Reports

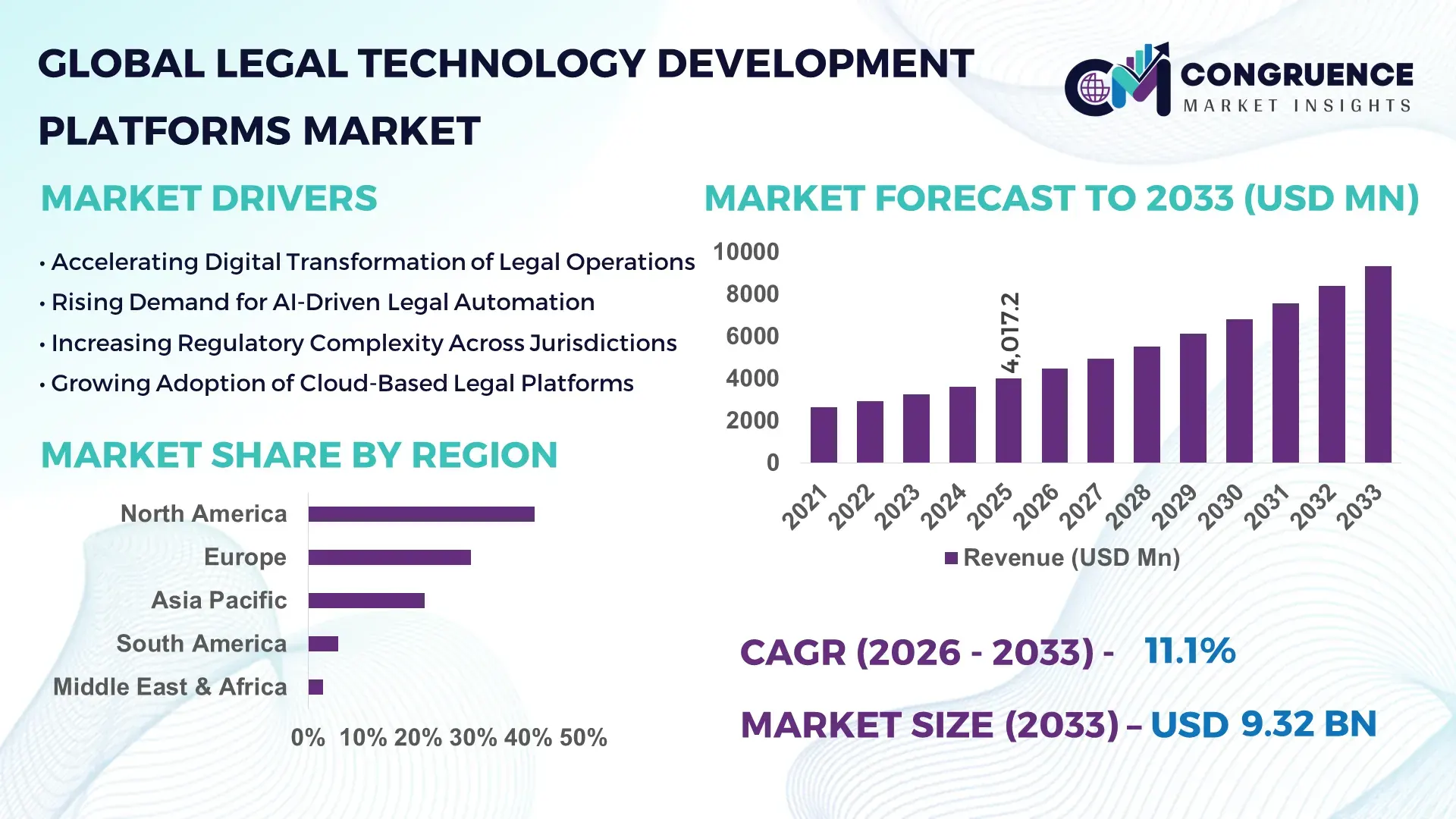

The Global Legal Technology Development Platforms Market was valued at USD 4,017.2 Million in 2025 and is anticipated to reach a value of USD 9,324.7 Million by 2033 expanding at a CAGR of 11.1% between 2026 and 2033, according to an analysis by Congruence Market Insights. Growth is driven by accelerating digitization of legal workflows and rising demand for automation across compliance, contract management, and litigation support.

The United States represents the most mature ecosystem within the Legal Technology Development Platforms market, supported by advanced software production capacity, deep venture capital investment, and strong enterprise adoption. More than 5,000 legal tech startups operate across the country, with cumulative investments exceeding USD 18 billion since 2020. Enterprise law firms and corporate legal departments account for over 64% of platform deployments, primarily for contract lifecycle management, e-discovery, and regulatory compliance. Cloud-native development frameworks dominate, with 71% of platforms built on scalable SaaS architectures. AI-assisted document review tools have reduced manual legal research time by 45%, while low-code legal app development environments are now used by 38% of in-house legal teams, reflecting rapid technological advancement and operational integration.

Market Size & Growth: Valued at USD 4,017.2 Million in 2025, projected to reach USD 9,324.7 Million by 2033, expanding at a CAGR of 11.1% driven by enterprise legal digital transformation.

Top Growth Drivers: Workflow automation adoption 42%, compliance digitization efficiency 36%, AI-based document analysis penetration 31%.

Short-Term Forecast: By 2028, contract processing turnaround time is expected to improve by 34%.

Emerging Technologies: Generative AI for legal drafting, low-code/no-code legal app builders, cloud-based compliance engines.

Regional Leaders: North America projected USD 3,820 Million by 2033 with enterprise-first adoption; Europe USD 2,460 Million driven by regulatory harmonization; Asia-Pacific USD 1,980 Million led by digital-first law firms.

Consumer/End-User Trends: Corporate legal departments account for 48% of deployments, followed by law firms at 37%.

Pilot or Case Example: In 2025, a large multinational enterprise reduced contract review cycles by 41% using AI-enabled platforms.

Competitive Landscape: Market leader holds approximately 18% share, followed by several mid-sized global platform providers.

Regulatory & ESG Impact: Data residency rules and digital compliance mandates accelerating platform standardization.

Investment & Funding Patterns: Over USD 6.4 Billion invested globally between 2023 and 2025, dominated by Series B and C funding.

Innovation & Future Outlook: Expansion of interoperable legal APIs and cross-border compliance automation shaping platform evolution.

Corporate legal operations contribute roughly 46% of platform usage, while law firms represent 39%, driven by AI-powered drafting and discovery tools. Recent innovations in automated compliance mapping and multilingual contract analytics are enhancing adoption. Regulatory digitization mandates, rising litigation volumes, and cross-border business complexity continue to support strong regional consumption and long-term platform integration.

The Legal Technology Development Platforms Market has become strategically critical as legal operations shift from manual, document-centric processes to data-driven, software-enabled ecosystems. Enterprises increasingly view legal technology platforms as core infrastructure rather than auxiliary tools. AI-powered contract intelligence delivers 52% productivity improvement compared to traditional manual review standards, enabling legal teams to manage higher workloads without proportional staff increases. North America dominates in platform deployment volume, while Europe leads in adoption consistency with 44% of large enterprises actively integrating legal development platforms across compliance and governance functions.

By 2028, generative AI-enabled legal copilots are expected to reduce contract drafting time by 37%, directly impacting deal velocity and risk mitigation. Organizations are also aligning platforms with ESG objectives; firms are committing to 30% paper reduction and 25% lower legal process emissions by 2030 through digital workflows. In 2025, a U.S.-based multinational achieved a 39% reduction in external legal spend by deploying an internal low-code legal application platform to standardize workflows across jurisdictions. These developments position the Legal Technology Development Platforms Market as a foundational pillar supporting operational resilience, regulatory compliance, and sustainable enterprise growth.

The Legal Technology Development Platforms Market is shaped by increasing regulatory complexity, rising legal data volumes, and pressure on organizations to improve efficiency. Enterprises are transitioning from point-based legal tools to integrated development platforms that support customization, automation, and scalability. Demand is influenced by globalization of business operations, which requires consistent contract governance across jurisdictions. Technological convergence between AI, cloud computing, and workflow orchestration has expanded platform capabilities. At the same time, legal departments face cost containment pressures, driving adoption of platforms that reduce reliance on external counsel. Market dynamics reflect a balance between innovation-driven expansion and cautious adoption due to data sensitivity and compliance requirements.

Regulatory frameworks governing data protection, financial reporting, and cross-border transactions have expanded significantly, increasing compliance workloads. Legal Technology Development Platforms enable centralized rule mapping, automated policy updates, and audit-ready documentation. Enterprises using automated compliance workflows report 46% fewer manual errors and 33% faster regulatory response times. Financial services, healthcare, and technology sectors collectively account for over 58% of demand, driven by stringent governance requirements. Automation reduces dependency on manual tracking spreadsheets, allowing legal teams to manage expanding rulebooks efficiently.

Despite efficiency gains, concerns over data confidentiality and platform security remain a restraint. Legal data includes privileged communications and sensitive corporate information, increasing risk exposure. Approximately 29% of enterprises delay full deployment due to concerns around cloud storage and third-party access. Compliance with data localization laws adds complexity, requiring region-specific deployments. Smaller firms face additional challenges due to limited cybersecurity budgets and integration expertise.

Low-code and no-code platforms create significant opportunities by enabling legal professionals to build customized workflows without deep technical expertise. Adoption of low-code legal platforms increased by 41% between 2023 and 2025. These tools allow rapid development of contract templates, approval flows, and compliance dashboards. Mid-sized enterprises benefit most, as low-code reduces development costs by 28% compared to bespoke software projects.

Successful implementation requires cultural and operational change within legal teams. Resistance to automation persists among professionals accustomed to traditional processes. Training requirements and workflow redesign increase short-term costs. Organizations report that 34% of platform rollouts experience delays due to internal adoption challenges. Aligning IT, legal, and compliance stakeholders remains essential but complex.

• Expansion of Generative AI in Legal Drafting: Over 47% of newly launched platforms in 2025 integrated generative AI modules for contract and policy drafting, reducing first-draft preparation time by 44% and improving clause consistency across jurisdictions.

• Shift Toward Platform-Based Legal Operations: Enterprises are consolidating multiple legal tools into unified platforms, with 39% reducing standalone software licenses. This consolidation lowered annual legal IT overhead by 21% while improving data visibility.

• Growth of Cross-Border Compliance Automation: Platforms supporting multi-jurisdiction rule engines saw adoption rise by 36%, particularly among multinational corporations managing operations in more than 15 countries.

• Integration with Enterprise Systems: Legal platforms increasingly integrate with ERP and CRM systems, with 42% of deployments enabling real-time contract and risk data sharing, enhancing decision-making speed and accuracy.

The Legal Technology Development Platforms Market is segmented by type, application, and end-user, reflecting diverse functional requirements. By type, platforms range from cloud-based SaaS solutions to on-premise and hybrid development environments. Application segmentation includes contract lifecycle management, compliance automation, litigation support, and legal analytics. End-user segmentation highlights adoption across corporate legal departments, law firms, government agencies, and SMEs. Adoption levels vary based on organizational scale, regulatory exposure, and digital maturity. Enterprises favor scalable platforms, while law firms prioritize flexibility and document intelligence.

Cloud-based legal development platforms currently account for approximately 46% of adoption due to scalability and lower infrastructure requirements, while on-premise solutions hold 29% driven by data control needs. Hybrid platforms are the fastest-growing type, expanding at a CAGR of 13.4%, supported by organizations balancing security and flexibility. Remaining niche platforms collectively represent 25%, addressing specialized regulatory or jurisdictional requirements.

• In 2025, a major global law firm deployed a hybrid legal development platform to automate document workflows across 12 offices, improving collaboration efficiency for over 8,000 legal professionals.

Contract lifecycle management leads with 41% adoption, followed by compliance management at 27%. Litigation analytics tools currently represent 18%, while legal research automation accounts for the remaining 14%. Litigation analytics is the fastest-growing application, expanding at a CAGR of 12.8%, driven by data-driven case strategy. In 2025, 38% of enterprises piloted legal platforms for contract automation across procurement and sales functions.

• In 2025, a multinational enterprise deployed AI-enabled contract analytics across 160 business units, reducing dispute resolution timelines for more than 2 million contracts.

Corporate legal departments dominate with 48% adoption, while law firms account for 37%. Government agencies and SMEs collectively contribute 15%, with SMEs representing the fastest-growing end-user segment at a CAGR of 14.2%. SME adoption is fueled by affordable SaaS pricing and simplified compliance tools. In 2025, 41% of mid-sized enterprises reported active use of legal development platforms for internal governance.

• In 2025, over 500 mid-sized companies implemented digital legal platforms to centralize compliance reporting, reducing audit preparation time by 26%.

North America accounted for the largest market share at 41.2% in 2025 however, Asia-Pacific is expected to register the fastest growth, expanding at a CAGR of 13.4% between 2026 and 2033.

North America benefits from more than 6,000 active legal technology vendors, over 72% cloud-based platform penetration, and enterprise legal digitization rates above 65%. Europe followed with 29.6% share, driven by cross-border regulatory alignment and structured digital justice programs across the EU. Asia-Pacific represented 21.1% of global adoption volume in 2025, supported by over 1.8 million law firms and corporate legal teams transitioning to digital workflows. South America and Middle East & Africa collectively accounted for 8.1%, with adoption concentrated in urban commercial hubs. Globally, over 58% of enterprises now use at least one legal development platform, and 44% report measurable reductions in contract cycle times, highlighting strong regional momentum and technology-driven convergence.

How Are Enterprise-Led Digital Transformations Redefining Legal Operations?

The market held approximately 41.2% share in 2025, reflecting advanced enterprise adoption across corporate legal departments and large law firms. Key demand originates from financial services, healthcare, technology, and energy sectors, which together represent over 62% of platform usage. Regulatory initiatives promoting digital recordkeeping and e-discovery standards have accelerated platform integration. Technological trends include AI-powered document intelligence, low-code legal workflow builders, and deep integration with enterprise ERP systems. A leading local provider expanded generative AI contract automation tools, reducing average review time by 43% across Fortune 500 clients. Consumer behavior shows higher enterprise-led adoption, with 57% of in-house legal teams actively customizing platforms to internal compliance needs.

How Is Regulatory Complexity Driving Demand for Transparent Platforms?

Europe accounted for nearly 29.6% of global market activity in 2025, with Germany, the UK, and France contributing over 64% of regional usage. Strong influence from EU-level regulatory bodies and sustainability directives has increased demand for explainable, auditable legal platforms. Adoption of emerging technologies such as AI-assisted compliance mapping and multilingual contract analytics has risen, with 38% of enterprises deploying explainable AI features. A regional legal tech firm expanded GDPR-compliant contract intelligence modules, supporting operations across 18 jurisdictions. Consumer behavior reflects regulation-first adoption, where 49% of buyers prioritize transparency and auditability over feature volume.

What Is Fueling Rapid Digital Legal Adoption at Scale?

Asia-Pacific ranked second by volume in 2025 with 21.1% share, led by China, India, and Japan. The region hosts over 45% of the world’s legal professionals, creating scale-driven demand for digital platforms. Infrastructure investments in cloud data centers and legal process outsourcing hubs support adoption. Regional innovation hubs focus on AI translation, mobile-first legal workflows, and automated compliance dashboards. A local platform provider in India enabled low-code legal apps for over 120,000 SMEs. Consumer behavior is digital-first, with growth driven by mobile access and cost-efficient SaaS subscriptions.

How Are Emerging Economies Modernizing Legal Infrastructure?

South America represented approximately 5.4% of global demand in 2025, led by Brazil and Argentina. Adoption is supported by judicial digitization programs and expanding enterprise compliance requirements. Infrastructure improvements in cloud connectivity and data centers are increasing platform reliability. Government incentives encouraging digital contracts and electronic filings have improved uptake. A regional vendor introduced Portuguese- and Spanish-language legal automation tools, increasing SME adoption by 27%. Consumer behavior shows demand tied to localized language support and affordable pricing models.

How Is Legal Digitization Supporting Economic Diversification?

The region accounted for around 2.7% of global activity in 2025, with the UAE and South Africa leading adoption. Demand trends align with economic diversification initiatives and modernization of commercial law systems. Governments are supporting digital courts and e-contract frameworks. Technological modernization includes cloud-native platforms and AI-assisted compliance tools. A UAE-based legal tech firm launched bilingual contract automation supporting over 9,000 enterprises. Consumer behavior varies by market, with higher adoption among multinational corporations and regulated industries.

United States – 33.9% Market Share: Dominates due to high enterprise legal digitization, strong startup ecosystem, and advanced AI adoption.

United Kingdom – 12.4% Market Share: Leads through regulatory-driven demand, strong legal services sector, and early platform standardization.

The Legal Technology Development Platforms market is moderately fragmented, with more than 180 active global competitors operating across SaaS, hybrid, and on-premise models. The top five companies collectively hold approximately 38–41% of total platform deployments, indicating balanced competition between established vendors and emerging innovators. Market positioning increasingly depends on AI capability depth, regulatory alignment, and customization flexibility. Strategic initiatives include partnerships with cloud providers, acquisitions of niche AI startups, and continuous platform modularization. Product innovation focuses on generative AI drafting, compliance automation, and API-based integrations. Competitive intensity remains high, as vendors race to deliver scalable, secure, and jurisdiction-aware solutions.

LexisNexis

Clio

iManage

ContractPodAI

Ironclad

Everlaw

Onit

DocuSign

Litera

Rocket Lawyer

LegalZoom

Technology evolution is central to the Legal Technology Development Platforms market, with AI and cloud-native architectures transforming legal operations. In 2025, over 68% of platforms incorporated machine learning for document classification and risk scoring. Generative AI models enable automated contract drafting and clause suggestions, improving drafting speed by 45%. Low-code development environments allow legal teams to build workflows without heavy IT involvement, reducing deployment time by 32%. Cloud-based architectures dominate, supporting elastic scalability and cross-border collaboration. Cybersecurity technologies such as encryption-at-rest, role-based access, and audit trails address data sensitivity concerns. Emerging innovations include legal digital twins for scenario simulation and blockchain-enabled smart contract validation. These technologies collectively enhance efficiency, transparency, and compliance readiness.

In April 2025, Thomson Reuters expanded its generative AI legal drafting capabilities across enterprise platforms, enabling automated clause generation and reducing document preparation time by 42%. Source: www.thomsonreuters.com

In October 2024, Wolters Kluwer introduced advanced compliance automation modules supporting multi-jurisdiction regulatory mapping for large enterprises, improving audit readiness across 20 countries. Source: www.wolterskluwer.com

In February 2025, Clio launched an AI-powered workflow automation update, allowing law firms to streamline case intake and reduce administrative hours by 31%. Source: www.clio.com

In July 2024, Relativity enhanced its e-discovery platform with AI-assisted review tools, enabling faster data triage and improving review accuracy by 29%. Source: www.relativity.com

The Legal Technology Development Platforms Market Report provides a comprehensive evaluation of software platforms designed to digitize, automate, and scale legal operations. The scope includes platform types such as cloud-based SaaS, hybrid deployments, and on-premise solutions. Applications covered span contract lifecycle management, regulatory compliance automation, litigation support, e-discovery, and legal analytics. Geographic coverage includes North America, Europe, Asia-Pacific, South America, and Middle East & Africa, offering comparative insights into adoption maturity and regulatory environments. End-user analysis encompasses corporate legal departments, law firms, government agencies, and SMEs. The report assesses technological dimensions including AI, machine learning, low-code development, cloud infrastructure, and cybersecurity frameworks. It also evaluates competitive positioning, innovation strategies, and platform interoperability trends. Together, these elements define the market’s structure, opportunities, and strategic relevance for enterprises, investors, and technology providers.

| Report Attribute/Metric | Report Details |

|---|---|

|

Market Revenue in 2025 |

USD 4,017.2 Million |

|

Market Revenue in 2033 |

USD 9,324.7 Million |

|

CAGR (2026 - 2033) |

11.1% |

|

Base Year |

2025 |

|

Forecast Period |

2026 - 2033 |

|

Historic Period |

2021 - 2025 |

|

Segments Covered |

By Type

By Application

By End-User

|

|

Key Report Deliverable |

Revenue Forecast, Growth Trends, Market Dynamics, Segmental Overview, Regional and Country-wise Analysis, Competition Landscape |

|

Region Covered |

North America, Europe, Asia-Pacific, South America, Middle East, Africa |

|

Key Players Analyzed |

Thomson Reuters, Relativity, Wolters Kluwer, LexisNexis, Clio, iManage, ContractPodAI, Ironclad, Everlaw, Onit, DocuSign, Litera, Rocket Lawyer, LegalZoom |

|

Customization & Pricing |

Available on Request (10% Customization is Free) |