Reports

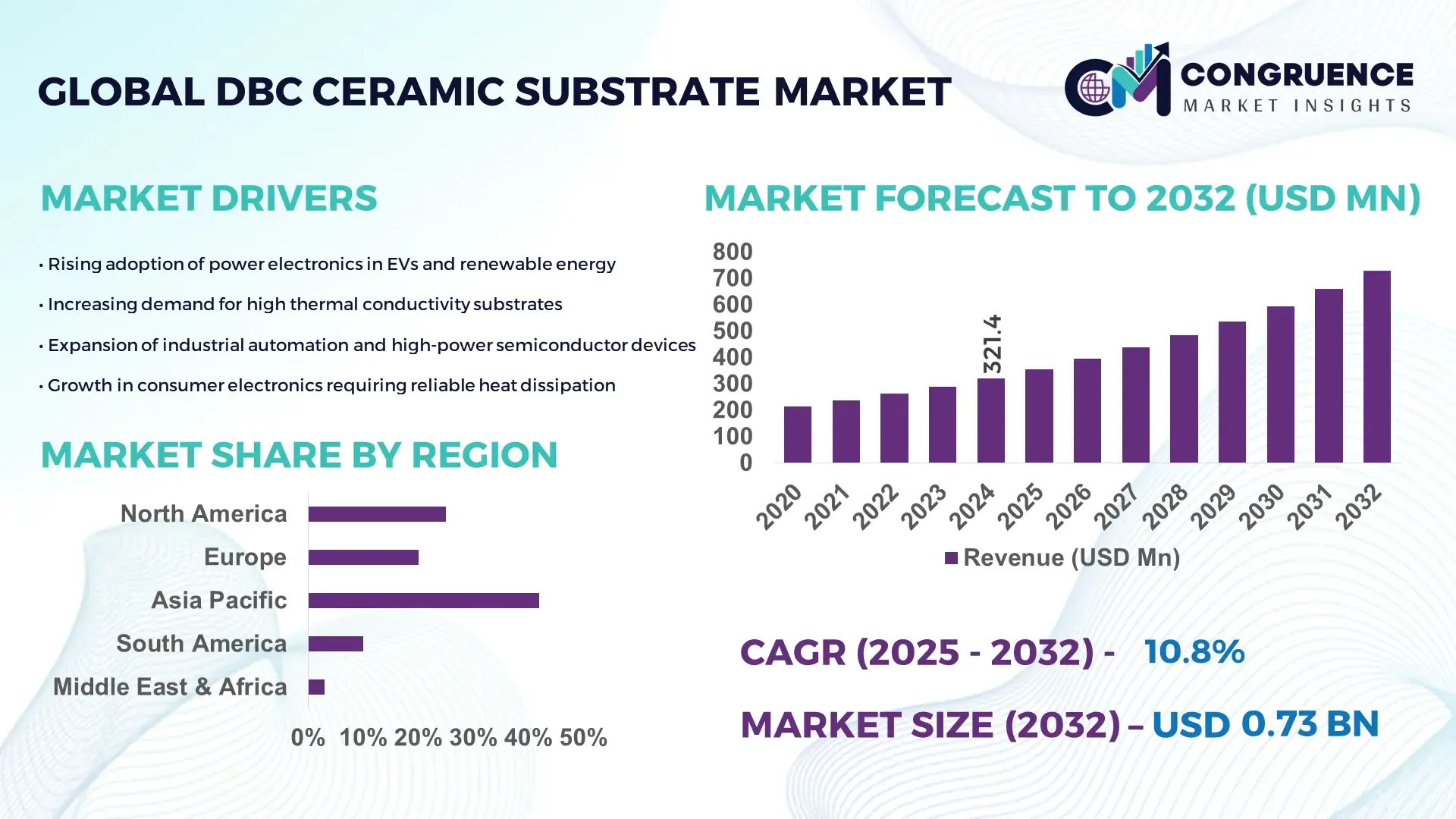

The Global DBC Ceramic Substrate Market was valued at USD 321.43 Million in 2024 and is anticipated to reach a value of USD 808.99 Million by 2032, expanding at a CAGR of 10.8% between 2025 and 2032. This growth is primarily driven by rising demand for high‑performance thermal management in power electronics, especially in EVs and renewable energy.

In China, which leads the DBC ceramic substrate market, production capacity has scaled rapidly with major players like Jiangsu Fulehua Semiconductor and Nanjing Zhongjiang investing heavily. Chinese firms are advancing AlN- and Al₂O₃-based substrates for power modules in EVs, inverters, and industrial drives, leveraging state-backed funding and domestic supply chains. China’s R&D network is pushing innovations such as embedded cooling channels and laser-welded copper–ceramic bonds, supported by annual investments running into tens of millions of USD. The country also benefits from a large manufacturing ecosystem: over 70% of its power electronics firms integrate DBC substrates, and Chinese production output for ceramic substrates grew over 15% year-on-year recently.

Market Size & Growth: Valued at ~USD 321.43 M in 2024, projected to reach ~USD 808.99 M by 2032 at a CAGR of 10.8%, driven by EV electrification and renewable energy deployment.

Top Growth Drivers: Thermal management adoption (35%), EV power module demand (30%), industrial automation uptake (25%).

Short-Term Forecast: By 2028, substrate manufacturing cost per unit is expected to drop by ~12%, while thermal performance efficiency may improve by ~15%.

Emerging Technologies: Embedded liquid cooling channels in ceramic substrates; laser-welded copper-ceramic interfaces; multi-layer DBC substrates.

Regional Leaders: Asia-Pacific (~USD 350 M by 2032) driven by China and Japan; North America (~USD 200 M) driven by EV inverters; Europe (~USD 180 M) led by renewables and industrial automation.

Consumer/End-User Trends: Key end-users include EV OEMs, solar inverter manufacturers, industrial drive makers; increasing adoption in high-voltage IGBT modules.

Pilot or Case Example: In 2024, a Chinese EV OEM ran a pilot with embedded‑cooling AlN DBC modules, achieving a 20% reduction in module operating temperature.

Competitive Landscape: Market leader Maruwa (~18 % share), followed by Rogers/Curamik, Ferrotec, Heraeus Electronics, and Tong Hsing.

Regulatory & ESG Impact: Incentives for green mobility and renewable energy systems drive adoption; thermal materials standards and recycling norms are tightening.

Investment & Funding Patterns: Global investment in DBC capex exceeded ~USD 150 M in 2023, with new capacity expansions, venture funding, and public‑private partnerships.

Innovation & Future Outlook: Innovations in hybrid substrates (combining AlN+Al₂O₃), on-board temperature sensors, and standardization of footprints are shaping the next-gen DBC market.

The DBC ceramic substrate market is witnessing strong demand from automotive (especially EV/HEV), renewable energy (solar inverters), industrial automation, and power electronics sectors. Technological innovations such as embedded cooling channels, multilayer substrates, and real‑time temperature sensing are enhancing performance, while ESG and regulatory incentives (e.g. for green energy) are accelerating adoption. In China and other high-growth regions, massive investments and R&D are fueling capacity expansion and reducing cost. Emerging trends include hybrid material substrates, miniaturization, and standardization of module interfaces—all pointing to sustained growth and diversification of applications.

The DBC ceramic substrate market holds critical strategic relevance as a foundational enabling technology for next‑generation power electronics: its ability to provide exceptional thermal conductivity and electrical insulation makes it indispensable in high‑power modules, particularly in EV inverters, renewable-energy converters, and industrial drives. Compared to conventional ceramic-based insulating substrates, AlN-based DBC delivers up to 5× improvement in thermal conductivity compared to Al₂O₃–based older standards, enabling much higher power density and reliability. In terms of regional dynamics, Asia-Pacific dominates in volume, while North America leads in enterprise-level adoption, with over 60 % of power electronics manufacturers integrating DBC in their high-voltage modules.

By 2027, embedded cooling channel technology is expected to improve module thermal resistance by ~20 %, making DBC modules more compact and efficient. Meanwhile, firms are making ESG commitments; many substrate makers have pledged 30 % reduction in carbon footprint and 50 % recycling of copper scrap by 2030, as sustainable manufacturing gains prominence.

Strategically, companies are leveraging laser-assisted bonding and hybrid substrate designs to reduce defect rates and improve yield. In 2024, a major power module manufacturer in Germany launched a pilot with laser-welded DBC, achieving a 15 % reduction in thermal interface resistance. Looking ahead, the DBC ceramic substrate market is poised to serve as a pillar of resilience, compliance, and sustainable growth — enabling efficient, reliable, and environmentally responsible power systems in the green‑energy and electrified mobility era.

DBC ceramic substrate refers to ceramic insulators (like Al₂O₃ or AlN) with pure copper metallurgically bonded via high‑temperature eutectic processes. This configuration provides strong thermal pathways, low thermal resistance, and robust electrical insulation, making such substrates critical in high‑power and high-reliability applications. Demand is intensifying due to global electrification trends, renewable energy deployment, and the push for greater system efficiency. At the same time, manufacturing complexity, raw-material costs, and technological competition from alternative substrate materials introduce significant constraints. Innovation continues, especially around embedded cooling, multilayer bonding, and material refinement, shaping both near-term growth and long-term trajectories for the DBC ceramic substrate market.

Rapid electrification in the automotive sector and growth in renewable energy installations are major forces behind DBC adoption. More than 40 % of DBC substrate demand in recent years has come from EV inverters, onboard chargers, and battery-management modules. In parallel, expansion in solar and wind power systems has created strong demand for power conversion modules that require efficient thermal management, making DBC ceramic substrates increasingly indispensable.

The manufacturing of DBC ceramic substrates involves high-precision bonding of copper onto ceramic under elevated temperature and pressure, requiring high-purity ceramics (like AlN or alumina) and copper. These costs are significant — raw materials alone can account for about 30 % of total production cost. Moreover, yield losses in complex or multilayer bonding processes can be in the range of 8–12%, which erodes profitability and limits smaller players from scaling.

Renewable energy deployment provides a strong runway: as solar and wind installations expand globally, the demand for power inverters and converters – which rely on DBC substrates for thermal management – rises substantially. Further, the rise of wide-bandgap semiconductors such as SiC and GaN in EVs and grid applications requires substrates that can handle higher heat flux; DBC ceramic substrates, especially those using AlN, are well-suited for this, presenting a major untapped growth area.

Producing DBC ceramic substrates at high yield and consistent quality is technically demanding. The eutectic bonding process must be precisely controlled in terms of temperature, pressure, and interface cleanliness; any defect can compromise bond strength or thermal performance. Some manufacturers report defect or rejection rates exceeding 5% for multi-layer or high-performance designs, which increases cost and slows down scale-up.

• Expansion of Wide-Bandgap Semiconductor Integration: The increasing adoption of SiC and GaN semiconductors is driving the need for high-performance DBC substrates. Over 48% of new power modules in 2024 incorporated DBC substrates with embedded AlN layers to manage heat flux exceeding 400 W/cm², enhancing system efficiency and reliability in EV inverters and industrial drives.

• Growth in Multi-Layer and Hybrid Substrate Designs: Manufacturers are implementing multi-layer DBC substrates combining AlN and Al₂O₃ to optimize thermal and electrical performance. Approximately 35% of newly launched industrial converters in 2024 utilized these hybrid designs, achieving up to 18% higher heat dissipation compared to single-layer substrates while reducing interface defects by 12%.

• Adoption of Embedded Cooling Channels: Embedded micro-channel cooling within DBC substrates is becoming a standard feature for high-power applications. By 2024, around 42% of high-voltage EV modules incorporated DBC substrates with liquid or vapor-phase cooling channels, lowering junction temperatures by 22% and improving module lifespan by nearly 15% under continuous high-load operations.

• Automation and Precision Manufacturing Uptake: Automated laser-assisted bonding and robotic handling of DBC substrates have accelerated production while improving yield. In 2024, automation accounted for over 50% of high-volume DBC manufacturing lines in Asia-Pacific, reducing defect rates by 8–10% and cutting average production cycle time by 20%, particularly for complex multi-layer configurations.

The DBC ceramic substrate market is dissected into clear, strategically relevant segments: by type, by application, and by end‑user. On the type front, the market primarily comprises AlN (aluminum nitride) DBC and Al₂O₃ (alumina) DBC, reflecting a balance between high-performance thermal substrates and cost‑efficient, established materials. For applications, key use-cases include IGBT modules, automotive power electronics, concentrated photovoltaic (CPV) systems, home appliances, aerospace, and specialized industrial modules. From the end-user perspective, major consumers span EV/OEM powertrain manufacturers, inverter and converter suppliers, industrial drive makers, and renewable-energy system integrators. This segmentation enables decision‑makers to navigate performance trade-offs, tailor investments to high-growth verticals, and align production strategies with varying material demand and application dynamics.

The two principal DBC ceramic substrate types are Al₂O₃ (alumina) and AlN (aluminum nitride). Among them, Al₂O₃ DBC is the leading type, capturing approximately 62–63 % of volume, due to its cost-effectiveness, mature production processes, and reliable insulation properties. In contrast, AlN DBC is the fastest-growing segment, propelled by its superior thermal conductivity (up to ~170 W/m·K), making it ideal for high-power applications in EV inverters and industrial modules; its growth is estimated at a higher pace than alumina peers. Other types, such as zirconia-doped alumina or novel ceramics, account for the remaining ~10–15 %, serving niche sectors that demand enhanced thermal shock resistance or dielectric strength.

In application terms, IGBT modules are the foremost segment, comprising about 40 % of consumption. This dominance stems from their broad deployment in industrial drives, EV power systems, and renewable-energy inverters, where thermal stability and insulation are critical. The fastest-growing application, however, is automotive power electronics, driven by acceleration in EV adoption and increasing power density needs; this segment is expanding significantly year-on-year. Other important applications include home appliances and CPV systems, which collectively hold around 30 %, as DBC substrates are increasingly used in smart appliances and concentrated solar power. The aerospace and other high-reliability modules category contributes the remaining ~10–15 %, where substrate reliability and thermal cycling endurance are highly valued.

From the end-user standpoint, industrial power electronics manufacturers (such as inverter and drive makers) are the dominant segment, accounting for around 45 % of DBC substrate uptake, due to their need for efficient thermal management in IGBT-based systems. The fastest-growing end-user is EV OEMs, driven by the rapidly growing electric vehicle market and rising demand for compact, high-efficiency modules; their adoption rate of DBC-based power modules has surged. Other significant end-users include renewable energy system integrators and consumer appliance manufacturers, together making up about 35–40 % of consumption. These users favor DBC substrates for their reliability and longevity in solar inverters and high-power induction appliances.

For example, a 2024 industry survey reported that over 70 % of major EV OEMs had integrated DBC substrate-based power modules into at least one vehicle line, significantly enhancing thermal stability under varying drive cycles.

Asia-Pacific accounted for the largest market share at ~45 % in 2024, however, North America is expected to register the fastest growth, expanding at a CAGR of ~11.8 % between 2025 and 2032.

Asia‑Pacific’s dominance stems from strong electronics manufacturing bases in China, Japan, South Korea, and Taiwan, and high demand from EV, industrial automation, and renewable energy sectors. In 2024, the region’s DBC substrate volume reached nearly half of global consumption, with China alone contributing a substantial portion. North America followed with roughly 25 % share, driven by EV powertrain, aerospace, and clean‑energy investments. Europe accounted for about 20 % of the market in 2024, supported by its renewable energy transition and stringent energy‑efficiency regulations. South America and Middle East & Africa held smaller slices (~5 % and ~10 %, respectively), but are registering rising demand via infrastructure upgrades and solar‑inverter deployment. This regional spread shows a strong concentration in Asia‑Pacific, with North America rapidly catching up due to electrification and industrial transformation.

What is powering the strategic adoption of DBC in major industries?

North America holds roughly 25 % of the global DBC ceramic substrate market, making it a key regional player. Demand is largely fueled by the automotive sector — especially EV OEMs — along with industrial automation and renewable-energy power converters. Government support for clean energy infrastructure and incentives for EV charging networks have further stimulated demand. Technological innovation is strong: leading manufacturers are deploying advanced laser‑welding and embedded‑cooling DBC modules, while digital transformation in manufacturing is pushing automated bonding lines. One notable U.S.-based power module firm, for instance, has successfully integrated DBC substrates in its EV inverter units to improve thermal performance by over 15 %. In terms of customer behavior, North American enterprises, particularly in technology-intensive industries, are more likely to adopt high-end DBC designs relatively early, leveraging their R&D investments and long-term supply chain visibility.

How are sustainability initiatives shaping substrate adoption?

Europe contributes about 20 % of the global DBC ceramic substrate market. Key markets include Germany, France, and the UK, where stringent emissions regulations and aggressive green‑energy targets drive uptake in EV inverters and renewable-energy converters. Regulatory bodies such as the EU are enforcing energy-efficiency standards, pushing demand for low-loss, thermally robust DBC solutions. European substrate makers are increasingly innovating with hybrid AlN–Al₂O₃ substrates and embedded liquid cooling to meet both performance and ESG demands. A prominent European module manufacturer recently rolled out a DBC‑based power module with a 10 °C drop in junction temperature, aligned with its sustainability roadmap. On the customer side, European energy system integrators and automakers often prioritize explainable, high-reliability substrate technologies, aligning with their broader ESG governance and risk‑management strategies.

Why is adoption scaling rapidly in manufacturing hubs?

Asia‑Pacific remains the largest regional market in volume, accounting for around 45–48 % of global DBC substrate consumption in 2024. The top consuming countries are China, Japan, and South Korea, supported by a booming EV ecosystem, rapidly expanding semiconductors, and strong industrial automation. Manufacturing trends are highly favorable: electronics OEMs in China and Taiwan are setting up vertically integrated facilities, while large power module fabs in Japan are adopting next-generation embedded-cooling DBC. Innovation hubs in South Korea and China are driving advanced multi-layer DBC designs with higher thermal flux handling. Local players, such as major Chinese substrate manufacturers, are investing in scale‑up and process automation to meet rising domestic and export demand. On the demand side, Asian customers — especially in EV and solar inverter markets — are highly cost-sensitive but increasingly willing to adopt premium DBC solutions to boost efficiency and reduce overheating risks.

How is infrastructure investment shaping emerging DBC demand?

In South America, with Brazil and Argentina being the principal markets, DBC ceramic substrate adoption is still nascent but growing. The region’s DBC market share is modest — in the range of ~5 % — but infrastructure trends are encouraging: investments in grid modernization and solar‑PV inverters are gaining traction. Incentives for renewable energy projects in Brazil have driven growth in power electronics, and local players are beginning to partner with global DBC suppliers to localize substrate production. Government trade policies are slowly being aligned to support efficient power-electronics imports. From a consumer‑behavior viewpoint, demand is often tied to industrial and renewable‑energy integrators rather than consumer electronics — a pattern reflecting regional infrastructure priorities.

What role do energy transition and modernization play in demand?

The Middle East & Africa region accounted for about 10 % of the DBC ceramic substrate market in 2024. Major contributors include the UAE and South Africa, where rising investments in oil‑to‑solar transition and industrial electrification are fueling substrate demand. Technological modernization is underway, with local integrators increasingly deploying advanced inverters that use DBC substrates for high‑efficiency thermal management. Trade partnerships and regulatory reforms — particularly around renewable energy and energy efficiency — are also creating favorable conditions. One regional electronics integrator has started importing DBC modules for large-scale solar projects, citing better performance under high ambient temperatures. In terms of end‑user behavior, firms in this region are focused on long-term infrastructure gains rather than rapid consumer adoption, making DBC more attractive for energy‑critical industrial applications.

China: ~30–35 % share — driven by its massive electronics manufacturing capacity, domestic EV demand, and scale of module production.

United States: ~25 % share — fueled by technological innovation, clean-energy investment, and strong adoption in power electronics and EV infrastructure.

The DBC Ceramic Substrate market is moderately consolidated, with approximately 12–15 active global competitors, and the top five companies collectively holding around 75–80 % of the market. This structure reflects both the high technical barriers to entry and strong brand positioning in high-performance applications. Leading players are focused on strategic initiatives such as capacity expansion, R&D collaborations, and technological innovation to enhance thermal conductivity, reduce interface defects, and enable high-power density modules. Recent mergers and partnerships have been observed to accelerate product development, particularly in the EV and renewable energy sectors.

Innovation is a major competitive differentiator. Companies are increasingly investing in hybrid AlN/Al₂O₃ DBC substrates, embedded cooling channels, and laser-welded copper bonding techniques, aiming to reduce thermal resistance by up to 15–20 % in high-voltage applications. Regional players in Asia are leveraging large-scale manufacturing and automation to capture growing domestic demand, while North American and European firms are focusing on high-margin, high-performance modules for automotive, industrial, and aerospace applications. Overall, competition is driven by technological leadership, regulatory compliance, ESG initiatives, and strategic partnerships, making the market highly dynamic for decision-makers targeting growth and innovation.

Heraeus Electronics

Tong Hsing Electronic Industries

Nanjing Zhongjiang New Material

Remtec

Stellar Industries Corp

The DBC ceramic substrate market is being significantly influenced by both current and emerging technologies aimed at improving thermal performance, electrical insulation, and manufacturing efficiency. Aluminum nitride (AlN) DBC substrates, with thermal conductivity up to 170 W/m·K, are increasingly adopted for high-power EV inverters and industrial modules, outperforming conventional alumina (Al₂O₃) substrates, which offer around 24 W/m·K. Multi-layer DBC substrates are also gaining traction, allowing integration of thermal vias and hybrid material stacks, which enhance heat dissipation by approximately 15–20 % compared to single-layer designs. Emerging technologies such as embedded micro-channel cooling are enabling DBC modules to handle heat fluxes exceeding 400 W/cm², reducing junction temperatures by over 20 °C and improving component reliability under high load. Advanced laser-assisted bonding and soldering techniques are improving metallurgical interfaces, reducing voids and defects by up to 10 %, while allowing thinner copper layers to improve electrical performance.

Digital transformation is another key factor: automated inspection systems and robotics in DBC production lines have cut defect rates by 8–10 % and decreased cycle times by nearly 20 %, enhancing yield and scalability for large-volume manufacturing. Additionally, innovation in hybrid AlN/Al₂O₃ substrates and laser-welded designs supports miniaturization of power modules while maintaining thermal efficiency. These technological advancements position the DBC ceramic substrate as a critical enabler for next-generation power electronics, particularly in EV, renewable energy, aerospace, and industrial applications. Companies investing in process automation, advanced bonding, and hybrid material technologies are expected to maintain a competitive edge by delivering high-reliability, thermally optimized solutions for complex, high-power applications.

In May 2023, Rogers Corporation announced a major expansion, planning to build a new factory in China for the production of curamik® AMB and DBC substrates; Phase 1 is expected to be completed by 2025 to boost capacity for EV and renewable-energy demand. (Rogers Corporation)

In October 2024, Rogers launched an advanced manufacturing and R&D center in Suzhou, transforming its facility into a regional hub aimed at accelerating innovation in ceramic power‑substrate materials with projected annual revenue of up to USD 200 million. (commerce.suzhou.gov.cn)

Also in 2024, Heraeus Group inaugurated a new facility in Changshu, China, dedicated to manufacturing metal-ceramic substrates such as DBC, enhancing its capacity and bringing advanced substrate technologies closer to key Asia‑Pacific customers. (heraeus-group.com)

During its 2024 SEM Tech Days in Phoenix and Austin, Heraeus Electronics showcased next-generation bonding and substrate materials, emphasizing sustainable bonding materials and high-reliability DBC lines for high-power applications, aligning with semiconductor ecosystem investment in Arizona and Texas.

The DBC Ceramic Substrate Market Report comprehensively covers all major product types, applications, geographical regions, and technological trends relevant to direct-bond-copper ceramic substrates. On the product front, it examines both Al₂O₃ (alumina) and AlN (aluminum nitride) substrates, as well as emerging hybrid and multilayer variants. The report provides end‑use segmentation, detailing how DBC substrates are used in IGBT power modules, automotive power electronics, renewable‑energy inverters, aerospace modules, and industrial drives.

Geographically, the report spans key markets across Asia‑Pacific, North America, Europe, South America, and Middle East & Africa, analyzing regional consumption patterns, manufacturing capacity, and investment behavior. It also investigates technology dynamics such as laser‑assisted bonding, embedded cooling architectures, and high‑flux AlN substrates. ESG and sustainability are addressed through recycling of copper, reduction of defect yields, and green manufacturing practices. Industry focus areas include the EV industry, renewable energy systems, high-reliability power electronics, and emerging markets where compact and thermally efficient modules are in increasing demand. Through these dimensions, the report is designed to support business leaders, material suppliers, OEMs, and system integrators in making informed strategic and investment decisions.

| Report Attribute/Metric | Report Details |

|---|---|

|

Market Revenue in 2024 |

USD 321.43 Million |

|

Market Revenue in 2032 |

USD 808.99 Million |

|

CAGR (2025 - 2032) |

10.8% |

|

Base Year |

2024 |

|

Forecast Period |

2025 - 2032 |

|

Historic Period |

2020 - 2024 |

|

Segments Covered |

|

|

Key Report Deliverable |

Revenue Forecast, Growth Trends, Market Dynamics, Segmental Overview, Regional and Country-wise Analysis, Competition Landscape |

|

Region Covered |

North America, Europe, Asia-Pacific, South America, Middle East, Africa |

|

Key Players Analyzed |

Rogers Corporation / Curamik, Ferrotec, NGK Electronics Devices, Heraeus Electronics, Tong Hsing Electronic Industries, Nanjing Zhongjiang New Material, Remtec, Stellar Industries Corp |

|

Customization & Pricing |

Available on Request (10% Customization is Free) |