Reports

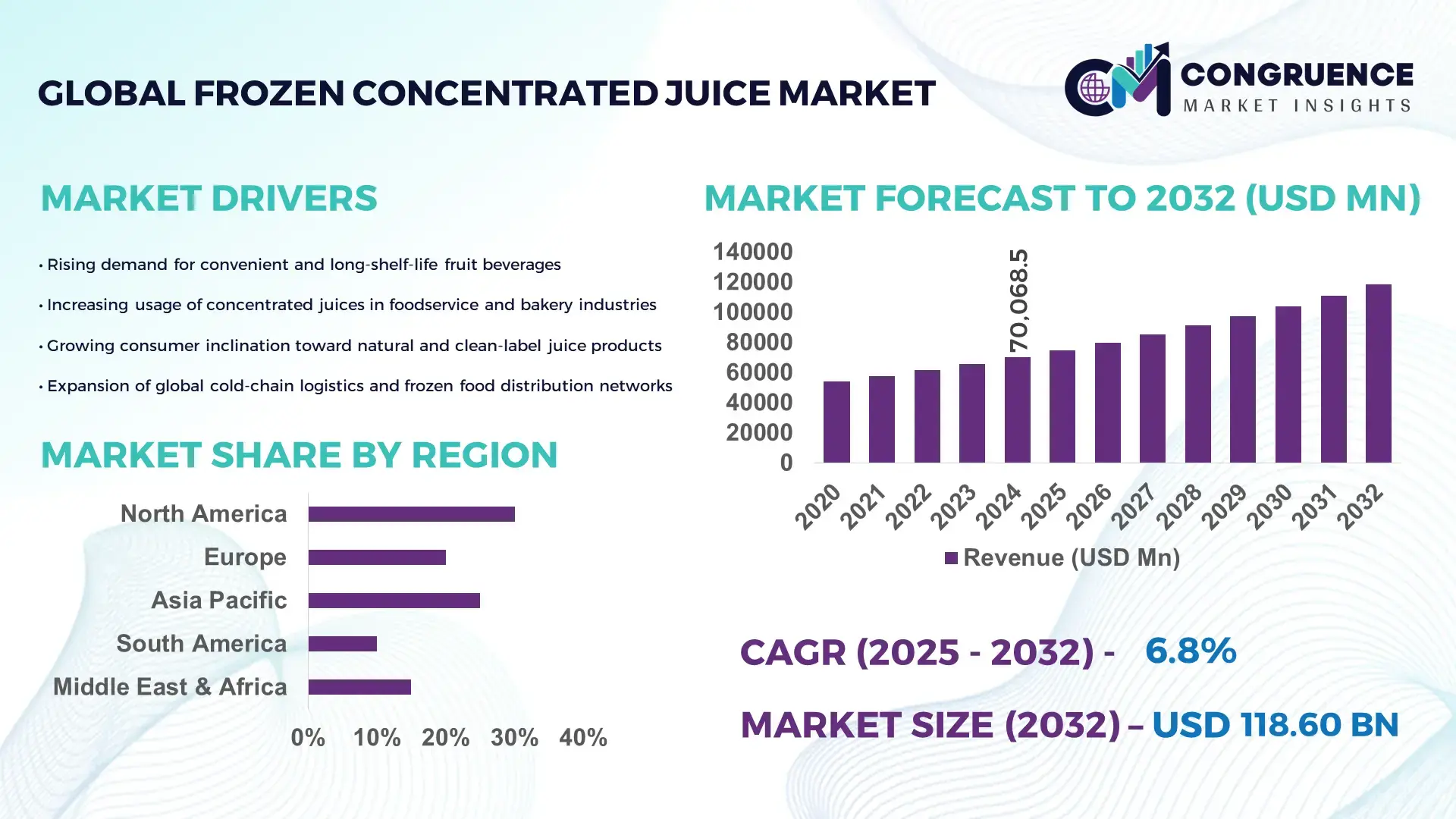

The Global Frozen Concentrated Juice Market was valued at USD 70068.53 Million in 2024 and is anticipated to reach a value of USD 118602.28 Million by 2032 expanding at a CAGR of 6.8% between 2025 and 2032. This growth is driven by rising demand for convenient juice products and increasing global beverage consumption trends.

In the country that dominates the marketplace — Brazil — the frozen concentrated juice industry benefits from decades of investment in high-capacity processing infrastructure and advanced production techniques. Brazil processes more than 1.2 million metric tons of orange juice concentrate annually through multiple large‑scale plants concentrated primarily in the state of São Paulo. Modern densification planting methods have boosted yield per hectare by over 80%, and industry leaders have invested substantially in cold‑chain logistics and large‑scale centrifuge and evaporation technologies to produce consistent, high‑quality concentrate. The concentrate is widely used in beverages, soft drinks, and food‑service sectors, leveraging Brazil’s efficient export network and production capacity.

Market Size & Growth: 2024 value ~ USD 70,068.53 M; projected 2032 value ~ USD 118,602.28 M; CAGR ~ 6.8% — growth underpinned by increasing global demand for convenient, long‑shelf‑life beverage solutions.

Top Growth Drivers: increased consumer demand for ready-to-drink juices (≈ 25%), expansion of retail distribution networks (≈ 18%), rising use in foodservice and industrial applications (≈ 15%).

Short-Term Forecast: by 2028, industry expects a 12–15% cost reduction in logistics per unit due to improved cold‑chain efficiencies.

Emerging Technologies: advancements in ultra‑efficient evaporation systems; novel aseptic freezing and pasteurization processes; automation and data‑driven quality control in juice concentrate manufacturing.

Regional Leaders: Latin America – ~ USD 45,000 M by 2032 (rapid export growth); North America – ~ USD 25,000 M by 2032 (steady demand for convenience beverages); Asia‑Pacific – ~ USD 20,000 M by 2032 (growing urban consumption and retail modernization).

Consumer/End-User Trends: rising consumption in ready-to-drink juices, smoothies, and blended beverages; growing preference for shelf‑stable concentrates in institutional catering and foodservice sectors.

Pilot or Case Example: In 2023, a processing facility in Brazil implemented advanced densification planting — yielding an 81% increase in output per hectare and reducing land usage by 45%.

Competitive Landscape: Market leader — a major Brazilian exporter (~ 70–75% of globally traded concentrate); key competitors include three major firms from Brazil and the US responsible for most global supply.

Regulatory & ESG Impact: compliance with global food‑safety regulations; increasing focus on sustainable agriculture and responsible land use; tighter environmental guidelines on water use and agrochemical application affecting cultivation practices.

Investment & Funding Patterns: recent investments in processing facilities, cold‑chain infrastructure and capacity expansion — totaling hundreds of millions USD globally; growing interest in private equity and project‑finance models for juice concentrate manufacturing in emerging regions.

Innovation & Future Outlook: continued development of energy‑efficient processing, increased use of alternative fruit concentrates, expansion into emerging markets in Asia and Africa, and integration of digital supply‑chain traceability — positioning the industry for sustained long‑term growth and diversification.

Frozen concentrated juice markets are evolving beyond traditional orange concentrates to include blends from exotic and tropical fruits for functional beverages. Growing demand in emerging economies, coupled with innovations in processing and supply‑chain management, is expected to drive steady expansion. Regional consumption patterns show increasing adoption in Asia‑Pacific and Africa, driven by urbanization and rising income levels. Environmental and regulatory pressures encourage sustainable farming and improved cold‑chain logistics, while major producers invest in capacity expansion and technological upgrades — shaping a future where frozen concentrate remains a core ingredient for global beverage and foodservice industries.

The Frozen Concentrated Juice market is strategically critical for global beverage supply chains, providing scalable solutions for both retail and industrial production. Modern processing technologies deliver 18% higher efficiency compared to conventional evaporation methods, reducing energy consumption and minimizing product loss. Latin America dominates in volume, while Asia-Pacific leads in adoption with 35% of beverage enterprises using advanced cold-chain and concentrate solutions. By 2027, AI-driven quality monitoring is expected to improve product consistency by 12%, enhancing overall operational efficiency. Firms are committing to ESG improvements such as 25% water recycling and energy consumption reduction by 2028. In 2025, Brazil achieved a 15% reduction in energy use through automated evaporation and ultra-efficient freezing technologies. The Frozen Concentrated Juice Market is positioned as a pillar of resilience, compliance, and sustainable growth, enabling producers to meet evolving consumer preferences, regulatory standards, and efficiency benchmarks through technological adoption and strategic investments.

The Frozen Concentrated Juice market is shaped by evolving consumer preferences, technological advancements, and supply-chain optimizations. Increasing urbanization and rising disposable incomes drive higher consumption of shelf-stable and convenient juice products. Improvements in cold-chain infrastructure and processing technologies enhance product quality, stability, and cost-efficiency, supporting year-round availability. Institutional buyers, including foodservice chains and beverage manufacturers, favor concentrates for their ease of storage and lower spoilage risks. These dynamics encourage investment in large-scale processing facilities, cold-storage logistics, and efficient distribution networks. Regional consumption patterns vary, with Latin America supplying the bulk of global concentrates, while Asia-Pacific shows faster adoption rates of modern processing and packaging solutions. The interplay between production capacity, logistics optimization, and consumer demand shapes a competitive and dynamic market landscape.

Rising demand for ready-to-drink and shelf-stable beverages drives the Frozen Concentrated Juice market by increasing production and consumption volumes. Urban populations prefer convenient, long-shelf-life options, fueling institutional demand from cafeterias, restaurants, and foodservice chains. Concentrates offer manufacturers consistent quality, ease of storage, and reduced spoilage. This trend boosts procurement volumes for producers, encouraging investment in advanced processing plants and cold-chain logistics. Consumer adoption is particularly strong in regions where fresh juice supply is limited, creating reliable demand for concentrates and reinforcing the importance of supply-chain efficiency.

Supply-chain inefficiencies and limited cold-storage infrastructure hinder market expansion. In emerging regions, inadequate refrigeration, storage, and temperature-controlled transport increase spoilage and reduce product reliability. Long transit distances and inconsistent electricity supply add operational challenges, raising costs. High initial capital investment in cold-chain logistics, including refrigerated trucks, warehouses, and monitoring systems, limits adoption for smaller operators. These challenges restrict market penetration and slow the spread of concentrate-based products, despite increasing consumer demand for shelf-stable juices.

Beverage innovation and emerging markets provide growth opportunities for Frozen Concentrated Juice producers. Manufacturers are developing blends with tropical or exotic fruits, functional ingredients, and customized mixes, increasing demand for diverse concentrates. Urbanization and rising incomes in Asia, Africa, and Latin America create new markets where fresh juice supply is limited but packaged juice demand is rising. Investment in processing variety, packaging, and logistics allows producers to tap underserved regions efficiently. Expanding into these markets can generate new revenue streams and increase adoption of concentrate-based solutions.

Regulatory compliance, environmental pressures, and raw material volatility pose challenges to the Frozen Concentrated Juice market. Food-safety standards require consistent monitoring, documentation, and hygiene practices throughout production and processing. Environmental regulations target water usage, agrochemical application, and sustainable land management, raising operational costs. Adverse weather, crop diseases, and fluctuating harvest yields create supply uncertainty and price volatility. Smaller producers face difficulty absorbing these risks, complicating long-term planning, capacity expansion, and reliable supply chain management.

Expansion of Cold-Chain Automation: Automated cold-chain systems are transforming the Frozen Concentrated Juice market by improving storage and transport efficiency. Recent deployments indicate a 28% reduction in spoilage and a 22% improvement in delivery reliability. Adoption is highest in Latin America and Asia-Pacific, where centralized processing and long-distance exports benefit from precision temperature control and real-time monitoring.

Integration of Advanced Evaporation Technologies: New evaporation methods in concentrate production deliver 18–20% higher juice yield compared to conventional systems. These technologies, increasingly implemented in Brazil and the United States, allow producers to optimize raw material usage, reduce energy consumption by up to 15%, and improve product consistency, driving efficiency in large-scale processing plants.

Growth in Sustainable Packaging Adoption: Over 42% of Frozen Concentrated Juice producers have introduced recyclable or biodegradable packaging in 2024–2025. Europe leads in adoption, with 60% of concentrate packages now made from sustainable materials, reducing plastic use and supporting ESG commitments. This trend aligns with consumer preference for environmentally responsible products and regulatory compliance initiatives.

Emergence of Fruit Blend Innovations: The market is witnessing a surge in tropical and functional juice blends, with 33% of new product launches incorporating exotic fruit concentrates. Asia-Pacific and North America are the primary adopters, with product lines targeting health-conscious consumers. These innovations increase market diversification, improve shelf appeal, and offer measurable differentiation in consumer preference surveys.

The Frozen Concentrated Juice market is segmented by product type, application, and end-user, reflecting varied consumer and industrial demand. By type, orange concentrates dominate, while exotic and mixed-fruit blends are gaining traction due to shifting consumer preferences. Application segmentation spans retail-ready juices, foodservice, and industrial beverage production, each influenced by convenience, shelf life, and production scale. End-user insights highlight retail consumers, foodservice, and industrial manufacturers as key adopters, with emerging markets increasingly driving demand. Regional adoption patterns vary, with Latin America leading production volume, Asia-Pacific accelerating adoption, and North America focusing on advanced processing and distribution efficiency. This segmentation supports targeted strategy formulation, operational planning, and investment prioritization for decision-makers.

The Frozen Concentrated Juice market includes orange concentrate, other citrus/fruit concentrates, mixed-fruit blends, and exotic/tropical fruit concentrates. Orange concentrate is the leading type, accounting for approximately 60% of global volume due to well-established supply chains and consistent consumer demand. Exotic/tropical fruit concentrates are the fastest-growing segment, expanding at an estimated 12% CAGR, fueled by rising interest in health-oriented and novel-flavor beverages. Mixed-fruit blends hold around 20%, other citrus/fruit concentrates 15%, and the remaining 5% consists of exotic/tropical varieties. Other types, such as apple, grape, and regional fruit concentrates, cater to niche markets and specialized beverages.

Applications of Frozen Concentrated Juice include retail-ready juices, foodservice, and industrial beverage manufacturing. Retail-ready juices dominate, representing roughly 50% of concentrate use, driven by supermarket distribution and urban consumer convenience. Industrial beverage manufacturing is the fastest-growing application, growing at an estimated 10% CAGR, as large beverage companies use concentrate for soft drinks and blended beverages to optimize supply-chain efficiency. Foodservice accounts for about 25%, serving restaurants, cafeterias, and catering operations. Minor applications include confectionery and bakery uses, representing 5%.

End-users of Frozen Concentrated Juice include retail consumers, foodservice companies, industrial beverage manufacturers, and export trading firms. Retail consumers are the leading segment, representing approximately 45% of total consumption, supported by supermarket penetration and urban demand for convenience beverages. Industrial beverage manufacturers are the fastest-growing end-user segment, with an estimated 11% CAGR, driven by cost efficiency and supply-chain optimization. Foodservice accounts for roughly 30%, while export trading firms cover 25%.

North America accounted for the largest market share at 30% in 2024 however, Asia‑Pacific is expected to register the fastest growth, expanding at a CAGR of 7.1% between 2025 and 2032.

North America’s mature consumption patterns, strong cold‑chain infrastructure and high consumer awareness have resulted in consistent demand for frozen concentrate products. Asia‑Pacific’s anticipated growth is driven by rapidly rising urban populations, expanding middle-income groups, and growing demand for convenient beverages in emerging economies. The disparity in base consumption volumes and growth trajectories positions North America as the market backbone today, while Asia‑Pacific offers the strongest expansion potential over the forecast horizon, reflecting shifting consumption patterns and evolving supply‑chain investments.

Is Cold‑Chain Maturity Fueling Consumption?

North America holds roughly 30% market share in the global frozen concentrated juice market, with the United States as the dominant contributor. The region benefits from widespread household adoption — about 40% of households regularly purchase frozen juice products — and strong demand from institutional buyers and foodservice industries. Key demand drivers include beverage manufacturers, breakfast‑juice retailers, and health‑conscious consumers favoring fortified or low‑sugar juice concentrates. Regulatory controls on food safety and quality standards support consistent product compliance, while digital transformation in supply‑chain logistics and temperature-controlled warehousing enhance reliability. For example, several major US beverage firms have upgraded to real-time cold‑chain tracking systems to minimize spoilage and ensure freshness across long-distance distribution. Regional consumer behavior shows high preference for ready-to-drink juices, convenience, and sugar‑reduced options, especially in health‑aware demographic groups.

Are Sustainability & Clean‑Label Driving European Demand?

Europe commands a significant portion of the global frozen concentrated juice market, with around 27% share in 2024. Key markets include Germany, France, and the UK — each showing strong demand for natural, organic, and clear-label juice concentrates. Regulatory bodies and sustainability initiatives across Europe have increased pressure on juice producers to comply with stringent food‑safety, environmental and packaging standards. Adoption of emerging technologies such as cold‑chain automation, eco‑friendly packaging, and preservative‑free concentrate processing is rising across European juice manufacturers. For instance, several German and French producers have shifted to biodegradable or recyclable concentrate packaging, and implemented controlled-atmosphere storage to preserve quality without additives. European consumers increasingly prefer clean-label, lower-additive products, driving demand for these compliant frozen concentrated juices, especially among health-conscious and environmentally aware buyers.

Is Urbanization & E‑commerce Changing Juice Consumption Trends?

Asia‑Pacific is emerging as a high‑growth region in the frozen concentrated juice market, with significant expansion in volume and consumption ranking. Key consuming countries include China, India, and several Southeast Asian nations. Urbanization, rising disposable income, and growth of e‑commerce channels have boosted demand for frozen juice concentrates. Infrastructure investments in cold‑chain logistics, warehousing, and modern processing facilities have increased capacity across the region. Technological innovations — such as real‑time inventory and temperature monitoring, automated packing lines, and regional distribution hubs — are being adopted by local producers to meet scale and quality demands. In India and China, producers have expanded concentrate lines for mango, pineapple and mixed‑fruit variants to cater to local flavor preferences and convenience demand. Regional consumer behavior shows rising adoption of frozen juice concentrates through online grocery platforms, ready-to-mix drinks, and home consumption, reflecting shifts away from fresh‑juice dependency.

Is Legacy Production Strength Sustaining Supply?

South America — led by major producing countries such as Brazil and Argentina — remains central to global frozen concentrated juice supply. The region retains a substantial share of global production volume, underpinned by robust agricultural infrastructure and established processing capacity. Brazilian processors continue to invest in cold‑chain systems and high‑capacity concentrate plants that support both domestic and export markets. Government incentives in key producing states help maintain favorable supply conditions, while trade policies enable efficient export logistics. Local players in Brazil periodically expand their concentrate output to meet global demand, especially for citrus-based concentrates. Regional consumer behavior is characterized by a stable base of domestic consumption, combined with export-driven volumes — supporting both local beverage industries and global distribution networks.

Is Import Reliance Driving Growth in Hot‑Climate Regions?

In the Middle East & Africa, demand for frozen concentrated juice is rising, largely driven by urbanization, tourism, hospitality, and rising consumption in hot‑climate markets. Major growth countries include UAE, South Africa and Saudi Arabia. Regional demand trends favor citrus and tropical fruit concentrates, aligning with consumer preferences for refreshing drinks in warm climates. Technological modernization — including improved import cold‑chain systems, distribution networks, and refrigerated retail infrastructure — supports increasing availability. Trade partnerships and import-based supply models enable distributors to cater to growing retail and foodservice demand. Consumer behavior in the region leans toward packaged juices, convenience, and imported concentrate-based products rather than fresh produce, due to limited local fruit cultivation and climatic constraints.

Brazil – ~ 50–55% market share; dominant due to its high production capacity and large-scale concentrate processing infrastructure.

United States – ~ 20–25% market share; strong end-user demand, mature cold‑chain logistics, and extensive retail and institutional consumption networks.

The competitive environment in the Frozen Concentrated Juice market remains moderately consolidated, with a defined set of large-scale players controlling a significant portion of global supply, while numerous smaller regional producers cater to niche markets and regional demand. Estimates indicate there are over 50 active competitors globally, with the top 5 players collectively accounting for approximately 45–50% of total global market volume — reflecting a structure where a few dominant firms shape pricing, supply, and innovation, while many smaller producers compete on specialization or regional supply. Major global players maintain strong market positioning through strategic initiatives such as capacity expansion, vertical integration, product diversification (e.g., fruit-blend concentrates, clean-label and organic options), sustainable packaging adoption, and improving cold‑chain logistics. Recent product launches have focused on exotic‑fruit concentrates and low-sugar or additive‑free variants, attracting health-conscious consumers and new markets. Some leading firms are forming partnerships with cold‑storage logistics providers to streamline distribution and reduce spoilage, especially for export operations.

Innovation trends influencing competition include investment in advanced evaporation and concentration technologies to improve yield and reduce energy costs; adoption of automated cold‑chain monitoring and real-time inventory tracking; and cleaner, sustainable packaging to meet regulatory and consumer demands. These efforts help companies differentiate their products on quality, consistency, and shelf‑life — key competitive levers in a market where freshness, purity, and reliable supply are critical. Market fragmentation among smaller players — often local or regional producers — allows for niche specialization, such as exotic fruit blends, organic or non‑GMO concentrates, or customized solutions for foodservice clients. However, the major global firms’ scale, integrated supply chains, and broad distribution networks give them a strategic advantage in volume supply, global export, and institutional contracts.

Overall, the competitive landscape is marked by a balance: large players leveraging scale, process innovation and global reach, while smaller producers exploit agility, niche products, and localized supply — creating a dynamic and evolving market environment for Frozen Concentrated Juice.

The Coca-Cola Company

Citrosuco S.A.

Sucocítrico Cutrale

PepsiCo, Inc.

SunOpta, Inc.

Döhler GmbH

Tree Top, Inc.

Old Orchard Brands, LLC

The Frozen Concentrated Juice market is increasingly influenced by technological advancements in processing, preservation, and supply-chain management. Advanced evaporation systems, including multi-effect and thin-film evaporators, are being widely adopted, delivering 18–20% higher juice yield compared to traditional methods while reducing energy consumption by up to 15%. Automation in processing plants, such as robotic filling lines, automated sorting, and aseptic packaging, enhances efficiency and reduces labor dependency, particularly in high-volume production facilities in Brazil and the United States.

Cold-chain technology is a central driver, with real-time temperature monitoring, IoT-enabled sensors, and predictive analytics improving product quality and minimizing spoilage. Approximately 60% of major processing plants in North America and Europe now utilize automated cold-chain systems to track storage conditions and distribution in real time, supporting long-distance exports and meeting regulatory compliance requirements.

Emerging technologies also include high-pressure processing (HPP) and pulsed electric field (PEF) treatments, which extend shelf life without compromising nutritional quality or flavor, increasingly adopted in premium and functional juice segments. Digital transformation is another key trend, with ERP integration and AI-driven predictive maintenance enabling producers to optimize throughput, reduce downtime, and enhance operational transparency across production and logistics networks.

In packaging, sustainable and recyclable materials are being implemented in over 40% of European and North American plants, aligning technological innovation with ESG commitments. Additionally, data-driven quality control systems leveraging machine vision are helping ensure consistent color, flavor, and pulp content in concentrated juices, supporting brand reliability and consumer trust. Overall, technology integration across processing, cold-chain logistics, and quality assurance is redefining efficiency, sustainability, and competitiveness in the Frozen Concentrated Juice market.

In December 2024, The Coca-Cola Company Brasil invested R$550 million (~USD 91 million) to expand a concentrate beverage plant in the state of Amazonas, enhancing production capacity for frozen concentrate beverages. (Reuters)

In July 2023, Döhler Group completed the acquisition of SVZ International BV — a supplier of fruit and vegetable concentrates and purees — expanding Döhler’s ingredient portfolio and global footprint across Europe, the U.S., and Asia. (SVZ)

In 2023–2024, major juice concentrate producers intensified launches of clean-label and organic concentrate variants, including tropical blends and preservative‑free options, with new SKUs introduced worldwide to meet rising health‑ and sustainability‑oriented consumer demand.

In 2024, several manufacturers adopted biodegradable or recyclable packaging for frozen concentrate products, reducing packaging waste and aligning with global sustainability regulations and consumer preferences for eco‑friendly packaging.

The Frozen Concentrated Juice Market Report provides a comprehensive analysis across multiple dimensions of the industry, covering product type segmentation (e.g., citrus‑based concentrates, mixed fruit blends, exotic/tropical concentrates, and emerging vegetable‑fruit concentrates), as well as application segments including retail ready‑to‑drink juices, foodservice supply, and industrial beverage and ingredient manufacturing. It spans geographic regions globally — North America, Europe, Asia‑Pacific, Latin America (South America), Middle East & Africa — offering region‑wise market insights, consumption patterns, infrastructure status, and regulatory influences.

The report also examines technological and processing dimensions: traditional evaporation and concentration methods, emerging high-pressure processing or alternative preservation techniques, cold‑chain logistics, sustainable packaging, and automation/digitalization in processing and distribution. It reviews industry focus areas such as clean-label and organic concentrate demand, functional or fortified juice blends, exotic‑fruit and plant‑based innovations, non‑sugar or reduced‑sugar variants, and sustainability/ESG‑compliant operations.

Additionally, the report analyses supply‑chain and trade aspects — harvest and production volumes in major producing countries, export flows, import‑reliant regions, and seasonal supply fluctuations. It includes competitive landscape mapping: large multinational players, regional producers, ingredient‑specialist firms, and niche innovators. Finally, the report addresses emerging niche segments such as functional beverage concentrates, organic/natural concentrates, exotic‑fruit blends, and concentrates for dairy or plant‑based beverage applications — providing strategic context for decision‑makers seeking diversification, investment, or expansion in the frozen concentrate segment.

| Report Attribute/Metric | Report Details |

|---|---|

|

Market Revenue in 2024 |

USD 70068.53 Million |

|

Market Revenue in 2032 |

USD 118602.28 Million |

|

CAGR (2025 - 2032) |

6.8% |

|

Base Year |

2024 |

|

Forecast Period |

2025 - 2032 |

|

Historic Period |

2020 - 2024 |

|

Segments Covered |

By Types

By Application

By End-User

|

|

Key Report Deliverable |

Revenue Forecast, Growth Trends, Market Dynamics, Segmental Overview, Regional and Country-wise Analysis, Competition Landscape |

|

Region Covered |

North America, Europe, Asia-Pacific, South America, Middle East, Africa |

|

Key Players Analyzed |

The Coca-Cola Company, Citrosuco S.A., Sucocítrico Cutrale, PepsiCo, Inc., SunOpta, Inc., Döhler GmbH, Tree Top, Inc., Old Orchard Brands, LLC |

|

Customization & Pricing |

Available on Request (10% Customization is Free) |