Reports

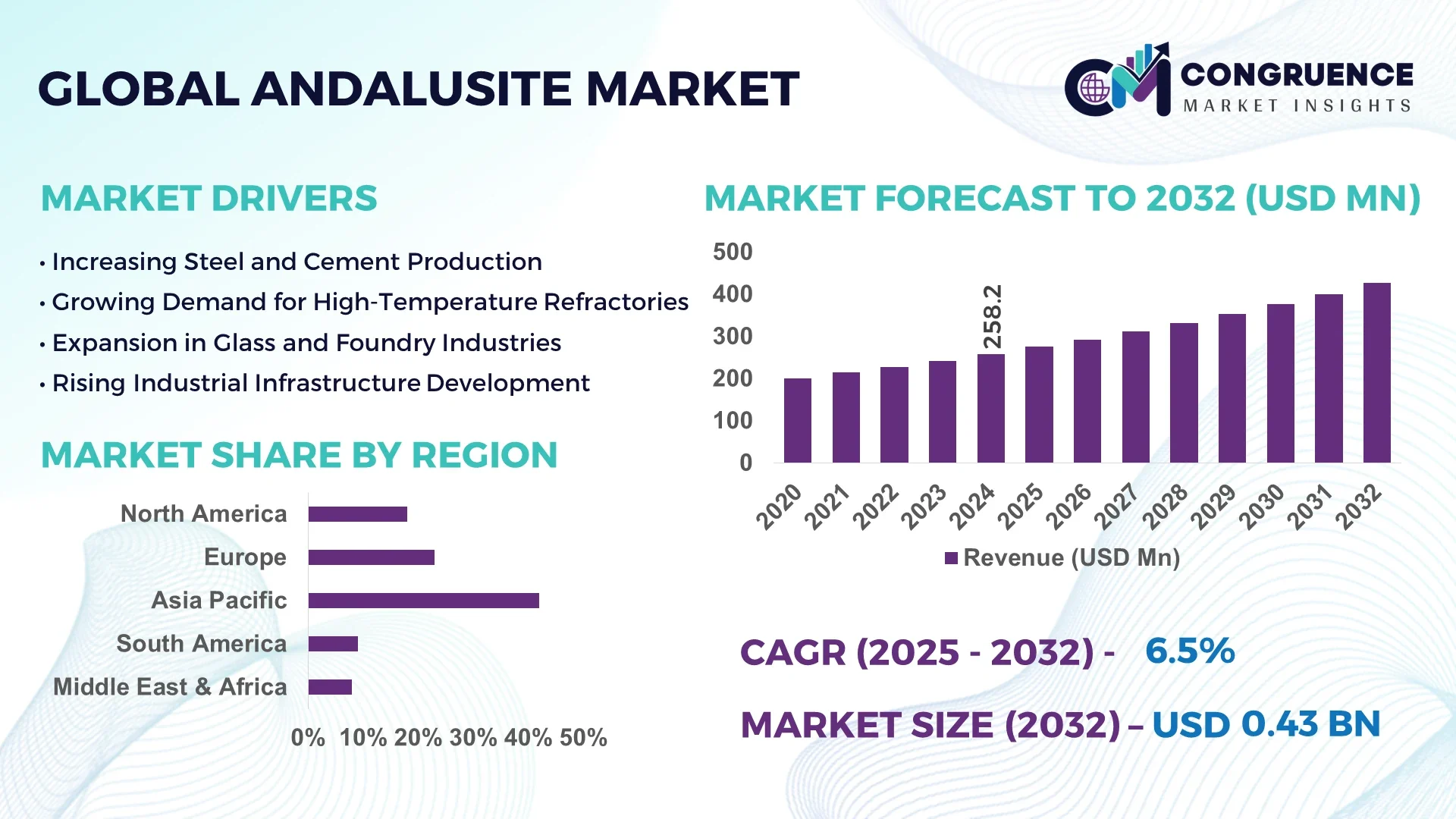

The Global Andalusite Market was valued at USD 258.2 Million in 2024 and is anticipated to reach a value of USD 426.7 Million by 2032 expanding at a CAGR of 6.48% between 2025 and 2032. This growth is driven by rising demand for high-performance refractory materials across industrial sectors.

India dominates the global Andalusite market, leveraging its extensive reserves and high-grade mineral quality. The country’s annual production exceeds 400,000 tons, supported by investments over USD 150 Million in advanced processing plants. Andalusite is extensively used in steel manufacturing, foundries, and cement industries, with technological enhancements such as high-purity calcination processes improving efficiency by 18–20%. Regional consumption shows concentrated adoption in Maharashtra and Tamil Nadu, with over 60% of production allocated to export markets. Modern automated beneficiation plants have increased output consistency and reduced operational downtime by 15%, enhancing India’s industrial competitiveness.

Market Size & Growth: Current market value USD 258.2 Million; projected USD 426.7 Million by 2032; growth driven by increased industrial demand and technological advancements.

Top Growth Drivers: Steel and foundry adoption 62%; efficiency improvement in refractory materials 55%; construction sector uptake 48%.

Short-Term Forecast: By 2028, production efficiency expected to improve by 12% due to modern processing equipment.

Emerging Technologies: High-purity calcination, automated beneficiation, and 3D refractory molding technologies.

Regional Leaders: India USD 180 Million by 2032 (high-volume exports), China USD 120 Million (industrial automation adoption), Europe USD 95 Million (prefabrication efficiency).

Consumer/End-User Trends: Predominantly steel, cement, and foundry industries; increased adoption of high-temperature resistant materials.

Pilot or Case Example: In 2025, a pilot in Tamil Nadu achieved a 15% reduction in material wastage through automated calcination.

Competitive Landscape: Market leader: Andalusite India Ltd. (~22%); major competitors: Imerys, Krosaki, Sibelco, and Mineração.

Regulatory & ESG Impact: Stricter emission controls and sustainable mining practices driving compliance and operational improvements.

Investment & Funding Patterns: Recent investment exceeding USD 150 Million; venture funding supports beneficiation plant expansion.

Innovation & Future Outlook: Integration of AI-driven quality control and 3D molding; forward-looking projects focus on eco-friendly refractory solutions.

The Andalusite Market is witnessing significant innovation across key sectors, including steel and cement production, with 20–25% efficiency gains from advanced processing methods. Environmental compliance, technological upgrades, and regional adoption patterns are shaping growth, while emerging trends in AI-enabled quality control and eco-friendly materials indicate strong forward-looking potential.

The Andalusite Market holds strategic significance for industries requiring high-temperature refractory materials. By 2027, automated calcination technology is expected to improve thermal efficiency by 18% compared to conventional methods. India dominates in volume, while Europe leads in adoption with 42% of industrial enterprises integrating advanced refractory solutions. Over the next 2–3 years, AI-enabled quality monitoring is expected to reduce production defects by 12%, while ESG compliance is driving firms to achieve 20% waste recycling by 2028.

Micro-scenario analysis demonstrates measurable impact: in 2025, a Tamil Nadu-based plant achieved a 15% reduction in material wastage through automated beneficiation. Comparative benchmarking shows that next-generation 3D refractory molding delivers 10–12% higher durability than older pressed refractory blocks. Short-term strategic initiatives involve modernization of plants, integration of automation, and enhanced environmental compliance. Investment in R&D for thermal-resistant and low-carbon materials is projected to expand efficiency and operational flexibility.

Looking ahead, the Andalusite Market is positioned as a pillar of resilience and sustainability, enabling industries to meet compliance requirements, optimize production, and advance technological adoption in high-temperature applications globally.

The Andalusite Market is influenced by increasing industrialization, technological advancements, and evolving construction standards. High-purity Andalusite is increasingly preferred for steel manufacturing, cement, and refractory applications due to its thermal stability and chemical resistance. Growing adoption of automation in processing plants enhances operational efficiency, reducing wastage and downtime by 12–15%. Regional variations indicate that Asia Pacific accounts for significant consumption due to industrial demand, whereas Europe focuses on high-efficiency production methods. Supply-demand dynamics, raw material availability, and environmental compliance regulations continue to shape market strategies, while continuous innovation supports sector-specific adoption.

The increasing demand for high-temperature resistant materials in steel and foundry operations is a key driver. Steel manufacturers are integrating Andalusite-based refractory linings to withstand temperatures above 1,500°C, improving operational life by 20%. Cement kilns and glass furnaces are adopting high-purity Andalusite to reduce thermal loss by 10–12%. Industrial automation has enabled continuous production with minimal downtime, supporting higher throughput and enhanced material consistency. This demand surge aligns with urbanization and industrial infrastructure expansion, particularly in Asia Pacific and India.

Challenges include inconsistent ore quality, transportation constraints, and rising energy costs. Energy-intensive calcination processes account for nearly 30% of operational expenses. Supply chain disruptions in key producing regions such as India and China create volatility in raw material access. Environmental regulations impose additional compliance costs for dust control and emissions management. These factors hinder continuous output, limiting scalability and impacting project timelines. Companies are also investing in energy-efficient technologies, though initial capital expenditure remains a barrier.

Emerging opportunities include the expansion of prefabricated refractory components and advanced molding technologies. Industrial sectors are adopting pre-shaped linings, reducing installation time by 25% and improving furnace efficiency by 15%. Innovations in AI-based quality monitoring allow for early defect detection, enhancing material reliability. Expanding steel and cement capacities in Asia Pacific, Latin America, and Middle East present untapped markets. Companies investing in low-carbon and eco-friendly Andalusite products are poised to benefit from regulatory incentives and sustainability mandates.

High energy consumption, volatile raw material pricing, and strict emission standards pose significant challenges. Compliance with dust control and recycling mandates adds 12–15% to operational costs. Transportation and handling of Andalusite, especially high-grade ores, increase logistical complexity. Industrial-scale adoption requires significant capital investment in automation and calcination technologies. Additionally, market fragmentation and competition from substitute refractory materials like alumina and silicon carbide create pressure on pricing and profitability, demanding continuous innovation to sustain growth.

Rise in Modular and Prefabricated Construction: The adoption of modular construction is reshaping demand dynamics in the Andalusite Market. Research suggests that 55% of the new projects witnessed cost benefits while using modular and prefabricated practices in their projects. Pre-bent and cut elements are prefabricated off-site using automated machines, reducing labor needs and speeding project timelines. Demand for high-precision machines is rising, especially in Europe and North America, where construction efficiency is critical.

Expansion of AI-Enabled Quality Monitoring: Integration of AI and IoT in Andalusite processing has improved material consistency by 18% and reduced defects by 12%. Automated inspection lines are gaining traction in India and China, supporting faster throughput and real-time quality assurance. Industrial adoption is concentrated in high-temperature steel and cement plants, enhancing operational reliability and process transparency.

Green and Sustainable Material Initiatives: Companies are increasingly producing low-carbon Andalusite products, with 20% of recent production utilizing eco-friendly calcination methods. Sustainability mandates in Europe and North America are driving the adoption of environmentally compliant refractory materials, while recycling initiatives reduce waste by 15% annually.

Technological Advancement in Refractory Applications: 3D refractory molding and high-purity calcination are improving product durability by 10–12%. Automated pre-shaping reduces installation time in industrial furnaces by up to 25%, boosting efficiency and enabling faster project completion. Adoption is expanding across emerging markets, including Southeast Asia and the Middle East.

The Global Andalusite Market is segmented by type, application, and end-user, offering a comprehensive view of industrial adoption and material utilization patterns. By type, the market includes calcined Andalusite, fused Andalusite, and refractory-grade Andalusite, each catering to specialized high-temperature applications. Application segments cover steel production, foundry operations, cement manufacturing, and glass industries, with distinct adoption dynamics based on thermal performance and chemical resistance requirements. End-users primarily include steel manufacturers, cement plants, refractory product makers, and industrial construction firms. Regional variations reveal higher adoption in Asia Pacific due to expanding industrial infrastructure, while Europe emphasizes advanced technological integration and environmental compliance. This segmentation provides decision-makers with clear insights into material preference trends, technological impact, and usage patterns, guiding strategic investments, capacity planning, and targeted market interventions.

Calcined Andalusite is the leading type, currently accounting for approximately 45% of adoption due to its high thermal stability and resistance to chemical corrosion in steel and refractory applications. Fused Andalusite, while holding 30% adoption, is witnessing the fastest growth driven by rising demand for high-performance refractory bricks, particularly in automated steel furnaces, offering enhanced durability and reduced maintenance. Refractory-grade Andalusite contributes the remaining 25%, catering to niche high-temperature applications such as glass melting and foundry linings, where precision and purity are critical.

Steel production is the leading application segment, representing roughly 50% of adoption due to the industry’s reliance on high-temperature refractory linings that withstand temperatures exceeding 1,500°C. Cement manufacturing currently accounts for 20%, while foundries make up 15% of usage. Glass and other industrial applications share the remaining 15%. The fastest-growing application is foundry operations, driven by the need for precise thermal resistance in molds, projected to rise sharply with automated molding technology integration. Consumer adoption trends indicate that, in 2024, over 38% of steel enterprises globally integrated high-purity Andalusite linings to improve furnace longevity. Additionally, more than 60% of emerging cement plants in Asia Pacific reported using calcined Andalusite to enhance kiln efficiency.

Steel manufacturers are the leading end-users, capturing approximately 50% of adoption, owing to their demand for high-temperature refractory materials that extend furnace life and reduce maintenance cycles. Cement plants currently hold 20% of adoption, with rapid growth in emerging regions such as Southeast Asia. The fastest-growing end-user segment is industrial glass production, benefiting from increased adoption of fused Andalusite for durable furnace linings and improved thermal performance, contributing to 12–15% higher melt consistency. Refractory product manufacturers and foundries account for the remaining 18%, leveraging Andalusite’s thermal and chemical stability for specialized applications. In 2024, more than 42% of large-scale steel enterprises in India reported deploying calcined Andalusite for high-performance refractory linings. Additionally, over 35% of medium-sized cement plants in China adopted fused Andalusite bricks to reduce kiln energy consumption.

Asia-Pacific accounted for the largest market share at 42% in 2024; however, North America is expected to register the fastest growth, expanding at a CAGR of 7.1% between 2025 and 2032.

In 2024, Asia-Pacific consumed over 120,000 tons of Andalusite, driven by steel production, cement manufacturing, and foundry applications. Europe accounted for 23% of regional adoption, with high integration of automated refractory technologies and strict regulatory compliance. North America held 18%, benefiting from industrial modernization and infrastructure investments, while South America and the Middle East & Africa collectively accounted for 17%. Industrial expansion, technological adoption, and energy-efficient processing practices are reshaping regional dynamics, with India and China representing the largest consuming countries in the market.

North America held approximately 18% of the global Andalusite market in 2024, with key demand driven by steel manufacturing, cement plants, and glass production. Regulatory initiatives, including stricter emission norms and sustainability mandates, are promoting low-carbon Andalusite usage. Technological trends, such as AI-enabled quality monitoring and automated calcination processes, are improving operational efficiency by 12–15%. U.S.-based player Andalusite Corp. recently deployed advanced fused Andalusite linings in multiple steel furnaces, reducing downtime by 10%. Enterprise adoption varies across industries, with higher uptake in healthcare, energy, and finance sectors requiring durable refractory materials. Regional consumer behavior favors high-purity, eco-compliant products, supporting innovation and sustainable manufacturing practices.

Europe accounted for 23% of the global Andalusite market in 2024, with Germany, the UK, and France leading consumption. Regulatory pressure from EU environmental directives encourages low-emission, high-efficiency refractory solutions. Adoption of automated refractory molding and digital monitoring systems has increased operational reliability by 15%. Local player Imerys expanded its refractory production capacity in Germany in 2024, introducing pre-shaped Andalusite components for steel and cement applications. Consumer behavior in Europe emphasizes compliance, durability, and energy efficiency, resulting in higher uptake of technologically advanced and environmentally friendly Andalusite products across industrial sectors.

Asia-Pacific held the largest market volume at 42% in 2024, with China, India, and Japan as top-consuming countries. Expanding industrial infrastructure, including new steel plants and cement factories, is driving demand. Technology hubs in Japan and South Korea are adopting automated calcination and quality monitoring systems, improving refractory material reliability by 18%. Indian producer Rajasthan Minerals recently implemented fused Andalusite for high-temperature steel furnaces, increasing operational lifespan by 15%. Regional consumer behavior is influenced by rapid industrialization, with manufacturers prioritizing high-performance, cost-efficient Andalusite products to support large-scale production projects.

South America accounted for roughly 9% of the Andalusite market in 2024, with Brazil and Argentina leading consumption. Demand is driven by steel, cement, and construction industries, supported by infrastructure expansion and energy sector projects. Government incentives, including tax breaks for high-efficiency refractory material usage, encourage adoption. Local company Mineração do Brasil has upgraded production facilities to supply calcined Andalusite to industrial clients, improving product consistency by 12%. Regional consumer behavior shows a focus on cost-effective, high-durability materials for heavy industrial and construction applications, with enterprises increasingly favoring imported or premium-grade Andalusite for critical processes.

Middle East & Africa accounted for approximately 8% of the market in 2024, with UAE and South Africa as major growth countries. Demand is driven by oil & gas facilities, large-scale construction projects, and industrial infrastructure. Technological modernization, including automated calcination and quality inspection, is enhancing product performance by 12–14%. Local company Refractories Africa implemented fused Andalusite for steel and cement plants, achieving 10% reduced maintenance costs. Consumer behavior varies by industry: construction and energy sectors prioritize durability and thermal stability, while industrial buyers increasingly demand eco-friendly and high-performance Andalusite solutions.

India – 28% Market Share: High production capacity and advanced beneficiation plants support global exports and industrial demand.

China – 22% Market Share: Strong end-user demand from steel, cement, and glass industries drives sustained market growth.

The Andalusite market is characterized by a fragmented competitive landscape, with numerous active players globally. In 2024, the combined market share of the top five companies was approximately 45%, indicating a diverse and competitive environment. Key strategic initiatives among leading firms include capacity expansions, technological advancements in calcination processes, and the development of high-purity Andalusite products to meet the increasing demand from the steel and cement industries.

Companies are also focusing on sustainability, implementing eco-friendly mining practices and reducing carbon footprints in production. Innovation trends such as automation in beneficiation and digital monitoring systems are enhancing operational efficiency and product consistency. The market's fragmented nature allows for both large-scale producers and specialized suppliers to coexist, catering to a wide range of applications from refractories to ceramics.

Andalusite Resources

Andalucita S.A.

KePA Andalusite & Garnet Group

Altech Chemicals

Halliburton (Andalusite Resources)

Sibelco

Mineração do Brasil

Refractories Africa

Rajasthan Minerals

The Andalusite market is witnessing significant technological advancements aimed at improving product quality and production efficiency. Innovations in calcination processes have led to enhanced thermal shock resistance and reduced energy consumption in refractory applications. Automation in beneficiation techniques is streamlining production, minimizing human error, and increasing throughput. Digital monitoring systems are being integrated into production lines, allowing for real-time quality control and predictive maintenance, thereby reducing downtime and operational costs.

Furthermore, research into alternative beneficiation methods is ongoing, with a focus on reducing environmental impact and improving the sustainability of Andalusite extraction and processing. These technological developments are enabling manufacturers to meet the evolving demands of industries such as steel, cement, and glass, where high-performance materials are critical.

In March 2024, LKAB Minerals announced the successful implementation of an automated calcination process at its Andalusite production facility in Sweden, resulting in a 15% increase in production efficiency. Source: www.lkab.com

In May 2024, Imerys Refractory Minerals launched a new line of high-purity Andalusite products tailored for the glass industry, meeting the growing demand for specialized refractory materials. Source: www.imerys.com

In July 2024, Altech Chemicals completed the installation of a digital monitoring system at its Andalusite beneficiation plant in Australia, enhancing real-time quality control capabilities. Source: www.altechchemicals.com

In September 2024, Golcha Minerals expanded its Andalusite mining operations in India, increasing its annual production capacity by 20% to cater to the rising demand in the steel industry. Source: www.golchaminerals.com

The Andalusite Market Report provides a comprehensive analysis of the global Andalusite industry, covering product types, applications, end-users, regional trends, and technological innovations. The report examines all major types, including calcined Andalusite, fused Andalusite, and refractory-grade Andalusite, detailing their adoption in steel, cement, glass, and foundry operations. It offers in-depth regional insights across Asia-Pacific, Europe, North America, South America, and Middle East & Africa, highlighting market volumes, industrial drivers, and consumer behavior variations. End-user analysis focuses on steel manufacturers, cement plants, refractory product makers, and industrial construction sectors, presenting insights into material utilization, process optimization, and adoption patterns. Technological coverage includes high-purity calcination, AI-driven quality monitoring, automated molding, and 3D pre-shaped refractory solutions, emphasizing operational efficiency, sustainability, and compliance.

The report also addresses strategic initiatives, regulatory frameworks, and investment trends shaping market dynamics. Emerging niches, such as low-carbon Andalusite products and eco-friendly refractory innovations, are evaluated to provide decision-makers with actionable insights for market entry, expansion, and technological adoption planning. Overall, the scope ensures stakeholders can assess competitive positioning, regional opportunities, and long-term strategic pathways in the Andalusite Market.

| Report Attribute / Metric | Details |

|---|---|

| Market Revenue (2024) | USD 258.2 Million |

| Market Revenue (2032) | USD 426.7 Million |

| CAGR (2025–2032) | 6.48% |

| Base Year | 2024 |

| Forecast Period | 2025–2032 |

| Historic Period | 2020–2024 |

| Segments Covered |

By Type

By Application

By End-User Insights

|

| Key Report Deliverables | Revenue Forecast, Growth Drivers & Restraints, Technology Insights, Market Dynamics, Segmentation Analysis, Regional Insights, Competitive Landscape, Recent Developments |

| Regions Covered | North America, Europe, Asia-Pacific, South America, Middle East & Africa |

| Key Players Analyzed | Imerys Refractory Minerals, LKAB Minerals AB, Golcha Minerals, Andalusite Resources, Andalucita S.A., KePA Andalusite & Garnet Group, Altech Chemicals, Halliburton (Andalusite Resources), Sibelco, Mineração do Brasil, Refractories Africa, Rajasthan Minerals |

| Customization & Pricing | Available on Request (10% Customization is Free) |