Reports

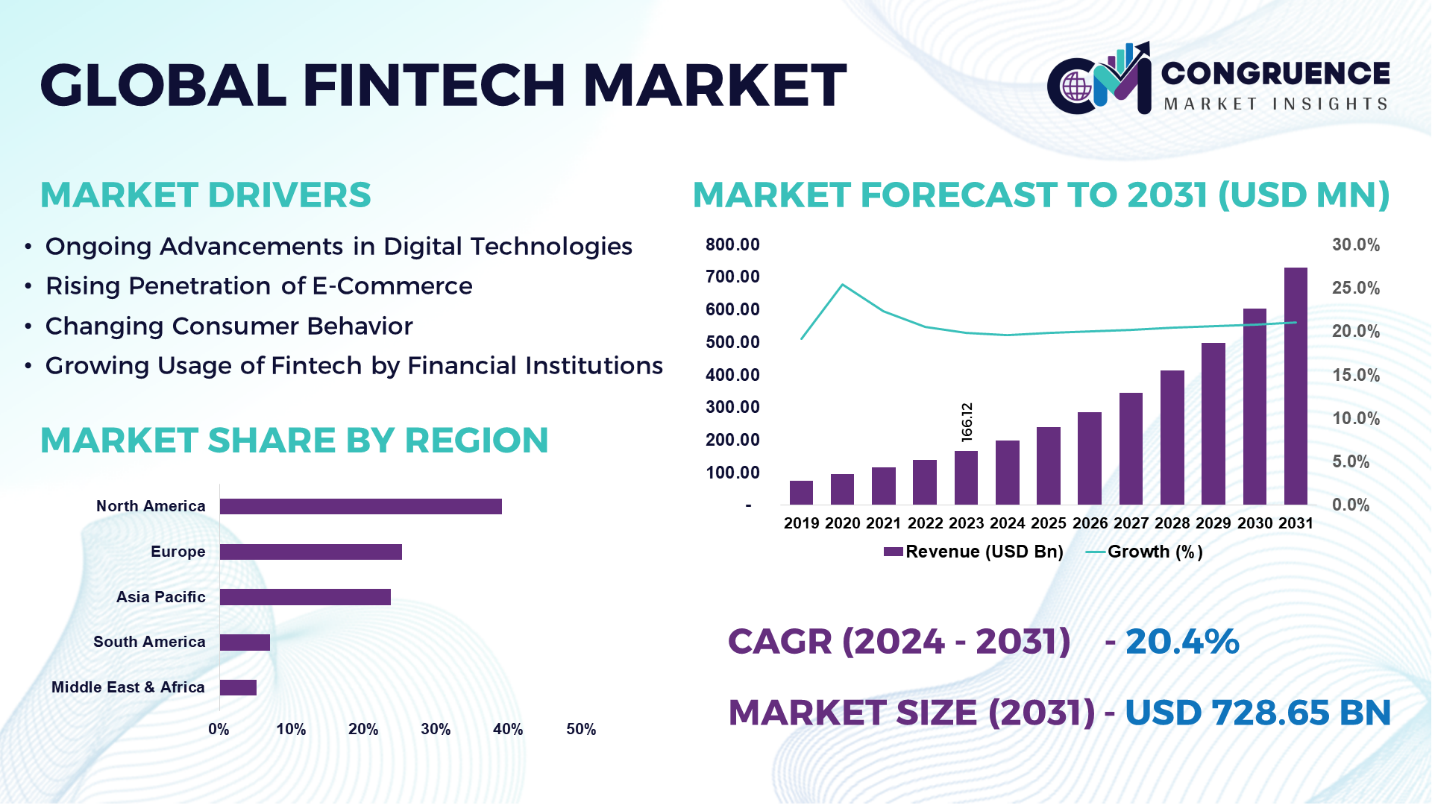

The Global Fintech Market was valued at USD 166.12 Billion in 2023 and is anticipated to reach a value of USD 728.65 Billion by 2031 expanding at a CAGR of 20.4% between 2024 and 2031.

Fintech stands for financial technology, which includes the use of innovative digital solutions and technology to support or improve banking and financial services and products. Fintech is a financial technology, which encompasses in the use of innovative technologies applied to the financial industry. The main purpose of fintech is to improve the traditional financial industry, streamline payment processes, enhance customer experience, expand financial inclusion, and cost reduction through automation, and digitalization. Key areas of fintech include payments, lending, insurance, fund transfer, digital banking, wealth management, and others. The fintech market is growing rapidly due to factors such as ongoing advancements in digital technologies, rising penetration of e-commerce, changing consumer behavior, and growing usage of fintech by financial institutions. This technology used in various sectors for fraud monitoring, kyc verification, compliance & regulatory support, money management, and others. The fintech market serves banks, financial institutions, insurance companies, and others.

To learn more about this report, request a free sample copy

Fintech Market Major Driving Forces

Ongoing Advancements in Digital Technologies: The rapid development of technologies is a significant factor driving the growth of fintech market. Emerging digital technologies such as blockchain, IoT, artificial intelligence, big data, and 5G are propelling the fintech market growth.

Rising Penetration of E-Commerce: The increasing penetration of e-commerce is driving the growth of the fintech market. As e-commerce continues to grow globally, there is an increasing need for secure and seamless digital payment solutions. Fintech companies provide innovative payment gateways, mobile wallets, and other digital payment options.

Changing Consumer Behavior: With the rapid advancements in technology, consumers are prioritizing digital financial services and mobile banking. The growing adoption of digital payments and contactless payments Increased adoption boost the growth of the fintech market.

Growing Usage of Fintech by Financial Institutions: The growing usage of fintech ny financial institutions is significantly driving global fintech market growth. The adoption of fintech services has been growing rapidly in the last few decades and is anticipated to continue further during the forecast period.

Fintech Market Key Opportunities

Advancements in Digital Banking and Payments: The advancements of digital banking and payments presents an opportunity for banks and financial institutions to provide their customers with innovative and convenient services. With increasing numbers of customers use digital channels for their banking and payment needs, banks use FaaS solutions to transform digital offerings and stay competitive.

Financial Inclusion: Financial inclusion is a significant opportunity for companies operating in the fintech market worldwide. Fintech companies can capitalize on this opportunity to address the needs of unbanked and underbanked populations worldwide by incorporating innovative technologies such as digital wallets, mobile banking, and blockchain.

Expanding Investments in Fintech Sector: Expanding investments in fintech sector is expected to provide lucrative opportunities for market expansion. Financial institutions and technology firms are increasingly investing in fintech innovations driven by customers growing need for e-commerce and mobile banking platforms that offer more user-friendly solutions for financial transactions.

Fintech Market Key Trends

· The rising interest in embedded finance that integrates financial services into non-financial platforms such as e-commerce, and social media

· Open banking is among the latest fintech trends in the industry, that enables secure data sharing and collaboration between technology firms, financial institutions, and customers

· The rise of Internet of Things (IoT), is one of the most revolutionary fintech trends, that has expanded the reach of financial services

· Integration of artificial intelligence (AI), and machine learning (ML) enables personalized financial advice, credit scoring, and risk management

· Major players operating in the fintech market are focusing on client tech labs to strengthen their position in the market

· The rise of mobile payment technology is a notable trend that is boosting growth of fintech industry

· The growing use of Regtech solutions that use cloud technology, machine learning, and big data analytics in order to provide accuracy and efficiency

Region-wise Market Insights

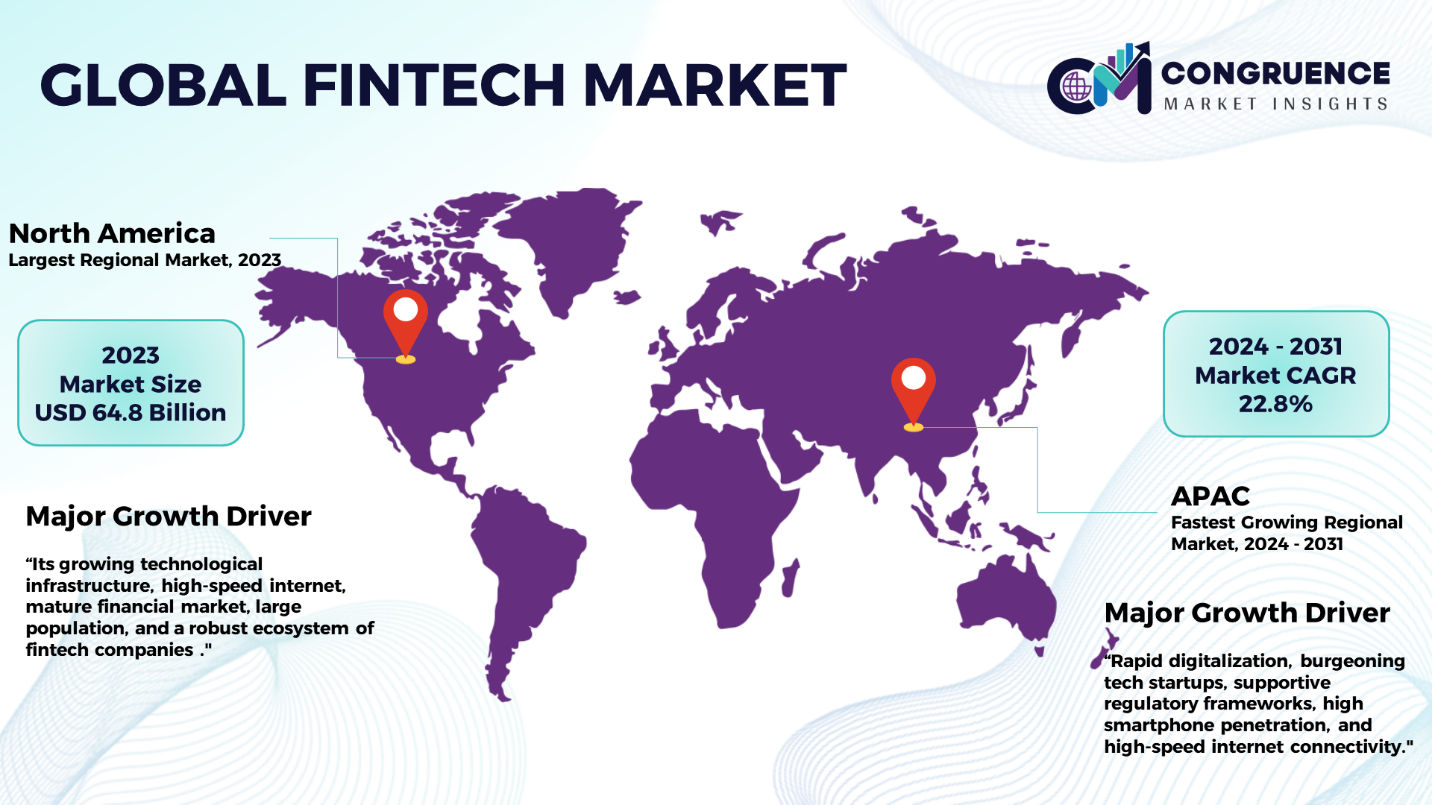

North America accounted for the largest market share at 39.0% in 2023 whereas, Asia Pacific is expected to register the fastest growth, expanding at a CAGR of 22.8% between 2024 and 2031.

To learn more about this report, request a free sample copy

North America was the largest region in the global fintech market. This dominance is attributed to its growing technological infrastructure, high-speed internet, mature financial market, large population, and a robust ecosystem of fintech companies in the region. Additionally, in North America, high digital adoption rates, established financial institutions, regulatory environment, and presence of prominent global players drives regional market growth. The Europe market growth is driven by the increasing number of banking institutions, launch of various digital payment methods, and significant investments from various venture capital, and corporate funding firms. In Asia-Pacific, the market is characterized by rapid digitalization, burgeoning tech startups, supportive regulatory frameworks, high smartphone penetration, and high-speed internet connectivity which has created an increasing demand for fintech. The Middle East and Africa has been witnessing a growing demand for fintech with the increasing penetration of mobiles and improvements in the banking infrastructure whereas, in South America, the market is influenced by economic factors, with rising popularity of mobile-based payment methods, growing number of fintech companies, and regulatory environment.

Market Competition Landscape

The global fintech market is characterized by high degree of competition among a large number of players operating in the industry. Market players are seeking different strategies, including strategic partnerships, to improve their offerings. Moreover, major players are investing aggressively in research & development activities to enhance their product offerings. Established brands leverage their reputation for quality and reliability to maintain market share, while newer entrants focus on disruptive innovations and unique selling propositions.

Key players in the global fintech market implement various organic and inorganic strategies to strengthen and improve their market positioning. Prominent players in the market include:

· Adyen

· Coinbase

· Ant Group CO., Ltd.

· Klarna Bank AB

· Avant, LLC

· SoFi Technologies, Inc.

· Circle Internet Financial, LLC.

· Robinhood

· Cisco Systems, Inc.

· PayPal Holdings, Inc.

· Revolut

· Block, Inc.

· ZhongAn Online P&C Insurance Co. Ltd.

· Finastra

· Fiserv, Inc.

· IBM Corporation

|

Report Attribute/Metric |

Details |

|

Market Revenue in 2023 |

USD 166.12 Billion |

|

Market Revenue in 2031 |

USD 728.65 Billion |

|

CAGR (2024 – 2031) |

20.4% |

|

Base Year |

2023 |

|

Forecast Period |

2024 – 2031 |

|

Historical Data |

2019 to 2023 |

|

Forecast Unit |

Value (US$ Mn) |

|

Key Report Deliverable |

Revenue Forecast, Growth Trends, Market Dynamics, Segmental Overview, Regional and Country-wise Analysis, Competition Landscape |

|

Segments Covered |

· By Service Type (Payments, Lending, Insurance, Fund Transfer, Digital Banking, Wealth Management, and Others) · By Technology (Big Data and Analytics, Cloud Computing, Blockchain, Artificial Intelligence (AI), Machine Learning (ML), and Robotic Process Automation (RPA)) · By Application (Fraud Monitoring, KYC Verification, Compliance & Regulatory Support, Money Management, and Others) · By End-User (Banks, Financial Institutions, Insurance Companies, and Others) |

|

Geographies Covered |

North America: U.S., Canada and Mexico Europe: Germany, France, U.K., Italy, Spain, and Rest of Europe Asia Pacific: China, India, Japan, South Korea, Southeast Asia, and Rest of Asia Pacific South America: Brazil, Argentina, and Rest of Latin America Middle East & Africa: GCC Countries, South Africa, and Rest of Middle East & Africa |

|

Key Players Analyzed |

Adyen,Coinbase,Ant Group CO., Ltd.,Klarna Bank AB,Avant, LLC,SoFi Technologies, Inc.,Circle Internet Financial, LLC,Robinhood,Cisco Systems, Inc.,PayPal Holdings, Inc.,Revolut,Block, Inc.,ZhongAn Online P&C Insurance Co. Ltd.,Finastra,Fiserv, Inc., and IBM Corporation |

|

Customization & Pricing |

Available on Request (10% Customization is Free) |