Reports

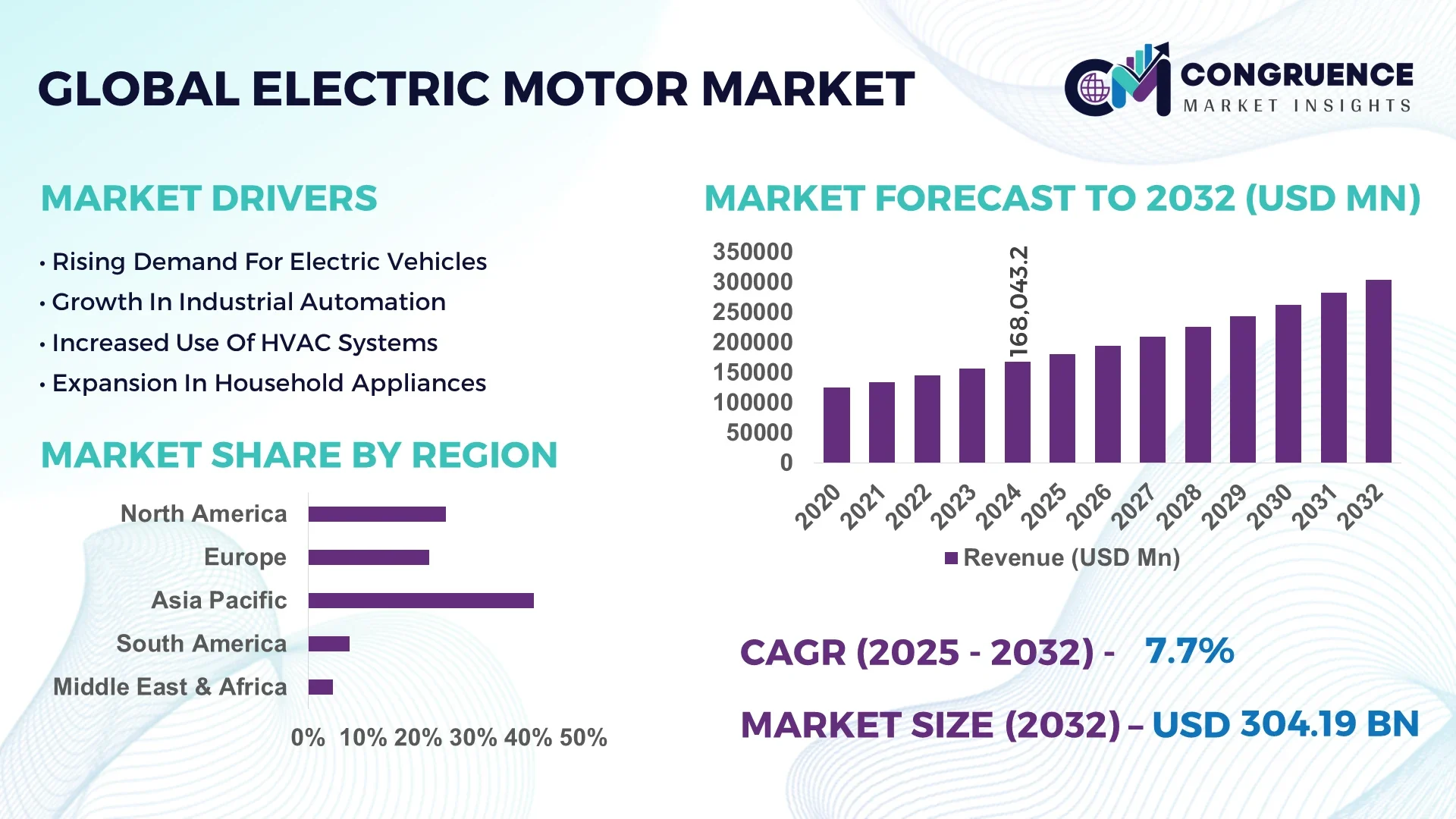

The Global Electric Motor Market was valued at USD 168,043.2 Million in 2024 and is anticipated to reach a value of USD 304,191.1 Million by 2032 expanding at a CAGR of 7.7% between 2025 and 2032.

The United States dominates the global electric motor market, driven by massive investments in industrial automation and increasing adoption of electric vehicles. In 2024, the U.S. accounted for a significant share due to technological advancements and strong manufacturing infrastructure supporting electric motor production and innovation.

The electric motor market is experiencing a surge driven by the rising electrification of the automotive sector, rapid industrialization, and the shift towards energy-efficient motor systems. The growing emphasis on sustainability, supported by government regulations and incentives, is encouraging industries to replace conventional motors with high-efficiency electric motors. Furthermore, the electric motor market is benefiting from increasing demand across HVAC systems, household appliances, and industrial machinery, propelling its growth trajectory consistently worldwide.

AI is reshaping the electric motor market by optimizing motor performance, enhancing predictive maintenance, and enabling smarter manufacturing processes. With AI algorithms, electric motors are becoming increasingly efficient, providing real-time diagnostics and minimizing downtime in industrial applications. Predictive maintenance powered by AI is reducing operational costs by identifying failures before they occur. Manufacturers are using AI to develop self-optimizing electric motor systems that adjust speed, torque, and energy consumption automatically, leading to substantial energy savings. The use of AI in electric motor design and testing is accelerating product development cycles, allowing companies to bring innovative solutions to market faster. Furthermore, AI integration is facilitating better control systems in electric vehicles, making motors more responsive, durable, and adaptable to various driving conditions. Robotics and industrial automation heavily rely on AI-enhanced electric motors to improve precision and productivity in complex operations. In 2025, AI's role in the electric motor market is expected to intensify as smart factories become the norm, leveraging AI for real-time monitoring, fault prediction, and optimization of electric motor operations across diverse industries.

“In January 2025, Siemens introduced an AI-powered drive system that enhances electric motor efficiency by up to 15%, using advanced neural networks for real-time optimization of speed and load handling, significantly improving industrial motor performance.”

The electric motor market is influenced by a range of dynamic factors, including technological innovations, evolving industry needs, and regulatory mandates pushing for energy efficiency. Increased electrification trends across various sectors like automotive, aerospace, and industrial manufacturing are strengthening the demand for versatile and robust electric motors. Advances in material science are enhancing motor durability, efficiency, and environmental friendliness. Additionally, initiatives promoting green energy solutions and electric vehicles are expanding the scope of electric motor applications worldwide.

The global push toward energy conservation is significantly influencing the electric motor market. Energy-efficient electric motors are becoming a critical choice for industries aiming to reduce their carbon footprint and operational costs. Motors compliant with international efficiency standards like IE3 and IE4 are gaining rapid adoption. Industrial plants and commercial infrastructures are increasingly investing in premium-efficiency motors, driven by regulations and corporate sustainability goals. This trend is boosting the sales of electric motors designed with enhanced power factors, lower operational noise, and minimal maintenance requirements.

While electric motors offer long-term operational benefits, their high upfront costs and integration complexities act as barriers, particularly for small and medium-sized enterprises (SMEs). Advanced electric motors, especially those integrated with AI and IoT capabilities, require significant investment not only in acquisition but also in training and infrastructure adjustments. The complexity involved in retrofitting old systems with new motor technologies further delays adoption, slowing the market expansion in some regions.

The rise of Industry 4.0 and smart manufacturing is opening new opportunities for the electric motor market. Electric motors are indispensable components in robotics, automated assembly lines, and material handling systems. The proliferation of collaborative robots (cobots) in various industries, including healthcare and logistics, is accelerating demand for highly precise and energy-efficient motors. Innovations focused on miniaturization and smart motor controllers are allowing electric motors to be deployed in more compact and complex automation environments, creating new growth avenues.

One of the critical challenges facing the electric motor market is the volatility in prices of key raw materials like copper, aluminum, and rare earth magnets. Fluctuating material costs impact manufacturing expenses and, subsequently, the pricing strategies of electric motor producers. Sudden spikes in raw material prices can strain profit margins and disrupt production schedules, leading to longer lead times and reduced competitiveness in cost-sensitive markets. Manufacturers must explore alternative materials and recycling initiatives to mitigate these risks.

• Surging Demand for Electric Vehicles (EVs):

The electric motor market is experiencing an unprecedented boost due to the soaring global demand for electric vehicles. Governments worldwide are setting ambitious EV adoption targets, significantly driving the need for highly efficient traction motors. In 2025, EV sales are expected to account for a large chunk of motor demand, particularly in regions like Europe and Asia-Pacific, where strong policy support exists.

• Rise in Industrial Automation:

Automation is transforming factories and warehouses, escalating the need for precision electric motors in automated guided vehicles (AGVs), robotic arms, and CNC machines. The industrial automation boom is particularly evident in countries like Germany, China, and South Korea, where smart factories are being rapidly deployed, pushing electric motor innovations to meet specific automation needs.

• Advancements in Motor Efficiency Standards:

Strict global energy efficiency regulations are encouraging manufacturers to innovate electric motors that meet or exceed IE4 and IE5 efficiency classes. Technological improvements such as better rotor designs, superior insulation materials, and advanced motor control algorithms are allowing manufacturers to produce motors with reduced energy losses and longer operational lives.

• Emergence of Wireless Electric Motor Control Systems:

The trend toward wireless technologies is impacting the electric motor market, with wireless motor controllers allowing for greater flexibility, reduced wiring costs, and easier system upgrades. These advancements are particularly beneficial in large industrial settings where traditional wiring can be cumbersome and costly. Adoption of wireless technologies is expected to grow sharply in the coming years, reshaping how electric motors are monitored and managed.

The electric motor market is broadly segmented based on type, application, and end-user industries, offering deep insights into the evolving demands across sectors. Understanding segmentation is crucial as it provides clarity on where the most significant growth opportunities lie within the electric motor landscape. Key electric motor types include AC motors, DC motors, and Hermetic motors, each serving diverse needs. Applications span from industrial machinery to electric vehicles and HVAC systems, while end-users range from automotive to aerospace, residential, and commercial sectors. Each segment is experiencing varied growth rates, influenced by technological advances, regulatory policies, and shifts in consumer behavior toward energy-efficient solutions and automation.

The electric motor market, by type, is categorized into AC motors, DC motors, and Hermetic motors. AC motors dominate the market share due to their widespread usage in industrial, commercial, and residential applications. Their robust design, low maintenance, and adaptability to different voltage conditions make them highly preferred. Particularly, induction motors within the AC segment are seeing strong demand due to their reliability and cost-effectiveness. DC motors, though smaller in market share, are witnessing rapid growth fueled by their critical role in electric vehicles and robotics. The DC brushless motor segment is the fastest-growing, attributed to its superior efficiency, reduced noise, and longer service life. Hermetic motors, primarily used in refrigeration and air-conditioning systems, are also seeing steady demand, particularly in the commercial HVAC sector. The flexibility, cost-efficiency, and energy-saving capabilities of brushless DC motors are making them a preferred choice for modern applications requiring compact, high-performance solutions.

Based on application, the electric motor market is segmented into industrial machinery, motor vehicles, HVAC equipment, household appliances, aerospace, and transportation. Industrial machinery holds the largest market share, driven by the increasing automation across manufacturing sectors globally. Electric motors are essential in conveyors, pumps, compressors, and robotic equipment. However, the motor vehicles application segment is the fastest-growing, fueled by the explosive rise in electric vehicle production and adoption. With governments globally enforcing stricter emissions norms, the shift towards electric mobility is massively benefiting electric motor demand. HVAC equipment also represents a strong segment, as the need for energy-efficient heating, ventilation, and air-conditioning solutions grows in both residential and commercial settings. In aerospace, electric motors are gaining traction for use in actuators and propulsion systems for electric aircraft prototypes, though the market share remains relatively smaller compared to automotive and industrial applications.

The end-user segmentation of the electric motor market includes automotive, residential, commercial, industrial, and aerospace sectors. The industrial sector leads in terms of revenue share, owing to the extensive adoption of electric motors across manufacturing plants, oil and gas operations, mining, and material handling. High demand for energy-efficient motors and automation solutions is driving substantial investment in this sector. Meanwhile, the automotive sector is the fastest-growing end-user segment, spurred by the unprecedented growth in electric vehicle production worldwide. Automotive manufacturers are increasingly focusing on electric motors for propulsion, power steering, and cooling applications, creating immense market opportunities. The residential sector is seeing consistent demand, mainly from applications in home appliances such as washing machines, refrigerators, and HVAC systems. Commercial end-users are adopting advanced electric motors to enhance energy efficiency in building management systems, while aerospace companies are exploring electric motor technologies to support innovations in sustainable aviation.

Asia-Pacific accounted for the largest market share at 41% in 2024; however, North America is expected to register the fastest growth, expanding at a CAGR of 8.2% between 2025 and 2032.

Asia-Pacific remains the dominant region for electric motor demand due to robust industrial growth, high production volumes in manufacturing, and rapid adoption of electric vehicles, especially in countries like China and India. The growing focus on energy efficiency and the expansion of electric mobility infrastructure are key factors driving the region’s market. North America, driven by the U.S. and Canada, is experiencing significant growth as industries increasingly invest in automation and electrification technologies.

Rising Adoption in Electric Vehicles and Industrial Automation

The North America electric motor market is experiencing significant growth, driven by the increasing adoption of electric vehicles (EVs) and industrial automation. The United States is leading this trend, supported by substantial investments in electric vehicle manufacturing, where electric motors are essential for propulsion systems. In 2024, North America’s electric motor market valued at USD 35 billion, with the U.S. accounting for the majority of consumption. The rising demand for electric vehicles, including light-duty cars and electric trucks, is one of the key drivers of this growth. Additionally, the U.S. and Canada’s manufacturing sectors are increasingly investing in automation technologies that rely on electric motors, enhancing productivity and energy efficiency. Canada's push for cleaner, more sustainable technologies in commercial and residential sectors is also contributing to a consistent increase in electric motor demand, especially in HVAC systems and renewable energy applications.

Transition to Energy-Efficient Motors in Industrial and Automotive Sectors

The Europe electric motor market is expanding rapidly, driven by the growing demand for energy-efficient solutions and the shift towards electric mobility. In 2024, the market reached an estimated USD 22 billion, with Germany, France, and the U.K. being the major contributors. The automotive sector, particularly the rise of electric vehicles, is a significant growth factor, with manufacturers transitioning to electric motor systems to meet environmental regulations. Additionally, Europe’s commitment to the green transition is pushing industries toward electric motors that comply with strict energy efficiency standards. Industries like manufacturing, particularly in the automation and robotics sectors, are increasingly utilizing electric motors to drive smarter production lines and optimize energy usage. The renewable energy sector, especially wind energy, also significantly contributes to the demand for electric motors in Europe.

Massive Growth Driven by Industrialization and Electric Vehicles

Asia-Pacific is the largest electric motor market, driven by rapid industrialization and the rising adoption of electric vehicles. In 2024, the region’s market size surpassed USD 70 billion, with China, Japan, and South Korea being the dominant players. China’s strong push for electric mobility has resulted in a surge in demand for electric motors, with EV sales exceeding 6 million units in 2024. Industrial applications, such as manufacturing automation, robotics, and material handling, are also fueling the demand for electric motors. Furthermore, China’s dominance in the production of energy-efficient motors and the country’s increasing focus on sustainable technologies are expected to drive continued market growth. Japan and South Korea are also witnessing increased investments in EVs and high-efficiency motors for use in robotics and home appliances, contributing to the region’s market expansion.

Increasing Demand from Electric Vehicles and Renewable Energy Projects

The South America electric motor market is growing steadily, driven by the rise in electric vehicle adoption and the region’s push for renewable energy solutions. Brazil is the leading market in this region, accounting for a large share of electric motor consumption, with significant growth observed in the automotive sector. In 2024, the South American electric motor market was valued at approximately USD 4 billion. The growing demand for electric vehicles in urban areas is propelling the need for electric motors, while the region’s expanding renewable energy initiatives, such as wind and solar energy projects, are creating additional demand for motors used in turbines and generators. Brazil is also enhancing its energy infrastructure with energy-efficient technologies, further boosting the electric motor market.

Focus on Energy Efficiency and Industrial Automation

The Middle East & Africa electric motor market is witnessing gradual growth, primarily driven by a focus on energy efficiency and industrial automation. In 2024, the market reached an estimated USD 3 billion, with Saudi Arabia, UAE, and South Africa leading the demand. The Middle East’s oil-based economies are transitioning toward more sustainable energy solutions, boosting the need for electric motors in renewable energy applications, such as solar and wind power. In addition, countries like Saudi Arabia and the UAE are investing heavily in smart cities and industrial automation, where high-efficiency electric motors play a critical role. South Africa is also increasing its reliance on electric motors in mining and heavy industries, driving demand across various segments.

The electric motor market is characterized by intense competition among established global players and emerging innovators. Leading companies like Nidec Corporation, Siemens AG, ABB Ltd, and WEG Industries continue to dominate the industrial and commercial sectors, offering a wide range of products from small motors to large industrial systems. These companies are investing heavily in research and development to enhance motor efficiency, integrate smart technologies, and expand their product portfolios.

Emerging players such as DeepDrive are introducing innovative motor designs, focusing on compactness and efficiency, which are gaining traction in the electric vehicle sector. Additionally, companies like Evolito Ltd are pioneering axial flux motors for aerospace applications, targeting the growing advanced air mobility market.

The competitive landscape is further shaped by strategic mergers and acquisitions. For instance, WEG Industries' acquisition of Regal Rexnord's industrial electric motors and generators business in 2024 expanded its global footprint and product offerings. Similarly, Siemens' acquisition of CG Power and Industrial Solutions strengthened its position in the Indian market, particularly in industrial applications.

Nidec Corporation

Siemens AG

ABB Ltd

WEG Industries

Evolito Ltd

DeepDrive

Regal Rexnord Corporation

CG Power and Industrial Solutions

Bharat Heavy Electricals Limited (BHEL)

General Electric (GE) Electric

The electric motor market is undergoing significant technological advancements aimed at enhancing motor performance, energy efficiency, and sustainability. One key development is the integration of Internet of Things (IoT) technology, which enables real-time monitoring and predictive maintenance. This allows businesses to optimize motor performance, reduce downtime, and improve operational efficiency. Additionally, innovations in power electronics, such as the use of silicon carbide (SiC) and gallium nitride (GaN) semiconductors, are enhancing the efficiency of electric motors by enabling them to handle higher voltages and deliver superior performance. The trend toward miniaturization is also growing, particularly for electric vehicle applications, as smaller, lighter motors are being developed without compromising their power output. Furthermore, advanced materials such as high-performance magnets and laminated cores are reducing energy losses and boosting motor efficiency, which is especially beneficial in automotive and industrial automation applications. These technological advancements are propelling the market toward greater adoption of electric motors across various sectors.

In April 2024, Nidec Corporation introduced an e-axle traction motor that integrates the gear, motor, and electronics for electric vehicles, enhancing performance while reducing space requirements.

In June 2024, LAPP introduced the ETHERLINE® FD bioP Cat.5e, its first bio-based Ethernet cable, featuring a bio-based outer sheath composed of 43% renewable raw materials, reducing the carbon footprint by 24% compared to traditional fossil-based TPU sheaths.

In November 2024, Siemens completed the acquisition of CG Power and Industrial Solutions, expanding its portfolio and strengthening its position in the Indian electric motor market, particularly for industrial applications.

In February 2025, Evolito Ltd received Design Organisation Approval (DOA) from the UK's Civil Aviation Authority for its electric propulsion systems, paving the way for the company’s entry into the aerospace market.

The Electric Motor Market Report provides a comprehensive and in-depth analysis of the global electric motor industry. The report covers critical aspects, including market size, growth projections, and segment-specific dynamics. It examines the market's segmentation by motor types, applications, and end-user industries, offering insights into key trends, challenges, and growth opportunities within each segment. The report also delves into regional market dynamics, providing a detailed examination of the electric motor market in North America, Europe, Asia-Pacific, South America, and the Middle East & Africa. It offers valuable information on market drivers, restraints, and emerging opportunities in different regions. The competitive landscape is analyzed to offer insights into the strategies adopted by key market players, along with their recent developments and innovations. Furthermore, the report explores technological trends and innovations shaping the future of the electric motor industry, such as the integration of smart technologies and the use of advanced materials to improve motor performance and efficiency.

| Report Attribute/Metric | Report Details |

|---|---|

|

Market Revenue in 2024 |

USD 168,043.2 Million |

|

Market Revenue in 2032 |

USD 304,191.1 Million |

|

CAGR (2025 - 2032) |

7.7% |

|

Base Year |

2024 |

|

Forecast Period |

2025 - 2032 |

|

Historic Period |

2020 - 2024 |

|

Segments Covered |

|

|

Key Report Deliverable |

Revenue Forecast, Growth Trends, Market Dynamics, Segmental Overview, Regional and Country-wise Analysis, Competition Landscape |

|

Region Covered |

North America, Europe, Asia-Pacific, South America, Middle East, Africa |

|

Key Players Analyzed |

Nidec Corporation, Siemens AG, ABB Ltd, WEG Industries, Evolito Ltd, DeepDrive, Regal Rexnord Corporation, CG Power and Industrial Solutions, Bharat Heavy Electricals Limited (BHEL), General Electric (GE) Electric |

|

Customization & Pricing |

Available on Request (10% Customization is Free) |