Reports

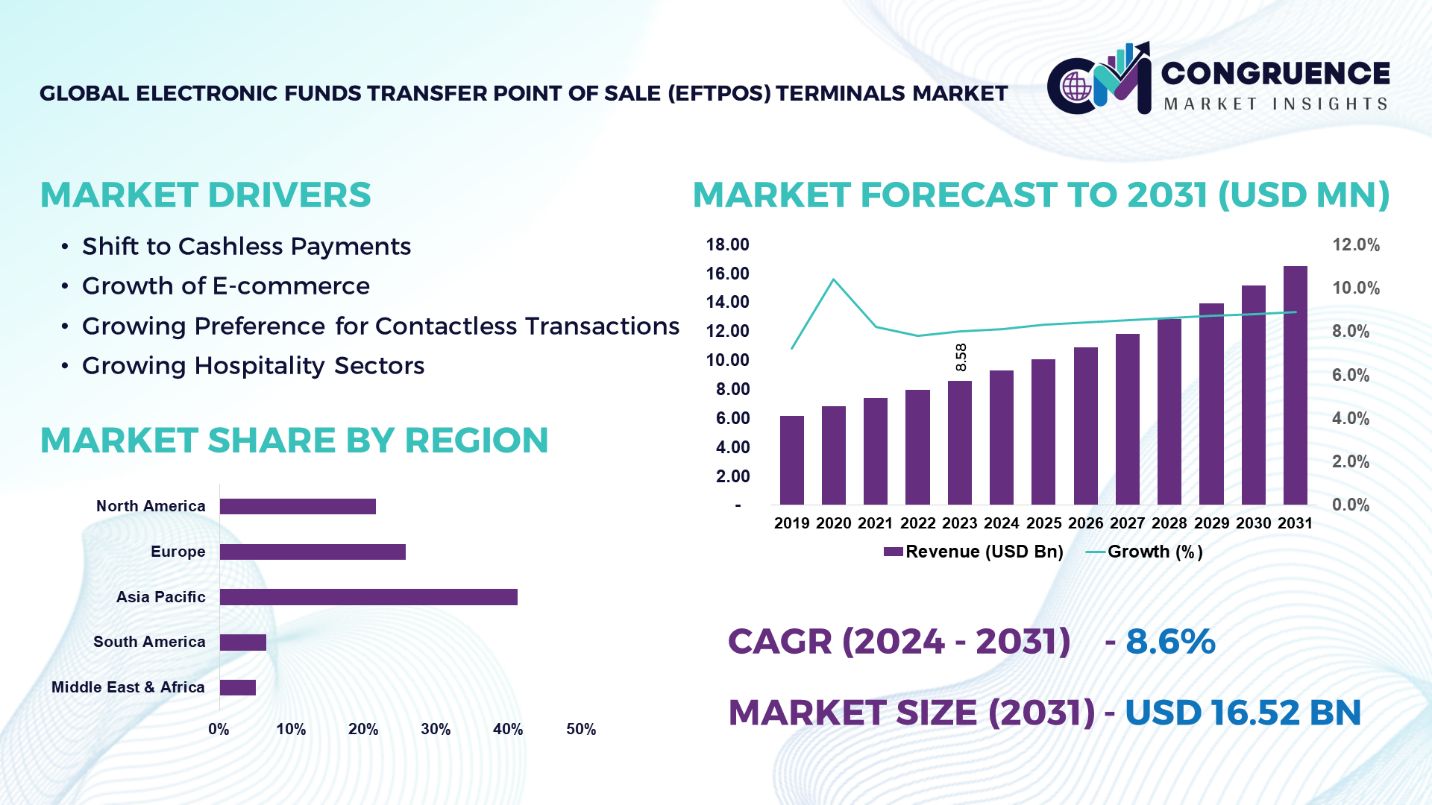

The Global Electronic Funds Transfer Point of Sale (EFTPOS) Terminals Market was valued at USD 8.58 Billion in 2023 and is anticipated to reach a value of USD 16.52 Billion by 2031 expanding at a CAGR of 8.6% between 2024 and 2031.

Electronic funds transfer point of sale (EFTPOS) terminals are electronic devices used in businesses to process the debit card and credit card based fund transfers at payments at the point of sale. These terminals play a vital role in facilitating transactions, providing to both merchants and customers in the digital age. Electronic funds transfer point of sale (EFTPOS) is an electronic system for paying for the purchase of goods and services including the use of credit card, or bank debit card at the terminals. The terminal reads the card information and communicates with the appropriate financial institution to authorize and complete the transaction. The main benefit of EFTPOS is that, similar to cheque, it removes the need to pay in ready cash. These systems are utilized in retail stores, restaurants, and other businesses to process electronic payments. Based on type, electronic funds transfer point of sale terminal market is segmented as counter-top terminals, mobile terminals, and inbuilt terminals. The market is influenced by growing preference for contactless transactions.

Electronic Funds Transfer Point of Sale (EFTPOS) Terminals Market Major Driving Forces

Shift to Cashless Payments: The global shift from cash to cashless payments using card and digital payments is the major driving factor of the market. With the increasing preference for contactless and card-based transactions, the demand for electronic funds transfer point of sale (EFTPOS) terminals is also growing.

Growth of E-commerce: The rapid expansion of retail and e-commerce sector is another factor significantly contributed to the market growth. Electronic funds transfer point of sale (EFTPOS) terminals are increasingly utilized by retailers to improve customer service and streamline payment processes.

Growing Preference for Contactless Transactions: The increasing consumer preference for contactless transactions is driving the demand electronic funds transfer point of sale (EFTPOS) terminals. EFTPOS are critical for contactless payment options for processing online transactions seamlessly.

Growing Hospitality Sectors: The presence of hotels, resorts and other establishments within the hospitality sectors significantly impacts the electronic funds transfer point of sale (EFTPOS) terminals market. Restaurants, hotels, and healthcare facilities are increasingly adopting these terminals for providing a secure and efficient means for electronic payments.

Electronic Funds Transfer Point of Sale (EFTPOS) Terminals Market Key Opportunities

Increasing Adoption of Digital Payments: The increasing adoption of digital payments is expected to create lucrative opportunities for market growth. The significant shift from cash to digital payments is creating a greater demand the electronic funds transfer point of sale (EFTPOS) terminals. Rising consumer demand for cashless transactions due to convenience, record-keeping, and security is the major factor boosting the market growth.

Technological Advancements: Advancements in technology, such as the introduction of contactless payment systems and mobile payment methods are anticipated to provide significant opportunities for market expansion. These technological advancements have made EFTPOS terminals more versatile and user-friendly. Contactless payments, mobile payments, and integration with other systems are further contributed to the market growth.

Emerging Markets: The increasing focus on expansion into developing economies is expected to create tremendous opportunities for market growth. These emerging economies are experiencing rapid economic growth and digitalization, providing a significant opportunity for the market expansion. Furthermore, governments are also supporting for cashless transactions and digital payment infrastructures, influencing the demand for FTPOS terminals.

Electronic Funds Transfer Point of Sale (EFTPOS) Terminals Market Key Trends

· The shift from cash to digital payments has been a major driving force in the EFTPOS terminal market

· Businesses are increasingly installing EFTPOS terminals as consumers are using debit cards to make payments

· The integration of value-added services, such as loyalty programs and analytics with EFTPOS terminals, allowing merchants to provide personalized services

· Incorporation of Near Field Communication (NFC) technologies, which allow for contactless payments via smartphones, smartwatches, or contactless cards

· The increasing adoption of cashless payments due to convenience and security is a major factor propelling the market growth

· Integration of additional features such as inventory management and customer analytics for making them more versatile and user-friendly

· Mobile EFTPOS solutions are gaining significant traction in the industry with high smartphone penetration and advanced digital infrastructure

Region-wise Market Insights

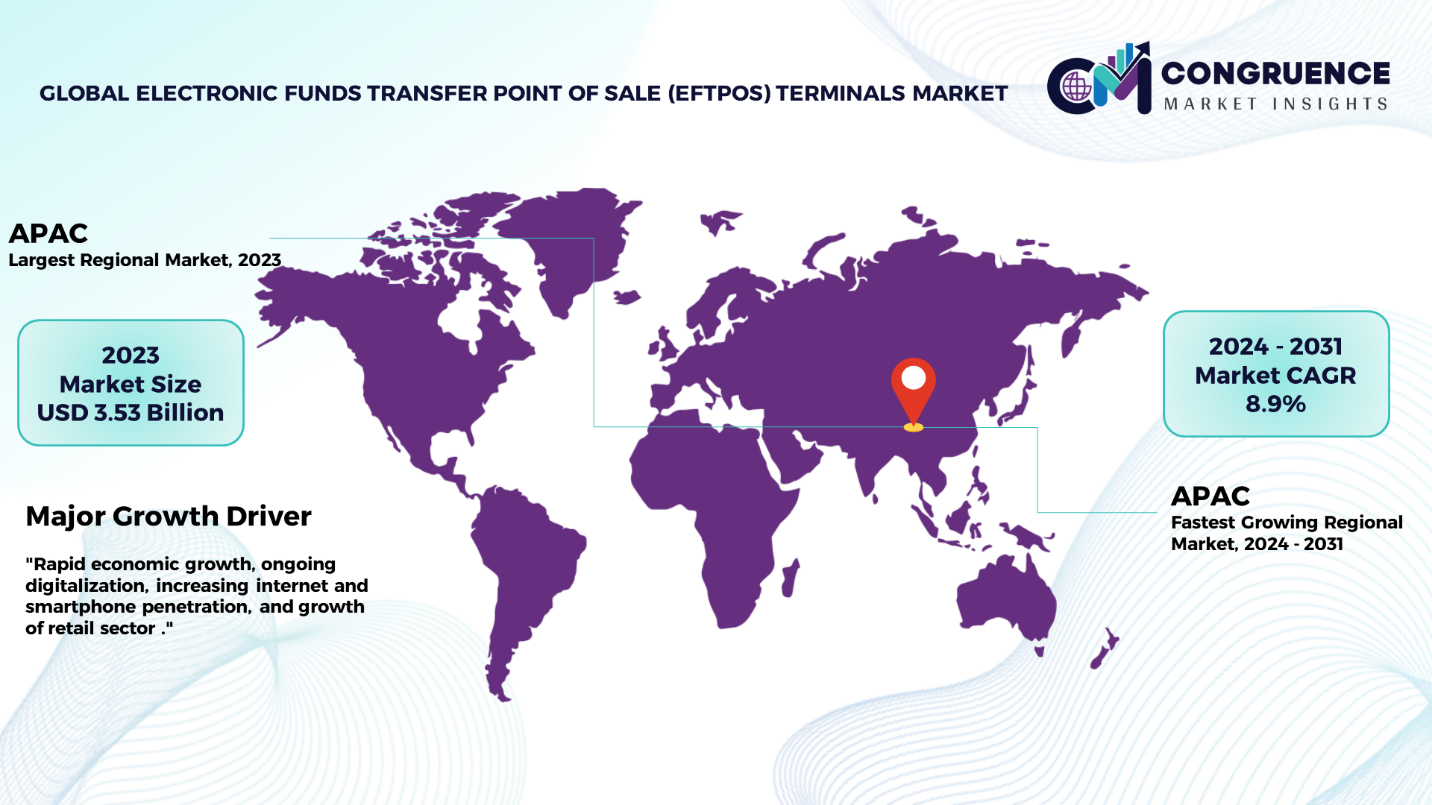

Asia Pacific accounted for the largest market share at 41.2% in 2023 whereas, Asia Pacific is expected to register the fastest growth, expanding at a CAGR of 8.9% between 2024 and 2031.

By regional analysis, the Asia Pacific region hold major share in global quality electronic funds transfer point of sale (EFTPOS) terminals market and is expected to exhibit higher growth in coming years. This growth is attributed to the factors such as rapid economic growth, ongoing digitalization, increasing internet and smartphone penetration, and growth of retail sector in the region. Additionally, governments in this region are also supporting for cashless transactions. In North America, the demand is driven by an increase in investment from small &medium-sized business (SMB) retailers across the region. In Europe, the market is characterized by significant shift towards cashless transactions and governments support to promote digital payments. The Middle East and Africa has been witnessing a growing demand for EFTPOS terminals due to the expanding retail sector and government initiatives whereas, in South America, the market is influenced by economic factors, with increasing penetration of smartphones and internet connectivity.

Market Competition Landscape

The global electronic funds transfer point of sale (EFTPOS) terminals market is characterized by high degree of competition among a large number of companies. These major companies are focused on integrating contactless payments, mobile payments, and integration with other systems for enhancing performance of the system. Key players in the electronic funds transfer point of sale (EFTPOS) terminals market engage in strategies aimed at gaining a competitive edge. These strategies include product innovation, design differentiation, and the incorporation of emerging technologies to meet evolving consumer preferences. Established brands leverage their reputation for quality and reliability to maintain market share, while newer entrants focus on disruptive innovations and unique selling propositions.

Key players in the global electronic funds transfer point of sale (EFTPOS) terminals market implement various organic and inorganic strategies to strengthen and improve their market positioning. Prominent players in the market include:

· Equinox Payments

· Dejavoo

· Diebold Nixdorf, Incorporated.

· First Data Corporation

· Fujitsu Frontech Limited

· Ingenico

· NCR Corporation

· PAX Global Technology Limited.

· Olivetti S.p.A.

· Oracle

· Spire Payments UK

· VeriFone Systems, Inc.

· Worldline S.A.

· SmartPay Limited

|

Report Attribute/Metric |

Details |

|

Market Revenue in 2023 |

USD 8.58 Billion |

|

Market Revenue in 2031 |

USD 16.52 Billion |

|

CAGR (2024 – 2031) |

8.6% |

|

Base Year |

2023 |

|

Forecast Period |

2024 – 2031 |

|

Historical Data |

2019 to 2023 |

|

Forecast Unit |

Value (US$ Mn) |

|

Key Report Deliverable |

Revenue Forecast, Growth Trends, Market Dynamics, Segmental Overview, Regional and Country-wise Analysis, Competition Landscape |

|

Segments Covered |

· By Type (Counter-Top Terminals, Mobile Terminals, and Inbuilt Terminals) · By Technology (Chip and PIN Terminals, Barcode Scanners, and Others) · By End-user (SMEs, and Large Enterprises) · By Application (Retail, Restaurants, Entertainment, Hospitality & Healthcare System, Warehousing, and Others) |

|

Geographies Covered |

North America: U.S., Canada and Mexico Europe: Germany, France, U.K., Italy, Spain, and Rest of Europe Asia Pacific: China, India, Japan, South Korea, Southeast Asia, and Rest of Asia Pacific South America: Brazil, Argentina, and Rest of Latin America Middle East & Africa: GCC Countries, South Africa, and Rest of Middle East & Africa |

|

Key Players Analyzed |

Equinox Payments, Dejavoo,Diebold Nixdorf, Incorporated.,First Data Corporation,Fujitsu Frontech Limited,Ingenico,NCR Corporation,PAX Global Technology Limited.,Olivetti S.p.A.,Oracle,Spire Payments UK,VeriFone Systems, Inc.,Worldline S.A., and SmartPay Limited. |

|

Customization & Pricing |

Available on Request (10% Customization is Free) |