Car Data Recorder Market Dynamics

DRIVER

Integration of Advanced Safety and Driver Assistance Technologies

The integration of ADAS (Advanced Driver Assistance Systems) is fueling the demand for car data recorders capable of real-time data analysis and event detection. These systems require precise data input, which is captured and processed through intelligent recorders installed in vehicles. Modern recorders now support lane departure warnings, forward-collision alerts, and pedestrian detection, all of which rely on continuous data logging. The increasing focus on reducing road fatalities and improving accident reconstruction through reliable footage is accelerating the adoption rate of these technologies. Automakers are also collaborating with tech firms to develop recorders that support multi-angle video capture and cloud-based data storage, enhancing both safety and compliance.

RESTRAINT

Rising Concerns Around Data Privacy and Cybersecurity Risks

As car data recorders collect and transmit sensitive information—such as location, speed, video footage, and driver behavior—there is growing concern over how this data is stored, shared, and protected. The risk of data breaches and unauthorized access is particularly problematic for fleet operators and individual consumers alike. With the growing prevalence of connected vehicles, the attack surface for potential cyber intrusions has expanded significantly. This has prompted regulators to consider stricter data handling and encryption requirements. Moreover, compliance with data protection laws like GDPR and CCPA adds to the operational complexity and cost for manufacturers, making smaller players hesitant to scale.

OPPORTUNITY

Government Regulations Mandating Black Box Installation in New Vehicles

A major opportunity lies in government mandates for Event Data Recorders (EDRs) and black boxes in vehicles, particularly in North America, Europe, and parts of Asia. These mandates aim to improve road safety by enabling post-crash investigations and helping determine liability in accidents. The regulation requiring EDRs in new cars from 2024 in some regions has triggered increased production and adoption of compliant car data recorder systems. Furthermore, governments are funding safety tech R&D initiatives, opening doors for manufacturers to innovate and launch next-gen recorders with AI, IoT, and machine learning features. The regulatory push ensures a steady demand pipeline, especially in emerging markets with growing vehicle populations.

CHALLENGE

High Cost of Advanced Car Data Recorder Systems and Integration

Despite the growing interest, the high cost of advanced car data recorder systems continues to be a key challenge for mass adoption, especially in mid-range and budget vehicles. Systems that support high-resolution video, real-time cloud backup, GPS tracking, AI-based analysis, and wireless communication significantly raise the total cost of ownership. Additionally, integrating these systems with existing vehicle architecture often requires professional installation and software tuning, which adds to operational expenses. This price sensitivity is more pronounced in developing markets where customers often prioritize cost over features. Consequently, manufacturers are under pressure to balance functionality with affordability while maintaining quality and compliance.

Car Data Recorder Market Trends

• Growing Demand for Fleet Management and Telematics Integration: The increasing adoption of telematics across commercial fleets is driving a sharp uptick in demand for car data recorders with GPS tracking, route optimization, and behavioral analytics. Fleet operators are now integrating car data recorders with cloud-based dashboards to monitor driver performance, fuel usage, and vehicle health in real time. This trend is particularly strong in North America, where logistics and e-commerce growth demand high operational efficiency. The integration of real-time alerts and remote diagnostics through data recorders is significantly improving fleet uptime and reducing accident-related liabilities.

• Shift Towards AI-Powered Smart Dashcams: The transition from traditional dashcams to AI-enhanced car data recorders is gaining momentum. Smart recorders now use machine vision to detect traffic signs, road anomalies, and driving violations. These AI-based systems can flag fatigue, distracted driving, or aggressive behavior by analyzing facial expressions and driving patterns. Premium vehicles across Asia-Pacific and Europe are increasingly being fitted with these intelligent dashcams as standard equipment. This shift is also impacting the insurance sector, where AI-recorded data is used to assess claims faster and more accurately.

• Expansion of Regulatory Mandates for Vehicle Surveillance: Global regulations are evolving to make car data recorders a compulsory feature in new vehicles. In regions like the EU, the installation of Event Data Recorders (EDRs) has become mandatory for all new car models. These systems capture crash-related metrics such as speed, braking intensity, and steering angle—crucial for accident reconstruction. Latin American markets are also seeing rising enforcement around in-vehicle surveillance and compliance, especially for public transport and school buses. This regulatory drive is significantly expanding the car data recorder installation base.

• Increasing Use of Cloud-Based Storage and Real-Time Streaming: As internet connectivity in vehicles improves, cloud-based car data recorders are becoming mainstream. These systems allow users to store video and telemetry data remotely, minimizing the risk of data loss during accidents or theft. Real-time video streaming is now being used in security-sensitive areas like ride-hailing, law enforcement, and commercial delivery vehicles. The adoption of 5G is expected to further enhance data transfer speeds, making real-time, high-definition streaming and multi-camera setups more efficient. This trend is creating demand for recorders with greater data bandwidth and network compatibility.

Segmentation Analysis

The Global Car Data Recorder Market is segmented based on type, application, and end-user, with each segment influencing market dynamics in unique ways. Types of car data recorders include single-channel, dual-channel, and multi-channel systems. Applications primarily range from accident analysis and driver behavior monitoring to fleet management and insurance telematics. In terms of end-user, the market is divided into individual vehicle owners, commercial fleet operators, insurance companies, and law enforcement agencies. Each segment is witnessing varied growth rates due to technological advancements, safety regulations, and rising demand for real-time vehicle data monitoring. The segmentation analysis helps stakeholders target key growth areas while developing tailored solutions for high-demand segments.

By Type

The Car Data Recorder Market is primarily segmented into single-channel, dual-channel, and multi-channel data recorders. Among these, dual-channel recorders dominated the market in 2024 due to their affordability and capability to record both front and rear views, providing a balanced solution for personal and commercial vehicle safety. They are widely used in both private vehicles and small commercial fleets, especially in regions with rising accident rates.

On the other hand, multi-channel data recorders are expected to be the fastest-growing segment between 2025 and 2032. These systems can simultaneously capture data from multiple angles—including interior and side views—making them essential for ride-hailing, public transportation, and logistics companies that require comprehensive surveillance and incident reconstruction capabilities. The growing trend toward 360-degree vehicle monitoring and integration with AI-powered analytics is significantly boosting the adoption of multi-channel recorders globally.

By Application

Based on application, the Car Data Recorder Market is segmented into accident analysis, driver behavior monitoring, fleet management, law enforcement, and insurance telematics. In 2024, accident analysis held the largest market share due to the increasing regulatory pressure to install EDRs (Event Data Recorders) for post-crash investigations. The ability of recorders to provide speed, braking, steering, and video data in real time has become critical for determining liability in road accidents.

However, fleet management is projected to be the fastest-growing application segment. As logistics and ride-sharing industries scale up globally, the need for real-time tracking, predictive maintenance, and fuel efficiency insights has made car data recorders indispensable. Commercial fleets are increasingly investing in recorders integrated with telematics to reduce costs, monitor driver performance, and ensure vehicle safety compliance—leading to higher demand from this application area through 2032.

By End-User Insights

The end-user segmentation of the Car Data Recorder Market includes individual consumers, commercial fleet operators, insurance providers, and government/law enforcement agencies. Individual consumers represented the leading segment in 2024, primarily driven by increased awareness of vehicle safety and affordability of dual-channel recorders. Personal car owners are now installing recorders to safeguard against fraudulent claims and improve road safety accountability.

The commercial fleet operator segment is expected to be the fastest-growing category during the forecast period. With rising operational costs and driver safety concerns, logistics and delivery businesses are increasingly turning to smart recorders with GPS, driver behavior analytics, and video surveillance. Additionally, insurance providers are also accelerating adoption to validate claims and develop usage-based insurance models. Government and law enforcement agencies continue to implement advanced recorders in patrol vehicles for traffic monitoring, evidential support, and accountability enhancement, contributing to steady demand growth.

Region-Wise Market Insights

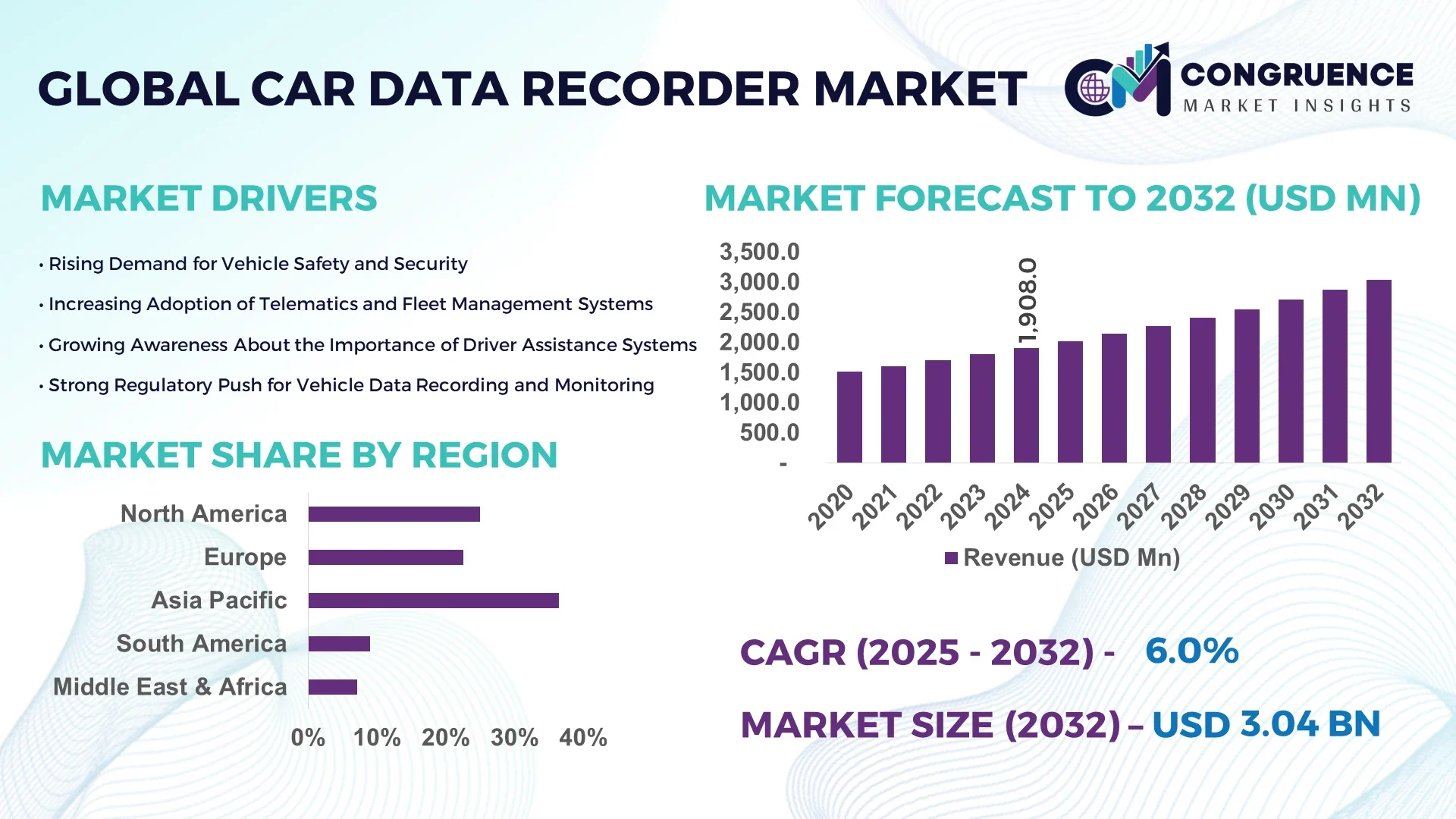

Asia-Pacific accounted for the largest market share at 36.4% in 2024 however, North America is expected to register the fastest growth, expanding at a CAGR of 7.2% between 2025 and 2032.

The dominance of Asia-Pacific is attributed to the region’s massive automobile production, increasing integration of safety technologies, and favorable regulatory frameworks across countries like China, Japan, and South Korea. Meanwhile, North America is witnessing growing adoption due to stringent driving safety regulations and rising awareness among consumers and fleet operators. Increasing investment in vehicle telematics and advanced ADAS is further boosting regional demand. Other regions such as Europe and South America are also experiencing consistent growth, driven by advancements in connected car technologies and the growing presence of global OEMs. The market outlook remains promising, with rising demand for intelligent data-driven systems playing a key role in driving regional growth dynamics over the forecast period.

North America Car Data Recorder Market Trends

Growing Integration with Connected Car Ecosystem

The North America Car Data Recorder Market is witnessing rapid transformation with widespread integration of vehicle data recorders into the broader connected car ecosystem. The U.S. continues to dominate regional sales, driven by strong consumer demand for real-time vehicle monitoring and insurance telematics. In 2024, over 28 million vehicles in the U.S. were equipped with some form of event data recorder (EDR), largely influenced by federal safety initiatives. Canada is also experiencing growing adoption, especially among commercial fleet operators seeking driver behavior monitoring solutions. Government-led initiatives for enhancing road safety and insurance policies linked to in-vehicle telematics are key growth enablers in this region.

Europe Car Data Recorder Market Trends

Demand Fueled by Strict Road Safety Regulations

Europe’s car data recorder market is expanding as stringent vehicle safety regulations continue to influence automakers. In 2024, more than 40% of newly manufactured vehicles in Germany and France came pre-installed with advanced data recording systems. The EU’s General Safety Regulation mandating installation of EDRs in all new models from mid-2024 has acted as a strong catalyst. European OEMs are investing in smart recording technologies integrated with ADAS and real-time diagnostics. The U.K., Germany, and Sweden are leading markets, while Eastern European countries are showing an upward trend due to increasing urbanization and demand for telematics.

Asia-Pacific Car Data Recorder Market Trends

Dominance in Production and Technological Deployment

Asia-Pacific remains the global leader in the car data recorder market owing to its strong automobile manufacturing base and technology-driven consumer preferences. China alone accounted for over 50% of the regional market share in 2024, driven by national vehicle safety mandates and massive domestic production. Japan and South Korea are also strong contributors due to their high penetration of electric and hybrid vehicles featuring advanced data recording modules. Increasing collaborations between OEMs and tech firms in Asia-Pacific are fueling innovations in AI-powered data recorders, ensuring continuous regional growth.

South America Car Data Recorder Market Trends

Rising Usage in Commercial Fleets and Ride-Hailing

The South America Car Data Recorder Market is gaining momentum with growing deployment in commercial fleets and ride-hailing services. Brazil leads the regional market, accounting for over 58% of installations in 2024, particularly within logistics and public transportation. The demand is driven by safety-focused regulations and insurance policies that incentivize use of in-vehicle monitoring systems. Chile and Argentina are following similar trends, aided by urbanization and digitalization in fleet operations. The region is gradually embracing integrated recording and telematics solutions for improving road safety and operational efficiency.

Middle East & Africa Car Data Recorder Market Trends

Growing Adoption in Urban Mobility and Government Fleets

The Middle East & Africa region is witnessing rising adoption of car data recorders due to enhanced urban mobility strategies and increasing demand in government fleet operations. The UAE and Saudi Arabia are leading markets, with more than 400,000 vehicles fitted with EDR and dashcam combinations by 2024. Growing interest in smart cities and intelligent transport systems is driving demand for vehicles equipped with advanced data collection and monitoring solutions. In Africa, South Africa is emerging as a key market due to regulatory initiatives focused on road safety and fleet management.

Top Countries Holding Highest Market Share

-

China: 28.9% market share in 2024 – Driven by strong manufacturing base and mandatory installation policies.

-

United States: 21.6% market share in 2024 – Influenced by regulatory requirements and widespread insurance telematics integration.

Market Competition Landscape

The Car Data Recorder Market is characterized by a competitive landscape with the presence of several key players that offer a wide range of products designed to enhance vehicle safety and performance monitoring. These companies are adopting various strategies such as product innovation, partnerships, and mergers and acquisitions to expand their market presence. Leading companies are focusing on integrating advanced technologies, including Artificial Intelligence (AI), Machine Learning (ML), and IoT, to deliver smart, real-time data recording systems. These advancements enable better driver behavior analysis, vehicle diagnostics, and crash detection. Furthermore, regulatory requirements in regions like North America and Europe, demanding the installation of EDR systems in vehicles, have provided a strong push to market growth. In addition, the increasing demand from commercial fleets and ride-hailing services is contributing to the intense competition among market players. Companies with strong R&D capabilities are expected to lead in terms of technological advancements, positioning themselves as leaders in the Car Data Recorder Market.

Companies Profiled in the Car Data Recorder Market Report

-

Bosch

-

Continental AG

-

Delphi Technologies

-

Denso Corporation

-

ZF Friedrichshafen AG

-

Garmin Ltd.

-

Panasonic Corporation

-

BlackVue

-

Thinkware

-

Lytx, Inc.

Technology Insights for the Car Data Recorder Market

The Car Data Recorder Market has been significantly transformed by advancements in technology, particularly through the integration of AI and IoT solutions. Modern car data recorders are no longer just passive devices; they have evolved into sophisticated systems capable of providing real-time analytics, predictive maintenance, and intelligent crash detection. The integration of AI algorithms helps improve the accuracy of data collection, offering advanced features such as facial recognition, driver behavior analysis, and automated accident detection. Furthermore, IoT connectivity is enabling car data recorders to interact with cloud-based systems, allowing for seamless data transmission and remote vehicle monitoring. This evolution is driving increased demand for smart data recording solutions that offer a higher level of security, driver convenience, and operational efficiency. The emergence of electric vehicles and the growing adoption of autonomous driving technologies are further fueling innovation in this space, pushing manufacturers to develop next-generation systems that cater to the evolving needs of the automotive industry.

Recent Developments in the Global Car Data Recorder Market

• In March 2024, Continental AG launched its new connected car data recorder that integrates with vehicle telematics systems to provide real-time data monitoring, enabling fleet operators to optimize route planning and vehicle maintenance schedules.

• In May 2023, Bosch unveiled a new generation of Event Data Recorders (EDRs) equipped with AI-based crash detection algorithms. This next-gen EDR improves the accuracy of post-crash analysis by providing granular data on vehicle movement before and after impact.

• In February 2024, ZF Friedrichshafen AG introduced its new video-based car data recorder system designed to improve accident reconstruction and assist in autonomous driving applications. The system integrates high-definition cameras with advanced AI to deliver real-time analysis.

• In July 2024, BlackVue, a leader in dashcam technologies, announced the launch of its cloud-connected car data recorder with real-time video streaming capabilities. This system enhances driver safety by allowing fleet managers to remotely monitor vehicles and receive instant notifications of incidents.

Scope of Car Data Recorder Market Report

The Car Data Recorder Market report provides a detailed overview of the industry, highlighting the growing demand for in-vehicle data recording solutions across different vehicle segments. As more consumers and businesses seek enhanced vehicle safety, driver behavior monitoring, and accident documentation, car data recorders are becoming increasingly integral. The report delves into various types of recorders, including Event Data Recorders (EDRs), Dashcams, and Black Box Recorders, each offering distinct advantages in vehicle safety and operational efficiency.

Additionally, the scope of the report includes key applications such as personal vehicles, fleet management, and law enforcement, with a focus on the rising demand from the commercial sector. The global market is expected to expand as regulatory standards for in-vehicle data recording become more stringent, particularly in regions like North America and Europe. The report also covers advancements in technology, such as the integration of AI, real-time data analytics, and IoT connectivity, which are enhancing the functionality and value of car data recorders. Geographically, the report provides insights into regional trends, with North America and Europe currently leading the market, while Asia-Pacific and the Middle East & Africa are emerging as fast-growing regions due to increased automotive production and technological adoption. This market report offers a comprehensive outlook for stakeholders looking to explore opportunities in the car data recorder space.