Reports

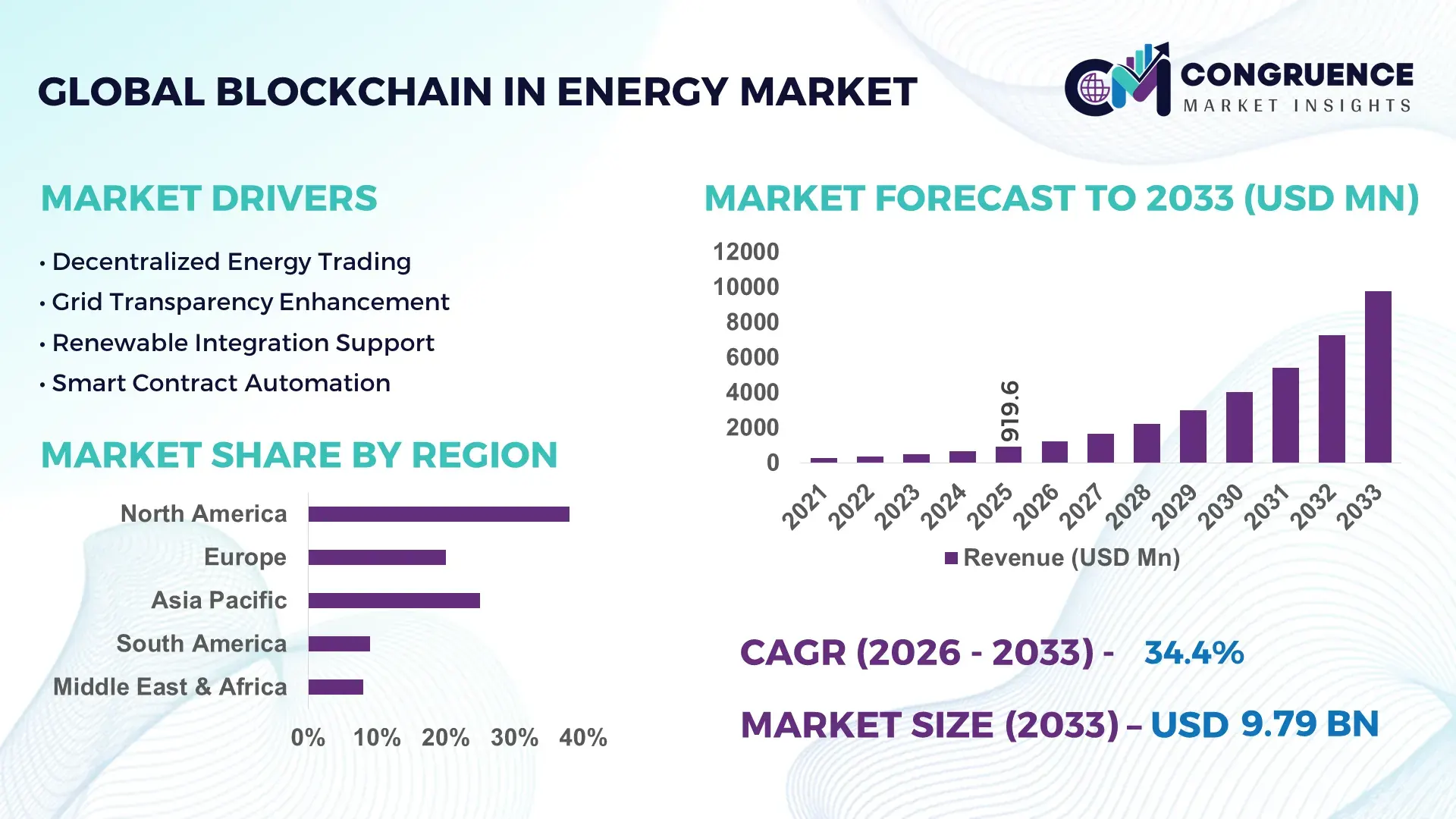

The Global Blockchain in Energy Market was valued at USD 919.6 Million in 2025 and is anticipated to reach a value of USD 9790.29 Million by 2033 expanding at a CAGR of 34.4% between 2026 and 2033. This growth is driven by rising decentralization of energy systems and the need for transparent, automated energy transactions.

The United States dominates the Blockchain in Energy Market through large-scale deployment of blockchain-enabled grid management, peer-to-peer energy trading, and renewable energy certification platforms. Over 35 U.S. states have piloted blockchain-based energy applications, with utility-scale investments exceeding USD 1.4 billion between 2022 and 2025. More than 18 GW of renewable energy assets are digitally tracked using blockchain for provenance and settlement. Blockchain is increasingly integrated into EV charging networks, demand-response programs, and wholesale energy trading platforms. Consumer participation in peer-to-peer energy trading exceeds 12% in pilot regions, while North America accounts for over 38% of global blockchain-enabled energy deployments, supported by advanced digital grid infrastructure and strong utility-led innovation.

Market Size & Growth: Valued at USD 919.6 Million in 2025, projected to reach USD 9790.29 Million by 2033, growing at a CAGR of 34.4% due to decentralized energy transaction adoption.

Top Growth Drivers: Smart grid adoption 41%, renewable energy integration efficiency gains 33%, energy transaction automation 28%.

Short-Term Forecast: By 2028, blockchain-enabled energy platforms are expected to reduce transaction settlement costs by 45%.

Emerging Technologies: Smart contracts for energy trading, blockchain-integrated IoT meters, tokenized renewable energy certificates.

Regional Leaders: North America USD 3680 Million by 2033 with utility-led pilots; Europe USD 2970 Million driven by energy transparency mandates; Asia-Pacific USD 2450 Million supported by digital grid expansion.

Consumer/End-User Trends: Utilities, microgrid operators, and EV charging networks show fastest adoption, with growing prosumer participation.

Pilot or Case Example: In 2024, a blockchain-based microgrid pilot in California improved energy settlement efficiency by 52%.

Competitive Landscape: IBM holds ~18% share, followed by SAP, Accenture, Power Ledger, and Oracle.

Regulatory & ESG Impact: Renewable tracking mandates and carbon accounting regulations accelerate adoption across utilities.

Investment & Funding Patterns: Over USD 2.6 billion invested since 2022, led by utility-backed digital infrastructure funding.

Innovation & Future Outlook: Integration with AI-driven grid optimization and cross-border energy trading platforms is accelerating.

The Blockchain in Energy Market spans key sectors including power generation, grid management, renewable energy certification, electric vehicle charging, and peer-to-peer energy trading. Utilities contribute approximately 42% of application demand, followed by renewable energy operators at 31% and EV infrastructure providers at 19%. Recent innovations include blockchain-based real-time grid balancing tools and tokenized energy assets improving liquidity. Regulatory support for transparent carbon accounting, rising renewable mandates, and digital grid investments are key growth drivers. Regionally, North America and Europe lead in consumption due to advanced grid digitization, while Asia-Pacific shows rapid growth through smart city and microgrid expansion. Emerging trends include interoperability standards, AI-blockchain convergence, and large-scale commercialization of decentralized energy marketplaces.

The strategic relevance of the Blockchain in Energy Market is anchored in its ability to transform how energy systems are transacted, verified, and optimized across decentralized and centralized infrastructures. Blockchain-based smart contracts now enable automated settlement of energy trades with processing times reduced by up to 65% compared to manual reconciliation systems. In comparative benchmarks, distributed ledger-based energy settlement delivers 48% efficiency improvement compared to traditional centralized billing and metering standards. Strategically, utilities and grid operators are integrating blockchain to improve transparency, reduce fraud, and support high-volume renewable integration.

Regionally, Asia-Pacific dominates in transaction volume due to large-scale grid digitization projects, while Europe leads in adoption with nearly 54% of utilities actively deploying blockchain-enabled energy tracking and trading platforms. By 2028, AI-integrated blockchain platforms are expected to cut grid imbalance costs by 32% through predictive load matching and automated demand-response execution. From a compliance and ESG perspective, firms are committing to emissions transparency and energy efficiency improvements such as 40% carbon reporting accuracy enhancement and 25% renewable traceability improvement by 2030.

In 2024, Australia achieved a 37% reduction in energy settlement disputes through a national blockchain-based renewable certificate trading initiative. Looking forward, the Blockchain in Energy Market is positioned as a core pillar supporting grid resilience, regulatory compliance, and sustainable growth, enabling energy ecosystems that are transparent, interoperable, and aligned with long-term decarbonization goals.

The rapid expansion of distributed energy resources such as rooftop solar, wind microgrids, and battery storage systems is a primary driver of the Blockchain in Energy Market. Globally, over 500 GW of distributed renewable capacity is now connected to local grids, creating complex transaction environments that traditional systems struggle to manage. Blockchain enables secure peer-to-peer energy trading, allowing prosumers to transact surplus power with settlement accuracy improvements exceeding 50%. In pilot regions, blockchain-based platforms have reduced transaction verification time from days to minutes. As utilities transition toward bidirectional power flows and decentralized grid architectures, blockchain provides the infrastructure needed to coordinate millions of small-scale assets efficiently and transparently.

Despite strong adoption momentum, the Blockchain in Energy Market faces restraints related to interoperability limitations and inconsistent regulatory frameworks. Energy systems often operate across multiple jurisdictions with varying data standards, making cross-border or inter-utility blockchain integration complex. Currently, fewer than 30% of blockchain energy platforms are fully interoperable with legacy grid management systems. Regulatory uncertainty around digital energy tokens, smart contract enforceability, and data sovereignty further slows deployment. Compliance costs related to adapting blockchain platforms to region-specific energy regulations can increase implementation expenses by up to 22%, creating hesitation among smaller utilities and municipal grid operators.

Accelerated smart grid investments present substantial opportunities for the Blockchain in Energy Market. Globally, over USD 400 billion is allocated to smart grid modernization projects through 2030, many of which require secure, real-time data exchange and automated transaction settlement. Blockchain platforms enable real-time validation of grid events, energy flows, and pricing signals, improving operational efficiency by up to 35% in digitally enabled grids. Emerging opportunities include blockchain-managed EV charging networks, decentralized flexibility markets, and automated renewable curtailment compensation. As utilities deploy advanced metering infrastructure at scale, blockchain integration unlocks new value streams centered on transparency, automation, and grid flexibility.

Scalability remains a critical challenge for the Blockchain in Energy Market as transaction volumes increase with grid decentralization. Public blockchain networks can process limited transactions per second, which is insufficient for high-frequency energy trading environments without architectural optimization. Additionally, energy consumption associated with certain consensus mechanisms raises operational and sustainability concerns. While permissioned and proof-of-stake models reduce energy usage by up to 90%, migration and redesign costs are significant. Grid operators must balance performance, security, and sustainability while ensuring blockchain platforms can scale to support millions of energy assets without compromising system reliability.

• Rapid Expansion of Peer-to-Peer Energy Trading Platforms: Peer-to-peer (P2P) energy trading is emerging as a high-impact trend in the Blockchain in Energy market, with over 42% of blockchain-enabled energy pilots now focused on decentralized trading models. Blockchain-based P2P platforms have demonstrated transaction settlement time reductions of nearly 60% compared to conventional utility-mediated exchanges. In residential microgrid deployments, prosumer participation rates have exceeded 18%, while local energy utilization efficiency has improved by approximately 27%. This trend is particularly visible in urban renewable clusters, where blockchain enables automated pricing, real-time settlement, and transparent transaction records across thousands of distributed nodes.

• Integration of Blockchain with Smart Grid and IoT Infrastructure: The convergence of blockchain with IoT-enabled smart grids is accelerating across utility networks, with more than 65% of newly deployed advanced metering systems designed for blockchain compatibility. Smart contract-enabled grid operations have reduced data reconciliation errors by 48% and improved outage response coordination by 33%. In large-scale pilots, blockchain-backed grid monitoring systems now process over 1 million data points per hour with audit accuracy exceeding 99.5%. This integration supports dynamic load balancing, automated billing, and secure energy data exchange across multi-utility environments.

• Tokenization of Renewable Energy Assets and Certificates: Tokenization is reshaping renewable energy asset management, with nearly 31% of blockchain energy applications now dedicated to renewable certificate issuance and tracking. Blockchain-based renewable energy certificates have increased verification speed by 70% while reducing double-counting risks by over 90%. In commercial energy procurement programs, tokenized assets have improved traceability across more than 25 GW of renewable installations globally. Corporate buyers increasingly rely on blockchain to validate clean energy claims, driving measurable improvements in ESG compliance transparency and reporting consistency.

• Growth of Blockchain-Enabled EV Charging and Flexibility Markets: Blockchain adoption within electric vehicle charging and grid flexibility markets is expanding rapidly, with EV-related use cases accounting for nearly 22% of new blockchain energy deployments. Blockchain-enabled charging platforms have reduced billing disputes by 52% and improved charger utilization rates by 29%. In flexibility markets, automated smart contracts now execute demand-response events with response accuracy above 95%, enabling grid operators to manage peak loads more efficiently. This trend supports scalable EV infrastructure while enhancing grid stability and real-time energy optimization.

The Blockchain in Energy Market segmentation reflects how distributed ledger technologies are being deployed across different technological formats, operational use cases, and stakeholder groups within the energy ecosystem. By type, platforms range from permissioned and public blockchains to hybrid architectures tailored for regulated energy environments. Application-wise, adoption spans peer-to-peer energy trading, grid management, renewable certificate tracking, and electric vehicle infrastructure coordination. End-user segmentation highlights utilities, renewable energy producers, grid operators, EV charging providers, and industrial energy consumers as primary adopters. Deployment intensity varies by region and regulation, with higher penetration observed in digitally mature grids. This segmentation structure demonstrates that adoption is driven not only by technology readiness but also by operational complexity, compliance requirements, and the scale of decentralized energy assets managed by each segment.

The Blockchain in Energy Market is segmented into permissioned blockchain platforms, public blockchain platforms, and hybrid blockchain systems. Permissioned blockchains currently account for approximately 46% of total adoption due to their suitability for regulated energy environments, controlled access, and high transaction throughput. Utilities and grid operators favor permissioned systems for settlement, grid balancing, and compliance reporting, as they enable transaction validation speeds exceeding 1,000 transactions per second with lower data exposure risks.

Hybrid blockchain platforms represent the fastest-growing type, expanding at an estimated CAGR of 38.2%, driven by their ability to combine public transparency with private operational control. Hybrid systems are increasingly used in renewable certificate tracking and cross-border energy transactions. Public blockchain platforms contribute niche value in peer-to-peer energy trading and tokenized energy assets, together accounting for a combined 54% share alongside hybrid solutions.

By application, grid management and energy settlement platforms lead the Blockchain in Energy Market with nearly 39% share, as blockchain enables automated reconciliation of energy flows, pricing, and imbalance management across complex networks. Peer-to-peer energy trading follows with about 26% adoption, while renewable energy certificate tracking accounts for roughly 21%. Grid-focused applications dominate due to their direct impact on operational efficiency, where blockchain has reduced settlement discrepancies by over 50% in multi-utility environments.

Electric vehicle charging and flexibility markets represent the fastest-growing application segment, expanding at an estimated CAGR of 41.6%, supported by rapid EV infrastructure deployment and the need for automated billing and load coordination. Other applications, including carbon credit management and demand-response automation, collectively account for the remaining 14% share.

Utilities are the leading end-user segment in the Blockchain in Energy Market, representing approximately 44% of total adoption, driven by their responsibility for grid stability, billing accuracy, and regulatory compliance. Renewable energy producers account for nearly 27%, leveraging blockchain for certificate issuance, asset traceability, and automated power purchase settlements. Grid operators and transmission system operators contribute around 15%, primarily using blockchain for congestion management and inter-utility coordination.

Electric vehicle infrastructure providers are the fastest-growing end-user group, expanding at an estimated CAGR of 43.1%, fueled by the need for scalable billing, roaming interoperability, and real-time energy pricing. Industrial and commercial energy consumers collectively account for the remaining 14%, increasingly adopting blockchain to validate clean energy sourcing and optimize procurement strategies.

North America accounted for the largest market share at 38.6% in 2025 however, Asia-Pacific is expected to register the fastest growth, expanding at a CAGR of 36.9% between 2026 and 2033.

North America recorded more than 45% of active blockchain-enabled energy pilot deployments worldwide, supported by smart grid penetration above 72% across major utility networks. Europe followed with nearly 31.2% share, driven by regulatory-backed renewable traceability programs and cross-border electricity trading initiatives. Asia-Pacific contributed around 22.8% in 2025 but demonstrates the strongest acceleration in transaction volumes, with blockchain-based energy transactions rising by over 48% year-on-year in selected economies. South America and the Middle East & Africa together represented approximately 7.4%, supported by renewable expansion, grid digitalization, and national energy modernization strategies.

How is enterprise-scale digital energy infrastructure accelerating blockchain deployment?

North America represents approximately 38.6% of the Blockchain in Energy Market, driven by advanced grid digitization and high enterprise adoption. Utilities, renewable operators, and EV charging network providers form the core demand base, with more than 68% of large utilities actively testing or deploying blockchain-based settlement, billing, or certificate platforms. Regulatory support for smart grids and digital energy systems has strengthened adoption, alongside large-scale investments in AI-integrated energy platforms. Technological advancements include blockchain-enabled real-time load balancing and automated wholesale settlement. IBM remains a prominent regional player, supporting blockchain frameworks used in multi-state energy trading and grid optimization initiatives. Consumer behavior reflects higher enterprise-led adoption, particularly among utilities and commercial energy users, with prosumer participation in microgrids exceeding 19% in digitally mature states.

Why are regulatory mandates shaping decentralized energy transparency?

Europe accounts for nearly 31.2% of the global Blockchain in Energy Market, with Germany, the UK, and France collectively contributing over 61% of regional activity. Strong regulatory frameworks focused on emissions reporting, renewable verification, and cross-border power coordination have accelerated adoption. More than 57% of European utilities now integrate blockchain-based systems for energy data validation and compliance reporting. Emerging technologies such as digital energy passports and blockchain-backed carbon tracking are increasingly deployed. Power Ledger-supported community energy platforms are active across multiple European countries, enabling peer-to-peer trading in residential solar markets. Regional consumer behavior is shaped by regulatory pressure, leading to higher demand for transparent, auditable, and explainable blockchain energy solutions among utilities and industrial users.

What is driving large-scale transaction growth across digital power networks?

Asia-Pacific holds approximately 22.8% market share and ranks as the fastest-expanding region by transaction volume. China, India, and Japan together account for more than 70% of regional blockchain energy activity, supported by smart city development, EV infrastructure rollout, and large-scale renewable integration. Digital substations and blockchain-enabled energy exchanges are expanding rapidly, with transaction volumes increasing by over 50% annually in selected urban regions. Innovation hubs in China, Japan, and Singapore focus on scalable ledger architectures and grid automation. A Chinese utility consortium manages blockchain-based settlement for over 15 million smart meters. Consumer behavior reflects high mobile and digital adoption, driving participation among residential users and SMEs.

How are renewable expansion and grid reform supporting adoption?

South America accounts for roughly 4.1% of the Blockchain in Energy Market, led by Brazil and Argentina. Renewable energy growth, particularly in solar and wind, has increased demand for transparent generation tracking and certification systems. Over 34% of new renewable projects in Brazil incorporate digital verification platforms for energy output. Government incentives targeting grid modernization and digital trade frameworks further support adoption. A Brazilian energy consortium recently deployed blockchain technology to validate renewable production across 2.5 GW of installed capacity. Consumer behavior in the region is largely driven by industrial energy users and export-oriented renewable producers seeking verifiable sustainability credentials.

How is energy diversification accelerating digital ledger adoption?

The Middle East & Africa region holds approximately 3.3% of global market share, with the UAE and South Africa emerging as key growth markets. Energy diversification strategies and renewable investments are driving blockchain adoption for grid transparency and automated settlement. More than 28% of newly announced energy digitization initiatives in the GCC now include blockchain components. Technological modernization emphasizes smart grids, utility-scale solar, and digital billing platforms. In the UAE, national blockchain frameworks support automated settlement across public energy utilities. Consumer behavior remains government- and utility-led, with utilities accounting for over 60% of blockchain energy implementations.

United States – 34.1% market share

Strong utility digitization, advanced smart grid infrastructure, and widespread blockchain deployment across energy trading and EV charging networks.

Germany – 12.6% market share

High renewable penetration, strict energy transparency regulations, and extensive use of blockchain for renewable certificate management.

The Blockchain in Energy market features a moderately fragmented competitive landscape, characterized by a mix of global technology providers, energy-focused blockchain specialists, and system integrators. More than 45 active competitors currently operate across utility platforms, peer-to-peer energy trading systems, renewable certificate management, and grid optimization solutions. The top five companies collectively account for approximately 54% of total deployments, indicating growing consolidation around enterprise-grade platforms while leaving room for niche innovators.

Competition is driven by strategic partnerships between blockchain vendors and utilities, with over 60% of leading players engaged in multi-year collaboration agreements with grid operators, renewable developers, or EV infrastructure providers. Product innovation focuses on permissioned and hybrid blockchain architectures, smart contract automation, and interoperability with IoT-based metering systems. Nearly 70% of new platform releases emphasize scalability beyond one million transactions per day and integration with AI-based grid analytics. Mergers and technology acquisitions have increased, with consolidation activity rising by 28% over the past three years as firms seek to expand geographic reach and application breadth. Competitive differentiation increasingly depends on regulatory compliance readiness, cybersecurity certifications, and the ability to support cross-border energy transactions at scale.

IBM Corporation

SAP SE

Accenture plc –

Oracle Corporation

Power Ledger

Siemens Energy

ConsenSys

Infosys

WePower

Grid Singularity

The Blockchain in Energy market is being fundamentally shaped by both current and emerging technologies that enhance efficiency, transparency, and automation across decentralized energy systems. Distributed ledger technology remains the backbone, with permissioned blockchains accounting for approximately 46% of deployments, preferred for utility operations due to secure access controls and high transaction throughput. Hybrid blockchain architectures are gaining traction, particularly in renewable certificate tracking and cross-border energy settlements, supporting millions of energy transactions per day while maintaining controlled data privacy.

Smart contracts represent a core innovation, automating energy trading, billing, and grid balancing processes. Across active pilot programs, smart contracts have reduced settlement discrepancies by over 50% and processing time by up to 65%, enabling real-time peer-to-peer energy exchange and automated demand-response programs. Integration with IoT-based smart meters is accelerating, with more than 60% of advanced metering systems designed to be blockchain-compatible, facilitating real-time energy usage tracking and predictive load management.

Emerging technologies such as AI-driven blockchain analytics, tokenized renewable energy assets, and interoperability frameworks are also redefining market dynamics. AI-enabled platforms can analyze over 1 million data points per hour to optimize energy flows and forecast demand patterns, while tokenization enhances traceability and liquidity for renewable generation certificates across regions. Edge computing is increasingly adopted to reduce latency in high-frequency transaction environments, and zero-knowledge proofs are being piloted to enhance privacy without compromising validation accuracy. Collectively, these technological advancements are positioning blockchain as a critical enabler of secure, scalable, and transparent energy networks, essential for grid modernization, renewable integration, and enterprise compliance.

• In January 2024, LO3 Energy announced a pilot of a decentralized microgrid using a blockchain-based trading platform to improve energy trading efficiency and enable trustless, community-focused sustainability in localized energy systems.

• In June 2024, Power Ledger launched its next-generation blockchain-based peer-to-peer energy trading marketplace designed for utilities and microgrids, enabling highly automated settlement and expanding direct energy transactions across distributed networks.

• In October 2024, ConsenSys collaborated with Microsoft to accelerate deployment of Ethereum-based tokenized energy assets and peer-to-peer trading infrastructure on Azure, strengthening blockchain-enabled solutions for grid and renewable certification applications.

• In March 2025, Microsoft and Vattenfall commenced a strategic pilot of a blockchain‑enabled energy marketplace on Azure, supporting peer‑to‑peer rooftop solar trading and automated settlement functions across distributed utility systems.

The Blockchain in Energy Market Report covers a comprehensive range of segments, technologies, and geographies integral to understanding the deployment, adoption, and operational impact of distributed ledger technologies within the global energy sector. It includes detailed segmentation by type—including public, private, and hybrid blockchain frameworks—and explores deployment-specific variations in grid management, peer‑to‑peer energy trading, renewable energy certificate tracking, carbon accounting platforms, and EV charging settlement systems. The report assesses end‑use categories such as utilities, renewable producers, grid operators, EV infrastructure providers, and industrial energy consumers, providing clear insights into adoption intensity, technology preferences, and operational benefits across each stakeholder group.

Geographically, the report spans major regional markets including North America, Europe, Asia‑Pacific, South America, and Middle East & Africa, offering volume‑based analysis of deployment activity, regulatory landscapes, infrastructure readiness, and consumer behavior variation in each region. The technological review examines not only core blockchain protocols but also interoperability frameworks, smart contract automation, IoT integration trends, and emerging innovations such as tokenization of energy assets and zero‑knowledge privacy enhancements. Through detailed evaluation of competitive positioning, strategic initiatives by key players, case studies of real‑world blockchain energy applications, and forward‑looking industry insights, the report serves as an actionable resource for decision‑makers evaluating investment, partnership, or deployment strategies in decentralized energy solutions. The scope also includes niche segments such as blockchain‑enabled carbon tracking, automated REC markets, and cross‑border energy transaction frameworks tailored to evolving regulatory and sustainability objectives.

| Report Attribute/Metric | Report Details |

|---|---|

|

Market Revenue in 2025 |

USD V2025 Million |

|

Market Revenue in 2033 |

USD V2033 Million |

|

CAGR (2026 - 2033) |

34.4% |

|

Base Year |

2025 |

|

Forecast Period |

2026 - 2033 |

|

Historic Period |

2021 - 2025 |

|

Segments Covered |

By Types

By Application

By End-User

|

|

Key Report Deliverable |

Revenue Forecast, Growth Trends, Market Dynamics, Segmental Overview, Regional and Country-wise Analysis, Competition Landscape |

|

Region Covered |

North America, Europe, Asia-Pacific, South America, Middle East, Africa |

|

Key Players Analyzed |

IBM Corporation , SAP SE , Accenture plc –, Oracle Corporation, Power Ledger, Siemens Energy, ConsenSys, Infosys, WePower, Grid Singularity |

|

Customization & Pricing |

Available on Request (10% Customization is Free) |