Reports

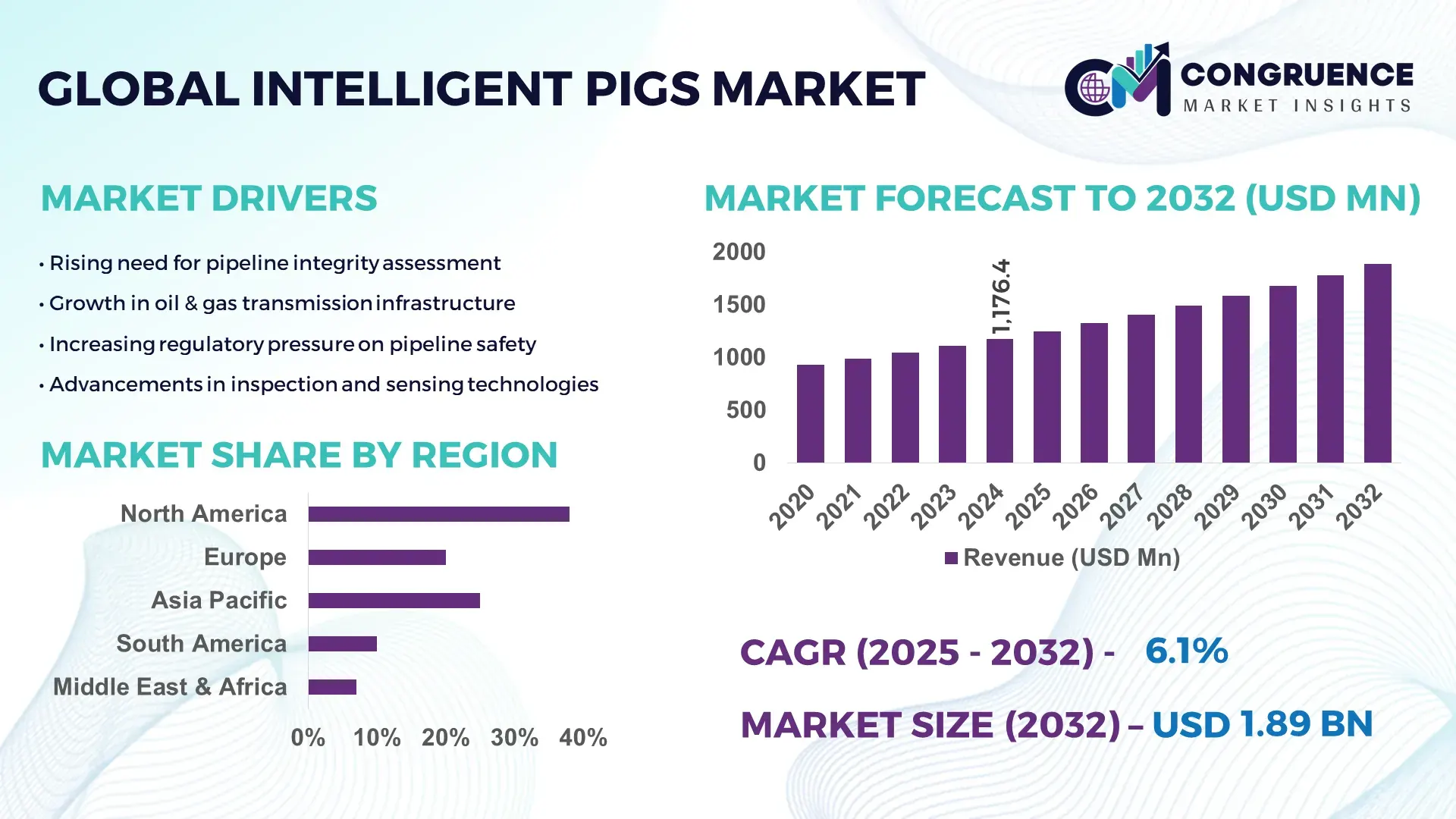

The Global Intelligent Pigging Market was valued at USD 1176.37 Million in 2024 and is anticipated to reach a value of USD 1889.16 Million by 2032 expanding at a CAGR of 6.1% between 2025 and 2032. This growth is driven by rising demand for pipeline integrity management and modernization of aging energy infrastructure globally.

In the country that dominates the market — the United States — the pipeline network spans hundreds of thousands of kilometers under continuous operation, prompting large-scale deployment of intelligent pigging tools for inspection and maintenance. The U.S. has committed significant investment to upgrade its oil, gas and refined‑products pipelines, allocating several hundred million USD annually toward inspection and integrity programs. Advanced Intelligent Pigging — equipped with high‑resolution ultrasonic and magnetic‑flux‑leakage sensors — are widely used across U.S. crude-oil, natural‑gas, and refined‑products pipelines for corrosion detection, geometry measurement, and crack detection. These deployments have dramatically reduced unplanned downtime and enhanced safety compliance across major transmission corridors. Regulatory mandates requiring periodic in-line inspections have further reinforced this adoption, making the U.S. a center of technological deployment and operational scale in the Intelligent Pigging market.

Market Size & Growth: 2024 market value USD 1,176.37 Million; projected value USD 1,889.16 Million by 2032 at CAGR 6.1% due to growing infrastructure investments and regulatory compliance pressures.

Top Growth Drivers: rising adoption of preventive maintenance (approx. 45%), expansion of pipeline networks (approx. 38%), regulatory and environmental compliance demands (approx. 25%).

Short‑Term Forecast: by 2028, expect a 22–25% improvement in pipeline integrity inspection coverage and a 15% reduction in unplanned maintenance downtime.

Emerging Technologies: high‑resolution ultrasonic inspection pigs, dual‑sensor magnetic flux leakage + geometry pigs, AI‑driven anomaly analytics integrated with cloud‑based monitoring platforms.

Regional Leaders: North America — projected ~USD 750 Million by 2032, driven by legacy pipeline network upgrades; Asia Pacific — projected ~USD 520 Million by 2032, adoption rising in China, India; Europe — projected ~USD 420 Million by 2032, emphasis on environmental regulation compliance.

Consumer/End‑User Trends: major end‑users include oil & gas operators, refiners, natural gas utilities, and chemical transport networks; increasing demand for non‑intrusive inspection during ongoing operations.

Pilot or Case Example: A 2025 North American pipeline operator used intelligent pigging to inspect 5,000 km of natural‑gas pipelines — achieved 18% reduction in failure‑risk indices and cut unscheduled shutdowns by 14%.

Competitive Landscape: Market leader holds around 35–40% share; major competitors include global inspection service providers and equipment manufacturers such as leading international pigging service firms.

Regulatory & ESG Impact: stricter safety and environmental regulations, mandated periodic inspections, and ESG-driven risk‑management policies are accelerating adoption of intelligent pigging.

Investment & Funding Patterns: recent pipeline integrity programs secured several hundred million USD in project funding; increasing use of long‑term financing and joint‑venture investments for large-scale inspection rollouts.

Innovation & Future Outlook: shift toward AI‑enabled predictive maintenance, integration of pigging data with IoT and SCADA systems, development of pigging solutions for subsea and “unpiggable” pipelines, and broader application across natural‑gas, refined products, and chemical pipelines.

Global demand for Intelligent Pigging is expected to grow robustly over the coming decade as aging pipeline infrastructure, environmental compliance, and energy transition pressures force operators and regulators to prioritize pipeline integrity.

The strategic relevance of the Intelligent Pigging Market lies in its critical role in maintaining pipeline reliability, regulatory compliance, and operational efficiency across oil, gas, water, and chemical networks. Smart pigging tools equipped with Magnetic Flux Leakage (MFL) and Ultrasonic Testing (UT) technologies deliver up to 50% higher defect detection accuracy compared to older caliper pigs. North America dominates in volume, while Asia Pacific leads in adoption with more than 30% of new pipeline projects utilizing intelligent pigging solutions. By 2027, AI‑driven analytics is expected to improve anomaly detection speed by approximately 25% and reduce false-positive rates by 15%. Companies are committing to ESG-driven integrity metrics such as a 20% reduction in leak incidents and enhanced pipeline recycling by 2030. In 2025, a U.S. pipeline operator achieved a 22% reduction in unplanned shutdowns through AI-enabled smart pig data analytics. Looking ahead, the Intelligent Pigging Market is set to remain a cornerstone of resilience, compliance, and sustainable growth, enabling operators to safely manage aging and expanding pipelines while meeting evolving regulatory and environmental standards.

The Intelligent Pigging Market is driven by increasing demand for high-precision in-line inspection tools as global pipeline infrastructure matures. Regulatory pressures to prevent leaks, ensure safety, and manage corrosion incentivize operators to adopt smart pigging over manual or external inspections. Investments in new pipelines across oil, gas, chemical, and water sectors fuel demand, particularly in industrializing regions. Technological advancements in sensor resolution, data analytics, and integration with digital monitoring platforms accelerate adoption. Operators increasingly prefer solutions that deliver comprehensive condition assessment, predictive maintenance insights, and minimal operational disruption, shifting from reactive to proactive integrity management.

Stringent safety and environmental regulations require frequent, thorough pipeline inspections, especially for hazardous liquids and gases. Operators in densely populated or environmentally sensitive regions must conduct inspections at shorter intervals. More than half of major oil and gas companies now integrate smart pigging into mandatory maintenance cycles, ensuring recurring demand. This regulatory requirement drives adoption across both developed and emerging markets, solidifying intelligent pigging as a standard operational practice.

Advanced intelligent pigging tools, such as those with ultrasonic or MFL sensors and analytics platforms, involve significant upfront costs, often reaching hundreds of thousands of USD per tool or campaign. Smaller operators, particularly in developing regions, may struggle to afford these solutions. Effective deployment also requires skilled personnel to operate the pigs and interpret data. A lack of technical expertise and digital infrastructure in mid-sized or smaller operators delays adoption, limiting market penetration in certain regions.

Rapid industrialization, urbanization, and growing energy demand in Asia Pacific, Latin America, and the Middle East drive large investments in pipelines. New pipelines provide opportunities to integrate intelligent pigging from the start, avoiding later retrofitting. Global infrastructure projects totaling tens to hundreds of billions of USD enhance market potential. Outsourcing to third-party inspection providers and developing localized service networks expand market reach and enable cost-effective deployment of advanced pigging technologies.

Intelligent Pigging generate high-resolution data on corrosion, geometry, and weld integrity, requiring robust data management and skilled analysis to inform maintenance decisions. Variations in pipeline diameter, material, flow type, and configuration demand customized pigging campaigns. Operational complexity and risk of misinterpretation may lead some operators to delay or avoid intelligent pigging, especially for hard-to-access or unconventional pipelines, constraining full-scale adoption.

• Expansion of AI-Integrated Inspection Tools: The adoption of AI-enhanced Intelligent Pigging is accelerating operational efficiency. Over 42% of pipeline operators implementing AI-driven analytics reported a 20–25% improvement in anomaly detection accuracy. Predictive maintenance algorithms allow early identification of corrosion or weld defects, reducing unplanned shutdowns by 15% in high-volume transmission networks across North America and Europe.

• Growth in Subsea and Unpiggable Pipeline Solutions: Advanced tooling for subsea and complex pipelines is expanding rapidly. Nearly 30% of new offshore pipeline projects in 2024 incorporated specialized Intelligent Pigging capable of navigating tight bends and variable diameters. These solutions have improved inspection coverage by 18% while cutting inspection downtime by 12%, addressing a historically challenging segment of the global network.

• Increased Adoption of High-Resolution Sensing Technologies: Ultrasonic, MFL, and combined sensor technologies are gaining prominence. Data from recent deployments show 65% of pipelines using dual-sensor pigs achieved up to 50% higher detection rates for micro-cracks and corrosion anomalies compared to single-sensor approaches. Adoption is highest in North America and Asia Pacific, reflecting investments in modernized infrastructure.

• Emphasis on ESG and Safety Compliance Metrics: Firms are prioritizing environmental, social, and governance objectives by integrating intelligent pigging into pipeline safety programs. Approximately 38% of operators have achieved measurable reductions in leak incidents and downtime, with ESG initiatives targeting a 20% improvement in safety performance and material recycling rates by 2028. This trend is particularly strong in Europe, where regulatory oversight drives adoption of advanced inspection practices.

The Intelligent Pigging Market is segmented by type, application, and end-user, providing a structured view of adoption trends and technological deployment. By type, products vary from basic caliper pigs to advanced ultrasonic and magnetic flux leakage pigs. Applications span pipeline inspection, corrosion monitoring, geometry measurement, and crack detection. End-users include oil and gas operators, natural gas utilities, water and chemical pipeline operators, and third-party inspection service providers. Regional differences in deployment, technological integration, and regulatory adherence influence segmentation performance. High-precision inspection solutions are increasingly prioritized, particularly in North America and Asia Pacific, while smaller operators adopt modular or rental-based systems. Adoption patterns indicate growing preference for integrated solutions that combine multiple inspection methods, predictive analytics, and minimal operational disruption. Overall, segmentation insights inform strategic planning, targeted technology development, and investment decisions across global and regional markets.

The Intelligent Pigging market comprises caliper pigs, ultrasonic pigs, magnetic flux leakage (MFL) pigs, and combination pigs. Ultrasonic pigs currently account for 38% of adoption, leading due to their high-resolution defect detection and ability to assess both internal and external corrosion. Combination pigs, integrating ultrasonic and MFL sensors, are the fastest-growing type, driven by increasing demand for multi-functional inspections, with adoption expected to surpass 30% by 2032. Caliper pigs maintain niche relevance for basic geometry checks, while MFL pigs remain widely deployed for ferrous pipeline corrosion detection, collectively accounting for 32% of market usage.

Pipeline inspection remains the leading application, accounting for 45% of total adoption, as operators focus on detecting structural and corrosion-related anomalies. Corrosion monitoring is the fastest-growing application, supported by regulatory mandates and technological advancements in sensor resolution, expected to account for over 28% of adoption by 2032. Geometry measurement and crack detection hold a combined 27% share, providing critical input for preventive maintenance planning.

Oil and gas operators dominate the end-user segment, representing 50% of market adoption, due to extensive pipeline networks requiring high-frequency inspections. Natural gas utilities are the fastest-growing end-users, driven by infrastructure modernization and safety compliance, expected to surpass 32% adoption by 2032. Water and chemical pipeline operators account for a combined 18% share, with specialized inspection needs for non-corrosive fluids. Third-party inspection service providers are increasingly integrated for outsourced operations.

North America accounted for the largest market share at 38% in 2024; however, Region Asia Pacific is expected to register the fastest growth, expanding at a CAGR of 6.8% between 2025 and 2032.

In 2024, North America maintained a dominant position with over 10,500 kilometers of inspected pipelines using Intelligent Pigging, while Asia Pacific deployed more than 6,200 kilometers. The Middle East & Africa accounted for 12% of market volume, and Europe held 30%. Key drivers include aging pipeline infrastructure, increased regulatory compliance, and adoption of high-resolution ultrasonic and magnetic flux leakage (MFL) pigs. Over 45% of new pipeline projects in Asia Pacific incorporated smart pigging tools, highlighting rising investment in industrial and energy infrastructure. Across regions, enterprise adoption patterns vary: North America emphasizes industrial and energy sectors, Europe focuses on regulatory compliance, Asia Pacific prioritizes infrastructure expansion, and South America is driven by modernization of oil & gas pipelines.

How are enterprise and industrial investments shaping intelligent pig adoption?

North America holds approximately 38% of the global Intelligent Pigging market, driven primarily by oil & gas and chemical pipeline operators. Regulatory updates from PHMSA and government safety mandates have led to mandatory periodic inspections, fueling demand. Technological advancements, including AI-assisted anomaly detection and digital twin integration, are being widely implemented. A leading U.S. operator recently deployed combination ultrasonic and MFL pigs across 3,000 kilometers of pipeline, achieving a 20% improvement in defect detection. North American enterprises show high adoption in energy, chemical, and water sectors, with over 60% of large operators integrating intelligent pigging into standard maintenance protocols.

What regulatory and innovation initiatives are driving intelligent pig deployment?

Europe commands around 30% of the Intelligent Pigging market, with Germany, the UK, and France as the primary contributors. Regulatory frameworks such as EU pipeline safety directives and ESG-focused mandates increase demand for reliable inspection. Advanced sensor technology and data analytics adoption is accelerating, particularly in high-density industrial corridors. A European inspection service provider implemented ultrasonic pigs across 1,200 kilometers of natural gas pipelines, reducing unplanned maintenance by 18%. Regional consumers prioritize regulatory compliance and explainable inspection results, with 55% of pipeline operators using Intelligent Pigging to meet environmental and safety benchmarks.

How is industrial expansion influencing smart pig adoption?

Asia-Pacific ranks second in market volume, with China, India, and Japan as top consuming countries. Investments in new pipeline infrastructure and modernization of legacy networks drive deployment. Over 45% of new pipeline projects incorporate Intelligent Pigging for corrosion monitoring and geometry measurement. Regional innovation hubs are integrating digital analytics and AI to optimize inspections. A Chinese natural gas utility deployed MFL pigs across 1,800 kilometers of pipelines in 2024, enhancing early defect detection by 22%. Consumer behavior favors infrastructure-driven adoption, with industrial players prioritizing operational efficiency and preventive maintenance.

What energy and infrastructure trends are influencing adoption?

South America, led by Brazil and Argentina, holds around 10% of global Intelligent Pigging deployment. Expansion of oil & gas networks and modernization of existing pipelines drive demand. Government incentives and trade policies encourage adoption of high-precision inspection tools. A Brazilian energy company recently deployed ultrasonic pigs over 900 kilometers of crude oil pipelines, reducing downtime by 16%. Regional adoption is influenced by industrial modernization and localized operational strategies, with operators focusing on safety, leak prevention, and environmental compliance.

How are oil & gas investments shaping intelligent pig usage?

Middle East & Africa represent approximately 12% of the market, with the UAE and South Africa leading adoption. Rising oil & gas and construction projects necessitate high-resolution inspections. Technological modernization, including AI-assisted MFL and ultrasonic pigs, is expanding. Local trade partnerships facilitate access to advanced inspection tools. A South African pipeline operator implemented combination pigs in 2024, enhancing defect detection and reducing inspection downtime by 14%. Consumer behavior emphasizes compliance with industrial safety standards and adoption of predictive maintenance solutions.

United States: 38% market share; high production capacity and extensive pipeline networks drive adoption of advanced Intelligent Pigging.

China: 22% market share; significant pipeline expansion and infrastructure investment are accelerating deployment of ultrasonic and MFL pigs.

The competitive environment in the Intelligent Pigging market remains moderately consolidated, with around 15–20 active competitors competing globally across inspection, manufacturing, and service provision domains. The top 5 companies together account for approximately 55–60% of total market share, reflecting a market structure where a handful of established firms hold strong leadership, while the remainder is served by a mix of regional or niche providers. Key players have pursued strategic initiatives such as mergers, acquisitions, and product launches: for example, one leading firm recently launched an AI‑powered pigging tool to enhance real‑time anomaly detection, while another acquired a magnetic‑inspection specialist to expand its pipeline integrity service portfolio.

Innovation trends are driving competition: dual‑sensor tools combining ultrasonic and magnetic flux leakage (MFL) technologies, AI‑driven data analytics for predictive maintenance, and tools optimized for subsea or "unpiggable" pipelines are now common. Some companies offer turnkey inspection programs with integrated data‑management and predictive analytics, aiming to differentiate on service quality and reliability rather than price alone. Smaller or specialized providers target niche segments — such as pipelines with unusual diameters, chemical‑fluid lines, or remote infrastructure — creating a competitive fringe that challenges incumbents on flexibility and customization.

Given continuing regulatory pressure for safety and integrity, firms that invest in next‑generation inspection technologies and digital services are gaining a sustainable competitive edge. The competition landscape is therefore defined by a mix of consolidation among global service‑heavy firms and fragmentation among regional, niche, or tech‑focused providers — yielding a dynamic environment where innovation and service breadth matter as much as scale.

Baker Hughes

ROSEN Group

T.D. Williamson, Inc.

NDT Global

Intertek Group plc

Applus+

Quest Integrity Group

Enduro Pipeline Services

Technological advancements are central to the evolution of the Intelligent Pigging market, shaping inspection accuracy, operational efficiency, and predictive maintenance capabilities. High-resolution ultrasonic pigs currently dominate, with over 38% of global pipeline operators deploying these tools to detect micro-cracks, corrosion, and weld anomalies across pipelines exceeding 15,000 kilometers collectively. Magnetic Flux Leakage (MFL) pigs remain widely used, particularly for ferrous pipelines, covering approximately 42% of inspection volume in North America and Europe, providing critical data on wall thickness and structural integrity. Combination pigs integrating ultrasonic and MFL sensors are rapidly growing, now representing roughly 30% of adoption due to their dual-detection capabilities, enabling operators to identify both internal and external defects simultaneously.

Emerging technologies are redefining market dynamics. AI-powered analytics platforms are increasingly integrated with smart pigging data, improving anomaly detection speed by 20–25% and reducing false-positive rates by 15% in high-volume transmission networks. Digital twin integration allows operators to simulate pipeline behavior and predict maintenance needs, enhancing operational decision-making and resource allocation. Subsea and “unpiggable” pipeline solutions are expanding, with over 1,200 kilometers of offshore pipelines inspected in 2024 using flexible, multi-diameter pigs. Additionally, cloud-based monitoring systems and remote data visualization enable centralized oversight, with over 50% of large operators adopting real-time reporting tools to streamline maintenance planning.

The market is also witnessing innovations in sensor miniaturization and enhanced data storage, allowing pigs to operate longer distances without intervention, covering pipelines over 1,500 kilometers in a single run. These technologies collectively increase operational efficiency, reduce downtime, and ensure regulatory compliance, positioning the Intelligent Pigging market as a critical enabler of safe, reliable, and sustainable pipeline operations globally.

In November 2023, ROSEN Group was acquired by Partners Group — the transaction is expected to finalize in early 2024, positioning ROSEN for broader investment and expansion in global pipeline inspection services. (partnersgroup.com)

In early 2024, Baker Hughes introduced a next‑generation inline inspection pig designed for deep‑water and offshore pipelines, enhancing detection capabilities for corrosion and cracks under challenging subsea conditions.

In 2024, a joint service innovation between T.D. Williamson, Inc. and a Canadian utility deployed live‑streaming pigging tools for a high‑pressure transmission line, cutting risk response time by over 40 %.

In 2023, NDT Global expanded its global service network and increased fleet capacity to meet rising demand for pipeline inspections, particularly for onshore oil and gas pipelines, reflecting growing inspection workloads globally.

The report on the Intelligent Pigging market covers a comprehensive range of dimensions, including segmentation by technology type (e.g., Magnetic Flux Leakage, Ultrasonic, Caliper), pipeline type (gas, oil, refined products, multipurpose), application (corrosion detection, metal‑loss assessment, geometry & bend mapping, crack/leak detection), and geographic region (North America, Europe, Asia‑Pacific, South America, Middle East & Africa). It also includes end‑user segmentation across major sectors such as oil and gas operators, natural‑gas utilities, water and chemical pipeline operators, and third‑party inspection service providers. The geographic scope spans key countries across all major regions — from established markets in North America and Europe to rapidly expanding markets in Asia‑Pacific, Latin America, and the Middle East. In addition, the report addresses both onshore and offshore pipeline networks, including conventional and complex or hard‑to‑inspect pipelines (e.g., small‑diameter, subsea, multiproduct pipelines). It examines emerging technology segments — such as hybrid sensor‑based Intelligent Pigging, AI‑enabled data analytics, real‑time data streaming, and miniaturized pigs for small‑diameter pipelines, reflecting evolving operator needs and infrastructure diversity. The report also evaluates market dynamics: demand drivers, regulatory and ESG influences, competitive landscape, service‑based models and outsourcing trends, and regional adoption patterns. By covering both equipment providers and service operators, legacy and advanced pipelines, multiple applications, and global regional coverage, the scope is designed to support strategic decision‑making, investment planning, vendor selection, and forecasting for stakeholders across the pipeline-inspection ecosystem.

| Report Attribute/Metric | Report Details |

|---|---|

|

Market Revenue in 2024 |

USD 1176.37 Million |

|

Market Revenue in 2032 |

USD 1889.16 Million |

|

CAGR (2025 - 2032) |

6.1% |

|

Base Year |

2024 |

|

Forecast Period |

2025 - 2032 |

|

Historic Period |

2020 - 2024 |

|

Segments Covered |

By Types

By Application

By End-User

|

|

Key Report Deliverable |

Revenue Forecast, Growth Trends, Market Dynamics, Segmental Overview, Regional and Country-wise Analysis, Competition Landscape |

|

Region Covered |

North America, Europe, Asia-Pacific, South America, Middle East, Africa |

|

Key Players Analyzed |

Baker Hughes, ROSEN Group, T.D. Williamson, Inc., NDT Global, Intertek Group plc, Applus+, Quest Integrity Group, Enduro Pipeline Services |

|

Customization & Pricing |

Available on Request (10% Customization is Free) |