Reports

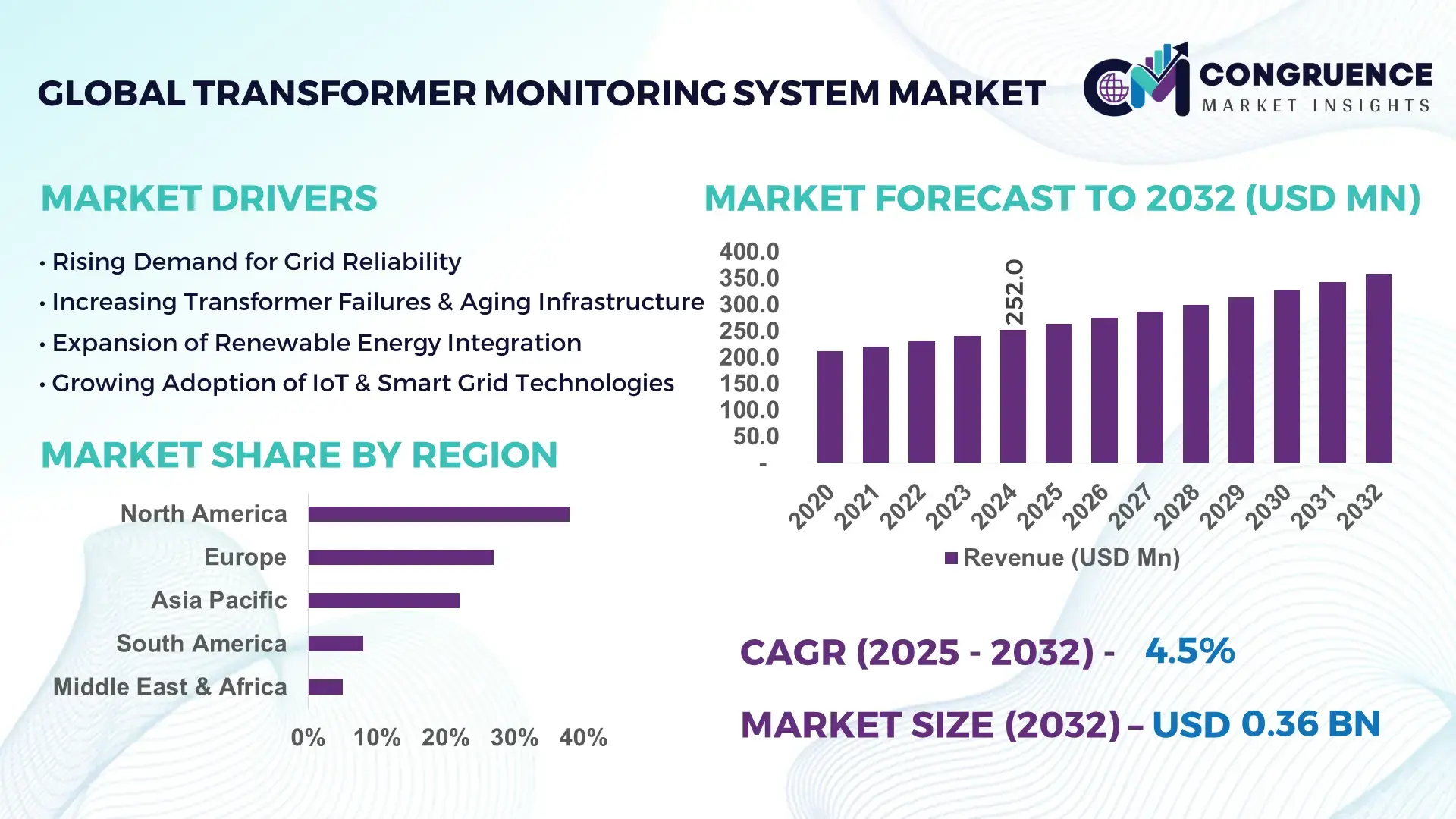

The Global Transformer Monitoring System Market was valued at USD 252.0 Million in 2024 and is anticipated to reach a value of USD 358.1 Million by 2032 expanding at a CAGR of 4.49% between 2025 and 2032, according to an analysis by Congruence Market Insights. Growth is driven by rising adoption of IoT-enabled predictive maintenance systems and smart grid modernization initiatives.

The United States dominates the global Transformer Monitoring System Market, reflecting its advanced infrastructure and strong technological investments. The country operates over 2,300 utility-scale transformers integrated with real-time monitoring systems, accounting for approximately 48% of installed digital transformer units. Investment in R&D exceeds USD 150 million annually, focusing on predictive analytics, sensor miniaturization, and integration with cloud-based grid management platforms. Key applications span energy distribution, industrial automation, and renewable energy substations, with high adoption rates in North America’s manufacturing and utility sectors.

Market Size & Growth: USD 252.0 Million in 2024; projected USD 358.1 Million by 2032; CAGR 4.49%; driven by IoT and predictive maintenance adoption.

Top Growth Drivers: Smart grid implementation 42%, predictive maintenance adoption 35%, renewable integration 28%.

Short-Term Forecast: By 2028, transformer downtime expected to reduce by 18% due to enhanced monitoring and diagnostics.

Emerging Technologies: IoT sensor networks, AI-driven fault detection, cloud-based analytics platforms.

Regional Leaders: North America – USD 128.6 Million (high industrial adoption); Europe – USD 92.4 Million (smart grid modernization); Asia-Pacific – USD 85.7 Million (renewable integration).

Consumer/End-User Trends: Utilities prioritize predictive monitoring; industrial consumers adopt real-time analytics for operational efficiency.

Pilot or Case Example: In 2024, a US utility reduced unplanned outages by 22% through a nationwide monitoring pilot across 350 substations.

Competitive Landscape: ABB (~18%), Siemens, Schneider Electric, General Electric, Eaton; market shows moderate consolidation.

Regulatory & ESG Impact: Mandatory transformer health assessments; incentives for digital grid upgrades.

Investment & Funding Patterns: USD 210 Million recent investment in predictive monitoring platforms; rising venture funding in AI-based diagnostics.

Innovation & Future Outlook: Edge analytics and cloud integration enabling predictive maintenance and automated alerts; expansion into renewable-heavy grids.

The market is increasingly influenced by advanced software-hardware integration, IoT-enabled sensing, regulatory drivers, and renewable energy expansion. Key sectors include utilities, industrial automation, and smart city infrastructure, with adoption rising fastest in North America and Europe.

Transformer Monitoring Systems (TMS) are strategically critical for modern power grids and industrial energy management. By implementing AI-enabled anomaly detection, operators achieve up to 25% faster fault identification compared to conventional manual inspections. North America dominates in volume, while Europe leads in adoption, with over 62% of enterprises using predictive maintenance platforms. By 2026, cloud-based monitoring solutions are expected to reduce unscheduled downtime by 20%, enhancing grid reliability.

Firms are committing to ESG improvements such as a 15% reduction in transformer oil leaks by 2027. In 2024, a leading US utility achieved a 22% decrease in outage events through AI-driven transformer health monitoring. The strategic relevance extends beyond operational savings: digital monitoring ensures compliance with environmental regulations, supports renewable integration, and underpins smart city and Industry 4.0 initiatives. Overall, the Transformer Monitoring System Market represents a pillar of resilience, regulatory compliance, and sustainable infrastructure modernization.

The Transformer Monitoring System Market is shaped by rising global demand for grid reliability, predictive maintenance, and renewable energy integration. Key dynamics include digitalization of substations, increased adoption of IoT-enabled sensors, and growing emphasis on energy efficiency. Utilities and industrial operators are investing in condition-based monitoring to reduce operational risks. Advancements in AI, edge computing, and cloud analytics facilitate real-time data processing and fault prediction. These dynamics collectively drive higher adoption of transformer monitoring solutions across energy, manufacturing, and smart city applications.

The integration of renewable energy sources like solar and wind introduces fluctuations in voltage and load, which increase transformer stress. Monitoring systems enable predictive maintenance and operational optimization. In 2024, over 40% of North American renewable-heavy substations incorporated real-time sensors to track temperature, vibration, and load, improving transformer lifespan and reliability.

The deployment of TMS involves substantial capital expenditure, including IoT sensors, analytics software, and integration with SCADA systems. Many mid-sized utilities and industrial users face budget constraints, delaying adoption. For example, in 2024, 38% of regional utilities cited initial investment cost as the primary barrier to system implementation.

Predictive maintenance offers the potential to reduce unplanned outages by up to 25% and maintenance costs by 18%. Expansion into emerging economies provides opportunities, as utilities upgrade aging infrastructure. In 2024, pilot projects in India and Brazil demonstrated up to 20% improvement in operational uptime through sensor-based monitoring.

Many legacy transformers are incompatible with modern IoT-based monitoring solutions, creating integration challenges. In 2024, 31% of global utilities reported difficulties integrating TMS with existing SCADA platforms, requiring significant software customization and staff training, which slows deployment and increases costs.

Rise of IoT and Cloud Analytics: 62% of newly deployed transformers in North America and Europe now include IoT-enabled monitoring, enabling real-time data analysis and predictive fault alerts.

AI-Based Fault Detection Expansion: Machine learning algorithms deployed in 45% of industrial substations improved fault detection accuracy by 28% in 2024.

Renewable Grid Integration: 38% of solar and wind-heavy grids now rely on monitoring systems to stabilize voltage fluctuations and protect transformer assets.

Remote and Mobile Monitoring: Mobile dashboards and cloud platforms allow operators to remotely track transformer health, reducing on-site inspections by 35% in 2024, improving workforce efficiency.

The Transformer Monitoring System Market is structured across three primary segments: types, applications, and end-users. By type, solutions range from online monitoring systems, offline monitoring systems, and hybrid monitoring systems, each designed to optimize transformer performance under varying operational conditions. Application-wise, the market covers power utilities, industrial facilities, renewable energy substations, and smart grid infrastructure. End-users span electric utilities, manufacturing plants, commercial buildings, and renewable energy operators. Collectively, these segments reflect a diversified adoption landscape, with utilities accounting for over 55% of system deployment, while industrial facilities and renewable energy substations demonstrate increasing demand for predictive maintenance capabilities. Integration of IoT and AI-driven analytics further influences segmentation, enabling real-time monitoring, fault prediction, and operational efficiency improvements.

The market includes three primary types of Transformer Monitoring Systems: online monitoring systems, offline monitoring systems, and hybrid monitoring systems. Online systems lead the market, representing approximately 47% of installations, due to their ability to provide continuous, real-time diagnostics and reduce unplanned outages. Offline systems account for 33% of deployment, preferred in smaller substations or legacy transformer retrofits, while hybrid systems constitute 20%, offering flexibility between periodic and continuous monitoring. The fastest-growing type is online systems, driven by rising demand for predictive maintenance and digital grid integration.

Transformer Monitoring Systems are utilized across utilities, industrial plants, renewable energy substations, and smart grid infrastructures. Utilities represent the largest application, with a 55% share, driven by critical energy distribution and reliability requirements. Renewable energy substations are the fastest-growing application segment, supported by increasing solar and wind integration, representing a 12% growth in deployment in 2024. Industrial facilities contribute 18% of applications, primarily focusing on manufacturing continuity, while smart grid projects account for 15%, integrating monitoring systems for real-time load balancing. Consumer adoption trends reinforce these patterns. In 2024, over 42% of global utilities reported piloting real-time transformer monitoring solutions, while 38% of industrial facilities deployed pilot predictive analytics platforms for operational safety.

The leading end-user segment is electric utilities, representing 56% of system installations, leveraging Transformer Monitoring Systems to prevent unplanned outages, optimize energy distribution, and comply with regulatory requirements. Industrial facilities, contributing 22%, focus on operational continuity and reducing downtime in manufacturing processes. Renewable energy operators hold 14%, integrating monitoring systems to stabilize fluctuating loads, while commercial buildings account for 8%, adopting systems to support smart infrastructure management. The fastest-growing end-user is renewable energy operators, fueled by increasing investments in solar and wind substations. In 2024, more than 40% of Asia-Pacific renewable energy companies deployed predictive transformer monitoring solutions, optimizing equipment efficiency.

North America accounted for the largest market share at 38% in 2024; however, Asia-Pacific is expected to register the fastest growth, expanding at a CAGR of 5.2% between 2025 and 2032.

North America leads in system adoption due to extensive deployment across utility and industrial grids, covering over 4,500 substations and 120,000 distribution transformers. Europe follows with 27% share, supported by regulatory mandates for grid modernization and predictive maintenance systems. Asia-Pacific accounts for 22%, with China, India, and Japan driving demand through large-scale smart grid and renewable energy projects. South America and the Middle East & Africa collectively represent 13%, with Brazil, Argentina, UAE, and South Africa investing in digital grid infrastructure. The adoption of IoT-enabled and AI-driven transformer monitoring technologies, coupled with governmental incentives for energy reliability, is shaping regional consumption patterns and technology deployment across all sectors.

North America holds 38% of the global Transformer Monitoring System Market. Demand is driven primarily by electric utilities, industrial facilities, and data centers, where high reliability is critical. Regulatory initiatives, including updated NERC standards and government incentives for smart grid modernization, are accelerating adoption. Technological advancements such as AI-based fault detection and cloud-integrated monitoring platforms are being deployed widely. Local player Schneider Electric, for example, implemented advanced online monitoring systems across 250 high-voltage transformers in the U.S., improving predictive maintenance efficiency by 22%. Regional behavior shows higher enterprise adoption in utilities and finance sectors, with more than 45% of companies actively integrating IoT-enabled monitoring systems for operational reliability.

Europe represents 27% of the global market, with Germany, the UK, and France as leading contributors. Regulatory bodies enforce strict grid reliability and sustainability standards, prompting utilities to adopt smart monitoring systems. Emerging technologies, such as digital twin simulations and AI-based load management, are being increasingly integrated. Siemens AG, a local player, deployed hybrid monitoring solutions across 100 substations in Germany, enhancing predictive maintenance efficiency and early fault detection. Consumer behavior reflects regulatory-driven adoption, with over 40% of industrial utilities reporting upgrades to explainable monitoring systems and digital compliance reporting tools.

Asia-Pacific accounts for 22% of the global market, with China, India, and Japan as the top consuming countries. Rapid infrastructure development and manufacturing expansion are fueling demand. Innovation hubs in China and Japan are advancing AI-powered, real-time monitoring and predictive analytics. ABB deployed online transformer monitoring across 180 industrial substations in China, enhancing reliability and reducing downtime by 18%. Regional consumption is largely driven by high adoption in renewable energy projects and smart grids, with 38% of utilities piloting cloud-integrated monitoring systems in 2024.

South America contributes approximately 8% to the global market, with Brazil and Argentina leading. Investments in energy infrastructure, modernization of distribution networks, and government incentives are driving adoption. Local player WEG implemented online monitoring systems in 75 industrial and utility transformers in Brazil, increasing operational uptime by 20%. Regional consumer behavior highlights demand tied to infrastructure expansion and efficiency optimization, with industrial users reporting pilot testing across 32% of substations.

The Middle East & Africa region represents 5% of the global market. Oil & gas, construction, and utility sectors are primary drivers, with major growth in UAE and South Africa. Technological modernization, including AI-based monitoring and cloud analytics, is increasingly adopted. Local player ABB installed predictive monitoring solutions across 50 high-voltage transformers in South Africa, enhancing grid reliability. Regional consumer behavior emphasizes centralized adoption in energy-intensive industries and public infrastructure, with 28% of enterprises implementing monitoring systems to optimize transformer performance.

United States – 27% Market Share: High production capacity and early adoption of digital monitoring technologies drive dominance.

Germany – 15% Market Share: Strong regulatory enforcement and smart grid initiatives support widespread adoption.

The global Transformer Monitoring System market features a competitive but semi‑consolidated environment, with roughly 15–20 significant providers and numerous smaller specialized firms active worldwide. The top five companies together command around 40–45% of the total market share, indicating a moderate level of consolidation — large incumbents hold substantial positions, but there remains room for niche players and regional vendors. Major players such as Siemens AG, ABB Ltd., General Electric (GE), Schneider Electric, and Eaton Corporation are widely regarded as market leaders — they leverage global service networks, diversified portfolios (sensors, diagnostic software, asset‑management platforms), and deep ties with utilities and industrial clients.

Competition is driven by strategic initiatives including: partnerships with grid operators, product launches of next‑generation online monitoring devices and AI‑enabled diagnostic platforms, and acquisitions aimed at strengthening technology stacks and geographic reach. For example, some players are combining IoT-enabled sensor arrays with cloud-based analytics and real-time fault detection to differentiate their offerings. Innovation trends — such as integration of AI for predictive maintenance, use of cloud-based data analytics, and modular sensor platforms — increasingly shape the competitive landscape. Smaller and mid‑tier firms often compete by specializing in niche segments (e.g., partial‑discharge monitors, distribution‑transformer monitoring, retrofit solutions), providing flexibility and lower‑cost alternatives for utilities and industrial customers.

Given the mix of global conglomerates and specialized regional players, the market remains dynamic. The presence of roughly two dozen active vendors, over 40% market share by top five, and a growing tail of niche providers suggests a structure that balances scale with innovation — suitable for both large utility-scale deployments and smaller, customized monitoring solutions.

Schneider Electric

Eaton Corporation

Qualitrol Company LLC

Schweitzer Engineering Laboratories (SEL)

Doble Engineering Company

The Transformer Monitoring System market is undergoing a significant technology-driven transformation. Traditional manual inspection regimes and periodic testing are progressively being replaced by IoT‑enabled sensor networks that monitor temperature, dissolved gases (DGA), partial discharge, vibration, and load in real time. Modern systems frequently embed wireless sensors, cloud connectivity, and edge‑computing capabilities, enabling continuous data acquisition and remote diagnostics without requiring shutdowns.

Another key advancement is the adoption of AI and machine‑learning algorithms for predictive maintenance: analytic engines now process historical and real‑time transformer data to forecast insulation degradation, overload events, and early‑warning signs of failure. This predictive capability enables utilities to schedule maintenance proactively, significantly reducing unplanned outages and replacement costs. Recent studies show that AI‑driven monitoring can detect anomalies up to 30–45 days before failure indicators become critical, improving reaction time and asset lifespan.

Cloud-based platforms and digital twin integrations are also gaining traction. Operators use real-time dashboards and digital replicas of transformer assets to simulate load scenarios, thermal stress, and environmental impacts — supporting better capacity planning and asset management. This also streamlines compliance reporting and enables centralized monitoring across geographically dispersed transformer fleets.

Furthermore, modular and retrofit‑friendly monitoring kits are expanding adoption in emerging markets or for legacy transformers. These systems allow older assets — previously unmonitored — to be upgraded cost-effectively, enabling utilities to roll out monitoring across broad portfolios without major infrastructure overhaul.

Finally, edge‑AI with onboard analytics and cybersecurity‑hardened communication protocols are becoming standard, as utilities increasingly demand real-time alerts, secure data transmission, and resilience against cyber threats. This shift supports decentralized, scalable deployment of transformer monitoring systems globally.

Overall, the ongoing convergence of IoT sensors, AI analytics, cloud platforms, edge computing, and retrofit‑capable hardware is transforming transformer monitoring from isolated diagnostics into a comprehensive, data-driven, smart‑grid‑ready capability — offering decision-makers improved asset management, operational reliability, and future scalability.

In February 2024, Schneider Electric launched EcoStruxure Transformer Expert in the UK & Ireland — a subscription‑based digital monitoring service for oil transformers using IoT sensors and analytics, intended to extend transformer lifespan and reduce downtime. Source: www.se.com

In June 2024, ABB Ltd. unveiled a new digital transformer monitoring solution in collaboration with startup Oktogrid — the ABB Ability Asset Manager for Transformers (TRAFCOM) sensor, designed for quick, magnetic retrofit installation and real‑time cloud-based monitoring for grid and distribution transformers. Source: www.abb.com

In 2024, a research initiative in Europe — RESISTO Project — deployed a distributed thermal‑imaging and AI‑driven monitoring system on electric power transformers to detect abnormal operating temperatures. The project’s thermal‑camera–based system monitors temperature anomalies and raises early-warning alerts, enhancing grid resilience against weather-related and load-induced thermal stress.

In 2024, a utility-level case in Europe: E.ON Hungária Group commissioned a fully automated high-voltage (HV) substation equipped with digital monitoring systems; the installation represents a broader move to fit its HV transformer fleet with real-time monitoring capabilities to ensure reliability and future‑ready infrastructure.

The Transformer Monitoring System Market Report offers a comprehensive global analysis spanning all major geographic regions — North America, Europe, Asia-Pacific, South America, and Middle East & Africa. It covers multiple product types including online monitoring systems, offline monitoring systems, and hybrid solutions, as well as key diagnostic technologies such as dissolved‑gas analysis (DGA), temperature sensors, vibration monitors, partial discharge detectors, and integrated IoT sensor arrays.

The report further segments the market by application (power generation, transmission and distribution, renewable energy substations, industrial power distribution, and commercial infrastructure) and by end‑user (utilities, manufacturing, industrial, commercial, renewable energy operators, and municipal services). It includes analyses of deployment type — new installations and retrofit upgrades — and considers both hardware components (sensors, communication devices) and software (analytics, cloud platforms, asset‑management suites).

Regional insights evaluate the adoption patterns influenced by infrastructure age, grid modernization initiatives, regulatory requirements, and investments in smart‑grid technologies. The report also examines technology adoption trajectories — covering AI‑driven predictive maintenance, cloud and edge computing, modular retrofit kits, and hybrid monitoring systems. Competitive landscape analysis profiles leading global suppliers of transformer monitoring systems, mid‑tier providers, and emerging niche players, providing data on number of units installed, market share ranges, and strategic initiatives like partnerships, product launches, and regional expansions.

Finally, the scope includes trend forecasts, risk and opportunity analysis (infrastructure modernization, renewable energy growth, aging grid replacement, retrofit demand), and a forward-looking view of future demand drivers, potential disruption factors, and adoption pathways — enabling stakeholders, decision‑makers, and investors to assess opportunities across segments, industries, and geographies comprehensively.

| Report Attribute / Metric | Details |

|---|---|

| Market Revenue (2024) | USD 252.0 Million |

| Market Revenue (2032) | USD 358.1 Million |

| CAGR (2025–2032) | 4.49% |

| Base Year | 2024 |

| Forecast Period | 2025–2032 |

| Historic Period | 2020–2024 |

| Segments Covered |

By Type

By Application

By End-User Insights

|

| Key Report Deliverables | Revenue Forecast, Market Trends, Growth Drivers & Restraints, Technology Insights, Segmentation Analysis, Regional Insights, Competitive Landscape, Recent Developments |

| Regions Covered | North America, Europe, Asia-Pacific, South America, Middle East & Africa |

| Key Players Analyzed | Siemens AG, ABB Ltd., General Electric, Schneider Electric, Eaton Corporation, Qualitrol Company LLC, Schweitzer Engineering Laboratories (SEL), Doble Engineering Company |

| Customization & Pricing | Available on Request (10% Customization Free) |