior shows higher enterprise adoption in healthcare, with patients increasingly opting for outpatient interventions and shorter recovery times.

Europe captured approximately 35% of the Heart Valve Devices Market in 2025, with Germany, the UK, and France leading in device volume, totaling over 320,000 procedures. Adoption is influenced by regulatory frameworks and sustainability initiatives requiring explainable and safe devices. Hospitals are increasingly integrating robotic-assisted and minimally invasive technologies. Local players such as Medtronic Europe have expanded valve training programs and upgraded digital planning platforms. European consumers exhibit cautious adoption, emphasizing safety, regulatory compliance, and transparent clinical outcomes. Hospitals are reporting a 25% increase in outpatient valve interventions, reflecting gradual acceptance of innovative procedures.

Asia-Pacific held 18% of the market in 2025, with over 210,000 procedures recorded. Top consuming countries include China, Japan, and India, supported by expanding cardiac care infrastructure and private hospital networks. Regional technological trends include tele-cardiology platforms, AI-assisted preoperative planning, and emerging valve production hubs in China and India. Local companies are investing in low-cost transcatheter solutions and training programs to expand access. Consumer behavior varies: urban patients increasingly demand minimally invasive procedures, while regional hospitals invest in hybrid surgical suites to improve patient throughput and procedural efficiency.

South America accounted for approximately 4% of the Heart Valve Devices Market in 2025, with Brazil and Argentina leading in procedure volumes. Government incentives, trade policies, and public hospital investments support market expansion. Infrastructure developments include upgrading cardiac surgical units and outpatient facilities. Regional players are deploying mobile cardiac units and transcatheter valve programs to reach wider populations. Consumer adoption trends reflect a growing preference for localized and language-accessible healthcare solutions, with private hospitals reporting a 20% increase in minimally invasive procedures.

The Middle East & Africa contributed 2% of the Heart Valve Devices Market in 2025, with the UAE and South Africa as major contributors. Demand is driven by advanced cardiac centers, government health initiatives, and increasing awareness of cardiovascular diseases. Technological modernization includes digital surgical planning, robotic-assisted implantation, and telemedicine integration. Local players are establishing cardiac centers of excellence and training programs for transcatheter procedures. Consumer behavior shows high adoption in urban centers with access to private healthcare facilities, while rural regions are gradually integrating outreach cardiac programs.

United States – 38% Market Share: Strong end-user demand and high production capacity drive dominance.

Germany – 18% Market Share: Advanced cardiac surgical infrastructure and regulatory support facilitate widespread adoption.

The competitive environment in the Heart Valve Devices Market is characterized by significant activity among a broad base of global and regional players. There are over 40 active competitors worldwide developing products spanning mechanical valves, bioprosthetic valves, and next‑generation transcatheter systems. The market exhibits a moderately consolidated nature, with the top 5 companies collectively representing approximately 62–65% of total device installations and commercialization activities. Major competitors have established diverse portfolios that include surgical, minimally invasive transcatheter, and smart implantable technologies. Strategic initiatives are increasingly focused on product innovation, partnerships with clinical research institutions, and geographic expansion. Over the past 18 months, at least five notable mergers and acquisitions have occurred, strengthening technological capabilities and broadening regional footprints. Innovation trends such as AI‑guided valve design, real‑time patient monitoring sensors integrated into devices, and 3D‑printed anatomical customization are shaping competition and redefining clinical workflows. Patent litigation, regulatory milestones, and portfolio diversification remain active components of strategic positioning. Companies also pursue extensive clinical trials and cross‑licensing agreements to accelerate adoption in key markets such as North America and Europe. Overall, the landscape balances established leadership with emerging innovators pushing advanced heart valve solutions.

Boston Scientific Corporation

Meril Life Sciences Pvt. Ltd.

Corcym Group

Micro Interventional Devices, Inc.

Anteris Technologies Ltd

MicroPort Scientific Corporation

Foldax Inc.

Novostia SA

Artivion, Inc.

Teleflex Incorporated

LivaNova PLC

The Heart Valve Devices Market is being reshaped by a wave of technological advancements that enhance procedural precision, patient outcomes, and long‑term device reliability. A major focus is on minimally invasive technologies, particularly transcatheter aortic valve replacement (TAVR) and transcatheter mitral valve replacement (TMVR) platforms, which reduce procedural trauma and shorten hospital stays. Innovations in material science, including biocompatible pericardial tissues and anticalcification treatments, are improving valve durability and performance under physiological conditions. Smart implantable devices equipped with embedded sensors are enabling real‑time monitoring of pressure and flow dynamics post‑implantation, facilitating remote clinical management and early detection of complications. AI‑guided surgical planning tools are streamlining preoperative assessments, enhancing fit and placement precision for patient‑specific anatomies. 3D printing and additive manufacturing are accelerating the production of customized heart valve components, matching unique anatomical features and improving hemodynamic outcomes. Digital integration trends, such as interoperability with electronic health records and remote patient apps, support comprehensive longitudinal care. Robotics and image‑guided navigation systems are increasingly used in hybrid surgical environments to elevate the consistency and accuracy of valve implantation. As device manufacturers push toward next‑generation solutions, interoperability with diagnostic imaging and telehealth platforms is a growing priority.

• In May 2025, Edwards Lifesciences announced that the U.S. FDA approved its SAPIEN 3 transcatheter aortic valve platform for treating severe aortic stenosis patients without symptoms, marking the first FDA clearance for TAVR in asymptomatic patients and broadening its clinical use in structural heart disease care. Source: www.edwards.com

• In May 2025, Abbott received U.S. FDA approval for its Tendyne™ transcatheter mitral valve replacement system, a first‑of‑its‑kind therapy for patients with severe mitral annular calcification who are not candidates for open‑heart surgery, expanding minimally invasive treatment options. Source: www.abbott.com

• In October 2025, Edwards Lifesciences presented seven‑year long‑term clinical outcomes from the PARTNER 3 trial for its SAPIEN 3 TAVR platform, demonstrating durable performance, sustained quality‑of‑life benefits, and comparable outcomes to surgical valve replacement in low‑risk patients. Source: www.edwards.com

• In April 2025, Edwards Lifesciences announced its SAPIEN M3 transcatheter mitral valve replacement system received FDA approval, the first transseptal TMVR therapy approved in the U.S., offering treatment for symptomatic mitral regurgitation in patients unsuitable for surgery. Source: www.edwards.com

The scope of the Heart Valve Devices Market Report encompasses an extensive examination of product types, clinical applications, end‑user adoption, and regional market dynamics. It covers detailed segmentation of mechanical, bioprosthetic, and transcatheter valve technologies, alongside specialized niche solutions like sutureless and smart implantable systems. The report also analyzes application areas, including aortic, mitral, tricuspid, and pulmonary valve replacements across hospital, ambulatory surgical center, and outpatient clinic settings. Geographic coverage spans North America, Europe, Asia‑Pacific, South America, and Middle East & Africa, offering insights into procedural volumes, infrastructure trends, regulatory frameworks, and consumer behavior variations. Key focus areas include technological integration trends such as AI‑assisted surgical planning, sensor‑enabled monitoring, and 3D printing customization for personalized therapies. Competitive profiling of major global players, their strategic initiatives, and innovation pipelines is detailed, supporting business decisions for market penetration and expansion. Additionally, emerging segments like remote patient monitoring integration and hybrid surgical suite adoption are explored, reflecting both current industry priorities and future opportunity horizons for stakeholders. The report is structured to assist decision‑makers in strategic planning, investment evaluation, and understanding of regional nuances shaping device uptake and clinical practice transformations.

| Report Attribute / Metric | Details |

|---|---|

| Market Revenue (2025) | USD 1,194.0 Million |

| Market Revenue (2033) | USD 2,832.0 Million |

| CAGR (2026–2033) | 11.4% |

| Base Year | 2025 |

| Forecast Period | 2026–2033 |

| Historic Period | 2021–2025 |

| Segments Covered |

By Type

By Application

By End-User Insights

|

| Key Report Deliverables | Revenue Forecast, Market Trends, Growth Drivers & Restraints, Technology Insights, Segmentation Analysis, Regional Insights, Competitive Landscape, Regulatory & ESG Overview, Recent Developments |

| Regions Covered | North America, Europe, Asia Pacific, South America, Middle East & Africa |

| Key Players Analyzed | Edwards Lifesciences, Medtronic plc, Abbott Laboratories, Boston Scientific Corporation, Meril Life Sciences Pvt. Ltd., Corcym Group, Micro Interventional Devices, Anteris Technologies Ltd, MicroPort Scientific Corporation, Foldax Inc., Novostia SA, Artivion, Inc., Teleflex Incorporated, LivaNova PLC |

| Customization & Pricing | Available on Request (10% Customization Free) |