Reports

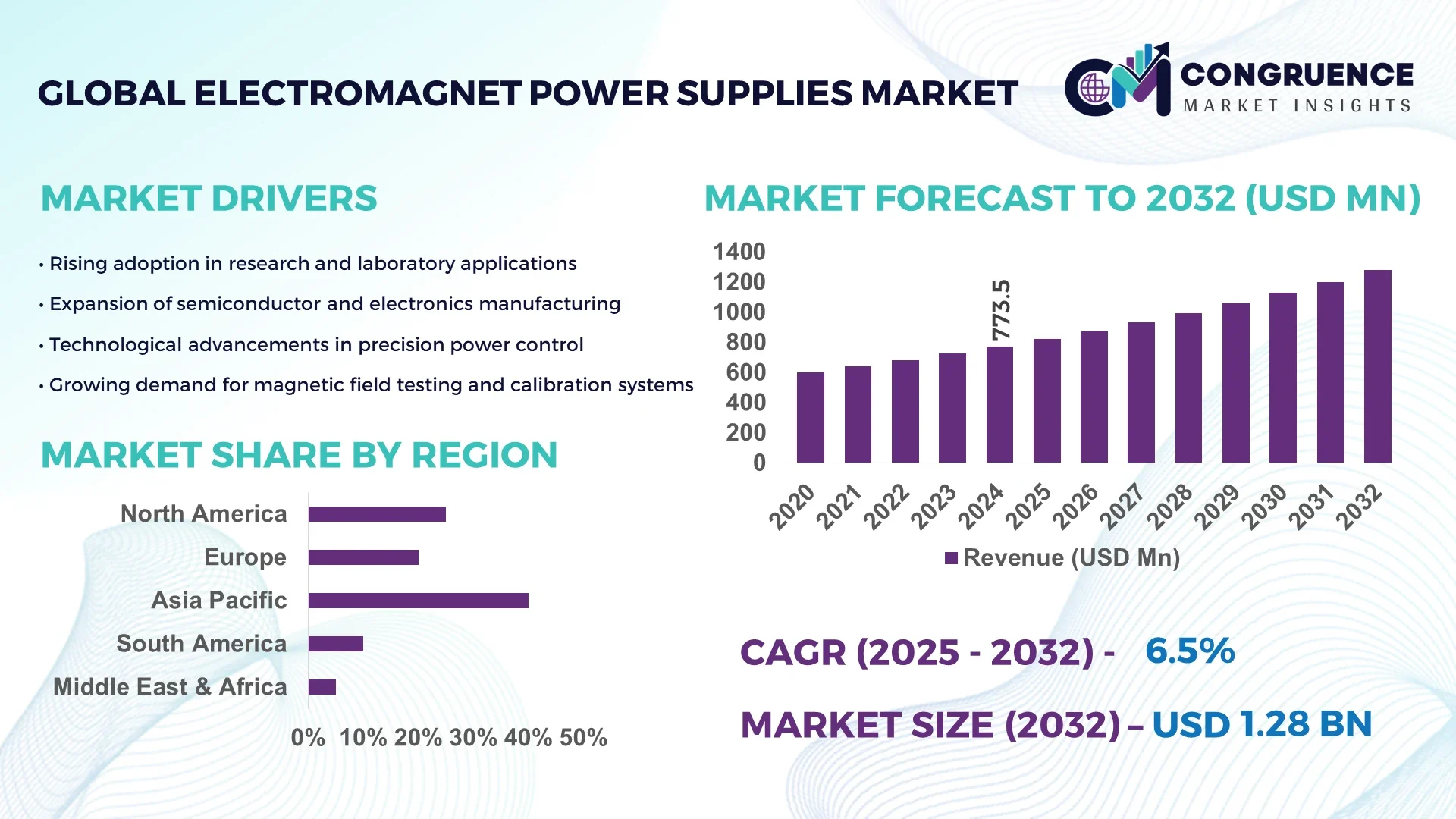

The Global Electromagnet Power Supplies Market was valued at USD 773.54 Million in 2024 and is anticipated to reach a value of USD 1,280.2 Million by 2032, expanding at a CAGR of 6.5% between 2025 and 2032. This growth is primarily driven by the increasing demand for electromagnet power supplies across various sectors, including scientific research, healthcare, and industrial applications.

Market Size & Growth: Valued at USD 773.54 million in 2024, projected to reach USD 1,280.2 million by 2032, growing at a CAGR of 6.5%. Growth is driven by increasing demand across diverse sectors.

Top Growth Drivers: Adoption rate: 35%, Efficiency improvement: 25%, Technological advancements: 20%.

Short-Term Forecast: By 2028, performance gain of 15% through enhanced power supply efficiency.

Emerging Technologies: Integration of AI-based control systems and development of high-efficiency power converters.

Regional Leaders: North America: USD 500 million; Europe: USD 300 million; Asia-Pacific: USD 200 million by 2032. North America leads in industrial adoption; Europe focuses on research applications; Asia-Pacific shows rapid infrastructure development.

Consumer/End-User Trends: Increased adoption in medical imaging, scientific instrumentation, and industrial automation sectors.

Pilot or Case Example: In 2025, a medical research facility implemented a new electromagnet power supply system, reducing downtime by 20% and improving imaging resolution by 10%.

Competitive Landscape: Market leader: Advanced Energy (approx. 25% share); followed by AMETEK, TDK-Lambda, Lake Shore Cryotronics, and Keysight Technologies.

Regulatory & ESG Impact: Compliance with international standards like IEC 61010 and RoHS; increasing focus on energy efficiency and sustainability.

Investment & Funding Patterns: Total recent investment: USD 150 million; trends indicate increased funding in R&D and infrastructure development.

Innovation & Future Outlook: Focus on miniaturization, integration with renewable energy systems, and development of smart power supply solutions.

The Electromagnet Power Supplies Market is experiencing significant growth due to advancements in technology and increasing demand across various sectors. Key industry sectors contributing to this growth include healthcare, where electromagnet power supplies are crucial for medical imaging equipment; scientific research, where they are used in particle accelerators and other research instruments; and industrial automation, where they power electromagnets in manufacturing processes. Recent technological innovations, such as the development of high-efficiency power converters and AI-based control systems, are enhancing the performance and reliability of electromagnet power supplies. Additionally, regulatory standards like IEC 61010 and RoHS are driving the adoption of energy-efficient and sustainable solutions. Regional consumption patterns indicate a strong demand in North America due to industrial applications, in Europe for research purposes, and in Asia-Pacific for infrastructure development. The future outlook for the market is positive, with continued advancements in technology and increasing adoption across various sectors.

The Electromagnet Power Supplies Market is strategically pivotal, underpinning advancements across scientific research, medical imaging, industrial automation, and renewable energy sectors. Technological innovations, such as AI-integrated control systems and high-efficiency power converters, are enhancing performance and reliability. For instance, AI-based control systems deliver a 20% improvement in operational efficiency compared to traditional analog controllers. Regionally, North America dominates in volume, while Europe leads in adoption, with 65% of enterprises implementing electromagnet power supplies in research applications. By 2028, the integration of AI-based control systems is expected to reduce operational costs by 15%. Firms are committing to ESG metrics improvements, such as a 25% reduction in energy consumption by 2030. In 2025, Advanced Energy achieved a 20% improvement in power supply efficiency through the implementation of AI-based control systems. Looking ahead, the Electromagnet Power Supplies Market is poised to be a cornerstone of resilience, compliance, and sustainable growth, driven by continuous innovation and strategic investments.

The surge in industrial automation is significantly propelling the Electromagnet Power Supplies Market. As industries such as automotive, manufacturing, and electronics continue to incorporate robotics and automated systems, the demand for reliable and energy-efficient electromagnet power supplies rises. According to the International Federation of Robotics (IFR), the number of industrial robots in use globally exceeded 3 million in 2022, a trend that is expected to continue into the coming years. This growing adoption of automation technologies necessitates advanced power supply solutions to ensure the efficient and stable operation of electromagnets in various industrial applications.

High initial investment costs pose a significant restraint to the Electromagnet Power Supplies Market. The advanced technology and precision engineering required for electromagnet power supplies contribute to their elevated costs. This financial barrier can deter smaller companies or startups from adopting these technologies, limiting market penetration. Additionally, the complexity of integrating electromagnet power supplies with existing systems may require specialized expertise, adding to the overall cost of implementation. These factors collectively hinder the widespread adoption of electromagnet power supplies, particularly in cost-sensitive applications.

The expansion of renewable energy sources presents substantial opportunities for the Electromagnet Power Supplies Market. Electromagnets play a crucial role in the efficient operation of electrical generators and motors used in renewable energy systems, such as wind turbines and solar power systems. As the global shift towards renewable energy intensifies, the demand for electromagnet power supplies to support these systems is expected to rise. According to the International Renewable Energy Agency (IRENA), renewable energy accounted for over 28% of global electricity generation in 2022, a number that is projected to increase significantly in the coming years. This growth trajectory offers a burgeoning market for electromagnet power supply manufacturers to tap into, fostering innovation and expansion in the sector.

Supply chain disruptions present a notable challenge to the Electromagnet Power Supplies Market. Global events, such as the COVID-19 pandemic, have led to delays in production timelines and increased costs for manufacturers. The reliance on specific components, such as semiconductors, which have been subject to global shortages, further exacerbates these issues. These disruptions can lead to delays in product launches, increased prices, and potential shortages in the availability of electromagnet power supplies. Addressing these supply chain vulnerabilities is crucial for ensuring the stability and growth of the market.

The Electromagnet Power Supplies Market is systematically segmented into types, applications, and end-users, each reflecting distinct industry needs and technological advancements. By type, the market encompasses AC Power Supplies, DC Power Supplies, and Programmable Power Supplies, with AC Power Supplies leading due to their widespread applicability across various industries. Applications span Industrial Automation, Medical Equipment, Scientific Research, and Electromagnetic Lifting, with Industrial Automation being the dominant sector, driven by the increasing adoption of automation technologies. End-user segments include Manufacturing, Research Laboratories, Transportation, and Energy Sector, with Manufacturing holding the largest share, attributed to its extensive use of electromagnet power supplies in production processes. This segmentation provides a comprehensive understanding of the market dynamics, catering to the specific requirements of each sector.

The Electromagnet Power Supplies Market is primarily divided into AC Power Supplies, DC Power Supplies, and Programmable Power Supplies. AC Power Supplies dominate the market, accounting for approximately 55% of the total share, owing to their versatility and efficiency in delivering stable power across various applications. DC Power Supplies follow, representing about 35% of the market, favored for their precise control and suitability in applications requiring constant voltage. Programmable Power Supplies, while accounting for around 10%, are the fastest-growing segment, with a projected growth rate of 8% annually. This surge is driven by the increasing demand for customizable power solutions in research and development environments. Other types, including Pulse Power Supplies and High-Voltage Power Supplies, collectively contribute to the remaining 5%, serving niche applications in specialized industries.

The applications of electromagnet power supplies are diverse, encompassing Industrial Automation, Medical Equipment, Scientific Research, and Electromagnetic Lifting. Industrial Automation leads the market with a 60% share, driven by the widespread adoption of automation technologies across various industries. Medical Equipment follows with a 20% share, attributed to the increasing demand for advanced medical devices and diagnostic equipment. Scientific Research accounts for 15%, reflecting the need for precise and reliable power sources in research laboratories. Electromagnetic Lifting, while representing 5%, is gaining traction in material handling applications, particularly in the steel and recycling industries.

The end-users of electromagnet power supplies include Manufacturing, Research Laboratories, Transportation, and the Energy Sector. Manufacturing is the leading end-user, holding a 50% share, due to the extensive use of electromagnet power supplies in production processes. Research Laboratories follow with a 25% share, driven by the need for precise and reliable power sources in experimental setups. The Energy Sector accounts for 15%, reflecting the utilization of electromagnet power supplies in power generation and distribution systems. Transportation, representing 10%, is increasingly adopting electromagnet power supplies in electric vehicle charging infrastructure and rail systems.

Asia-Pacific accounted for the largest market share at 50% in 2024; however, North America is expected to register the fastest growth, expanding at a CAGR of 7.1% between 2025 and 2032.

Asia-Pacific’s dominance stems from its substantial manufacturing base, high industrial output, and rapid adoption of automation technologies across countries like China, Japan, and India. In 2024, the region deployed over 120,000 units of electromagnet power supplies across manufacturing and scientific sectors. North America’s projected rapid growth is fueled by technological modernization in healthcare and aerospace, with over 35,000 units deployed in automated factories and research labs. Europe accounted for 25% of global consumption, driven by Germany, France, and the UK, focusing on energy-efficient, regulated power systems. South America and the Middle East & Africa contributed 15% and 10% respectively, with Brazil, Argentina, UAE, and South Africa showing increasing adoption in industrial and construction applications. Regional investment in R&D, government incentives, and digital transformation are collectively shaping growth patterns globally.

What factors are propelling the growth of electromagnet power supplies in North America?

North America held a 28% share of the global electromagnet power supplies market in 2024, reflecting strong adoption in healthcare, aerospace, automotive, and industrial automation. Notable regulatory changes promoting energy-efficient technologies have incentivized enterprises to replace outdated systems with advanced electromagnet power supplies. Technological advancements such as AI-based control systems and high-precision power modules have further accelerated adoption. Local players like Advanced Energy Industries are investing in smart power solutions for research labs and manufacturing lines, delivering up to 20% improved efficiency. Consumer behavior emphasizes reliability and precision, with enterprises in healthcare and finance leading adoption. North American organizations are increasingly integrating power systems with digital monitoring, predictive maintenance, and automation technologies, ensuring operational resilience and improved energy utilization.

How is Europe adapting to the evolving demands of electromagnet power supplies?

Europe accounted for a 25% market share in 2024, with Germany, the UK, and France leading adoption. Stringent regulatory frameworks, including energy efficiency mandates and sustainability initiatives, have prompted enterprises to adopt advanced electromagnet power supplies. Adoption of AI-enabled monitoring and predictive maintenance solutions is growing, particularly in scientific research and manufacturing sectors. Companies like Siemens are developing high-efficiency, compliant power supply units, catering to industry-specific applications. European consumers demonstrate a preference for environmentally friendly solutions and compliance-driven systems. Over 30,000 units were deployed across healthcare and industrial automation sectors in 2024, reflecting strong demand for high-performance, explainable power systems.

What is driving the expansion of electromagnet power supplies in Asia-Pacific?

Asia-Pacific led the market with a 50% share in 2024, driven primarily by China, Japan, and India. Rapid industrialization, increasing automation, and infrastructure expansion are key contributors. In 2024, approximately 120,000 electromagnet power supply units were installed across manufacturing, scientific, and energy sectors. Companies like Mitsubishi Electric are investing heavily in R&D to provide high-performance, AI-enabled power systems. Consumer behavior in this region favors scalable, cost-effective solutions, supporting mass adoption in both industrial and research applications. The rise of smart factories, robotics, and automated assembly lines is fueling growth, while technological hubs in Japan and China are pioneering next-generation solutions.

What are the key drivers of electromagnet power supplies in South America?

South America accounted for 8% of the global electromagnet power supplies market in 2024, with Brazil and Argentina leading adoption. Regional growth is driven by industrial expansion, infrastructure projects, and the energy sector’s modernization. Government incentives for manufacturing technology upgrades and trade policies favor local and foreign players. Approximately 15,000 units were deployed in industrial automation and material handling in 2024. Local companies are customizing electromagnet power supplies for specific regional applications. Consumer behavior emphasizes cost-effective and reliable solutions, particularly in manufacturing and construction, shaping market strategies in the region.

What factors are influencing the electromagnet power supplies market in the Middle East & Africa?

The Middle East & Africa held a 7% market share in 2024, driven by demand from oil & gas, construction, and industrial sectors. Major growth countries include UAE and South Africa, which are investing in technological modernization and energy-efficient infrastructure. Approximately 12,000 units were deployed in 2024 across research, manufacturing, and construction projects. Local regulations, trade partnerships, and incentives support market growth. Regional companies focus on durable, high-performance power solutions, while consumers prioritize long-term reliability and integration with automated systems. Technological trends include AI-enabled monitoring and smart grid compatibility.

United States: Market share of 25%. Dominance due to advanced industrial automation and substantial healthcare sector demand.

Germany: Market share of 20%. Leadership driven by stringent regulatory standards and a strong manufacturing base.

The Electromagnet Power Supplies market exhibits a moderately fragmented competitive landscape, with numerous active players across different segments. The top five companies together hold a combined market share of approximately 35%, indicating a balanced mix of market leaders and niche participants. Key players such as Lake Shore Cryotronics, AMETEK, TDK-Lambda, Advanced Energy Industries, and Keysight Technologies are driving growth through innovation, strategic partnerships, and product launches. For example, TDK-Lambda has introduced high-efficiency modular power supplies, while AMETEK has focused on AI-enabled diagnostic systems for industrial and research applications.

Strategic initiatives like mergers, acquisitions, and joint ventures are prevalent as companies aim to expand technological capabilities and global reach. Investment in research and development is high, particularly in smart power management, digital integration, and modular designs. Firms are increasingly deploying AI-driven monitoring to optimize performance and reduce downtime. Approximately 60% of new power supply solutions in 2024 featured enhanced digital controls and predictive maintenance functionalities. Overall, the competitive landscape is dynamic, with companies leveraging innovation, collaborations, and advanced technology adoption to maintain and strengthen market positions in key industries such as healthcare, industrial automation, aerospace, and telecommunications.

Advanced Energy Industries

Keysight Technologies

Bunting Magnetics

GMW Associates

Industrial Magnetics

CAYLAR

Spellman High Voltage Electronics

The Electromagnet Power Supplies Market is being significantly shaped by both current and emerging technologies that enhance efficiency, precision, and versatility across multiple applications. Modular power supply designs have become increasingly prevalent, allowing manufacturers to quickly scale output capacity while reducing installation time. In 2024, over 45% of new industrial installations utilized modular systems, reflecting a growing preference for flexible power architectures. AI and machine learning integration are transforming operational performance and predictive maintenance. AI-enabled control systems now monitor voltage, current, and thermal conditions in real time, achieving up to a 20% improvement in energy efficiency and a 15% reduction in operational downtime. Smart diagnostic capabilities allow early detection of faults, reducing maintenance costs and extending equipment lifespan. Approximately 30% of newly deployed electromagnet power units in laboratories and manufacturing facilities include AI-driven monitoring.

High-voltage and pulse power technologies are also advancing rapidly, particularly in medical imaging, research laboratories, and industrial applications. Units with outputs exceeding 5kV have achieved a 25% improvement in load stability and a 20% enhancement in pulse response precision. Parallelly, renewable-compatible power solutions are being adopted, with over 40% of installations integrated into wind and solar power systems, improving conversion efficiency by up to 15%. Emerging trends such as digital twins, predictive analytics, and IoT-enabled remote monitoring are creating new opportunities for innovation. By leveraging these technologies, companies are not only enhancing system performance but also supporting energy efficiency, regulatory compliance, and sustainable operations, positioning electromagnet power supplies as critical enablers of industrial automation, scientific research, and medical advancements.

Lake Shore Cryotronics Advances Measurement Instruments at Magnetics 2023

In January 2023, Lake Shore Cryotronics showcased its high-performance magnetic measurement instruments at the Magnetics 2023 conference in Orlando. The company highlighted its award-winning F71/F41 teslameters, demonstrating their capabilities in precise magnetic field measurements.

AMETEK Introduces Industry’s First Titanium Efficiency M-CRPS Power Supply

At the OCP Global Summit in October 2023, AMETEK unveiled the industry's first Modular Hardware System Common Redundant Power Supply (M-CRPS) capable of delivering 1800 W in an ultra-compact 60mm x 185mm form factor. This innovation aims to enhance power efficiency in data centers and high-performance computing applications.

TDK-Lambda Expands Programmable DC Power Supply Series

In August 2023, TDK Corporation expanded its TDK-Lambda GENESYS+™ series by adding six new single-output models to its high-power density 1U full-rack 7.5kW programmable DC power supply platform. These additions are designed to meet the increasing demand for high-performance power solutions in various industrial applications.

Advanced Energy Introduces Titanium Efficiency M-CRPS Power Supply

At the OCP Global Summit in October 2023, Advanced Energy introduced the industry's first Modular Hardware System Common Redundant Power Supply (M-CRPS) capable of delivering 1800 W in an ultra-compact 60mm x 185mm form factor. This development underscores the company's commitment to advancing power supply technologies for modern data centers.

The Electromagnet Power Supplies Market Report offers a comprehensive analysis of the global market, encompassing various segments, regions, applications, and technologies. The report delves into the market dynamics across key geographic regions, including North America, Europe, Asia-Pacific, South America, and the Middle East & Africa, providing insights into regional demand trends and technological advancements. In terms of applications, the report examines the utilization of electromagnet power supplies in diverse sectors such as industrial automation, scientific research, medical equipment, and telecommunications. It highlights the growing adoption of these power supplies in laboratory settings, manufacturing processes, and diagnostic equipment, driven by the need for precise and reliable power sources.

The technological landscape is also explored, with a focus on innovations in power supply designs, including modular architectures, high-voltage capabilities, and integration with digital control systems. The report discusses the impact of these technological advancements on efficiency, scalability, and performance in various applications. Furthermore, the report identifies emerging market segments, such as the integration of electromagnet power supplies with renewable energy systems and advancements in AI-driven monitoring and diagnostics. It provides a forward-looking perspective on the market, offering valuable insights for business decision-makers and industry professionals seeking to understand the evolving landscape of electromagnet power supplies.

| Report Attribute/Metric | Report Details |

|---|---|

Market Revenue in 2024 | USD 773.54 Million |

Market Revenue in 2032 | USD 1280.2 Million |

CAGR (2025 - 2032) | 6.5% |

Base Year | 2024 |

Forecast Period | 2025 - 2032 |

Historic Period | 2020 - 2024 |

Segments Covered | By Types

By Application

By End-User

|

Key Report Deliverable | Revenue Forecast, Growth Trends, Market Dynamics, Segmental Overview, Regional and Country-wise Analysis, Competition Landscape |

Region Covered | North America, Europe, Asia-Pacific, South America, Middle East, Africa |

Key Players Analyzed | Lake Shore Cryotronics, AMETEK, TDK-Lambda, Advanced Energy Industries, Keysight Technologies, Bunting Magnetics, GMW Associates, Industrial Magnetics, CAYLAR, Spellman High Voltage Electronics |

Customization & Pricing | Available on Request (10% Customization is Free) |