Reports

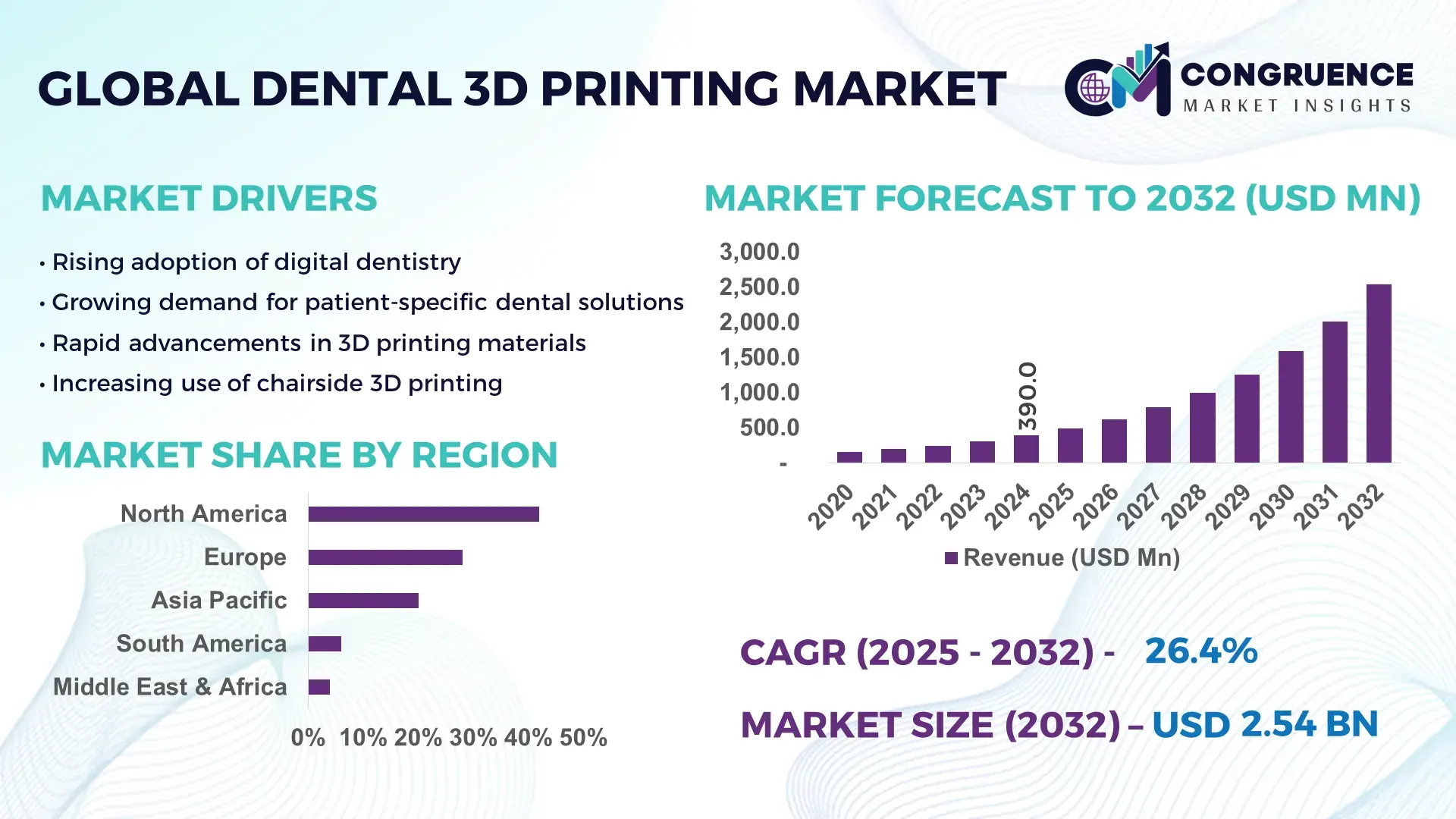

The Global Dental 3D Printing Market was valued at USD 390.0 Million in 2024 and is anticipated to reach a value of USD 2,541.2 Million by 2032 expanding at a CAGR of 26.4% between 2025 and 2032, according to an analysis by Congruence Market Insights. This growth is driven by increasing adoption of precision dentistry and rapid advancements in 3D printing technologies.

The United States dominates the Dental 3D Printing Market, supported by its high production capacity and substantial investment in advanced dental manufacturing technologies. Over 65% of dental laboratories in the country have integrated 3D printing solutions into their workflows, facilitating faster production of crowns, bridges, and orthodontic appliances. The nation has invested over USD 450 million in dental 3D printing R&D in the past three years, with cutting-edge technologies like digital light processing (DLP) and stereolithography (SLA) being widely implemented. Rapid adoption in clinics and labs has enabled improvements in accuracy, material efficiency, and turnaround times, with patient-specific prosthetics being produced at scales previously unattainable.

Market Size & Growth: Market valued at USD 390.0 Million in 2024, projected to reach USD 2,541.2 Million by 2032, driven by rising demand for customized dental solutions.

Top Growth Drivers: Increasing adoption of 3D printing (68%), enhanced operational efficiency (57%), rapid prototyping in dental labs (49%).

Short-Term Forecast: By 2028, 3D printing workflows expected to reduce production time of dental appliances by 35%.

Emerging Technologies: Digital light processing (DLP), stereolithography (SLA), and metal additive manufacturing for dental implants.

Regional Leaders: North America projected at USD 1,020 Million by 2032 with high clinical adoption; Europe at USD 780 Million focusing on material innovation; Asia-Pacific at USD 500 Million with growing lab integration.

Consumer/End-User Trends: Increasing preference for customized dental prosthetics and orthodontics; over 60% of dental clinics adopting in-house printing for efficiency.

Pilot or Case Example: In 2025, a leading U.S. dental lab achieved 40% faster turnaround using integrated DLP printers.

Competitive Landscape: Stratasys leads with ~28% market presence; other major competitors include 3D Systems, EnvisionTEC, Formlabs, and SprintRay.

Regulatory & ESG Impact: Adoption influenced by ISO standards for dental materials; incentives for sustainable resin use in North America.

Investment & Funding Patterns: Over USD 450 Million in recent R&D funding and venture-backed projects; trend toward integrated workflow solutions.

Innovation & Future Outlook: Integration of AI for precision modeling, hybrid materials, and automation in dental appliance production shaping future growth.

Dental 3D printing is increasingly utilized across orthodontics, prosthodontics, and implantology, with innovations in resins, ceramics, and metals enhancing precision and durability. Regional consumption patterns indicate high adoption in North America and Europe, while Asia-Pacific is investing heavily in automated lab workflows. Environmental and regulatory measures are promoting sustainable material use, and future trends point toward AI-driven design, hybrid materials, and faster production cycles across clinics and labs.

The Dental 3D Printing Market serves as a critical driver for precision, efficiency, and innovation in modern dentistry. Advanced digital light processing (DLP) technologies deliver up to 40% higher accuracy compared to traditional stereolithography methods. North America dominates in production volume, while Europe leads in adoption, with over 62% of dental clinics implementing 3D printing workflows. By 2026, AI-driven dental modeling is expected to improve treatment planning efficiency by 30%, reducing patient wait times and operational costs. Firms are committing to ESG metrics, such as achieving 25% reduction in resin waste and improving recycling of dental materials by 2027. In 2025, a U.S.-based dental lab achieved a 35% reduction in prosthetic production time through AI-assisted automated design and printing. Moving forward, the Dental 3D Printing Market will remain a pillar of resilience, driving compliance, operational excellence, and sustainable growth within the dental industry.

The Dental 3D Printing Market is witnessing rapid transformation due to technological innovation, increasing clinical adoption, and rising patient demand for personalized dental solutions. Developments in digital workflows, resin chemistry, and printing accuracy are reshaping how dental appliances are designed and produced. Investment in research and development is facilitating faster, cost-effective production, while integration of AI and automation streamlines lab operations. Emerging applications in prosthodontics, orthodontics, and implantology are expanding market opportunities. The competitive landscape is strengthening with global players focusing on hybrid technologies, cloud-based workflow integration, and sustainable material development.

Increasing patient preference for personalized dental prosthetics has fueled adoption, with over 68% of dental clinics integrating 3D printing for crowns, bridges, and aligners. Customization reduces turnaround times by 30–40% and improves accuracy in complex procedures. Enhanced workflow efficiency, material flexibility, and high-resolution output allow laboratories to produce patient-specific appliances rapidly. Rapid prototyping capabilities enable faster adjustments, reducing chair-side modifications and improving patient satisfaction, driving broader adoption across the industry.

The market faces challenges due to constrained availability of high-quality biocompatible resins and metal powders, restricting application in certain clinical procedures. Material limitations can result in reduced durability, color matching issues, or regulatory compliance challenges. Furthermore, cost and supply chain constraints for specialized resins and metals hinder small laboratories from fully adopting advanced printing technologies. This limits scalability and slows integration into high-volume production environments.

AI integration in design and workflow optimization presents significant opportunities. Predictive modeling can reduce errors, while automated design software improves precision by up to 35%. Emerging hybrid printing materials allow multi-material prosthetics, expanding treatment options. Additionally, cloud-based digital workflows enable remote collaboration among laboratories and clinics, enhancing productivity. Rapid technological innovation and increasing adoption in emerging economies provide new avenues for market expansion, particularly in orthodontics and implantology.

High initial investments in printers and training, coupled with stringent ISO and FDA regulations for dental materials, present barriers. Small labs struggle with operational expenses, while evolving material standards require continuous upgrades. Compliance with biocompatibility, sterilization, and environmental regulations increases operational complexity. These factors can delay implementation and limit adoption, particularly in regions with fragmented supply chains and limited access to certified materials.

Rapid Adoption of Digital Workflows: Over 60% of dental clinics in North America and Europe have implemented fully digital design-to-print workflows, reducing chair-side adjustments by 25% and production errors by 30%.

Emergence of Multi-Material Printing: Integration of hybrid materials, including resins and metals, enables the production of durable, patient-specific prosthetics. 40% of high-volume labs have adopted multi-material systems in 2025.

AI-Enhanced Design Optimization: Artificial intelligence software is improving design accuracy by 35% compared to traditional CAD methods, enabling faster turnaround and reduced material waste in dental labs.

Expansion of Orthodontic Applications: 3D printing adoption in clear aligner production has increased by 50% in the past two years, allowing mass customization and quicker delivery of orthodontic appliances across Europe and North America.

The Dental 3D Printing Market is systematically segmented by type, application, and end-user to provide a nuanced understanding of adoption patterns and operational relevance. Type segmentation encompasses printers based on technology and material compatibility, each serving specific clinical and laboratory requirements. Application segmentation covers orthodontics, prosthodontics, implantology, and surgical guides, reflecting distinct procedural uses that influence workflow and material selection. End-user segmentation highlights dental laboratories, hospitals, clinics, and academic institutions, illustrating the operational and clinical integration of 3D printing solutions. Consumer adoption is increasing in regions with higher technological infrastructure, with over 60% of dental labs in North America and Europe utilizing in-house 3D printing. This structured approach allows decision-makers to assess strategic opportunities, identify niche markets, and align production or investment decisions with technological and clinical trends.

Stereolithography (SLA) currently leads the Dental 3D Printing Market, accounting for approximately 45% of adoption due to its high precision, smooth surface finish, and compatibility with biocompatible resins. Digital Light Processing (DLP) printers hold around 30% of the market, offering faster print speeds, and adoption in multi-material hybrid systems is rising fastest, projected to surpass 35% by 2032, driven by the need for complex prosthetics and dental appliances. Selective Laser Sintering (SLS) and Fused Deposition Modeling (FDM) contribute a combined 25% share, primarily used for niche applications such as temporary crowns, study models, and educational training.

Orthodontics is the leading application in the Dental 3D Printing Market, representing 40% of adoption, driven by increasing demand for clear aligners, precision brackets, and patient-specific appliances. Implantology accounts for approximately 28% of use, while surgical guides are emerging fastest, expected to exceed 32% adoption by 2032, propelled by digital workflow integration and advanced imaging technologies. Prosthodontics and maxillofacial applications comprise the remaining 32%, serving high-precision, custom restoration needs. In 2024, over 38% of dental clinics globally reported piloting 3D printing for orthodontic solutions, while 42% of hospitals in the U.S. were integrating printing for surgical guides.

Dental laboratories are the leading end-user segment, accounting for 50% of market adoption, driven by demand for rapid prototyping, in-house production, and high-precision appliances. Clinics and hospitals represent around 30% of usage, while academic institutions and research centers hold 20%, with the fastest-growing adoption observed in hospital-based surgical departments, projected to surpass 35% integration by 2032 due to digital workflow implementation and procedural efficiency gains. In 2024, more than 38% of dental clinics globally piloted in-house 3D printing systems for patient-specific orthodontics and prosthetics. Over 60% of Gen Z patients in urban areas prefer clinics offering customized appliances via 3D printing.

North America accounted for the largest market share at 42% in 2024; however, Asia-Pacific is expected to register the fastest growth, expanding at a CAGR of 27% between 2025 and 2032.

In 2024, North America had over 2,500 dental laboratories actively integrating 3D printing technologies, while more than 1,200 clinics deployed in-house systems for orthodontic and prosthodontic applications. Europe followed with 28% of the market, and Asia-Pacific captured 20%, supported by rapid lab adoption in China, Japan, and India. South America and the Middle East & Africa accounted for 6% and 4%, respectively. Over 65% of dental labs in North America and 52% in Europe adopted stereolithography (SLA) or digital light processing (DLP) printers. Orthodontics contributed approximately 40% of overall usage, while prosthodontics and surgical guides represented 35% and 25%, respectively.

North America holds 42% of the global Dental 3D Printing Market. Key industries driving demand include dental laboratories, hospital-based surgical centers, and academic institutions focusing on dental research. Regulatory enhancements and government support, such as FDA guidelines for biocompatible resins and tax incentives for digital dental equipment, are encouraging adoption. Digital transformation trends include AI-assisted design, automated workflows, and hybrid material printing. A leading player, Stratasys, expanded its U.S. lab network in 2025, enabling faster production of patient-specific surgical guides. Consumer behavior shows higher adoption in healthcare facilities, with over 60% of clinics implementing in-house 3D printing for orthodontics and prosthetics, enhancing both accuracy and patient satisfaction.

Europe accounts for 28% of the global market, with Germany, the UK, and France as the top contributors. Regulatory oversight from bodies such as the European Medicines Agency and sustainability initiatives promoting recyclable dental resins are shaping market practices. Emerging technologies, including multi-material DLP and SLA systems, are being widely adopted. A local company, EnvisionTEC, launched advanced dental printers in Germany, enhancing lab productivity and enabling rapid prototyping. Consumer behavior is influenced by regulatory compliance, with clinics and laboratories prioritizing explainable, safe, and environmentally friendly printing processes. Over 55% of European dental laboratories now utilize 3D printing for orthodontic and prosthodontic workflows.

Asia-Pacific captured 20% of the market in 2024, ranking third by market volume. Top-consuming countries include China, Japan, and India, with over 1,100 labs adopting 3D printing. Investments in infrastructure, particularly automated lab setups and hybrid material printers, are accelerating production capacity. Innovation hubs in Japan and South Korea are advancing AI-assisted design and precision printing. A notable example is SprintRay’s deployment of DLP systems across Chinese dental labs in 2025, producing over 150,000 aligners annually. Consumer behavior reflects growing preference for digitally optimized treatments and mobile-integrated orthodontic services, driving rapid regional adoption.

South America holds 6% of the global Dental 3D Printing Market, with Brazil and Argentina as primary contributors. Investments in lab infrastructure and energy-efficient printing technologies are supporting growth. Government incentives for digital healthcare solutions, including tax relief and import support for medical devices, are enhancing adoption. A local player in Brazil deployed SLA printers in 2024, enabling faster production of surgical guides for over 20,000 patients. Consumer behavior emphasizes media-driven awareness and language-localized patient engagement, leading to higher acceptance of digitally customized dental appliances.

The Middle East & Africa contributed 4% of the market in 2024, with the UAE and South Africa as major growth countries. Technological modernization trends include the adoption of hybrid printing systems and digital workflows in dental labs. Regional regulations are supporting safe biocompatible resin usage, and trade partnerships are facilitating equipment imports. A UAE-based dental clinic implemented DLP printers in 2025, producing over 5,000 custom orthodontic appliances annually. Consumer behavior reflects growing adoption in private healthcare networks, emphasizing high-quality, precision dental solutions for affluent patient segments.

United States - 42% Market Share: Dominance supported by high production capacity, strong adoption in dental labs, and robust regulatory infrastructure.

Germany - 12% Market Share: Strong end-user demand and advanced technological integration in both laboratories and clinical settings.

The Dental 3D Printing Market is moderately fragmented, with over 120 active competitors globally, including both established players and emerging innovators. The top five companies—Stratasys, 3D Systems, Formlabs, EnvisionTEC, and SprintRay—collectively account for approximately 58% of total market presence, indicating a competitive yet partially consolidated landscape. Strategic initiatives such as partnerships with dental laboratories, product launches of high-resolution SLA and DLP printers, and mergers to expand geographic reach are common. For example, Stratasys expanded its network of dental labs in North America and Europe in 2024, enhancing service delivery and local production capabilities. Innovation trends are shaping competition, with companies focusing on hybrid material printing, AI-assisted design software, automated workflow integration, and high-speed printer development. Smaller players are carving niches in specialized resin and ceramic printing solutions, while large players leverage scale, brand recognition, and cross-industry partnerships. The market emphasizes precision, speed, and cost efficiency, driving ongoing R&D investments across regions. Over 65% of global dental labs now utilize 3D printing technologies, intensifying competitive pressures.

EnvisionTEC

SprintRay

Asiga

Prodways

Carbon3D

DWS Systems

Nexa3D

Dental 3D printing technologies have advanced significantly, transforming the production of crowns, bridges, implants, orthodontic appliances, and surgical guides. Stereolithography (SLA) remains the leading technology, providing precision up to 25 microns and high-resolution surface finishes. Digital Light Processing (DLP) is increasingly adopted for faster print speeds and multi-material compatibility. Emerging technologies include AI-assisted design software that reduces design errors by over 35%, and hybrid printing combining resin and metal powders for complex prosthetics. Multi-material 3D printing now accounts for approximately 28% of global adoption, enabling simultaneous fabrication of rigid and flexible components in a single workflow. Automation in post-processing, such as washing and curing, is reducing labor requirements by up to 40%. Laser-based selective sintering is gaining traction in implantology for durable metal frameworks. Cloud-based software platforms are streamlining remote design collaboration, allowing over 1,200 dental labs to share STL files and manufacturing instructions across regions. Technological advancements are also enhancing patient-specific modeling, improving procedural accuracy, and reducing chair-side adjustments, creating a more efficient and precise dental care ecosystem.

In April 2024, Formlabs launched its new resin 3D printer Form 4. The printer uses a new “Low Force Display™ (LFD)” print engine and offers 2–5× faster print speeds compared to its predecessor, enabling many dental parts to be completed in under two hours. Source: www.formlabs.com

In January 2024 at CES, Formlabs also unveiled a new resin supply option — the Resin Pumping System — along with a new dental‑grade material, Premium Teeth Resin. These releases help dental labs boost throughput, reduce resin change‑overs and packaging waste by up to 86%, and support continuous, high-volume printing. Source: www.dentalproductsreport.com

In 2025, 3D Systems announced plans to release its new NextDent 300 MultiJet 3D printer — part of the upcoming NextDent Jetted Denture Solution — designed for multi-material, monolithic denture production. The system allows high‑volume labs to produce fully cured, patient‑specific dentures in a single print job, significantly improving speed and scalability of denture fabrication. Source: www.3dsystems.com

In 2023, As part of its ongoing innovation strategy, Renishaw introduced a new cobalt‑chromium alloy material tailored for dental applications — specially for printing partial denture frames — offering high strength and biocompatibility. This expanded the material options available to dental 3D printing users. Source: rss.globenewswire.com

The Dental 3D Printing Market Report encompasses a comprehensive analysis of product types, applications, end-users, and geographic distribution. It covers major printer technologies, including SLA, DLP, SLS, and emerging hybrid multi-material systems. Applications addressed range from orthodontics, prosthodontics, and implantology to surgical guides and maxillofacial solutions. End-users include dental laboratories, hospitals, clinics, and academic institutions. The report evaluates regional dynamics across North America, Europe, Asia-Pacific, South America, and the Middle East & Africa, highlighting adoption patterns, technological infrastructure, and regulatory influences. It also examines material innovation, digital workflows, and AI-assisted design software impacting production efficiency. Niche segments such as temporary crowns, biocompatible resin printing, and custom surgical templates are included. The report provides insights into industry drivers, emerging technologies, competitive strategies, and market trends, offering actionable intelligence for investors, manufacturers, and decision-makers seeking to optimize operations, expand regional presence, and capitalize on technological advancements in the dental 3D printing ecosystem.

| Report Attribute / Metric | Details |

|---|---|

| Market Revenue (2024) | USD 390.0 Million |

| Market Revenue (2032) | USD 2,541.2 Million |

| CAGR (2025–2032) | 26.4% |

| Base Year | 2024 |

| Forecast Period | 2025–2032 |

| Historic Period | 2020–2024 |

| Segments Covered |

By Type

By Application

By End-User Insights

|

| Key Report Deliverables | Revenue Forecast, Market Trends, Growth Drivers & Restraints, Technology Insights, Segmentation Analysis, Regional Insights, Competitive Landscape, Recent Developments |

| Regions Covered | North America, Europe, Asia-Pacific, South America, Middle East & Africa |

| Key Players Analyzed | Stratasys, 3D Systems, Formlabs, EnvisionTEC, SprintRay, Asiga, Prodways, Carbon3D, DWS Systems, Nexa3D |

| Customization & Pricing | Available on Request (10% Customization Free) |